Fundamental changes to DSO roles and core responsibilities are needed within the next five years for today’s challenges to not become tomorrow’s insurmountable problems.

DSO 2.0: the evolution

As the dynamics of energy change, the underlying system model will have to evolve too. The reality is that we cannot continue to add load, or supply, without compromising the network. Though “connect and reinforce” has managed long enough, it is fast becoming unsustainable.

DSOs that want to be part of the energy future will have to make adaptions to their operating models now to give them the agility to respond to evolving industry dynamics.

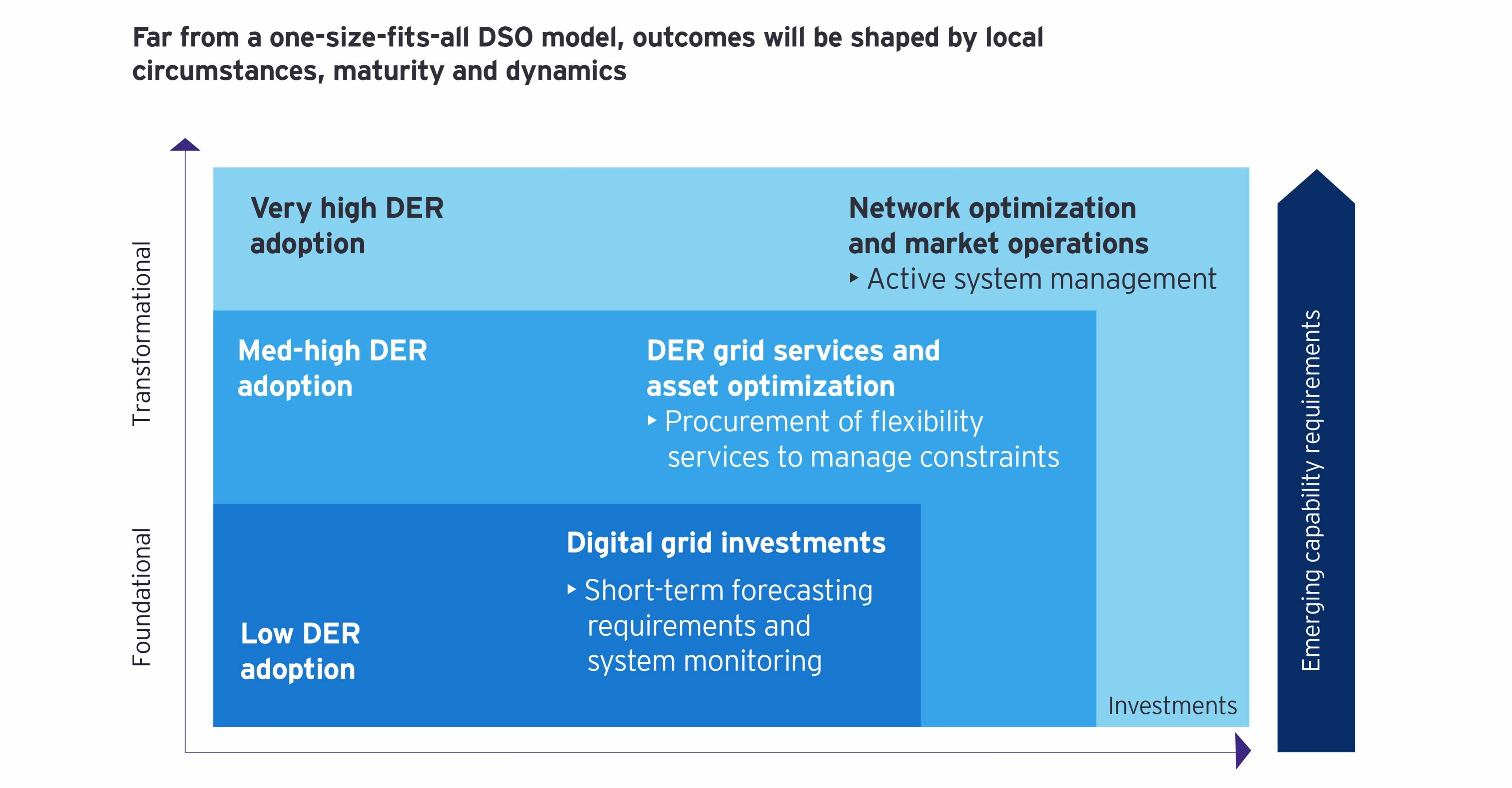

Of course, not every country, region or DSO is at the same level of maturity, nor are they experiencing the same local circumstances, levels of technology, DER implementation or flexibility requirements. There is no one-size-fits-all DSO model, rather broad parameters on what the future DSO might look like given developments in policy, economy, technology and the electricity marketplace.

Related article

Source: EY

So, what can we expect?

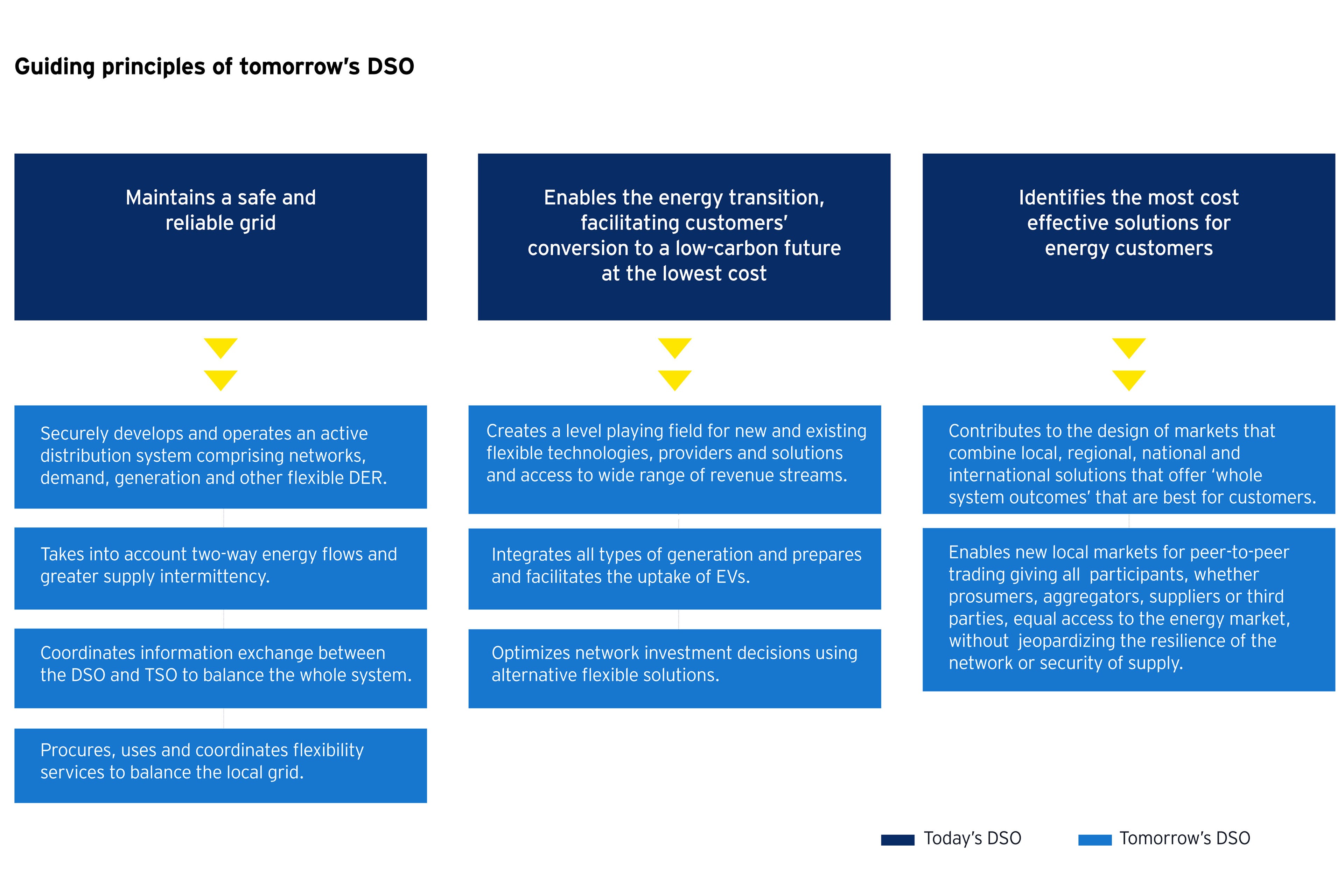

DSOs will continue to serve their local distribution networks and retain their core responsibilities of maintaining a safe and reliable grid, connecting new generation and load, and identifying the most cost-effective solutions for their customers. However, the transition already underway in energy will force them to champion innovation and digitization if they are to continue to deliver energy resiliency at a local level.

Chief among their priorities will be enhanced visibility over power flows, identified by 71% of the 117 respondents to an EY DSO survey, as a hurdle to a safe and reliable grid. DSOs will need to coordinate with transmission system operators (TSOs) on digital investments to regulate voltage, integrate all types of generation and harness the flexibility of DER right across the network. Moreover, the network will have to become increasingly “smart,” with corresponding investment in skillsets, such as data management, robotics, artificial intelligence and cybersecurity, if they are to integrate and optimize emerging energy solutions.

Related article

For 71% of survey respondents, enhanced visibility over power flows is essential for a safe and reliable grid.

Given that the energy market is becoming increasingly crowded with network customers, prosumers, flexibility providers, aggregators, etc., DSOs will step up to the role of neutral market facilitators. It will see them develop commercial protocols and platforms to procure flexibility services, irrespective of technology. It will enable them to safeguard security of supply and deliver the most efficient outcomes for the network as a whole.

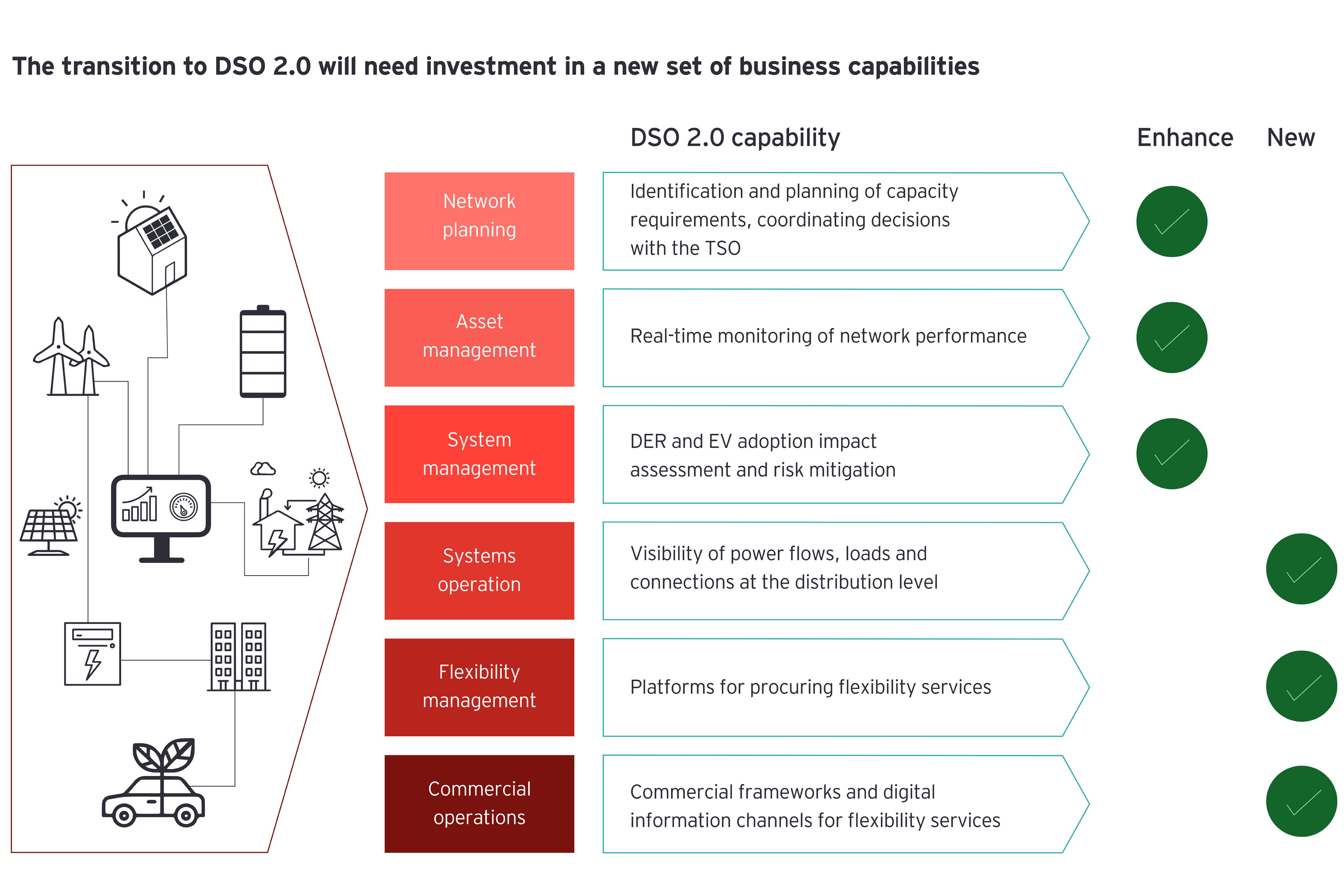

EY teams envisage that six functional areas will define the role and scope of DSO 2.0. Some will be enhancements to existing capabilities, while others will be completely new.

- Network planning: using tools to evaluate DER coming on to the system, plans network capacity requirements and coordinates with the TSO to keep energy flowing across the entire system, not just the local network.

- Asset management: trials and validates advanced network operations tools across different DER scenarios in real time to detect and react to variations in load.

- System management: undertakes sensitivity analysis to understand the magnitude and impact of DER and EV adoption on the network and assesses the risk mitigation required.

- System operations: creates visibility over power flows, loads and connections at the distribution level; “sensorizes” the network to monitor DER at all voltage levels, backed by remote monitoring, controls and automation of data exchanges.

- Flexibility management: develops platforms for cost-effective procurement of flexibility and participation by DER owners and aggregators.

- Commercial operations: builds digital information channels for customers and suppliers to connect and interact on flexibility services.

Source: EY

DSO 2.0: getting there

The magnitude of this transition will impact DSOs’ investments and capability priorities. Much of the investment in tools, people and infrastructure is needed within the next few years. DSOs will also require a new cultural mindset and partnership models if they are to meet the energy transition head on.

Together with TSOs, DSOs will need to co-design relevant and value-creating markets in which all network customers can connect and exchange energy services. The transition will be a phased journey, directed by growing levels of DER integration over time and increasing technology sophistication.

Phase 1: Investment in making the grid robust, resilient and intelligent enough to accommodate increases in DER, EV charging infrastructure, data centers, and electrification of heat and other large energy consumers. Demand profiles will adjust to supply peaks in renewable generation to boost overall capacity of the power system. Success will depend on visibility across multiple connection points and the means to evaluate and plan for their likely impact on the network.

Phase 2: Investment in sensors and other digital tools to automate and control the network. DSOs will value flexibility from different kinds of generation and demand sources; develop platforms for streamlined customer inquiries, connections and installations, and prototype solutions across the network. Alongside TSOs, DSOs will develop new market frameworks for ancillary services to encourage participation from DER owners and aggregators and create new, fairer and cost-reflective tariffs. Increasingly, DSOs will become neutral facilitators of markets, enabling the sale and purchase of energy between participants.

Phase 3: Investment translates into enhanced systems and optimized networks to enable the energy transition and secure the future of DSOs for the years ahead. By now, active network management capabilities will be embedded across all EU power systems, ensuring grid stability and platforms for trading energy and delivering microgrid services, and across DSOs, regions and borders.

Source: EY

Staging post to DSO maturity

The transition to DSO 2.0 is not a destination but a stop-off point on the journey to DSO 3.0 and beyond.

And just as there is no one-size-fits-all operating model, there is no such thing as a timed itinerary. Every market is different, and every journey will start at a different place. It is, however, a phased transition and one, when accompanied by the appropriate investments in capabilities and technologies, that will earn DSOs entry into the energy future.

Progress, however, is thwarted by the absence of a robust regulatory framework that:

- Incentivizes investment in fledgling technologies

- Acknowledges the roles and responsibilities of market players, including DSOs, flexibility providers and aggregators

- Facilitates trade between DER owners and aggregators in an ancillary market

- Ensures network tariffs accurately reflect network usage and contributions to maintenance

Until then, progress will be slow, and the energy transition – as well as those ambitious decarbonization and climate change targets – could be compromised.

Summary

Somehow, distribution system operators must keep up with the relentless pace of technology and proliferation in distributed energy resources without derailing the energy transition. So, they are embarking on their own transformation, which will see new roles and responsibilities emerge alongside existing obligations. The future DSO will manage and coordinate distributed generation at a local level, act as a neutral facilitator of open markets and enable easy access to transmission and distribution networks for all energy market participants. If they don’t adapt – and regulation might stand in their way – the energy transition will still happen, but not quite as fast.