Africa Attractiveness Report 2023

The Africa Attractiveness Report is a trends and insights report with data insight and analyses that provides readers with a deeper understanding of the investment flows into the Africa market.

EY Africa Attractiveness Report 2023

Executive Summary

- FDI rose 64% measured by project numbers

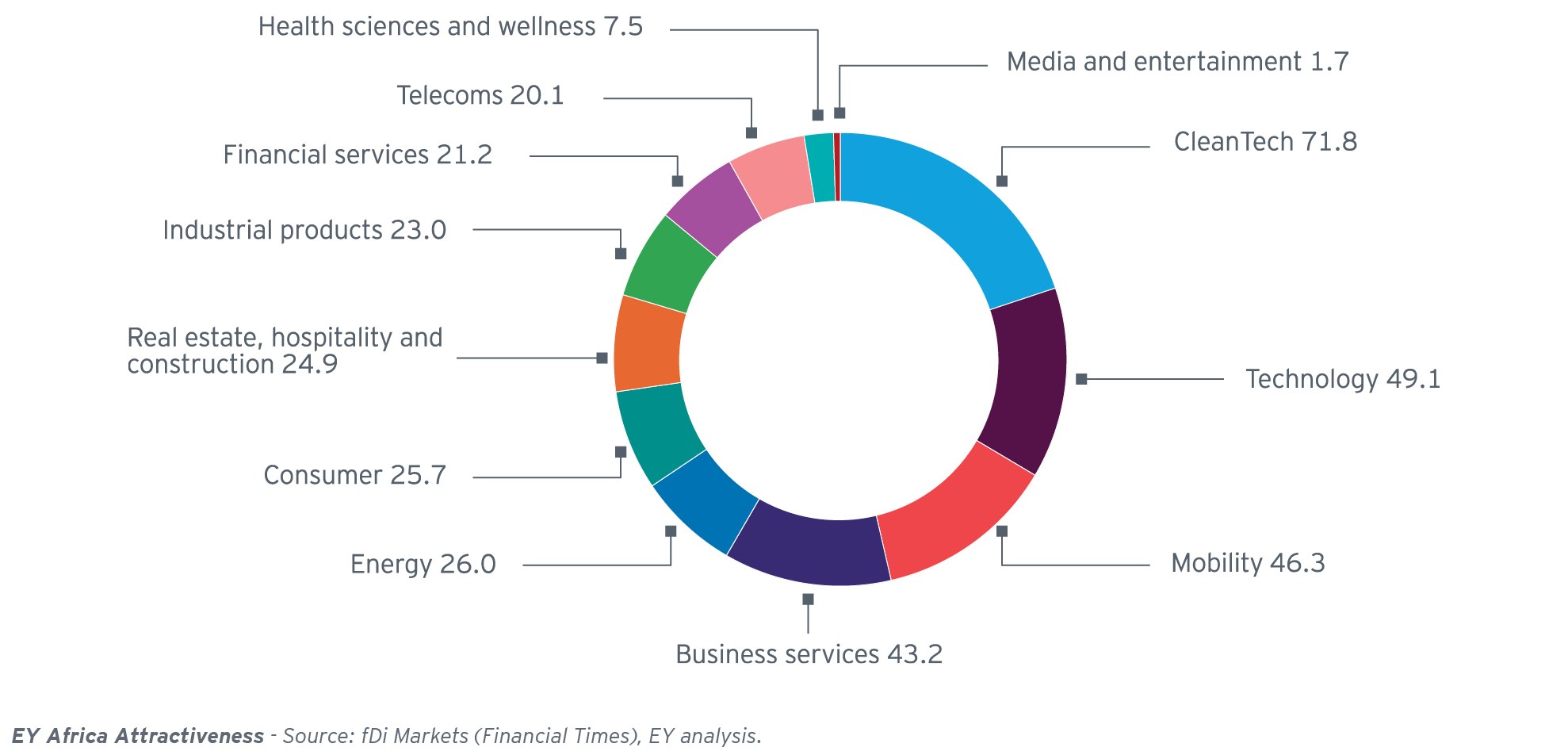

- CleanTech became the leading sector with a FDI score of 72

- Africa remains strongly reliant on the west for its FDI, accounting for 53%* of the total

Introduction

In this report we highlight how economic policies, regulations, investment incentives and taxes, amongst others, will need to be further enhanced if the continent is to meaningfully benefit from inflows of investment capital. While many across the continent aim to increase their focus toward the east and the global south, for now, the Western Hemisphere remains by far the largest investor into Africa.

2022 was the first visible sign of Africa’s return to the investment arena, much remains to be done to ensure that its investment attractiveness improves so that it can build on 2022’s fortunes. There are encouraging signs from countries that are embarking on structural economic reforms and making the business environment easier to navigate.

In recent years, foreign direct investment (FDI) into Africa has faced significant challenges, due to a series of global shocks which started with the COVID-19 pandemic.

Chapter 1

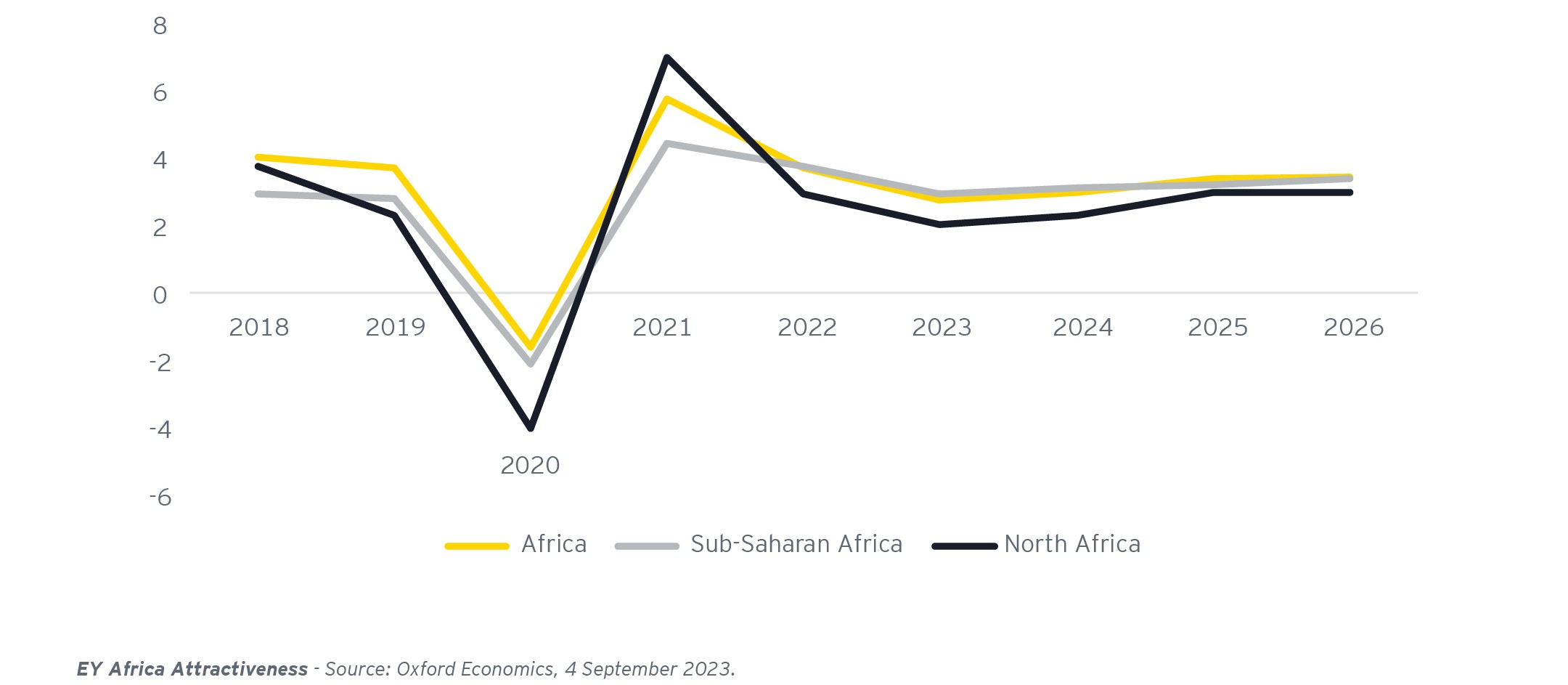

Africa’s growth recovery stalls as global events squeeze the economic outlook

Africa’s growth recovery stalls as global events squeeze the economic outlook

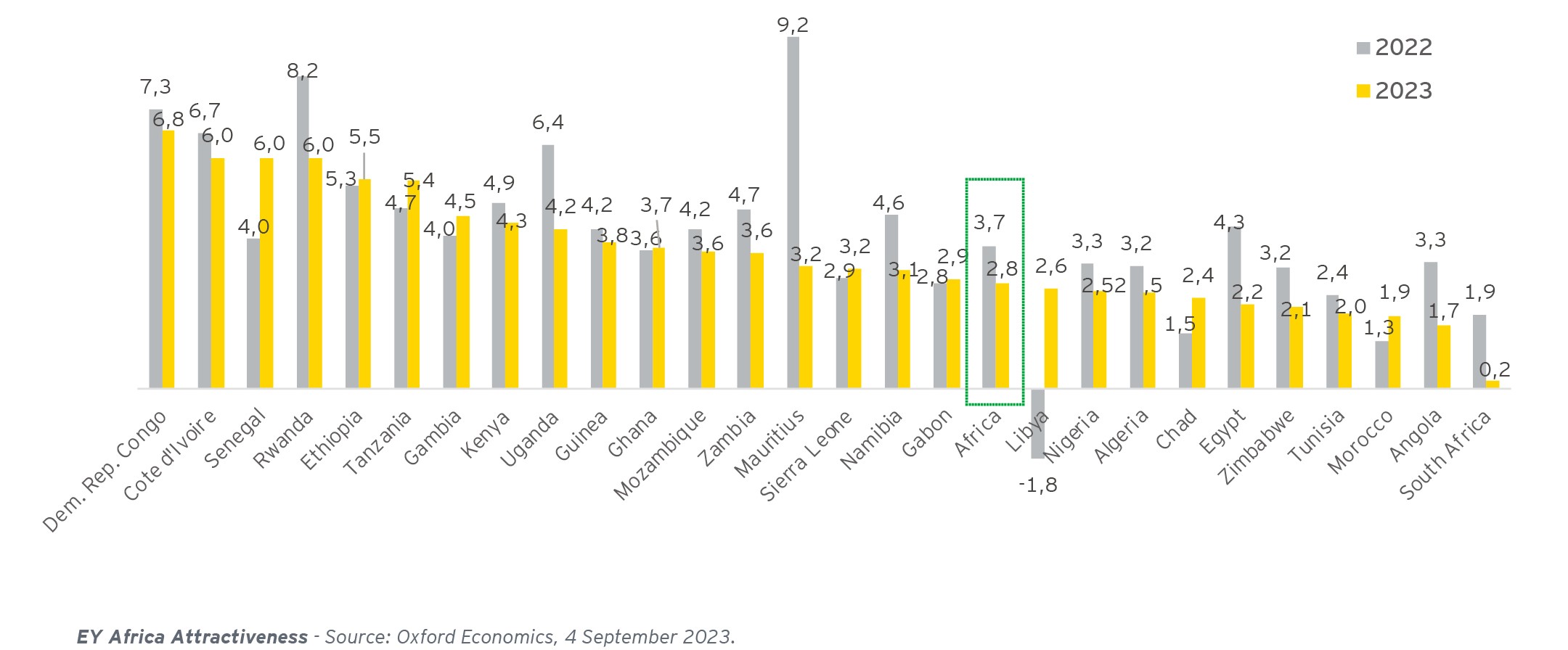

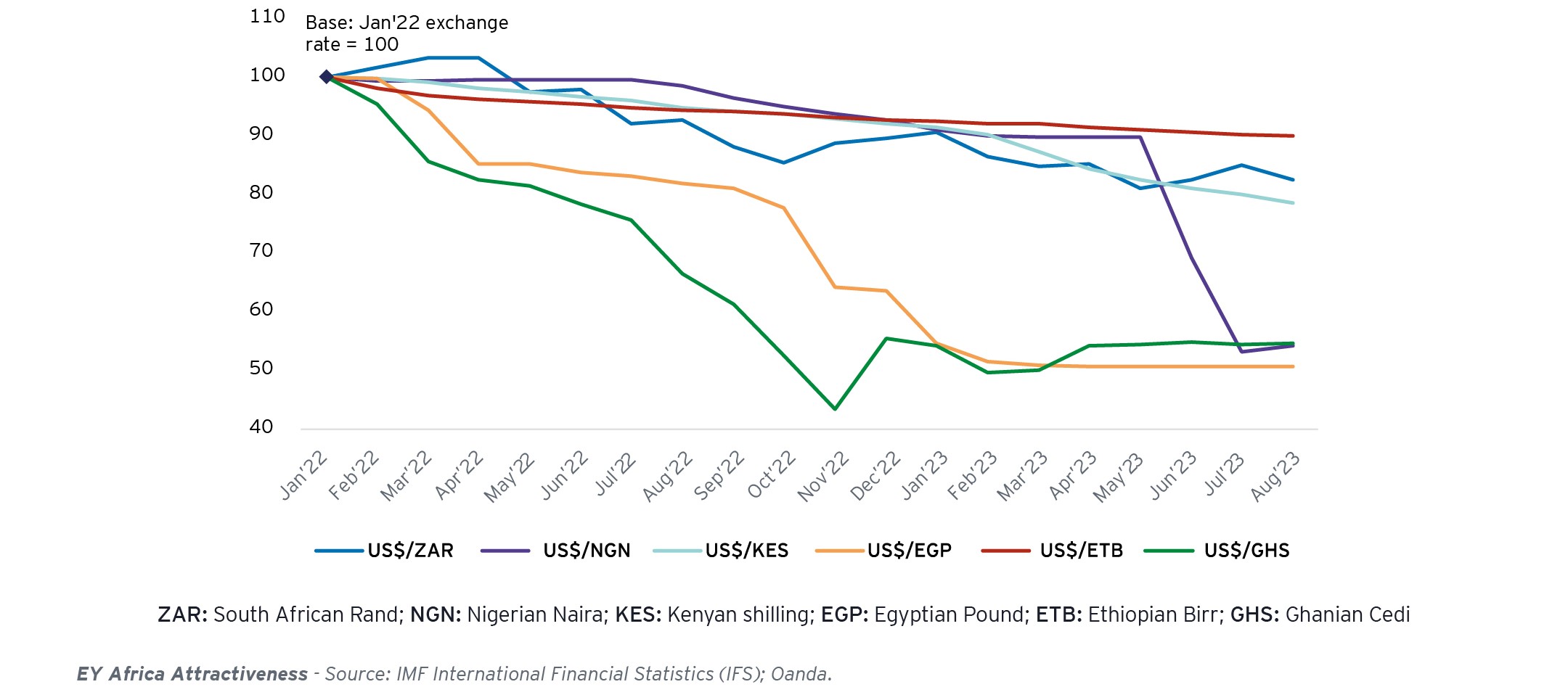

The three largest economies on the African continent all face specific locally driven factors that have caused their growth to stall. In the case of both Egypt and Nigeria, a pegged currency has led to major distortions in the business environment.

Africa is poised for a multi-speed recovery path, with significant country and regional cluster variances.

Across Africa, and with few exceptions, central banks are hiking interest rates. South Africa’s central bank rate has risen 500 basis points thus far, while Nigeria and Egypt have seen even sharper rate hikes, all designed to tame inflation, manage currency trading values, and provide economic stability, something that investors typically want to see.

Nigeria, being Africa’s largest economy is particularly vulnerable to strained national finances and rising national debt.

Africa’s outlook will also be squeezed by currency depreciation

Chapter 2

FDI rebound

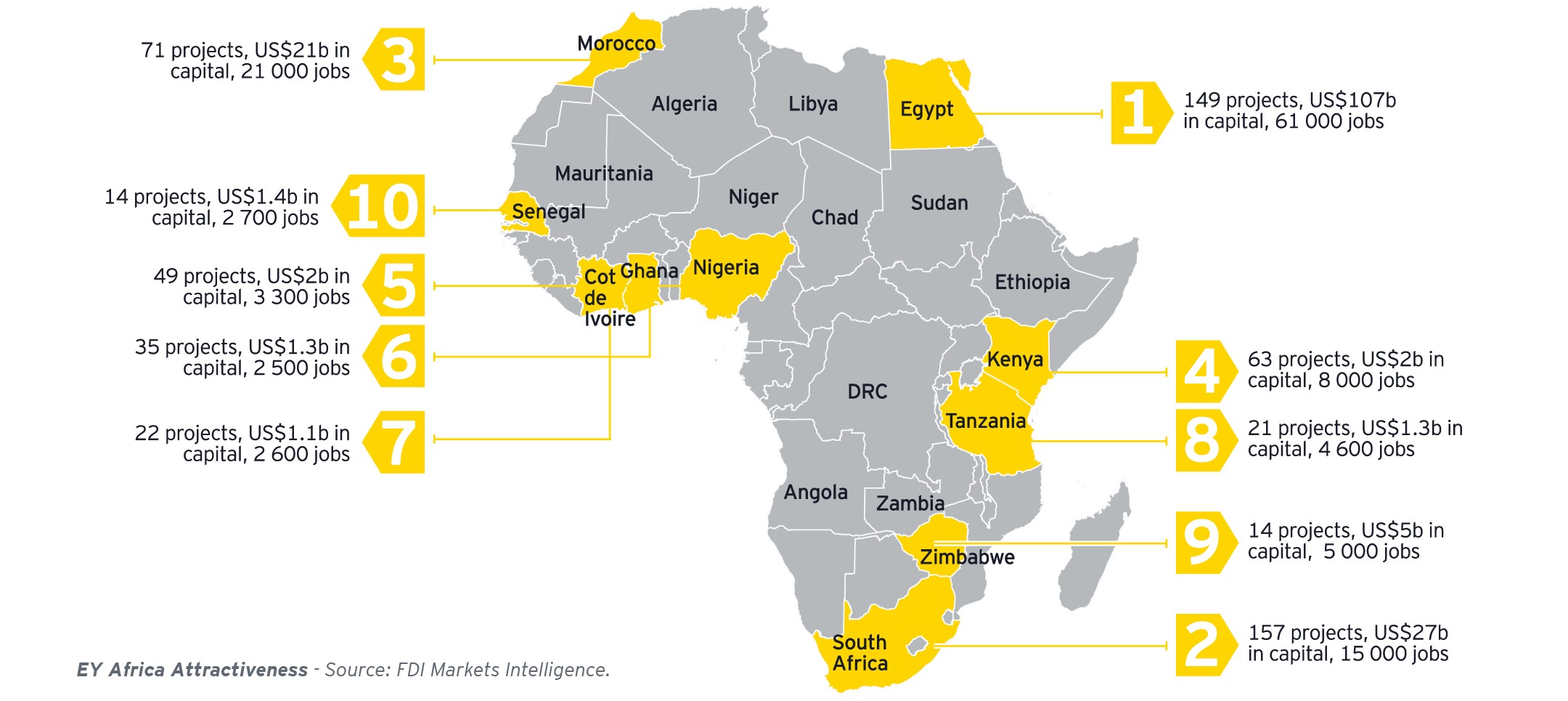

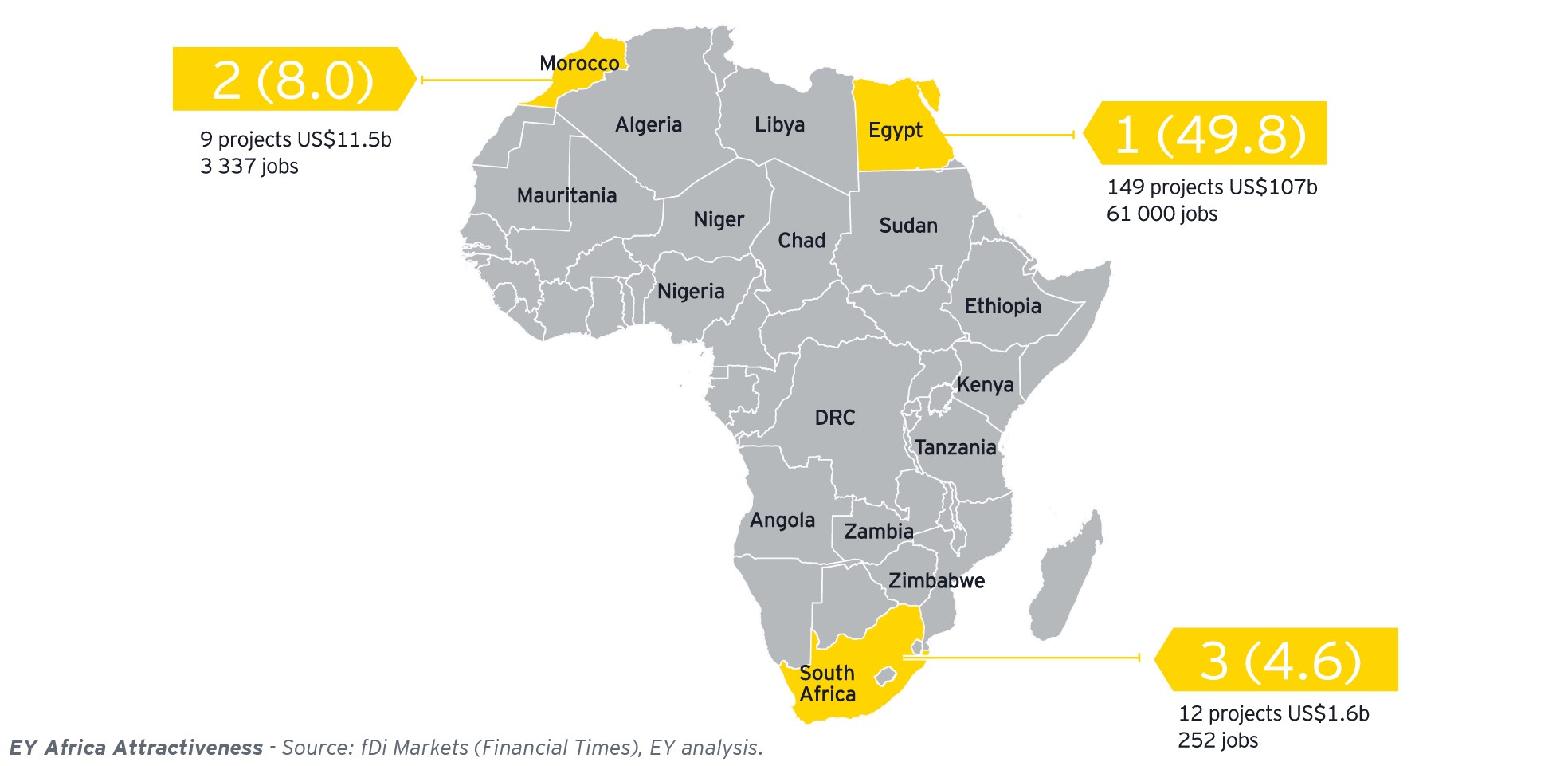

FDI rebounds strongly, with North and Southern Africa the largest hubs

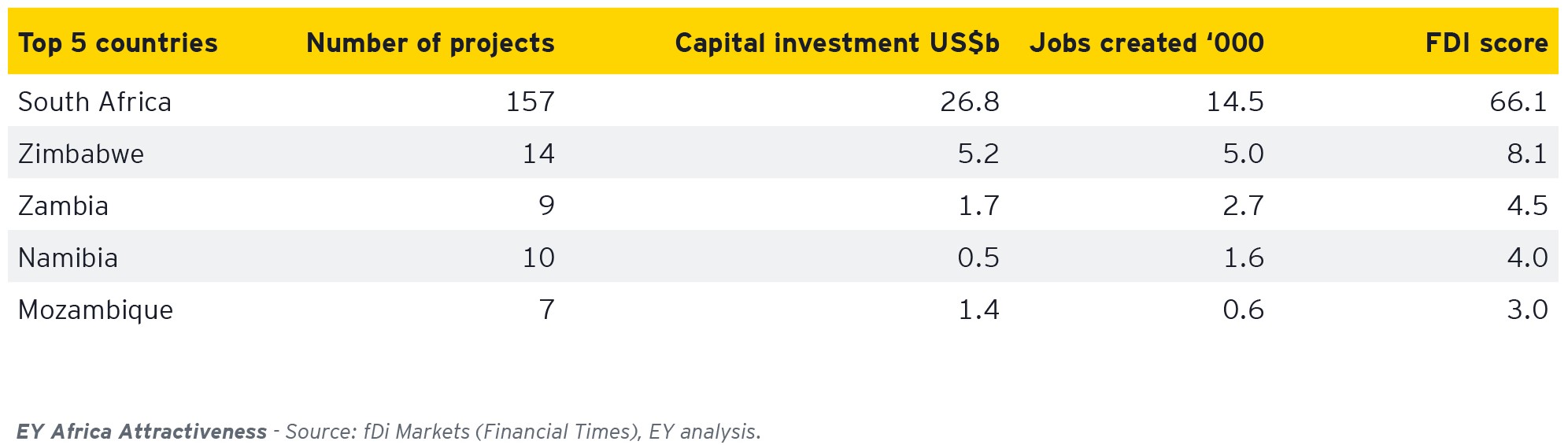

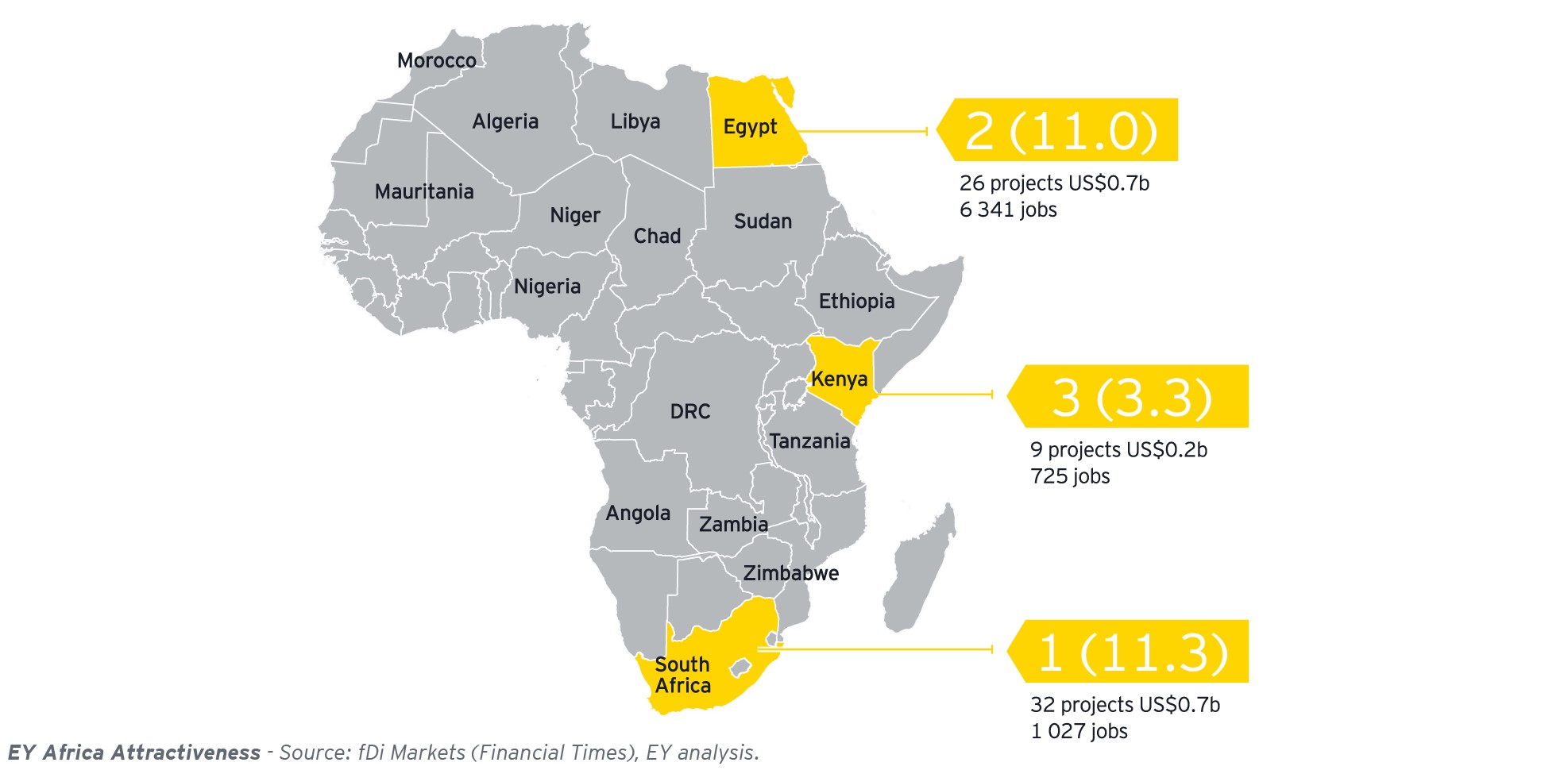

South Africa still dominates the region, despite its slow growth

South Africa still dominates the region, despite its slow growth In 2022, Southern Africa attracted the second-highest number of investment projects (207, +47%), with capital investment of US$36b, creating 25,000 jobs. Almost 75% of the southern region’s FDI (measured by projects) went to South Africa. Investment into the rest of the region struggled as it grappled with soaring commodity prices, food insecurity, debt distress, climate shocks, poor infrastructure and water scarcity. While South Africa’s growth outlook is tepid, the country’s energy crisis also brings opportunities for investors. This can be evidenced by it being the third-largest recipient of CleanTech FDI into Africa, trailing only Egypt and Morocco. Evidence suggests that solar rooftop photovoltaic (PV) rose from 983MW in March 2022 to 4,412MW by June 2023.* As the energy crisis continues, the shift from the national grid escalates the need for alternatives.

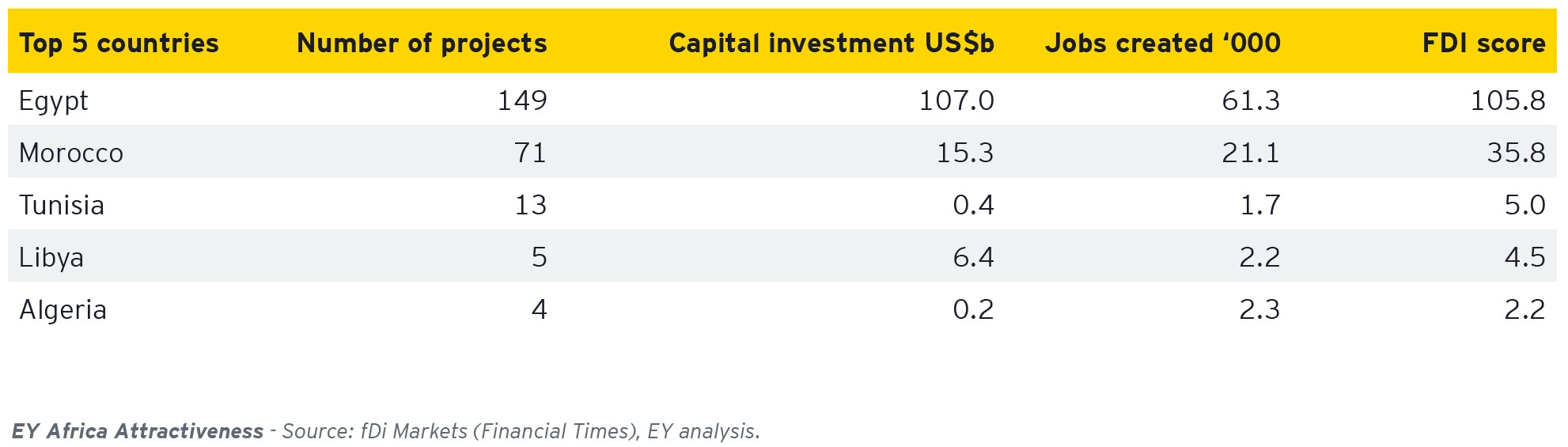

North Africa

FDI in the region was primarily led by Egypt and Morocco.

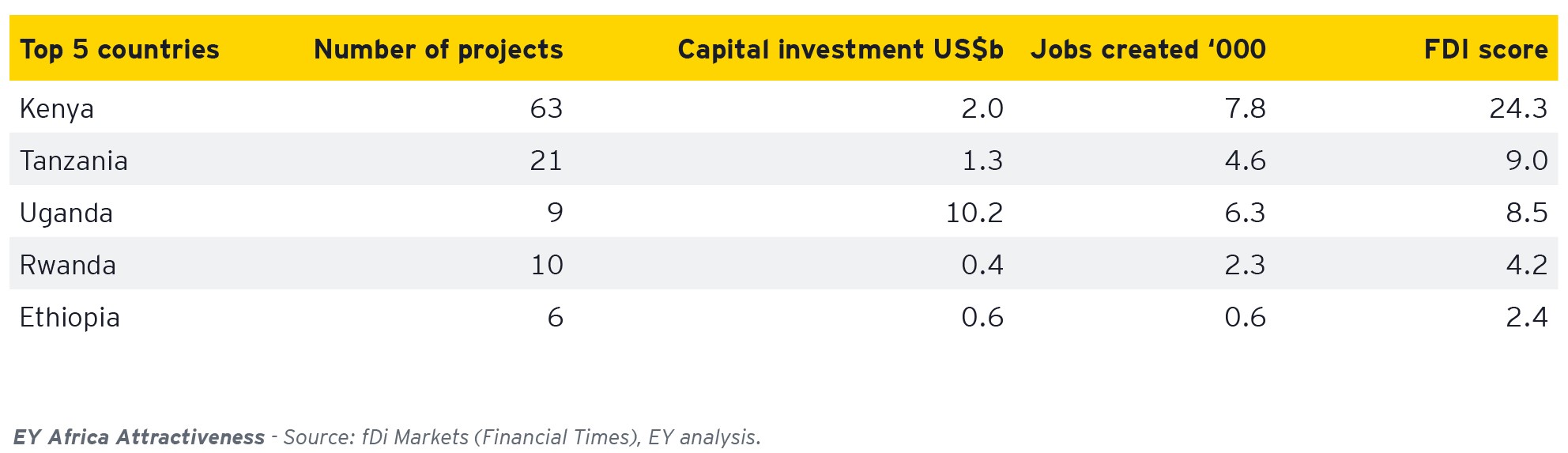

East Africa

Kenya remains buoyant and becomes an ever larger regional FDI hub.

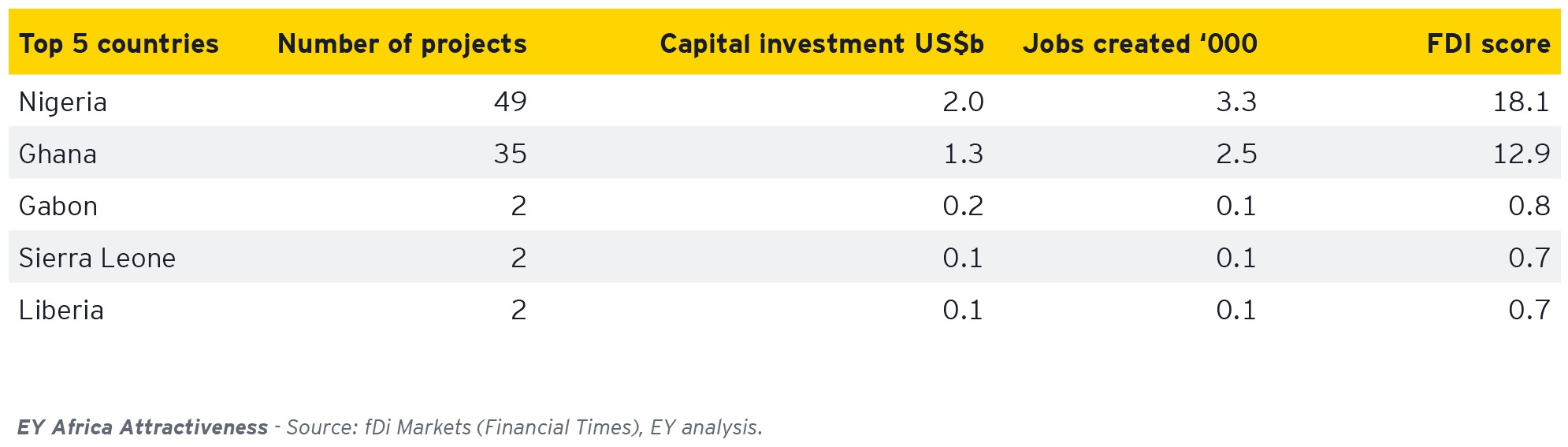

West Africa

Nigeria remains the largest FDI destination in the region.

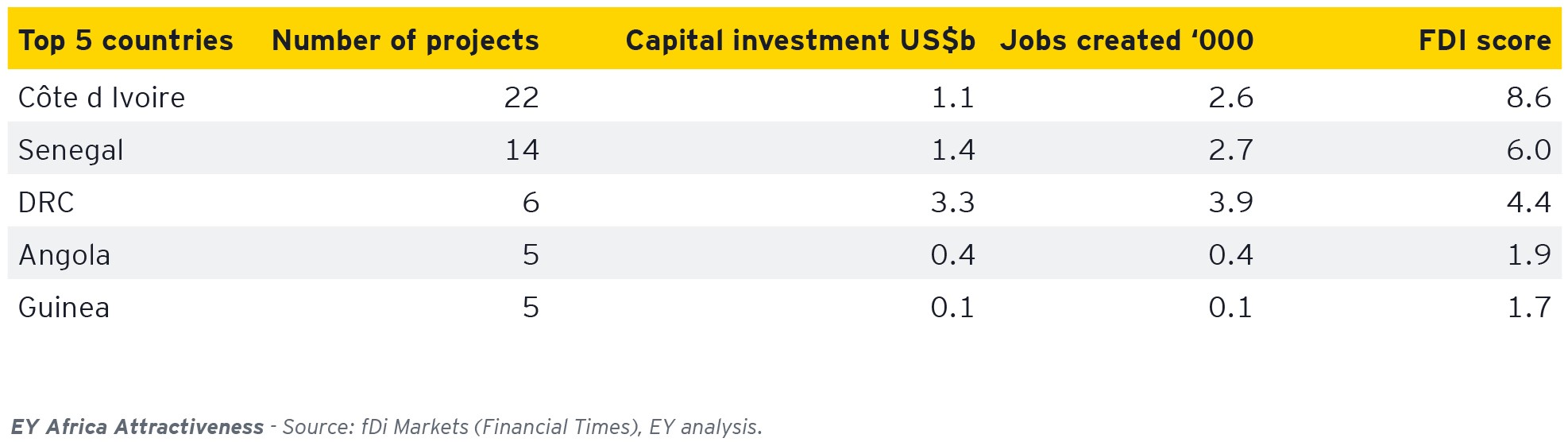

Central Africa and FSSA

Cote d’Ivoire and Senegal lead FSSA’s FDI drive.

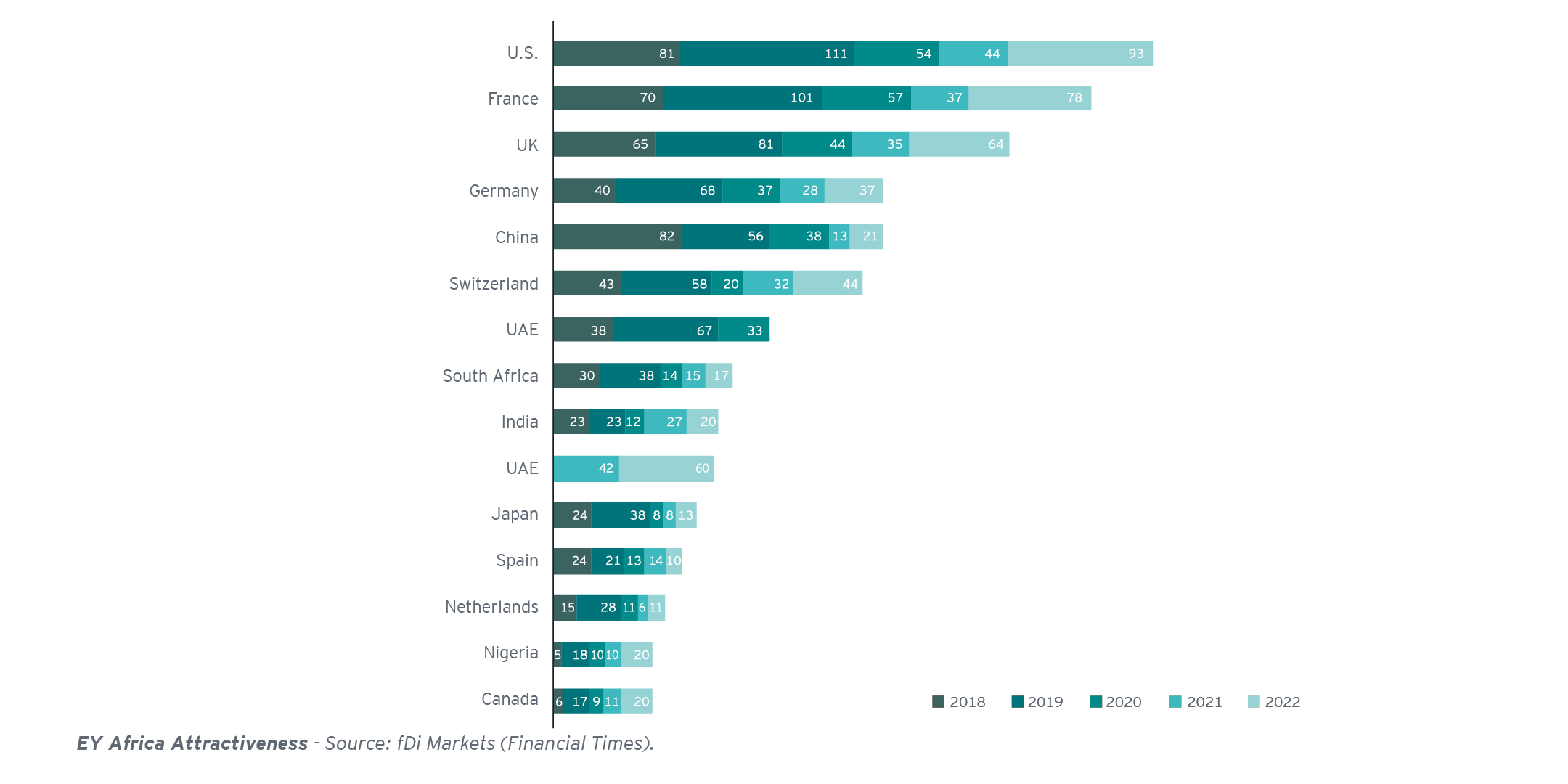

FDI 2018-22 by Source: Top 15 origin countries

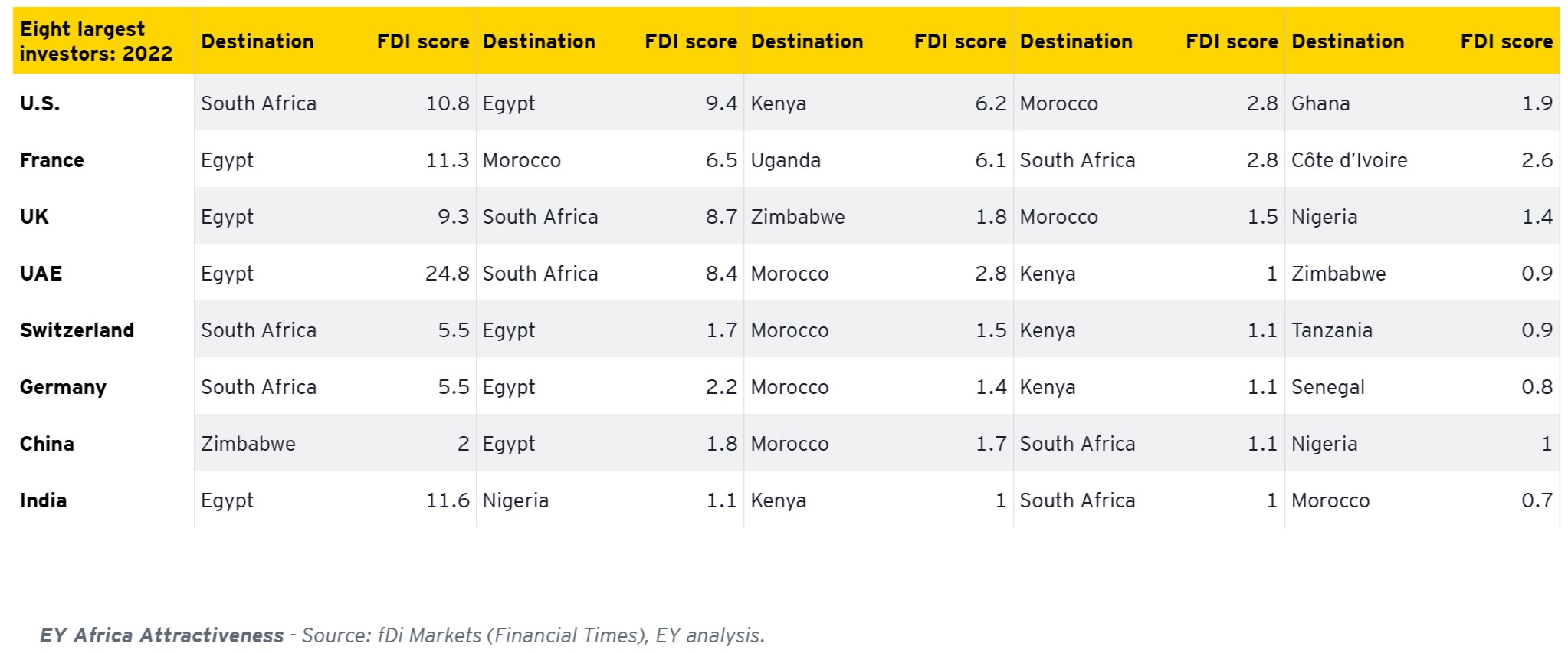

The US is the single largest investor by project

The US remains the largest investor in Africa by project numbers, contributing to 13% of Africa’s total investment — its highest since 2016. However, when measured in capital terms, the country trails the UAE, France and India. In 2022, the US invested US$7b across Africa, the highest since 2018, with South Africa, Egypt and Kenya being the largest recipients. Key projects announced were in South Africa (telecoms), Egypt (business services) and Kenya (technology). Under the African Continental Free Trade Area (AfCFTA), the US and Africa announced several initiatives to boost trade and investment between the two partners. Since 2021, the US government has facilitated more than 800 trade and investment deals worth US$18b across 47 African countries, while the U.S. private sector has closed investment deals in Africa valued at US$8.6b.

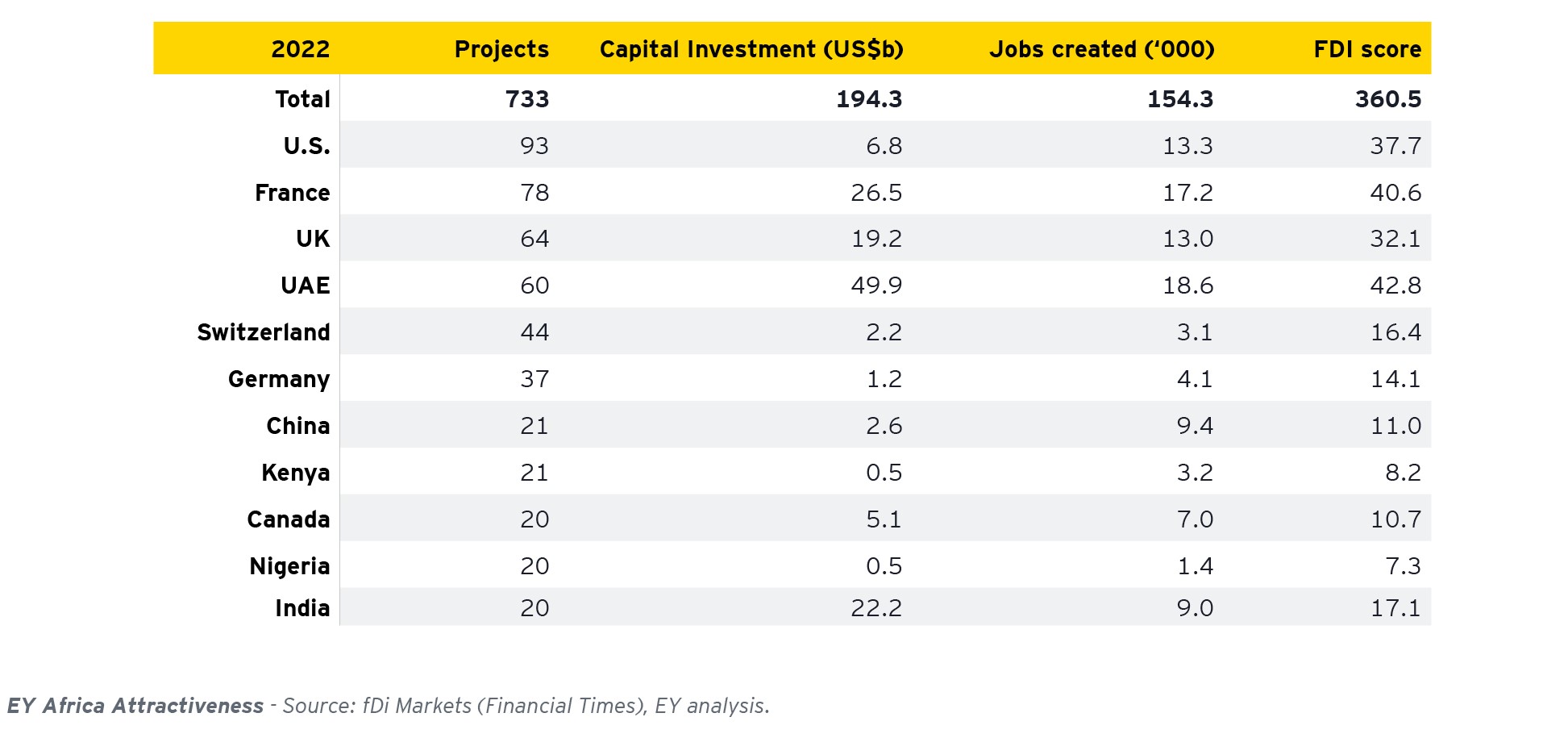

2022 FDI by source country ranked by projects.

South Africa and Egypt tie as the largest FDI beneficiaries.

Chapter 3

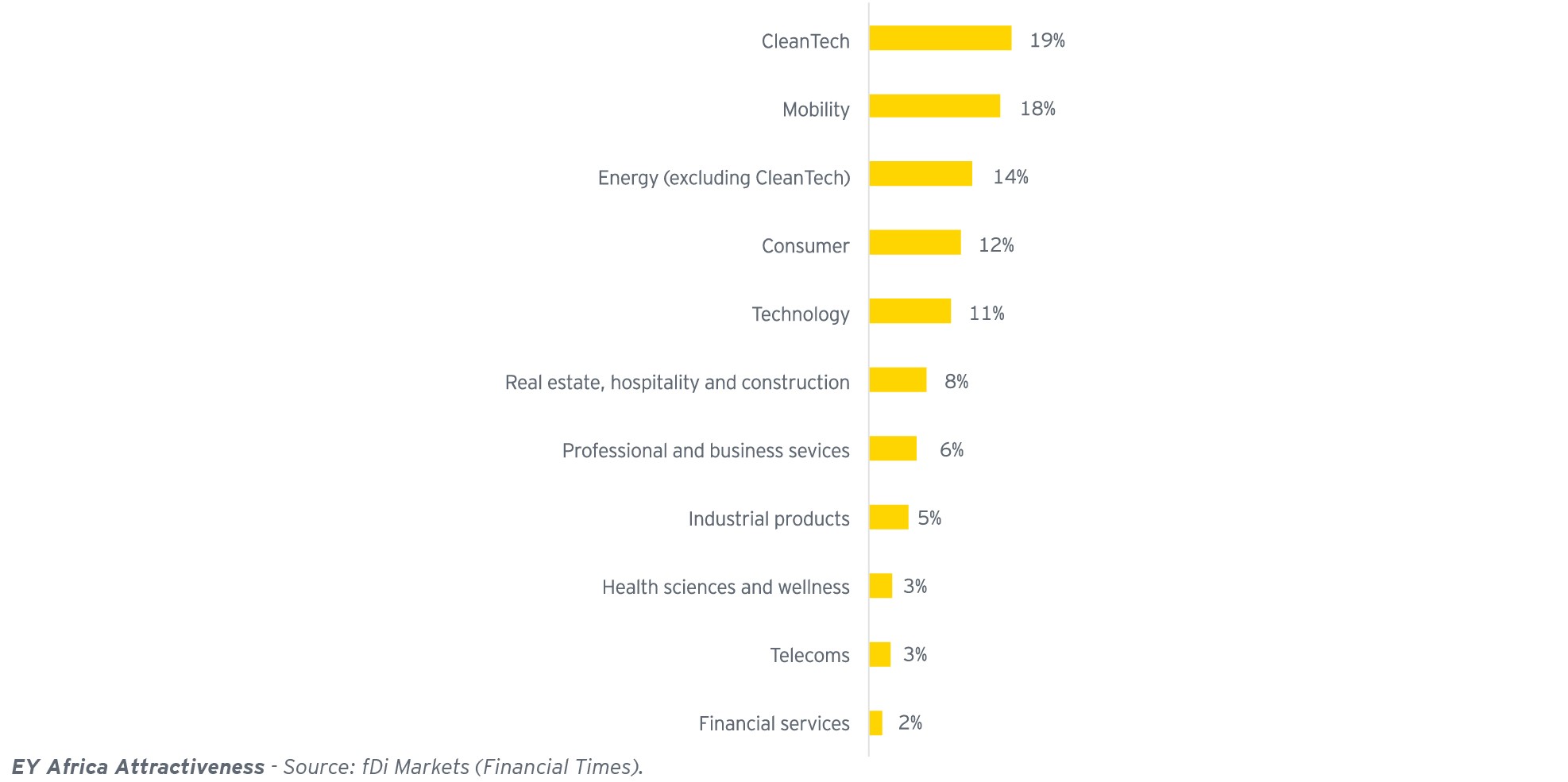

CleanTech becomes the leading FDI sector in Africa

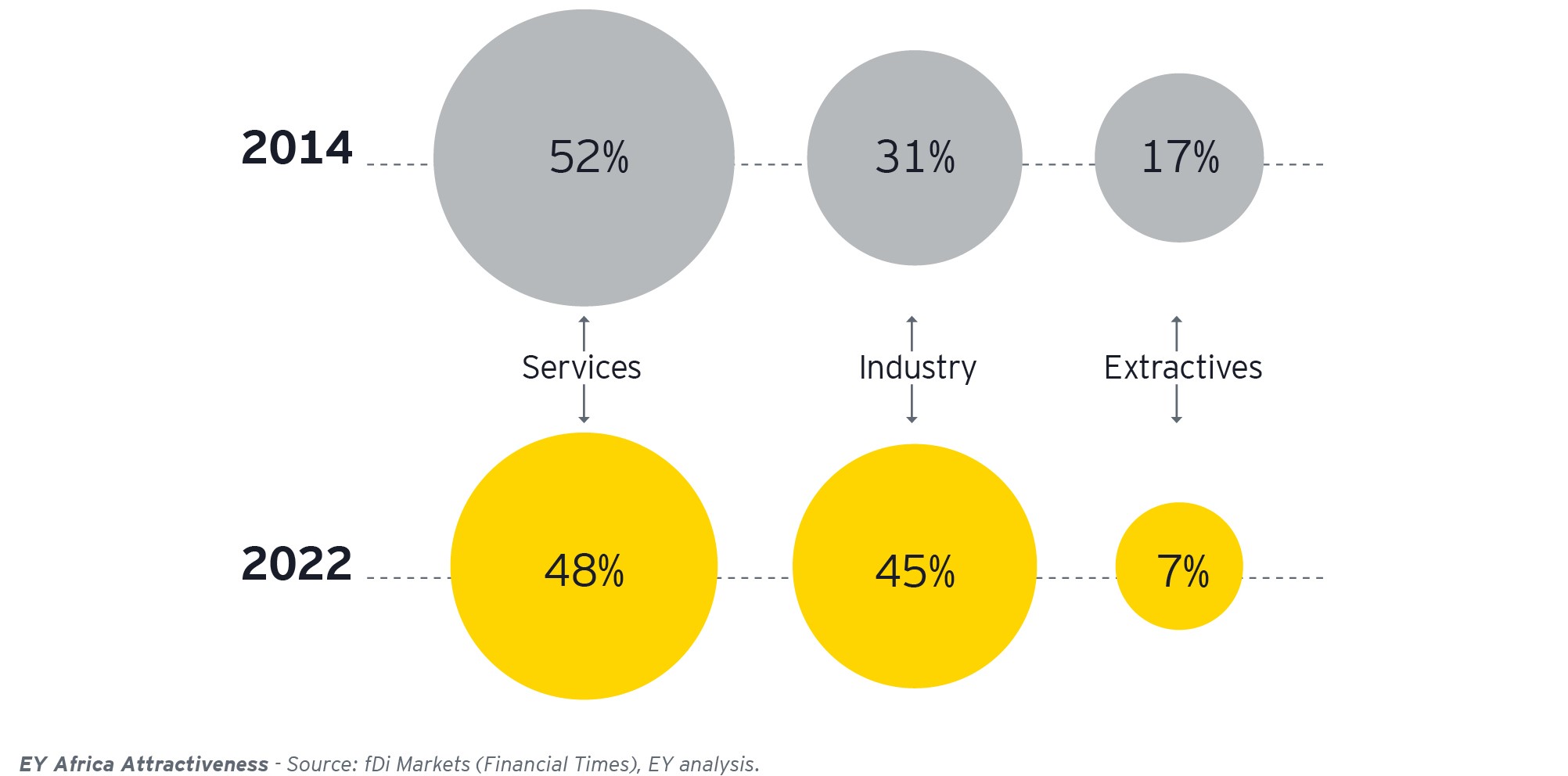

The dominance of services as a driver of FDI continues.

On a project count, these service industries accounted for more than half of Africa’s total FDI in 2022 (51.6%), although they brought in only 13.6% of the total capital flows and created 24.6% of the total jobs.

Extractives, on the other hand, accounted for only 4.3% of projects and created fewer jobs than services FDI, although they brought in nearly 25% of capital inflows (given the capital intensity of energy projects). EY has long argued that more services-oriented FDI leads to more sustainable growth, supports urbanisation and helps address poverty reduction, as it is focused on middle class consumers and workers with rising incomes and aspirations. The encouraging shift over the last 20 years away from extractive investment toward services continues unabated.

(The combined industries making up services are technology, media and telecoms; business and professional services; financial services; consumer; and health sciences and wellness.)

CleanTech becomes the leading FDI sector in Africa.

CleanTech FDI is being driven by a “green revolution” sweeping across Africa: Africa is beginning to harness its renewable energy infrastructure. However, according to BloombergNEF (BNEF), clean energy investments are concentrated in only a few countries. South Africa, Egypt, Morocco and Kenya account for nearly 75% of all renewable energy investment since 2010, amounting to US$46b. There remains a huge deficit of clean energy, with fossil fuels still making up the bulk of Africa’s power generation. The International Renewable Energy Agency (IRENA) and the African Development Bank (AfDB) estimate the continent’s solar PV potential at 7,900GW, hydropower at 1,753GW and wind energy at 461GW.

Top 3 destinations by sector using FDI score:

Renewables (20% of total FDI)

Africa’s digital ecosystem is growing rapidly as it catches up with the rest of the world, unlocking growth potential, creating employment, and providing innovation and access to new-age services.

Technology remains a prominent driver of FDI in Africa

CleanTech, Mobility and Energy are crucial job creators

FDI into CleanTech and energy made up one-third of the jobs created in 2022. The global energy transition has led to employment opportunities in solar and wind investments in parts of the continent. IRENA estimates that renewables have created over 1.9 million jobs in Africa.

Although services create the most FDI opportunities, their contribution to job creation lags both manufacturing and energy

Chapter 4

Assessing the FDI leaders and laggards

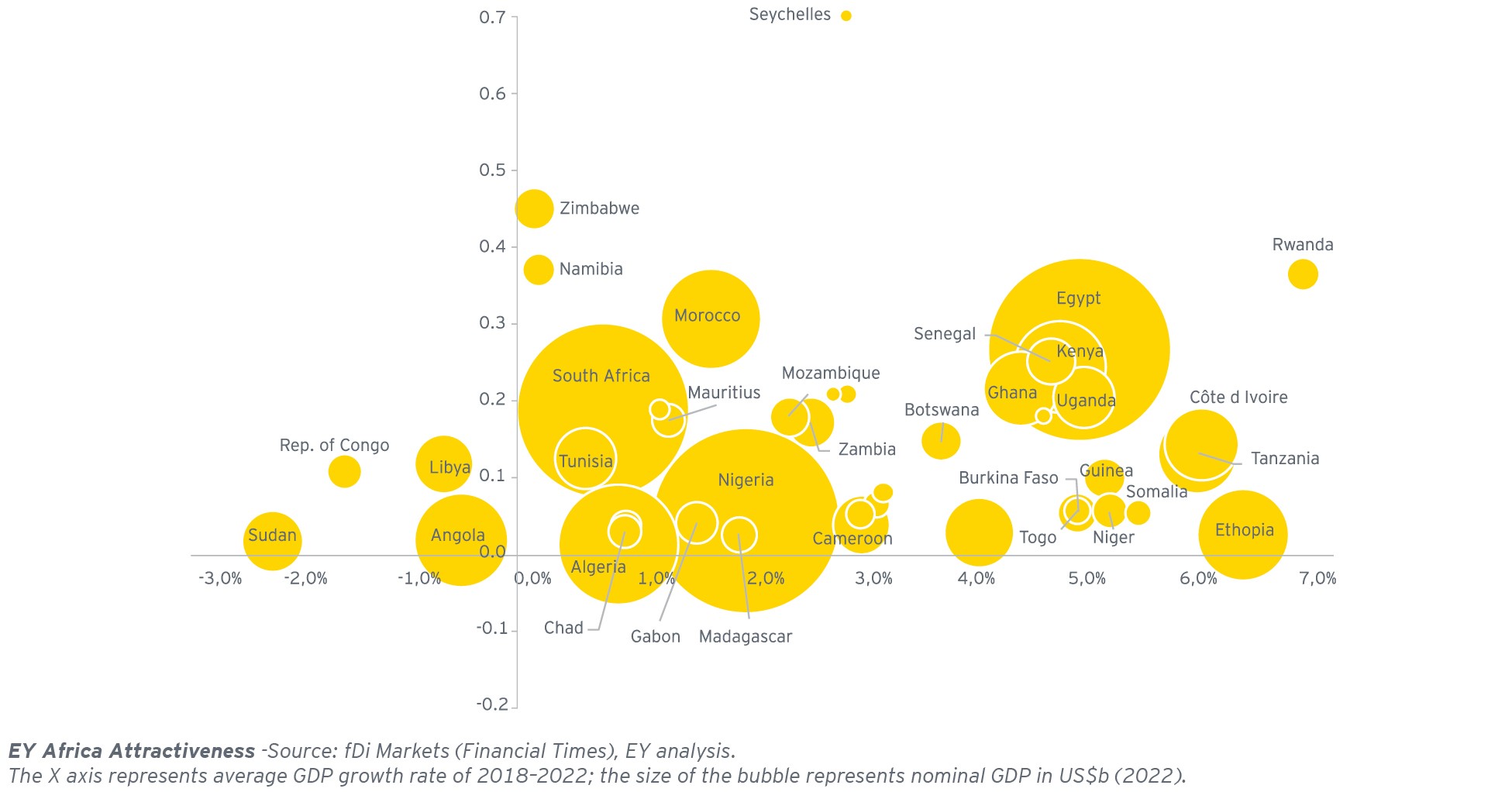

Faster growing economies tend to attract larger FDI inflows

We have once again provided context to the FDI numbers as, on face value, they do not illustrate any indication of how well each country is faring in its ability to attract inbound investment. For example, a host of countries have economies close to the US$100b level, but they attract vastly different levels of FDI. On the one hand, Kenya attracts a diversity of investments across several sectors, despite its strong reliance on agriculture exports. On the other end of the spectrum is Angola, which remains over-reliant on fossil fuels FDI, with limited inbound investment in other sectors. This difference arises from each country’s approach to attracting investment. Some regimes take a more centralized approach to managing economies and do not necessarily encourage all FDI, other than specific investments on terms and conditions deemed suitable by the recipient authorities. To measure how countries are faring in attracting FDI, we devised a metric whereby the FDI score as a share of nominal GDP is calculated.

Chapter 5

What policies could Africa adopt to attract sought after FDI?

Preparing Africa for a stronger role in the world economy.

To prepare Africa for a stronger role in the world economy, there is a need to:

1,Tackle youth unemployment and promote skills development

Unemployment is rising across Africa, compounded by the impact of the COVID-19 pandemic. It reached record levels in many of Africa’s economies in 2022, with South Africa’s unemployment rate just under 34% — one of the highest in the world. Nigeria (31%), Kenya (23%) and Namibia (21%) also have high unemployment. Africa has a large pool of young people (aged 15 to 35) who remain either unemployed or underemployed and, according to the AfDB, its youth will double to over 830 million by 2050. If properly tapped into, youth employment could provide the muchneeded push in productivity and inclusive economic growth to further drive investment across the region

2,Improve agricultural output to address food security

Food insecurity in Africa has intensified in the past decade, with climate change and adverse weather conditions impacting agricultural production and productivity. The COVID-19 pandemic and the Russia-Ukraine war have added to food shortages, with higher prices and cost of transport, as well as disrupting critical food imports. The IMF cites sub-Saharan Africa as the most food-insecure region in the world, with over 20% of its population facing chronic hunger. The situation is grave in Somalia, Chad, South Sudan, the DRC, Burundi and Madagascar. Kenya, Ethiopia, Morocco, Tanzania and Mozambique also faced food prices soaring in 2022. The World Food Programme identified the drought in the Horn of Africa as the world’s worst food emergency in 2022. As a result, many countries implemented shortterm and untargeted support measures, including subsidies and tax cuts on food or fuel, price controls and export restrictions. Governments should aim to achieve self-sufficiency for major food commodities, and increase crop productivity and yields to address the acute food insecurity in the region, take coherent action against hunger and poverty, and build more resilient intraregional food supply chains that are less vulnerable to external events or internal conflicts.

3,Accelerate economic diversification and energy transition

Despite efforts to diversify, many of Africa’s economies remain overly dependent on exports of agricultural, mining and extractives, which remain volatile to external market fluctuations. The UN Conference on Trade and Development (UNCTAD) cites 45 African economies as being solely dependent on a few commodities, vulnerable to global macroeconomic forces. UNCTAD cites several factors that could drive economic and trade diversification across the continent, including “the implementation of the African Continental Free Trade Area, a growing middle class, an emerging consumer market, the increased use of financial services and technology, and dynamic private entrepreneurs.” It also mentions the importance and role of a strong private sector (particularly micro-enterprises and SMEs) to venture into new and innovative industries, as well as financial aid to fund innovative ideas.

4,Focus on digitalization and development of basic infrastructure

The World Bank estimates that the poor state of infrastructure in Africa constrains economic growth by 2% each year and cuts productivity by as much as 40%. With the population of 28 African countries having doubled in the last 30 years, and an additional 26 African countries expected to double in the next 30 years, it is an absolute imperative to accelerate and scale up infrastructure development. In addition, driving economic growth and boosting trade requires:

- Electricity access to increase by 93% by 2035

- Half of the roads and highways to be paved

- An increase in container handling performance at major ports from 20 to 25–30 moves per hour

- Internet access for 300 million more people

With a rapidly urbanizing population, the role of digitalization becomes crucial to reshaping the economy, providing social security, alleviating poverty and developing technical skill sets. A report by the International Finance Corporation (IFC) and Google says Africa’s internet economy could add another US$180b to the economy (5.2% of GDP) by 2025.

5,Manage public finance and national debt to avoid credit defaults

Public debt in sub-Saharan Africa has risen steadily in the last decade, especially in recent years due to increased spending and falling revenues caused by the COVID-19 crisis. Rising government debt is also a growing concern, increasing from an average 15% of GDP in 2010 to 30% in 2020. An already constrained fiscal budget leaves governments susceptible to global capital market swings, with institutional investors quick to shift funds from high-risk locations. As previously mentioned, some African states have already benefited from IMF assistance. These countries are required to embark on economic reforms to qualify for assistance and have little leeway to diverge from these programs. Building coherent policies to maintain these lines of funding is important to keep these economies solvent.

Summary

To attract and retain investment, African governments could prioritize investment promotion and create favorable business environments that addresses youth unemployment, skills shortages and infrastructure constraints, among other issues.