Key divestment drivers across the globe

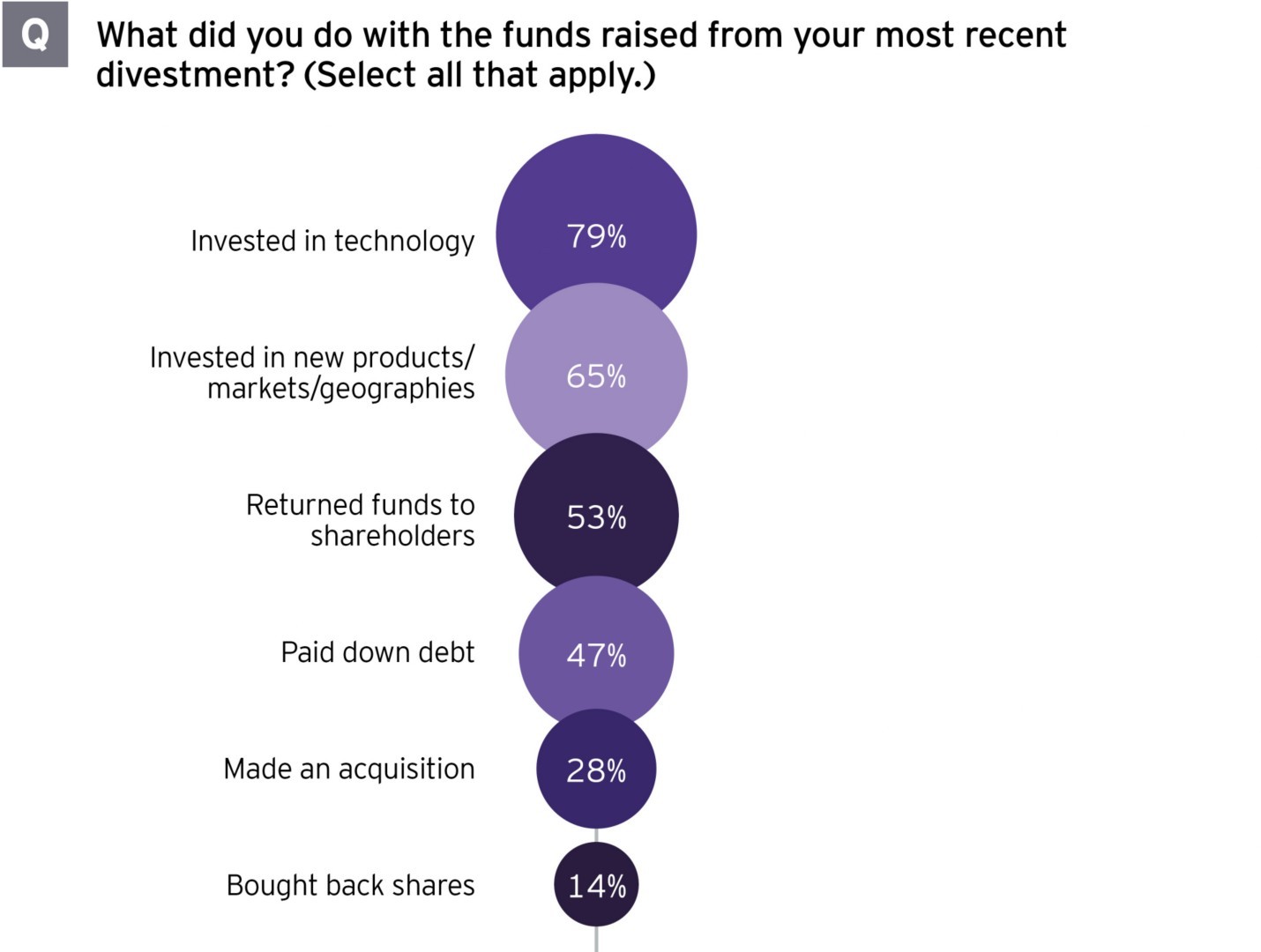

The pandemic is affecting deals across the globe, driving companies to raise funds to invest in technology and meet new customer needs — or prompting companies to sell poorly performing businesses. Nearly all companies (94%) confirm that changes to the technology landscape are directly influencing divestment plans, up from 59% pre-pandemic. And two-thirds of companies say their most recent divestment was triggered by suboptimal returns in the divested business.

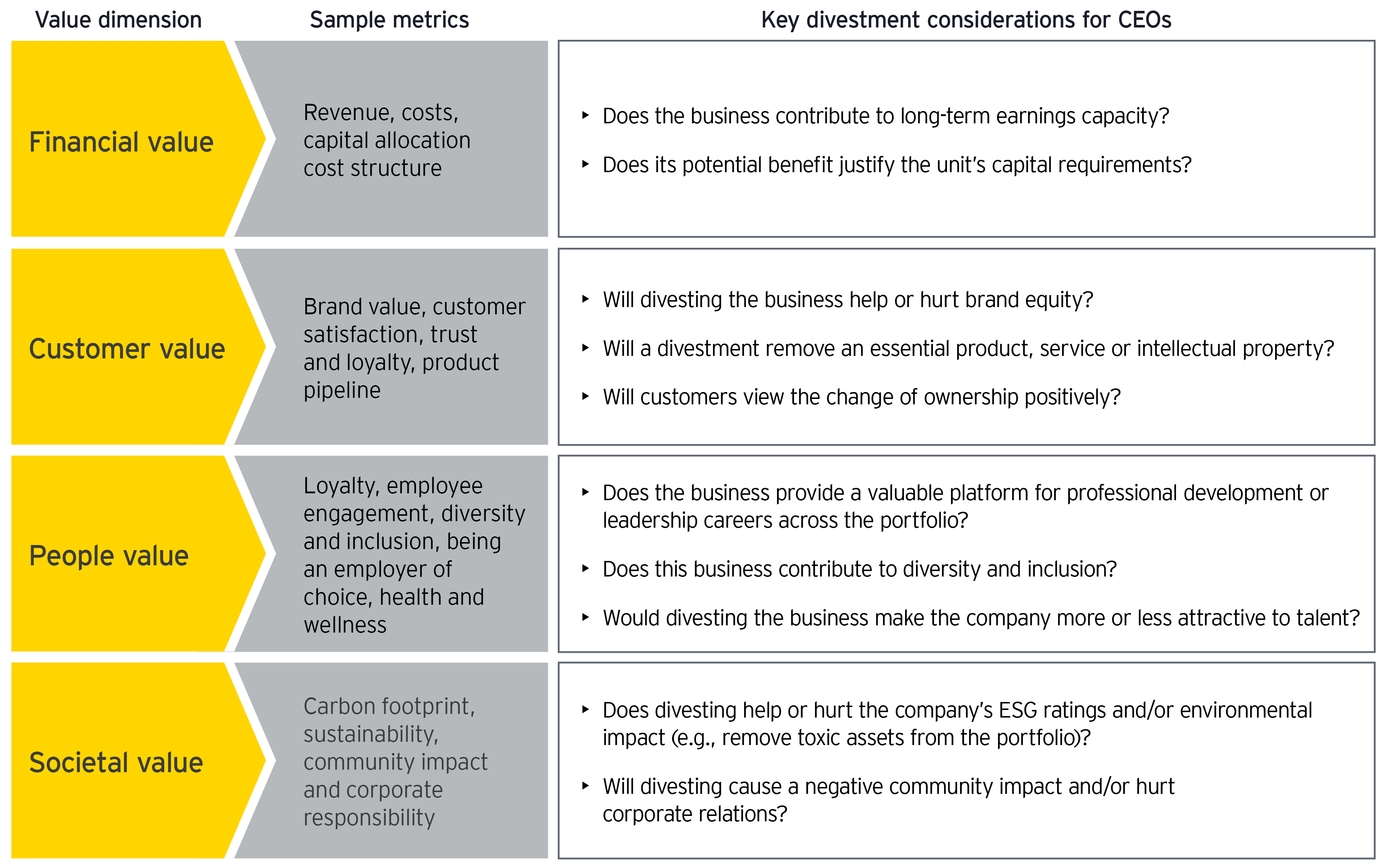

Environmental, social and governance (ESG) issues are also an emerging factor. Globally, 46% of sellers say these issues directly influence divestment plans, though ESG is currently a much larger factor in Asia-Pacific (84%) than in EMEA (47%) and the Americas (14%). Regulatory changes that require companies to reduce their carbon footprint, especially in Europe, are now influencing divestment decisions, while companies in the Americas ponder the impact on management and workforce diversity when carving out or spinning off a business.

Use your divestment strategy to determine which assets are core

As companies face a myriad of geopolitical, macroeconomic and operational challenges, the decision of what and when to divest starts with strategy.

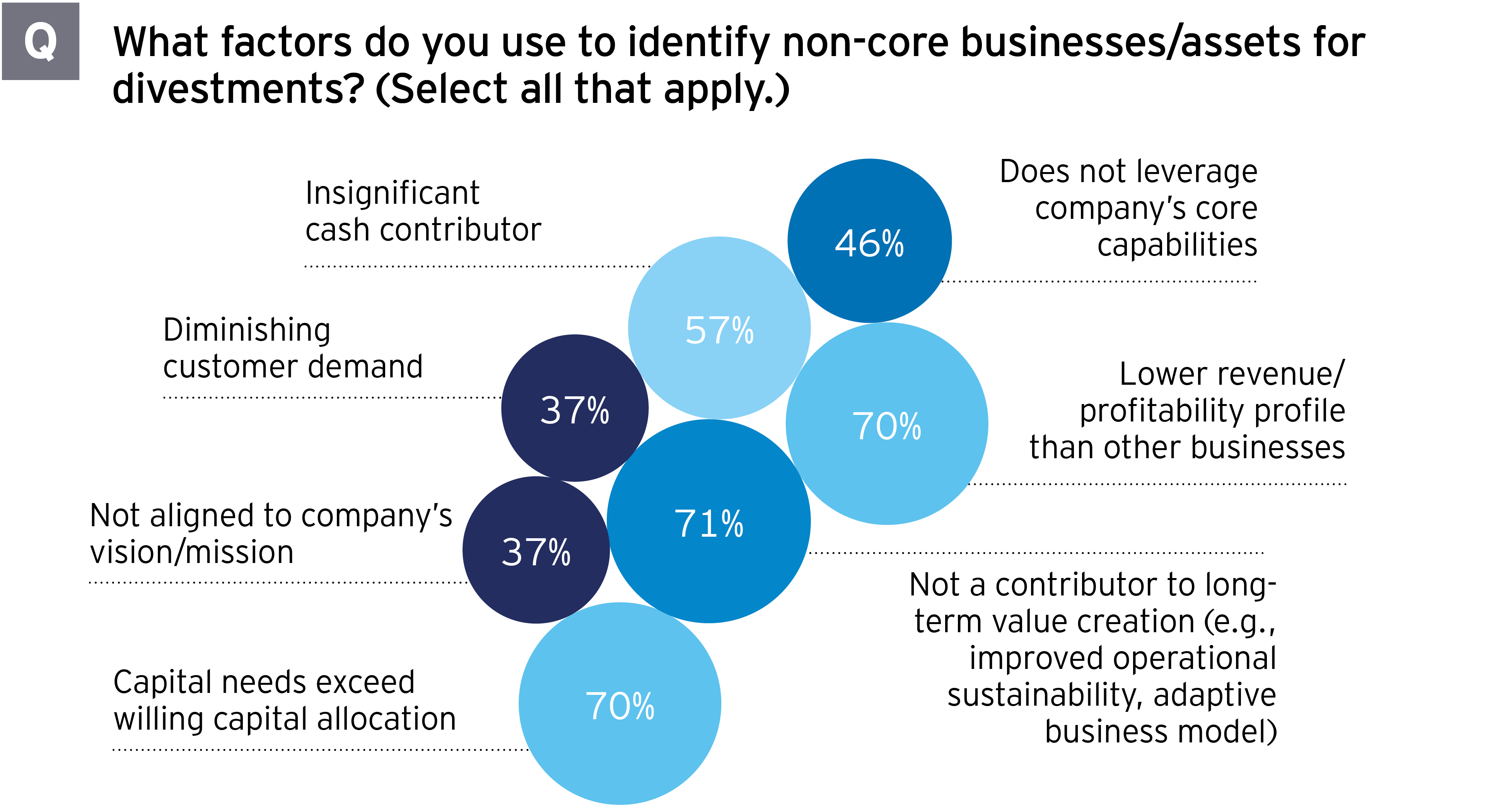

CEOs need to determine which businesses no longer help drive the company’s strategy — which are deemed non-core — by taking a broad view on how a company generates long-term value for stakeholders. Yet 39% still struggle to define which businesses in their portfolios are core or non-core, and only 37% consider alignment to the company vision or mission a factor in identifying divestments. This suggests that, in some cases, strategy may not be the driving force behind decisions, with short-term financial factors instead taking the lead.