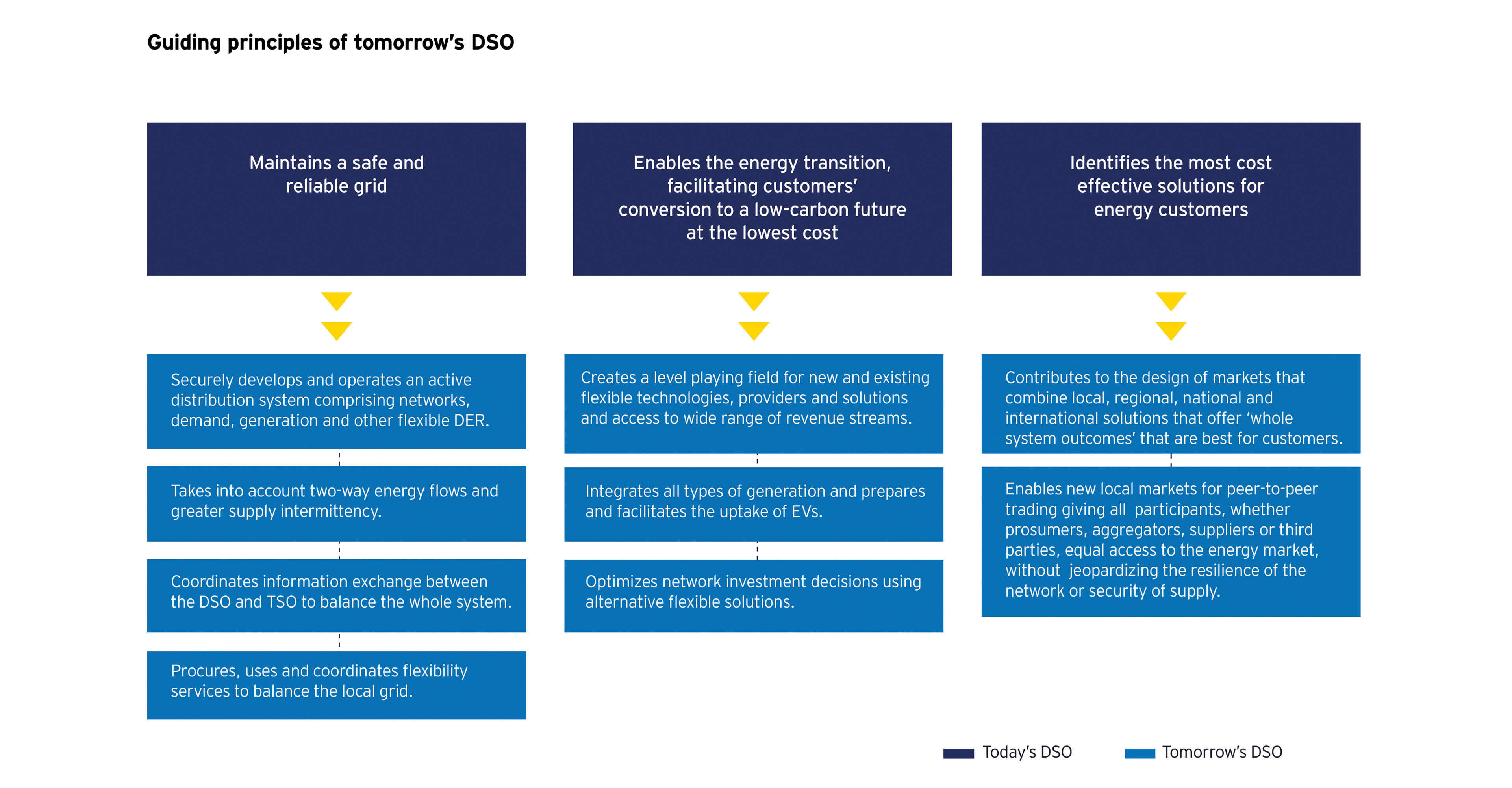

Though DSOs can keep the network running in a reliable, affordable and sustainable way, before long, smart controls and intelligence to manage expanding and multi-directional energy flows will be needed.

Of course, as respondents to EY’s survey point out, there is no one-size-fits-all future model. Outcomes will be shaped by local circumstance, maturity and dynamics. Some will be characterized by high EV adoption, others by low technology implementation and lower levels of DER. Some will serve buzzing urban communities, others will support rural users. Some markets will be home to multiple DSOs, others to few. Each circumstance however, puts the DSO in charge of delivering the energy transition.

Alongside TSOs, DSOs will design markets in which all network customers can connect and exchange energy services and recover value. They will optimize local peer-to-peer interactions and enable access to regional, national and cross-border trade. Progress to the future energy system will be phased.

- Phase 1: Invest to make the grid robust, resilient and intelligent enough to accommodate DER, EV-charging infrastructure, data centers, electrification of heat and other modifications. Adjust demand profiles to supply peaks in renewable generation, boosting overall capacity. Provide visability across multiple connection points.

- Phase 2: Invest in digital solutions and technology to automate and control the network, which includes valuing flexibility from different generation and demand sources. DSOs and TSOs develop cost-reflective tariffs as well as frameworks for ancillary services to encourage participation from DER owners and aggregators.

- Phase 3: Investment pays off in optimized systems and networks to enable the energy transition. Embed active network management capabilities into all EU power systems to ensure grid stability. Provide advanced distributed grid intelligence, control systems, platforms for energy trading and micro-grid services go live.

Making regulation work

Though the will to enable the energy transition is there, a relevant and adaptive regulatory and policy framework is lacking. The entire industry can influence regulatory direction. When we asked industry figures what they most wanted from regulation, they said it should:

- Recognize the role of DSOs

- Encourage and reward investment in a high renewables-based system

- Ensure investors get fair returns

- Incentivize DSOs to embrace new technologies

- Deliver mechanisms that enable DSOs as neutral market facilitators

On the investment front, policy makers must be cognizant of the time it takes for payback from new technologies and overall “smartening” of networks to filter through. Meanwhile, incentives are sought that apply neutrally to both CAPEX and OPEX, given the shift from one to the other as innovative technologies mature.

Ensuring flexibility will be critical as generation, particularly from variable DER, increases. Regulation must recognize therefore, the roles of distributed generators, flexibility providers, self-consumers and communities, and enable a level playing field in which no one business model is prioritized.

Don’t delay

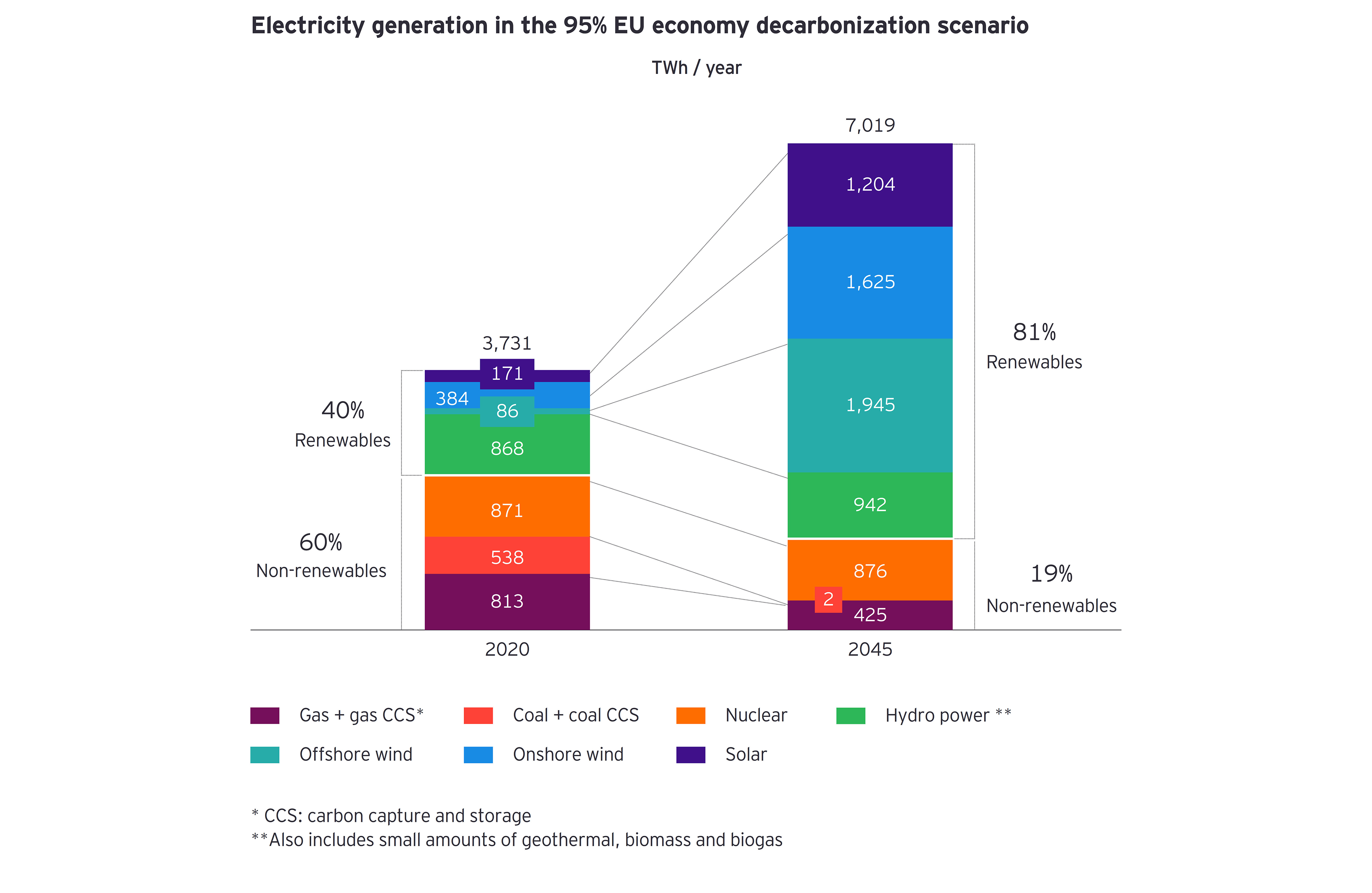

Red flags are waving; the charge towards decarbonization is on. Failure to anticipate oncoming changes to generation and technology, risks undermining the affordability of the energy transition and jeopardizing energy security and supply going forward.

We are on the brink of a very different energy world. Change is imminent; delay is not an option.

Related article

Summary

The way we generate, consume and store energy is transforming. The next five years will be critical as technology accelerates, distributed energy resources become mainstream and electric vehicles and other innovations move us swiftly toward a decarbonized future. But is the network fit to deliver increased load? Are all grid and system costs allocated fairly across customer groups? How will distribution system operators go about integrating intermittent and decentralized energy resources? What needs to change and how long have we got? Without radical intervention, and a new regulatory model, the honest answer is probably not long enough.