Excellence in Integrated Reporting 2023 Report

EY is committed to continue the quest for excellence in integrated reporting. We hope that companies will be both inspired and encouraged by those who have set the bar high to improve the quality of their integrated reports.

Download the Report

12 Years of Awarding Excellence in Integrated Reporting in South Africa

This year marks 12 years of our integrated reporting awards and a total 26 years since its 1998 inception as ‘EY South Africa’s Annual Excellence in Financial Reporting Awards (EIR)’. This programme continues to focus on the critical theme of building trust and strong relationships with key stakeholders through transparent reporting. This year, in recognition of the growing emphasis on sustainability reporting globally we performed an analysis of the top 100 JSE listed companies’ most recently published sustainability reports (or equivalent).

Most of the Top Integrated Reporters have a holistic and mature approach toward sustainability reporting with ambitions to enhance this further, which lends credence to the assumption that South African listed entities are well-positioned to become leaders in sustainability reporting, irrespective of the pace at which this becomes a mandatory requirement in this jurisdiction.

Integrated thinking is considered by top reporters to be a strong advantage when it comes to achieving sustainability reporting goals.

Reflecting on the 2023 Winners

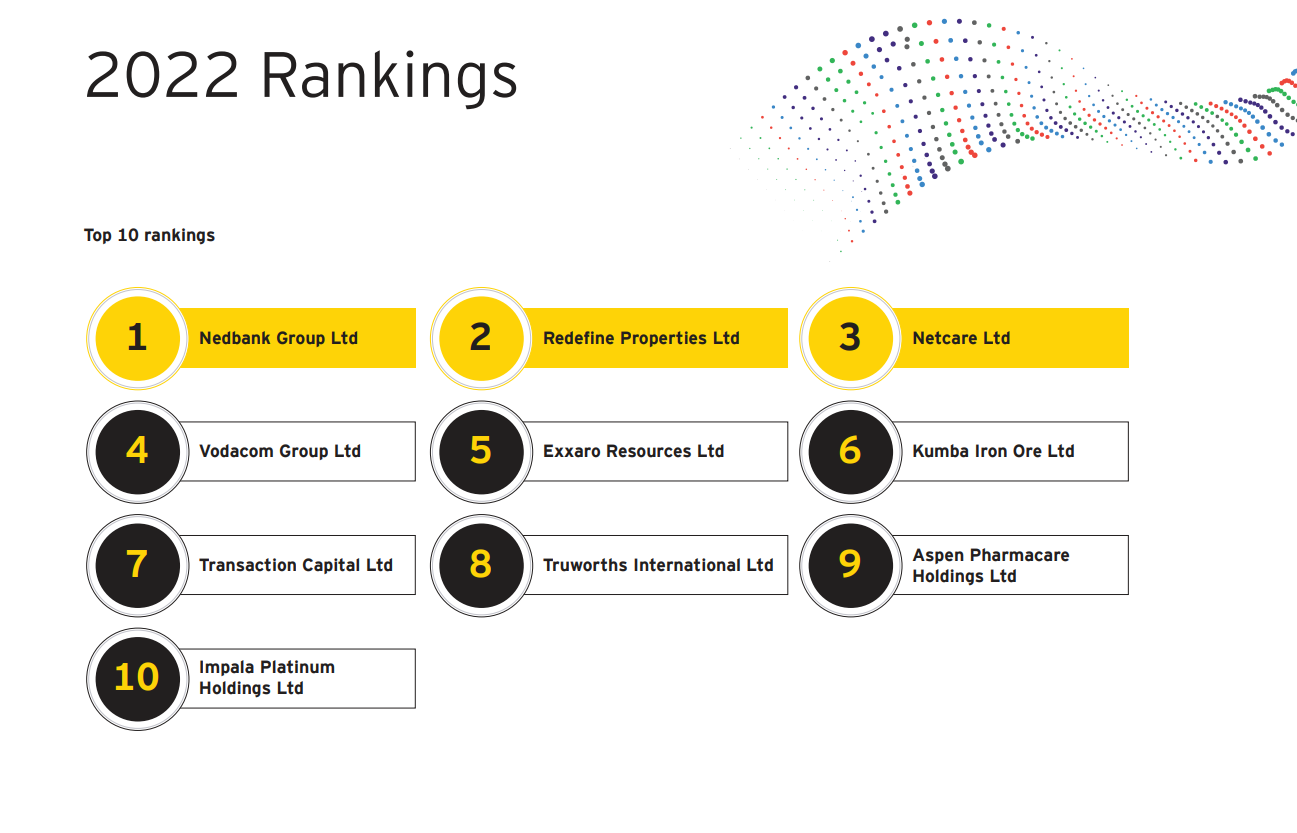

It is our great pleasure to congratulate our 2023 Top 10 and Excellent Category winners, with last year’s winner, Nedbank Group Ltd once again achieving first place in the Awards. Find out what the judges said about each report by clicking on the drop down below:

-

Top 10

-

1. Nedbank Group Ltd

Nedbank’s report is well laid out, easy to read and good use is made of infographics to summarise complex information in a way that is understandable. The report has a discernible focus on value creation, preservation, and erosion. We particularly liked the strategic focus of the report and the way in which strategic performance is supported by detailed key performance indicators. These key performance indicators include three years of performance data, targets, benchmarks, the outlook for the medium and long term, levels of assurance, as well as linkage to executive remuneration. The focus within the governance section on the key issues considered by the board, together with extensive discussion of these issues, is best practice. The group’s outcomes are detailed and supported by meaningful hard data. The presentation of key strategic trade-offs demonstrates the way in which the group assesses the availability and quality of its capital inputs and clearly illustrates short-term and long-term considerations. The overall coherence and connectivity of the report is excellent.

-

2. Redefine Properties Ltd

Redefine’s report is crisp, concise and has a narrative flow that is easy to follow. Good use is made of icons to make the necessary links between the various content elements to tell an integrated story. The introductory summary of the group’s integrated approach to business and value creation, which provides useful context for what is to follow, is excellent. The report has a strong future focus, particularly in relation to value creation which is presented on a capital-by-capital basis. We particularly liked the governance section of this report with its clear link to strategy and its focus on how the board is responding to material matters. The report includes a detailed and understandable business model that clearly shows the group’s inputs, business activities, outputs, and outcomes. The explanation of the group’s operating context is sufficiently detailed for the reader to get a good sense of the global drivers, macroeconomic factors and industry trends that affect the business and how these matters drive the group’s strategy.

-

3. Kumba Iron Ore Ltd

Kumba’s report has a clear strategic focus with an emphasis on value creation both for itself and for other stakeholders, together with relevant information on how the value that is created is measured. The explanation of the group’s approach to materiality using the concept of ‘double materiality’ and the way in which the materiality determination approach is explained is excellent. We particularly liked the connectivity within the section that shows the interdependencies between value creation and the capitals that the group’s business model depends on. The report includes a comprehensive explanation of the group’s strategy across three distinct time horizons together with clear disclosures of how the group has performed against previous strategic ambitions. The group’s risks and

opportunities are clearly presented and the way in which these are linked to value creation and the strategic focus areas is an indication of integrated thinking within the group.

-

4. Netcare Ltd

Netcare’s report has a clear emphasis on value creation and strategy. The report has a sensible structure that commences with a brief overview of the business and its strategy, followed by the necessary detail on governance, the group’s value creation story and in-depth discussions of its capitals. We particularly liked the detailed explanation of the context within which the group operates and the way in which items within this section are linked to the group’s strategy. The inclusion of ‘key takeaways’ in explaining the operating environment is innovative and helpful. The disclosure of the group’s risks and opportunities that includes the risk management framework, an explanation of how the top business risks have been identified, a risk exposure heat map, and a comprehensive and integrated disclosure of each risk is excellent. The presentation of group’s performance against each of its strategic initiatives is sufficiently detailed and appropriately linked to the Exco scorecard.

-

5. Anglo American Platinum Ltd

The Amplats report has a sensible layout that contains a wealth of useful, well contextualised, and clearly explained data which makes the value creation narrative easy to follow. We particularly liked the explanation of the group’s approach to reporting and the graphic that is used to illustrate this explanation. The detail provided on the group’s purpose is useful in understanding the context of the strategic priorities that follow.

The detailed disclosure of these strategic priorities together with clearly identified strategic initiatives, current performance and medium to long-term targets is excellent. The discussion of the group’s trade-offs is specific to its business and clearly shows how the group manages these trade-offs to create long-term value. The group’s risks are clearly

presented, appropriately integrated with strategy, and illustrated with a heat map that shows the likelihood and consequence of each risk.

-

6. Vodacom Group Ltd

Vodacom’s report is easy to navigate and makes excellent use of icons to link sections and guide the reader. The report is crisp, concise, attractive, and uses language that is easy to read. We particularly liked how the group’s purpose and approach to ESG are explained early-on in the report together with links to where more sustainability information can be found. The disclosures of how the group is responding to ‘hot topics’ on a macro, industry and company level is excellent. The emphasis on value creation is supported by performance measures and detailed discussions which clearly show the extent to which various strategic objectives have been achieved. These performance measure disclosures are comprehensive and include three years of historic data, medium-term targets, links to executive directors’ remuneration as well as an indication of whether value has been created, eroded, or sustained.

-

7. Exxaro Resources Ltd

Exxaro’s report has a clear future focus on sustainable growth. The report commences with a clear ‘big picture’ outline of how the group is driving value through transition and which provides a coherent basis for the narrative that follows. We particularly liked the specific focus within the report on business reliance and how the group uses its intellectual capital to enable its responses to challenges in the market and position the business for the future. Strategy is central to this report and is unpacked in sufficient detail to get a clear sense of how the group aims to create and preserve value by delivering sustainable growth and impact. The explanation of the group’s opportunities and how these have informed strategy is excellent. The explanation of the group’s business model is comprehensive

and in addition to inputs, activities, trade-offs, outputs, and outcomes includes useful detail on how outcomes are being improved.

-

8. Truworths International Ltd

Truworths’ report is easy to navigate, avoids the use of jargon and is written using language that is clear and concise. The report includes detailed and integrated disclosure of each material issue that incorporates performance against objectives and targets, challenges encountered, future objectives and plans, risks and opportunities as well as achieved

and target key performance measures. We particularly liked the way in which the governance disclosures provide a good overview of the board’s deliberations and have a strong link to value creation. The explanation of the business model is comprehensive and exhibits a high level of coherence with the way in which the group manages and explains its

business. The Chief Financial Officer’s report which blends a traditional style of reporting with an appropriate explanation of how financial capital has been increased, preserved, or eroded is excellent.

-

9. Impala Platinum Holdings Ltd

Impala Platinum’s report focuses on value creation and contains an appropriate mix of forward-looking information and performance disclosures. The explanation of the group’s materiality determination process and reporting boundary are clearly presented together with an explanation of what additional material can be found in other reports. We

particularly liked the information provided with respect to the availability, affordability and quality of capitals that is shown within the business model infographic. Risk disclosures are comprehensive and are enhanced by disclosure of short and medium-term risk outlook factors. The detail provided within each divisional review is excellent and provides suitable

granularity with respect to material matters, risks and opportunities, strategy, and performance. The section that shows the group’s performance against KPIs and targets is excellent.

-

10. Absa Group Ltd

Absa’s report focusses on value creation and contains an appropriate mix of forward-looking information and performance disclosures. The explanation of the basis of preparation and presentation of the report is suitably detailed and supported by an explanation of the extent to which the report has been assured. A wealth of useful, well contextualised, and clearly explained data is provided within the report and the extensive use of cross referencing makes the report easy to navigate. We particularly liked the context provided by the comparison of the group’s position relative to its most significant peers in each country within which it operates. The materiality determination process is comprehensively explained, and the material matters are unpacked and linked to risks, opportunities, strategy, stakeholders, and their impact upon the business model. The section that deals specifically with the outlook for the group is excellent.

-

-

Excellent Category

AngloGold Ashanti Ltd

Aspen Pharmacare Holdings Ltd

DRDGOLD Ltd

Momentum Metropolitan Holdings Ltd

MTN Group Ltd

Pick n Pay Stores Ltd

Royal Bafokeng Platinum Ltd

Sappi Ltd

Sasol Ltd

Standard Bank Group Ltd

Telkom SA SOC Ltd

Transaction Capital Ltd

Meet the Judges

Mark Graham

Emeritus Associate Professor, University of Cape Town

Alexandra Watson

Emeritus Professor, University of Cape Town, Independent non-executive director

Goolam Modack

Associate Professor, University of Cape Town

Find out more about the Annual Survey and Awards

-

About the Survey

The purpose of the survey is to encourage and benchmark standards of excellence in the quality of integrated reporting to investors and other stakeholders in South Africa’s listed company sector.

Over the years it became clear that financial statements on their own did not tell the whole story of a company’s performance. Companies therefore started reporting on their environmental impacts, employee-related issues and corporate social responsibility issues in a separate report often referred to as a sustainability report, which accompanies the financial information distributed to shareholders.

Since 2010, all companies listed on the Johannesburg Stock Exchange (JSE) have been required to produce an integrated report in line with King III. This requirement has been carried forward to King IV, effective for financial years commencing on or after 1 April 2017.

In addition, the JSE requires application and disclosure of King IV in any report lodged with them after 1 October 2017. EY has been commissioning the Excellence in Integrated Reporting survey for the last 11 years in order to encourage excellence in the quality of integrated reporting to investors and other stakeholders by South Africa’s top companies.

Frequently Asked Questions

-

How are companies chosen for inclusion in the EY "Excellence" in Integrated Reporting Awards?

The companies chosen for inclusion in the awards survey are the top 100 companies listed on the Johannesburg Stock Exchange (JSE), which are selected on the basis of their market capitalisation on the last trading day of the calendar year. This is usually the 31st December.

All companies are regarded as being eligible to be included in the survey other than pure holding companies, if there are any.The final top 100 includes the full range of listed companies on the JSE, from resources to industrials, retailers and financial institutions, as well as a number of companies with dual listings. In the case of those companies which operate through a dual listing structure, only the combined group is included in the survey.

-

How is the mark plan developed?

The mark plan is developed by three adjudicators from the College of Accounting at the University of Cape Town, in conjunction with EY’s Professional Practice Group. The UCT team comprises Professors Alexandra Watson, Goolam Modack and Mark Graham. All of the adjudicators have been involved for many years in EY's "Excellence" in reporting series, and in EY’s Excellence in Integrated Reporting survey since 2011.

-

What is included in the mark plan?

The mark plan is quite simple and is based on the Guiding Principles and Content Elements that appeared in the International Integrated Reporting Council’s Integrated Reporting Framework (the Framework), which was issued in December 2013 and updated in January 2021. A mark out of ten is awarded for each of the seven Guiding Principles (i.e. strategic focus and future orientation, connectivity of information, stakeholder relationships, materiality, conciseness, reliability and completeness and lastly consistency and comparability). Similarly, a mark out of 10 is awarded for each of the eight Content Elements (i.e. organisational overview and external environment, governance, business model, risks and opportunities, strategy and resource allocation, performance, outlook and finally basis of presentation and preparation). Marks are also awarded for the extent to which the integrated report incorporates the Framework’s fundamental concepts, dealing with how value is created with reference to the six ‘capitals’ where relevant.

-

What do the adjudicators expect to see with respect to the six capitals?

The adjudicators believe that an explanation of how a business creates value with respect to the six capitals, is a particularly suitable way for most companies to present the content that needs to be presented within its integrated report. Furthermore, an explanation of how value is created within an organisation can sensibly be structured around how value is embodied in the capitals that it uses. Doing this should also give the report a more logical flow. Therefore, whilst the adjudicators do not expect companies to explicitly structure their report around the six capitals, or use specific terminology, they would certainly look for disclosures relating to the stock and flow of the capitals (i.e. financial, manufactured, intellectual, human, social and relationship as well as natural) and the extent to which tradeoffs between different capitals may influence the organisation’s strategy.

-

Which document is adjudicated?

The document that is actually labelled as being the integrated report is reviewed and adjudicated. For the dual listed companies that do not produce an integrated report, the adjudicators evaluate the information contained in their annual report. This is generally not detrimental to those companies as many of the integrated reporting principles are included in their reports, nonetheless.The combined report is reviewed for the companies that operate through a dual listing. In all cases the online pdf or hard copy of the report is reviewed. The adjudication is only made on the basis of information presented and there is no validation of the performance or outcomes achieved.

-

Are separate sustainability reports or other reports reviewed?

No, the adjudicators only look at the document that is labelled as being the integrated report or the annual report in the case where companies have not produced an integrated report.

-

Do the adjudicators attempt to achieve consensus on the scores?

No, it’s really the ranking that matters. Where an adjudicator’s ranking differs widely from the others, this is reviewed to ensure that information has not been overlooked. Often, scores may vary widely. While the adjudicators generally agree on what is good disclosure, perception of the relative importance of items may differ. Despite this, there is a high degree of consensus among the adjudicating members’ overall perceptions and recommended rankings.

-

Is there an overriding objective to the ranking?

Yes, absolutely. The overriding objective in ranking the integrated report is the extent to which it complies with the spirit of integrated reporting which is defined by the <IR> Framework as being “a concise communication about how an organisation’s strategy, governance, performance and prospects, in the context of its external environment, lead to the creation of value over the short, medium and long term” and which King IV positions as the “culmination of a series of leadership responsibilities executed by the governing body.”

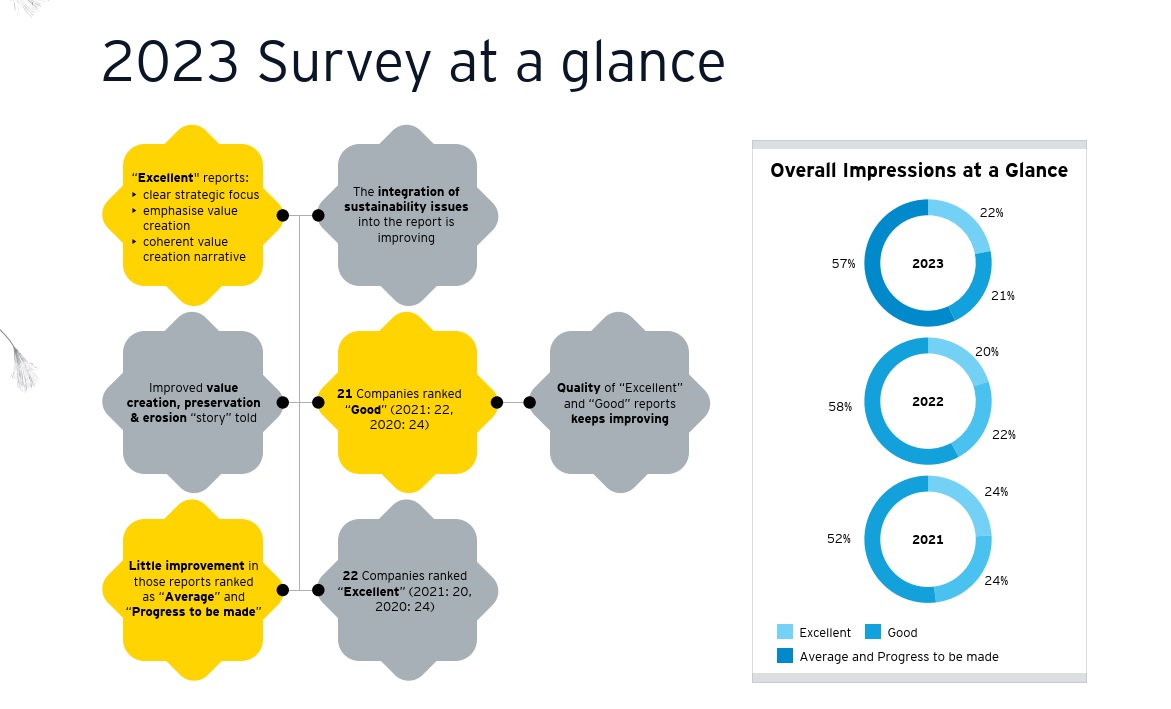

The adjudication process results in each of the 100 companies being ranked as “Excellent”, “Good”, “Average” or “Progress to be made”. A further evaluation then results in a ranking of the 10 best integrated reports from amongst those that are ranked as “Excellent”.

-

How do the adjudicators identify and rank the Top 10?

There are three specific areas which are believed to be crucial to excellence in integrated reporting. These are, the extent to which the report has a clear strategic focus, an emphasis on value creation and a high level of connectivity between the various elements presented. These three areas are then used to identify the Top 10 integrated reports from all the companies ranked as "Excellent" and to assign them a ranking within the Top 10.

-

Other than the Top 10, are there any other awards?

From 2016 - 2021, an "Honours" award was given to those high-qaulity intergrated reports which the adjudicators believed came closest to complying with all of the requirments of the Intergrated Reporting Framework. In 2022 there were no "Honours" awarded, this is mainly due to the current changing landscape in reporting.

-

Who adjudicates the integrated reports?

Each of the integrated reports of the top 100 companies is separately adjudicated by each of the three adjudicators from the College of Accounting at the University of Cape Town using the pre-agreed mark plan.

-

Is this simply a box ticking exercise?

No, absolutely not. Much more emphasis is placed on the quality of information presented – the relevance, understandability, accessibility and connectedness of that information; whether users of the integrated reports would have a reasonable sense of the issues that are core to the operations of each of the companies and whether companies have dealt with the issues that users would have expected. This implies that much more credit is given for crisply presented information that highlights relevant facts compared to the same information needing to be extracted from less relevant information. Furthermore, once the marking process is complete, the scores for the seven Guiding Principles, the eight content elements and for adherence to the fundamental concepts and individual members’ recommended rankings are collated, resulting in a final ranking being awarded. The final ranking is therefore based on a combination of the average of these scores, overall perceptions and extensive discussions surrounding the final rankings for each company. This ranking process is particularly important as the scoring process is subjective and scores may differ, based on the adjudicators’ impressions at the time.

Previous Excellence in Integrated Reporting Awards

2022 Top 10

2021 Top 10

2020 Top 10