Chapter 1

Why platforms are essential to value creation

Platforms help life sciences companies to safely and quickly connect data sources to their deep scientific and clinical data.

We are entering a Fourth Industrial Revolution where rapid technological advances have made it possible to generate and disseminate data at unprecedented rates. As new technologies empower individuals to see and share their health data, they are demanding greater say over their lifelong health journey, as well as new health products and services.

Sensing an opportunity, digital health and technology entrants are moving to meet consumers’ demands. The explosion of narrow, disease-specific point solutions are slowly being aggregated into integrated systems that create engaging, high-touch offerings. In this rapidly converging world, life sciences companies must consider how they will adapt their current business models to create future value.

Creating future value

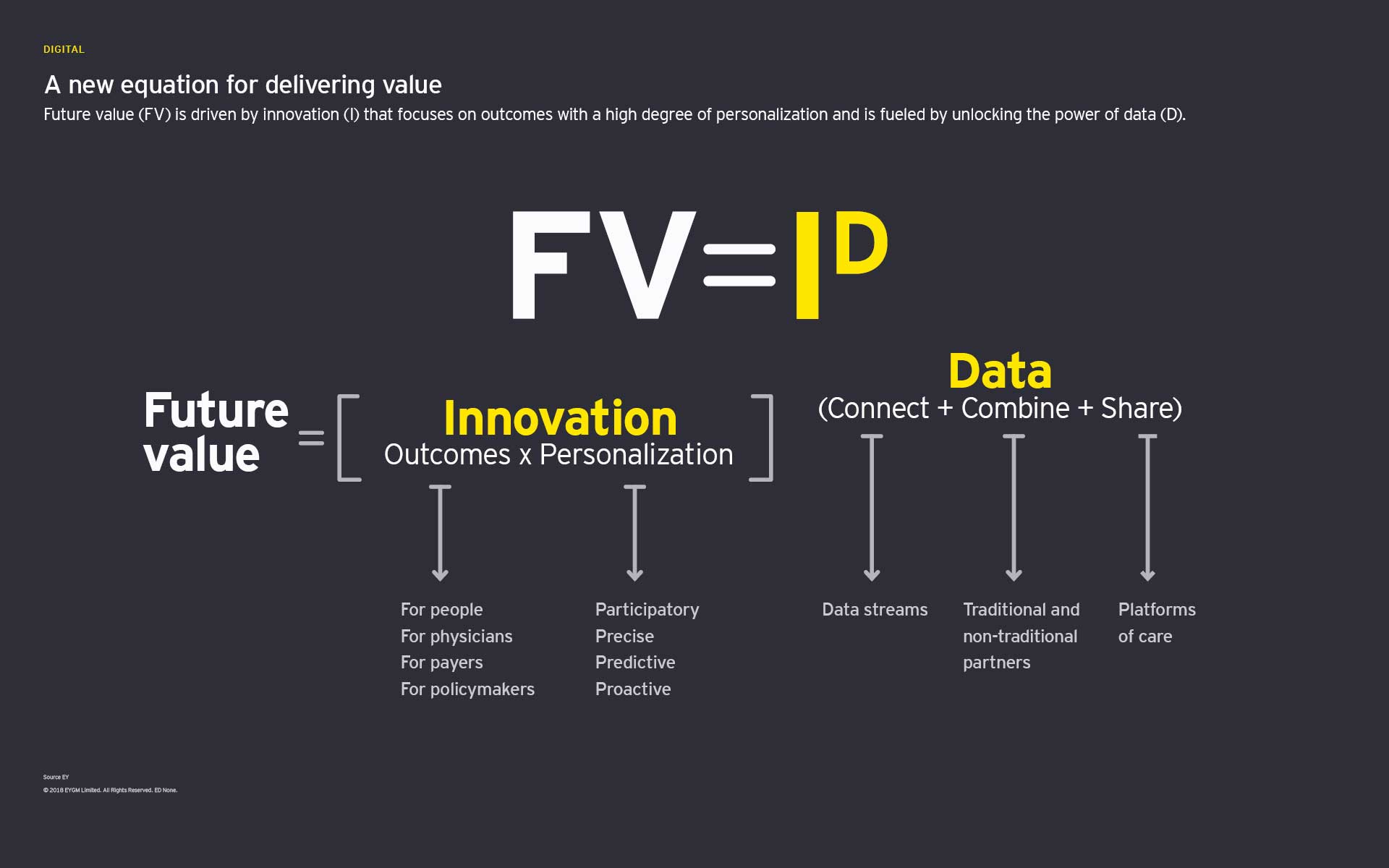

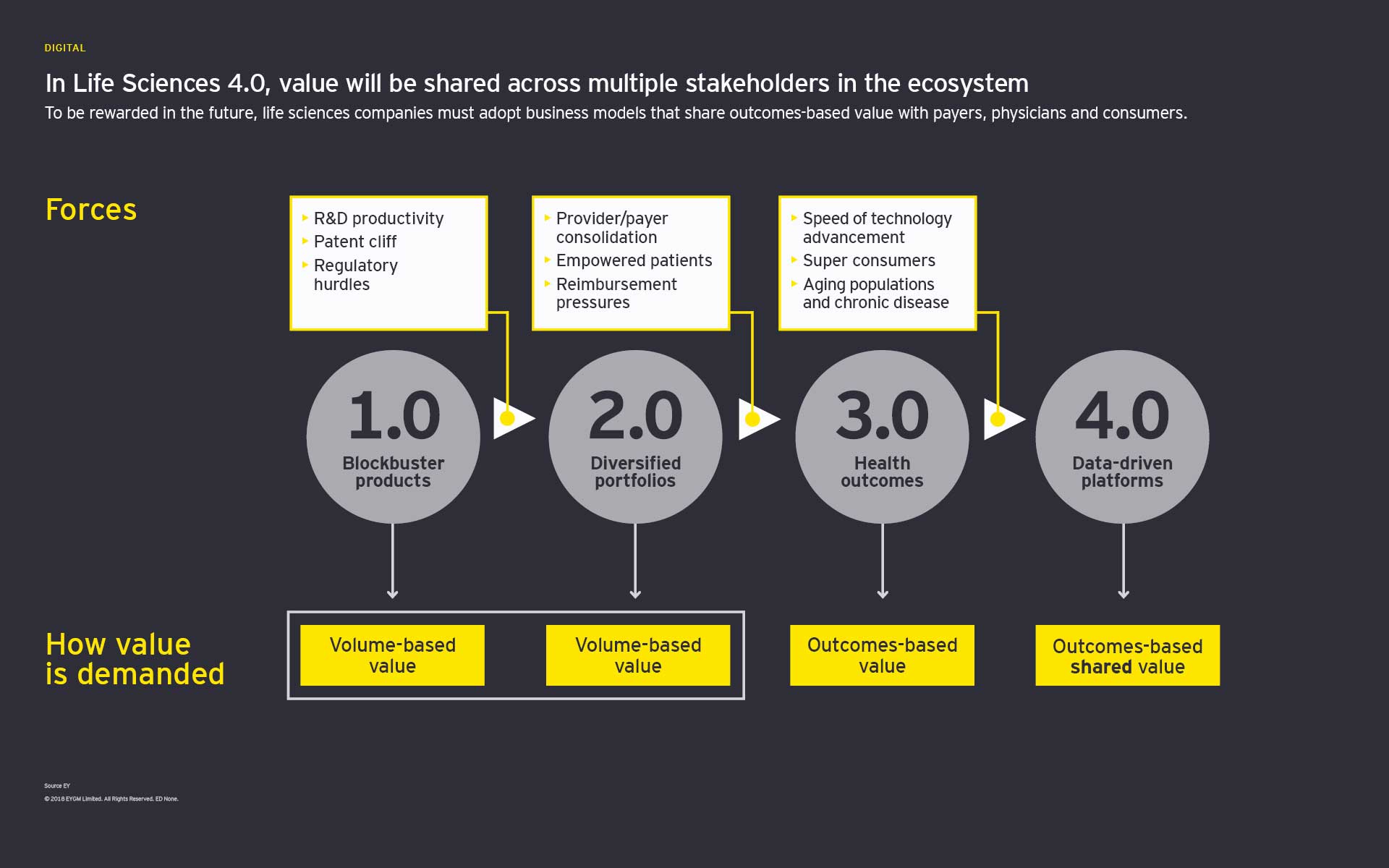

Innovation will continue to be a central component of how life sciences companies create future value. But increasingly these innovations will be valued based on their ability to satisfy the demands of life sciences companies’ diverse customers – payers, care providers, policy makers and consumers.

To do so, companies will need to frame innovation in terms of health outcomes, affordability and personalization. This broader definition of innovation means products are no longer the central driver of value. Instead, innovation will be powered by an increasingly diverse stream of data that resides outside the confines of the traditional health ecosystem and the electronic medical record.

Creating agile and data-centric platforms

To be successful in this new environment, life sciences companies need new ways to safely and quickly tap into different data sources to combine and connect them to their deep scientific and clinical data. Platforms, interfaces that promote the exchange of information between new and existing stakeholders, are one way to do this.

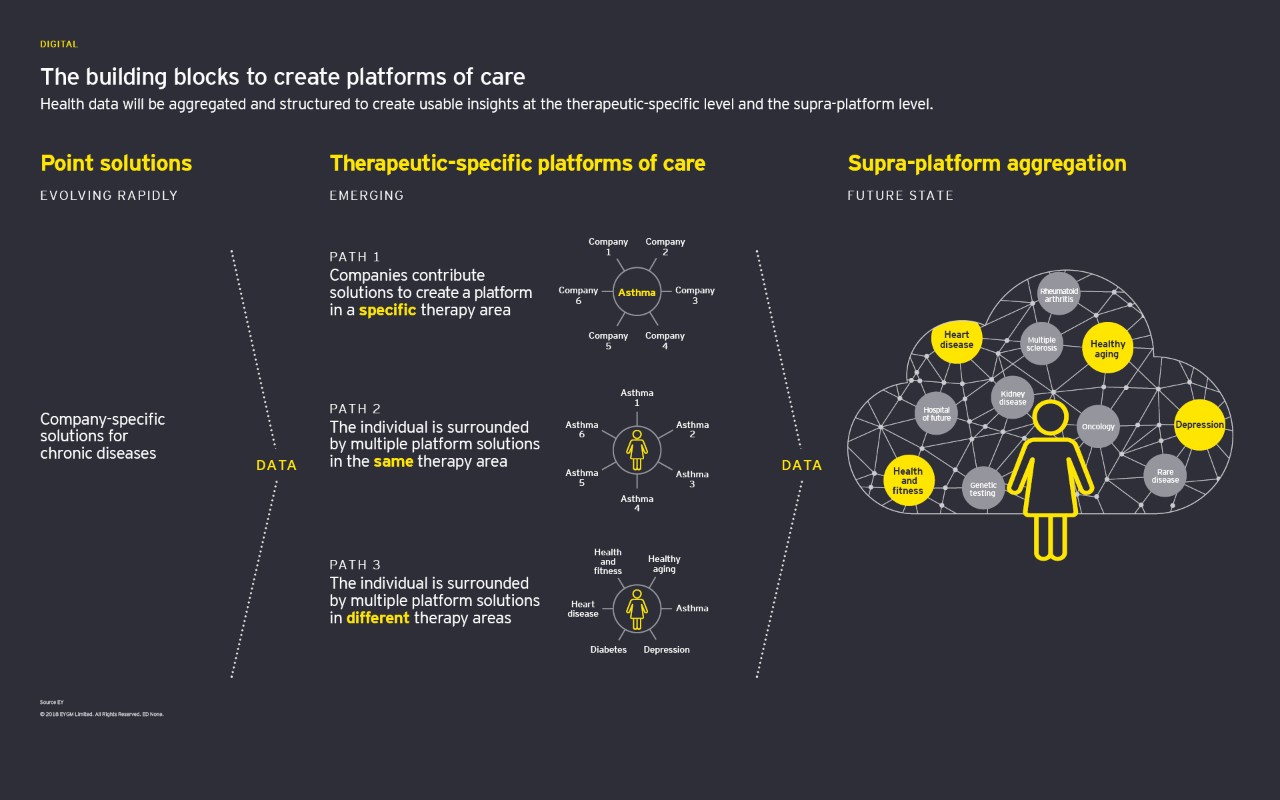

In health, platform capabilities are emerging at two different levels. In immediate proximity to consumers, companies developing different applications, products or tools will join forces to create platforms of care that address specific health needs. Above these individual platforms of care, global technology, artificial intelligence and data analytics companies will combine skills to become supra-platform aggregators, helping to scale insights gained at the platform of care level across multiple therapeutic areas.

Embracing the health technology opportunity

Although life sciences companies currently house only a small amount of data tied to health outcomes, the data they do hold are incredibly rich. If life sciences companies combined these clinical data with environmental, behavioral and financial insights, they could position themselves as one of the primary owners of the outcomes data that drives future value, strengthening their position as key health technology providers in a wider ecosystem.

Chapter 2

How platforms help life sciences capture future value

Platforms enable life sciences companies respond to the changing demands of their customers.

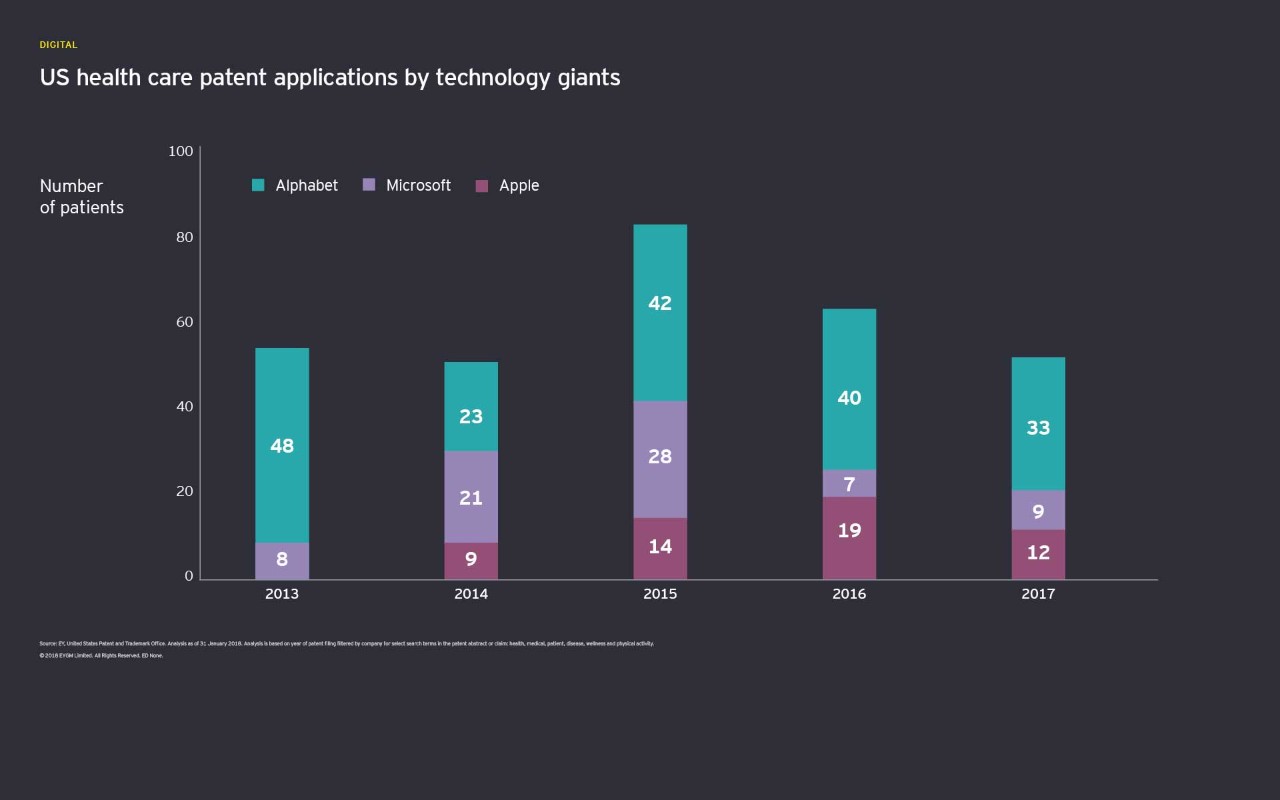

Digital health start-ups and technology incumbents are using their engineering and data expertise to create new products and services that satisfy the demands of consumers, physicians and payers. An EY analysis of the US health patents filed by major technology players shows the investment technology giants are making in health care.

Life sciences companies have responded to this potential disruption with their own exploratory programs, using AI and other digital tools to improve or optimize clinical trial recruitment, drug discovery and interactions with payers and physicians.

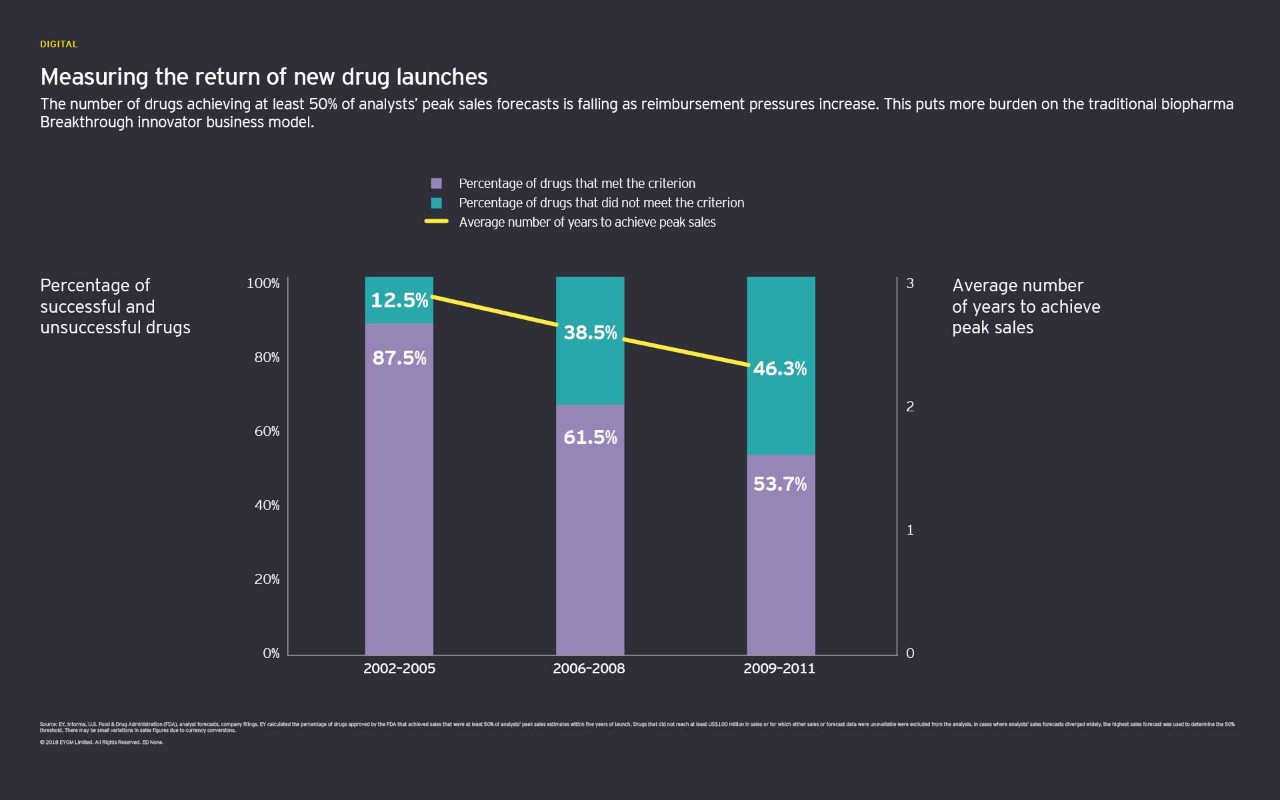

These efforts are important. An analysis by EY shows that even major clinical breakthroughs face the prospect of diminishing returns as cost-conscious payers require proof of real-world value. As life sciences companies expand their digital efforts, however, the investments are too often made in isolation of each other. As a result, companies are at risk of underinvesting in the technologies that will transform their business models and generate significant future top-line returns.

Rethinking the business model

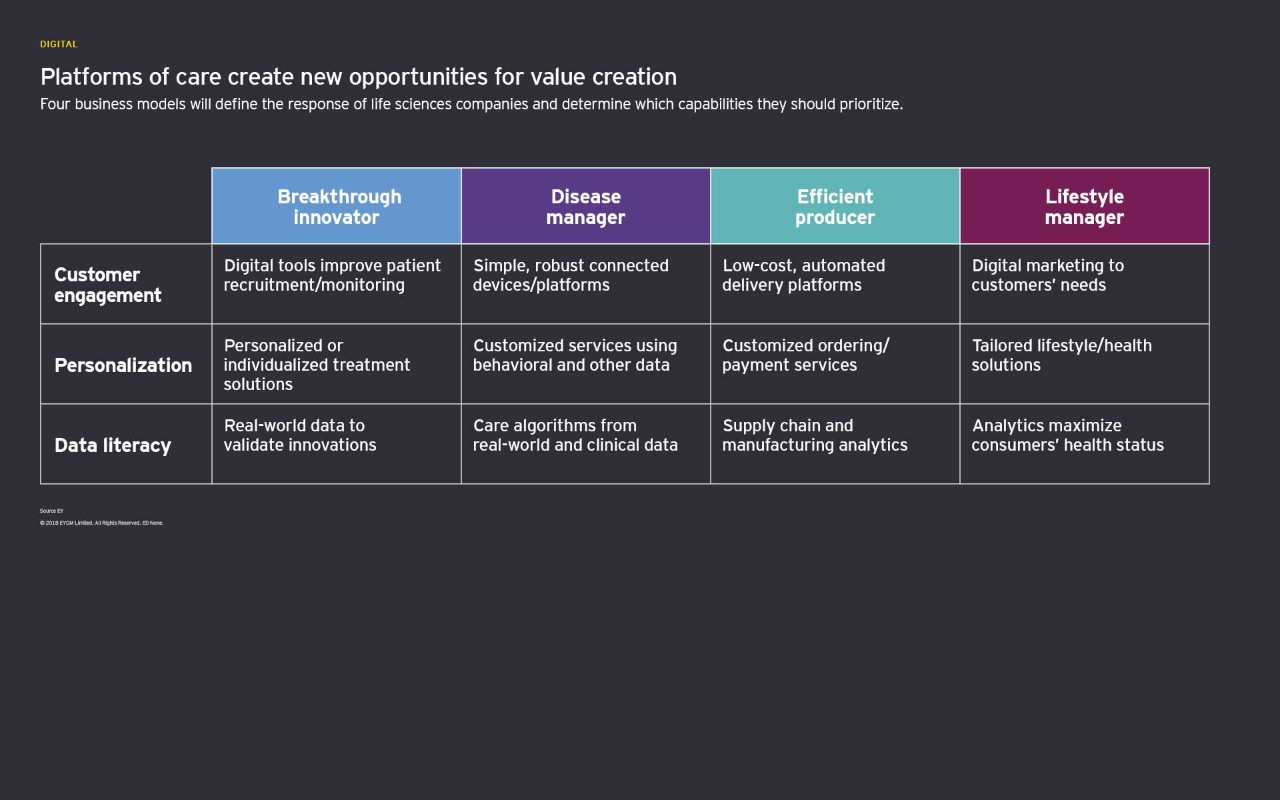

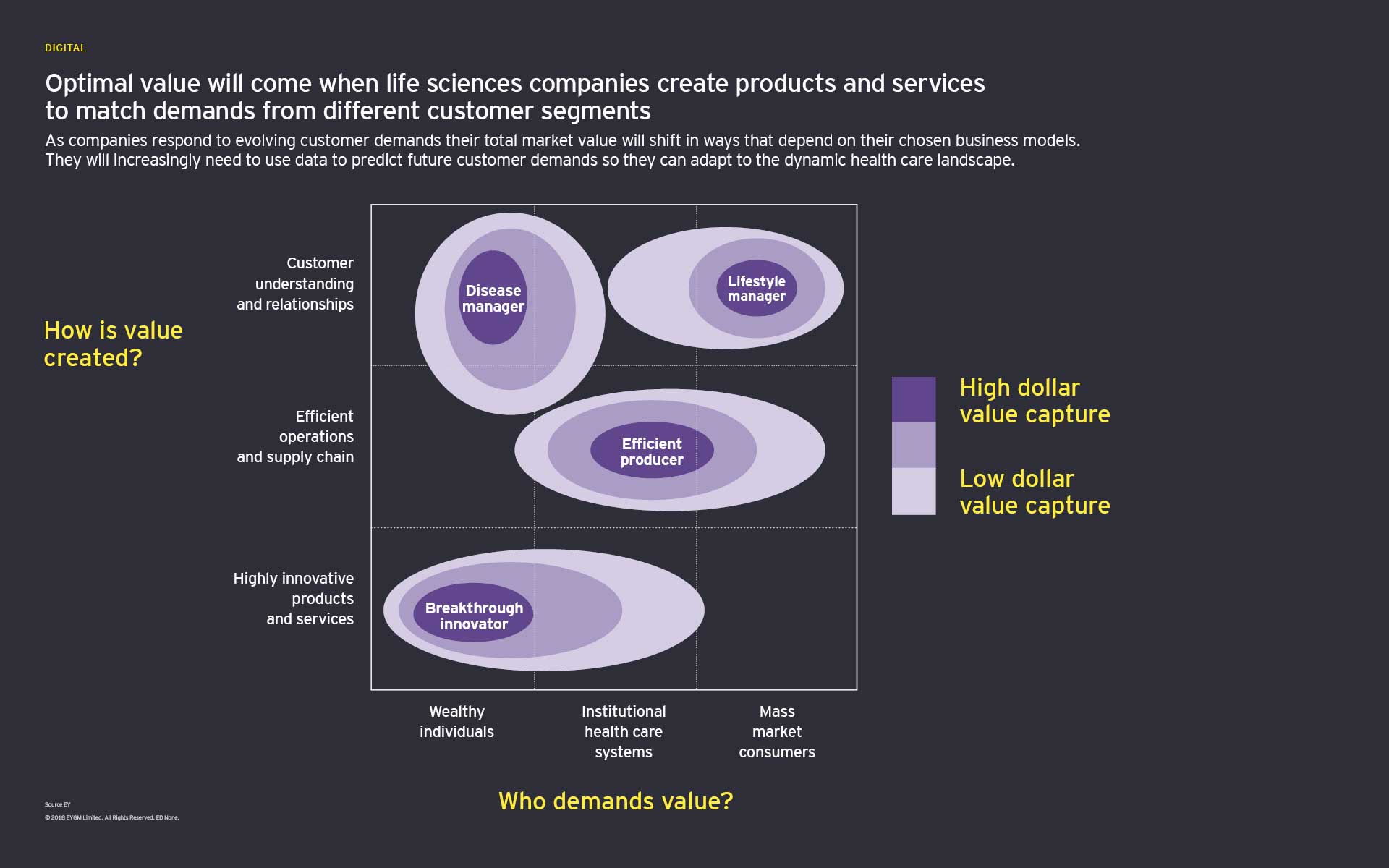

Life sciences companies traditionally adopt one of the following four business models:

- Breakthrough innovator: Developer of premium-priced, best-in-class products primarily paid for by health insurance.

- Disease manager: Developer of products and solutions to manage chronic conditions

- Efficient producer: Developer of lower cost products that perform as well as the competition

- Lifestyle manager: Developer of products aimed at prevention and overall health maintenance sold directly to the consumer

Platforms have an important role to play in each of these business models, enabling companies to respond to the changing demands of their different customers. They create a positive feedback loop that encourages continued customer participation and help differentiate products and services in a crowded marketplace.

New capabilities

Succeeding in the emerging platform environment requires new capabilities in three distinct areas:

- Customer engagement: Leading platforms in other sectors establish direct linkages with customers via cloud and mobile-based tools. That direct relationship remains a distant dream in the life sciences, but companies focused on rare diseases have demonstrated how to cultivate high-touch, high-data relationships with consumers.

- Personalization: Personalization is one of the key opportunities emerging from the wealth of consumer health data. To transform business models, life sciences companies must define personalization in terms of individual behaviors, engagement styles and tolerance for risk and uncertainty.

- Data literacy: There has been an explosion in the amount of data now available, from clinical results, to payers’ claims data, to real-time data generated by mobile sensors. To extract full value from these data, companies must break down existing siloes and partner with companies with analytics expertise.

It’s not difficult to imagine the gain companies could realize from building or participating in platforms that achieve scale in a given disease area. Some life sciences companies might choose to develop and own their own platforms, while others will find ways of using digital platforms built by other companies.

Chapter 3

How companies can participate in new platforms of care

Collaborations to create platforms must span public and private entities and include organizations from health care, consumer products, technology and life sciences.

Wellness-focused platforms of care linked to the development of fitness and nutrition solutions have already emerged, and we are beginning to see the emergence of platforms to manage chronic diseases such as diabetes and asthma. Outside these indications, there has been a proliferation of interesting, but confusing technologies that don’t integrate seamlessly with each other. When platforms start to achieve the scale needed to transform health delivery, we’ll see a significant shift in value generation.

Laying the foundation

At least initially, multiple care platforms for the same disease area or health purpose will be created. Over time, leading platforms in specific disease categories will emerge as users gravitate to platforms that provide greater value. As organizations build data and analytics capabilities, supra-platform aggregators will connect data generated from discrete disease-specific platforms to help individuals and health systems address larger health goals.

Multiple stakeholders across multiple industries will contribute resources to create functional platforms of care. Collaborations must span public and private entities and include organizations from health care, consumer products, technology and life sciences.

Creating tomorrow’s care platforms

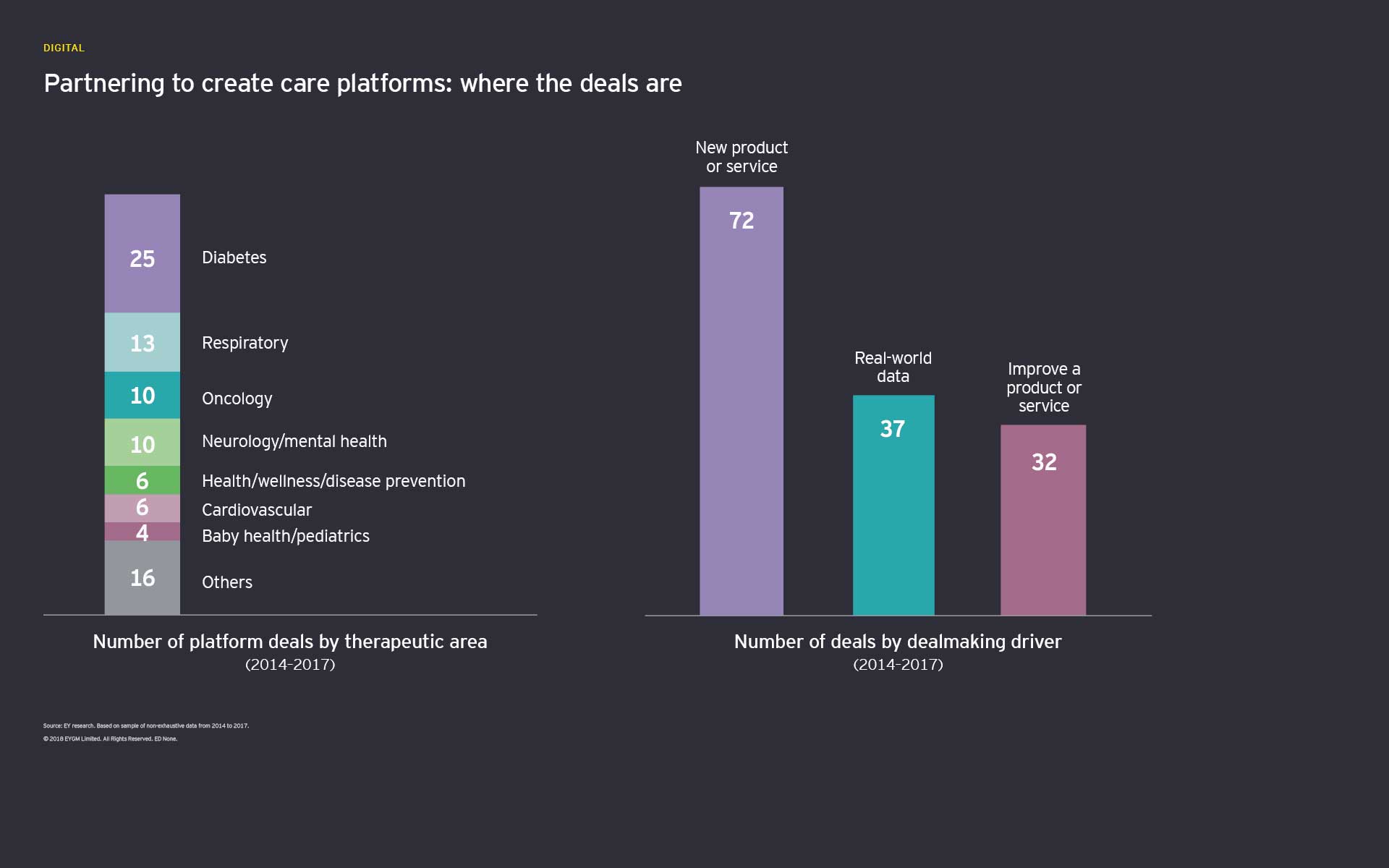

To better understand where companies are partnering to build capabilities or access resources, EY interviewed more than 25 life sciences leaders and analyzed more than 150 digitally focused partnerships announced between life sciences companies and other stakeholders since 2014.

No single external database tracks partnerships of a digital nature, so EY created its own digital deals database (pdf), searching company reports, news releases and third-party analyst reports for relevant partnerships. Our study reveals a complicated web of relationships emerging between biopharma, medtech, digital health start-ups and technology companies.

EY also analyzed the findings to understand the growth in partnerships over time, the therapeutic areas commanding the greatest interest and the types of capabilities being accessed. Of the nearly 90 partnerships with a clear therapeutic area of focus, 50% of them involve platform capabilities in the diabetes or respiratory arenas, while 14% involve oncology-focused products or services.

The importance of being brand-agnostic

Currently, product developers interested in accelerating customer-centric care platforms will consolidate capabilities in given disease areas to further extend market reach and know-how. As product developers join forces with innovators, payers and physicians to develop more integrated solutions, emphasis will shift to the creation of more holistic care platforms that manage complicated disease conditions across the care continuum.

To be most successful, these holistic platforms shouldn’t be designed to drive sales of certain therapeutics or devices. There are regulatory, ethical and practical reasons why life sciences companies must embrace brand-agnostic platforms that address wider issues related to the customer’s day-to-day experience with his or her disease.

Related article

Chapter 4

How platforms will accelerate value-based health care

Platforms can help improve the quality of care delivery and lower the total cost of care.

Robust platforms of care won’t become a reality unless life sciences companies also partner with payers, providers and consumers to create a shared vision of future value that is linked to health outcomes.

As care platforms become a more important part of capturing future value, life sciences companies can deepen existing relationships using data. They can help stakeholders achieve value-based care goals that include increasing the quality of care delivery, lowering the total cost of care and most importantly, improving overall long-term health outcomes.

Future models

Platforms can help accelerate alternative payment models that share risk more broadly with payers, physicians and consumers. Life sciences companies should be aware of three different models of growing importance:

Subscription-based: Subscription models allow consumers to pay for higher-touch care in increments, making the service more affordable. For physicians, subscription models allow them to spend more time with individuals with more complicated medical needs. Life sciences companies, meanwhile, have new opportunities to develop services that improve medication adherence or make lasting behavioral changes.

Population-based: Population-based models pay a physician or group of physicians a set amount for each enrolled individual assigned to them during a defined period. The idea is to create incentives that standardize treatment protocols in order to provide the most cost-effective care to the greatest number of people. Most biopharma or medtech products are not included in population-based payment models due to the complexities associated with defining which products and services should be included, but examples in diabetes and end-stage renal disease merit watching.

Pay-as-you-live: A recent trend in the insurance market is the rise of “pay-as-you-live” (PAYL) models that reward customers for adopting healthy behaviors. In exchange for providing data to the insurer via wearables or mobile phones, consumers are encouraged with lower premiums and personalized solutions to make long-term changes that reduce the risk of chronic illness. While most current PAYL models are linked to wellness, they could be adapted to the treatment of diseases and involve not just insurers, but life sciences companies as well.

Chapter 5

How companies can transform their business models to realize Life Sciences 4.0

Life sciences companies must differentially invest in capabilities and intellectual property that align to their business models.

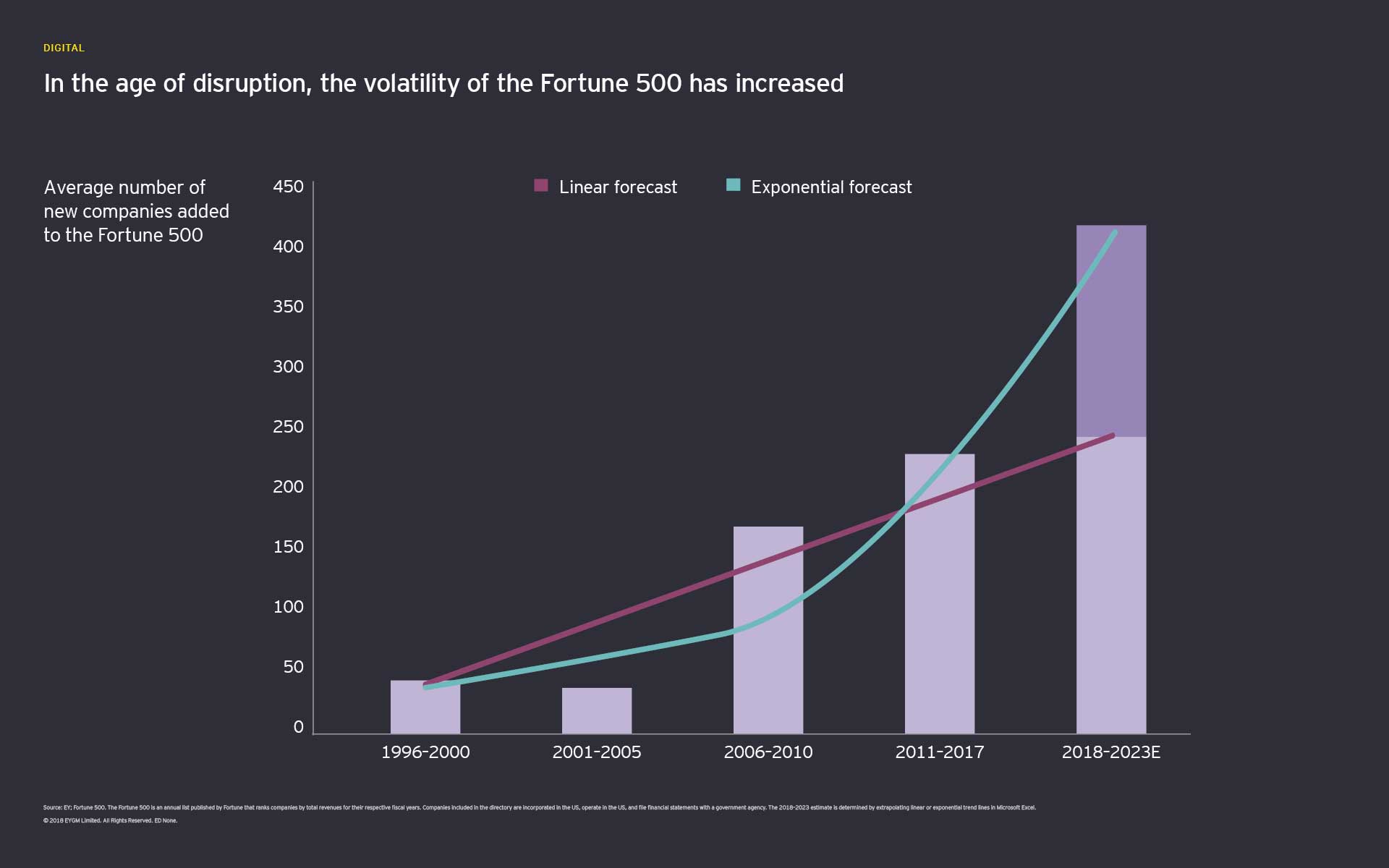

Across all industries, convergence has accelerated the turn-over rate for companies earning a Fortune 500 listing. Based on EY forecasts, between 47% and 81% of the companies on the Fortune 500 could be new by 2023. The implications for the 18 life sciences companies listed on the Fortune 500 are significant: only four might still be there by 2023.

Although many life sciences leaders question the return on investment associated with platforms, these interfaces are a way to seize disruption in a transformative age. Because of their scientific and clinical knowledge, life sciences companies can play a leading role in shaping platforms of care into robust, evidence-driven interfaces that exponentially improve health outcomes.

Creating value in the convergent age

As companies respond to evolving customer demands, their share of total market value will shift in ways that depend on their chosen business models: Breakthrough innovator, Disease manager, Efficient producer, Lifestyle manager. To be successful, companies must differentially invest in capabilities and intellectual property that align to their business models. Should companies decide to shift business models, they must also understand the investment in time, money and talent required.

Future-proofing the business

Convergence will create new business models, and new opportunities for life sciences companies to capture value. Indeed, the four traditional models may shift, meld or completely disappear as a result of rising customer expectations and technological changes. In the future, life sciences companies will be better able to use data to understand the shifting market landscape and predict how changing customer needs directly affect the future value they can create.

Life sciences companies have a limited window of opportunity to embrace and participate in the development of platforms of care. In doing so, companies not only gain direct access to customers, but build trust by working alongside payers and physicians to improve the health care experience, and solidify their place as trusted contributors to the overall health ecosystem.

Listen to a summary of Life Sciences 4.0: securing value through data driven platform on audiobook

You can also listen on:

- iTunes (for iOS users)

- Google Play Music (for Android users / US & Canada only)

- Spotify (for iOS and Android users / accessible via mobile and tablets)

Summary

The rise of platform-based models presents two options to life sciences companies: get involved or fall behind.