The answer to the innovation paradox - how to bring that innovation from the edge back into our business - is a million dollar question. We ask this every day.

Venky Balakrishnan

Diageo

In Zero to One, Peter Thiel’s bestselling book on entrepreneurship, the author reveals that he never invests in a CEO who wears a suit.2 The maverick is rarely a good corporate citizen, but no innovation takes hold without adoption – and in the end the maverick needs the suit.

This study into corporate venture explores a rich variety of strategies, approaches and models. By interviewing some of the most dynamic drivers of corporate venture innovation in diverse sectors and geographies, we uncover the strategies that market leaders are using to survive and thrive. The study shows how parent companies are using their venture activities to access extreme innovation – the so-called bleeding edge – to help them realize their future visions.

For discontinuous leaps to be achieved, innovators typically remove themselves to what jazz musicians and John Kao3, innovation thinker and author, calls ‘the woodshed.’ But parent companies must also find a way for those innovations to be injected back into their operations. Leaders must find a balance between managing today’s business and laying the foundations, however threatening, of tomorrow’s business.

There is no secret sauce to managing and executing on innovation, but in this study we offer a range of insights and analysis that will help company leaders, policy-makers and governments get close to solving the innovation paradox.

Chapter 1

Into the woodshed

When you have a very successful business model, there is a collective cognitive myopia.

In 1992, Karlheinz Brandenburg and his team of government-funded researchers at the Fraunhofer Institute in Erlangen found a way to shrink musical data to a 12th the size of an audio CD. They did it by removing all the musical sound that is inaudible to the human ear. The compression enabled whole albums to be shared over the limited bandwidth of 1990s internet connections. They released MP3-encoding software for free, allowing anyone to rip music files onto computers. The team also invented the first ever portable MP3 player but never patented it, because no one could see the transformative nature of digital music technology at the time. In fact a Philips executive, seeing the prototype in 1995, spoke for many when he pronounced, “There will never be a commercial MP3 player.”4

The following year, Eastman Kodak, with 90% of the US film market and the world's fourth most valuable brand, had a market capitalization of US$31b. In 2012, it successfully filed for Chapter 11 after more than a year of bankruptcy. Kodak didn't miss digital transformation. In 1975, it actually invented the digital camera, but its focus on maintaining and growing the business that had served it so well – namely that of physical film – meant that venturing into digital was too difficult. Kodak focused on its product – not on the consumer.

Motorola, building on its expertise in car radio technology, invented the mobile phone, with its DynaTAC, in 1984. Some 15 years earlier, the first words transmitted to Earth from the Moon used a Motorola transponder. The super skinny metal-clad RAZR V3, launched in 2004, helped it gain market share from market leader Nokia. Just under one in five (18%) of all mobile phones sold in 2005 was made by Motorola and by end-2006 the company's cash reserves were US$11b (Global Insight 2007).

But in less than three years that market share nose-dived to below 5%. Lenovo bought Motorola’s Mobile Devices business in 2014, and at CES 2016 announced it would no longer be using the Motorola name on its handsets.

Even Clayton Christensen, the Harvard Business School academic who coined the phrase ‘disruptive innovation,’ failed to see the impact of the iPhone. In an interview with BusinessWeek, he said, “The iPhone is a sustaining technology relative to Nokia. In other words, Apple is leaping ahead on the sustaining curve [by building a better phone]. But the prediction of the theory would be that Apple won't succeed with the iPhone.”

As one corporate fund manager says, “Oftentimes consumers don’t know what they want. Back in 2007, who wanted an iPhone? We had phones, they worked fine.” But when Steve Jobs unveiled the first iPhone and said, “This will change the world,” he wasn’t exaggerating. Today over 50% of the global population owns a smartphone.

In 2000, Reed Hastings, the founder of a then fledgling startup called Netflix, flew to Blockbuster's headquarters in Dallas to propose a business partnership. It didn’t go well. “Neither RedBox nor Netflix are even on the radar screen in terms of competition,” said Blockbuster CEO Jim Keyes, speaking to the Motley Fool in 2008. “It’s more Wal-Mart and Apple.”

By 2010, Blockbuster was bankrupt and today Netflix has a market capitalization of over US$60bn. But Blockbuster was not unusually naive. The company had grown into a fearsome retail business renting out videos to millions of customers and earning significant profits from charging them late fees. Netflix operated without all the costs of a bricks and mortar retail business, but more importantly, it adopted a subscription model. Customers could hang on to their rented DVDs as long as they liked. Blockbuster’s problem was focusing on the business, not the consumer.

When you have a very successful business model, there is a collective cognitive myopia.

Professor Gary Dushnitsky

Associate Professor of Strategy and Entrepreneurship at London Business School.

Professor Gary Dushnitsky, Associate Professor of Strategy and Entrepreneurship at London Business School, says: “It’s hard to see beyond something that you’ve excelled at for the last 15 or 20 years. Look at digital streaming music. It’s less that you don’t want to be cannibalized but more that you truly believe in the business model you live by.”

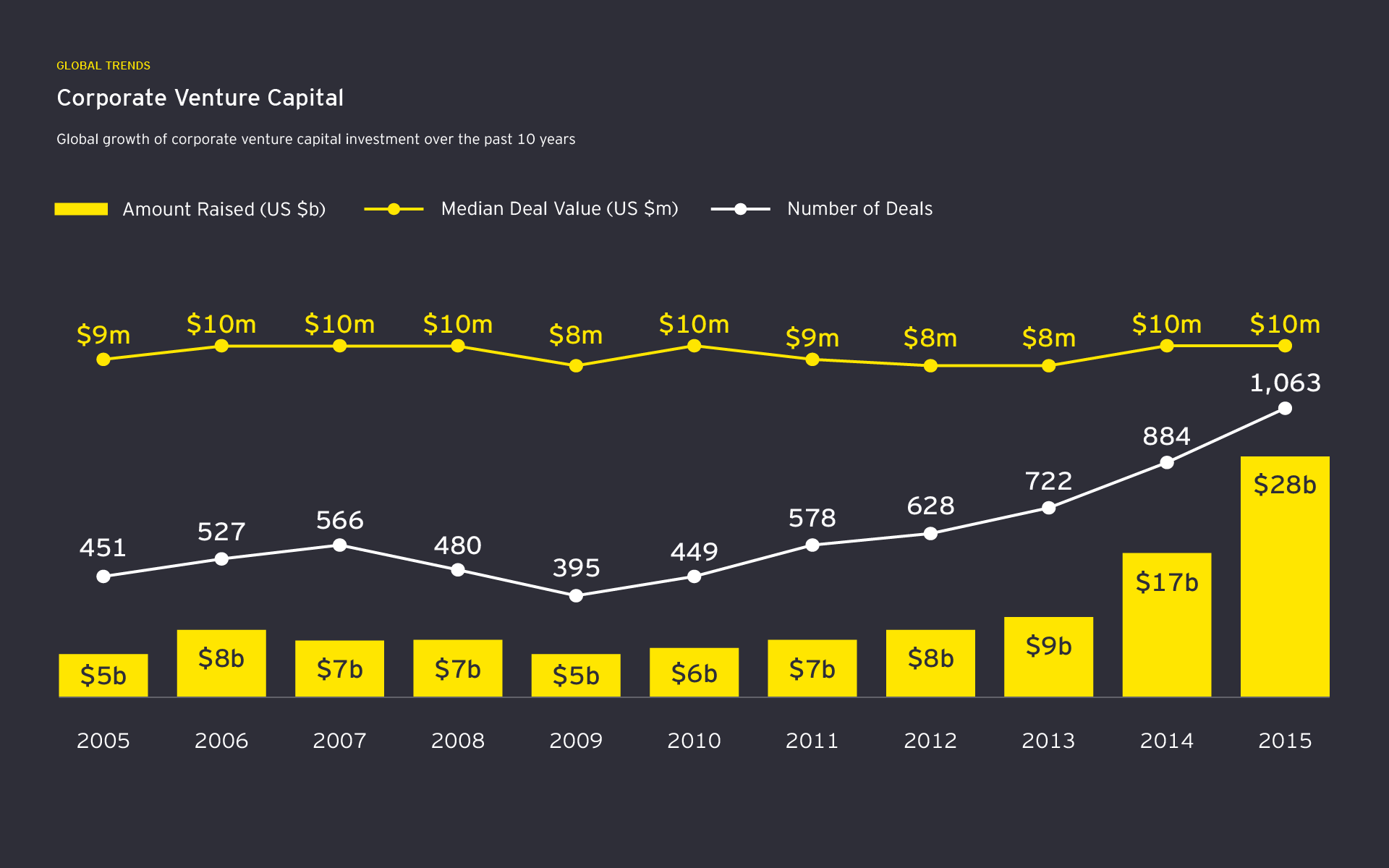

Researchers calculated in the unprecedented boom of corporate venture in the late 1990s, that every dollar invested in venture capital was three or four times as potent in stimulating innovation as a dollar invested in internal R&D.5

To help overcome collective myopia, many companies launch arms-length units that are both insulated from the parent culture and plugged into an ecosystem in which innovation is thriving. This is what distinguishes a corporate venturing model from internal R&D.

“The question for me is, ‘What does corporate venturing offer you that traditional R&D doesn’t?'” asks Dushnitsky. “What is a cost-effective method of driving innovation and how do you measure it?”

Fund managers agree that measuring strategic impact is very difficult. Some use the number of relationships with a business unit as a proxy for impact; others keep a qualitative track on knowledge transfer into the parent.

Other fund managers are strategically positioned to drive an M&A pipeline for their parent, and that can be measured. More difficult is to judge what may be the most valuable knowledge transfer - a better understanding of market moves, changing consumer behaviors and cross- or extra-sector change.

Bertelsmann Digital Media Investments’ Urs Cete explains why he believes market leaders need exposure to the wilderness outside the castle walls. “We are for example spending time thinking about how a publisher focused only on SnapChat could look like,” he says, “while our in-house magazine division, Gruner + Jahr is probably not there yet. We look for lighthouses and are a little earlier to spot them.”

Debra Brackeen of Citi Ventures says, “We spark and accelerate innovation at scale across Citi's businesses, and our mission is to drive discovery-powered growth for the company by putting the customer at the center of everything we do.”

In his book, Jamming, John Kao draws a parallel between jazz improvisation and corporate innovation. Charlie Parker, the famous sax player, literally went to the woodshed behind his house and came back with a radical new jazz language called be-bop. “Going to a place that is free from any feedback, positive or negative, just being alone,” is a well-established medium for creating discontinuous leaps, says Kao.

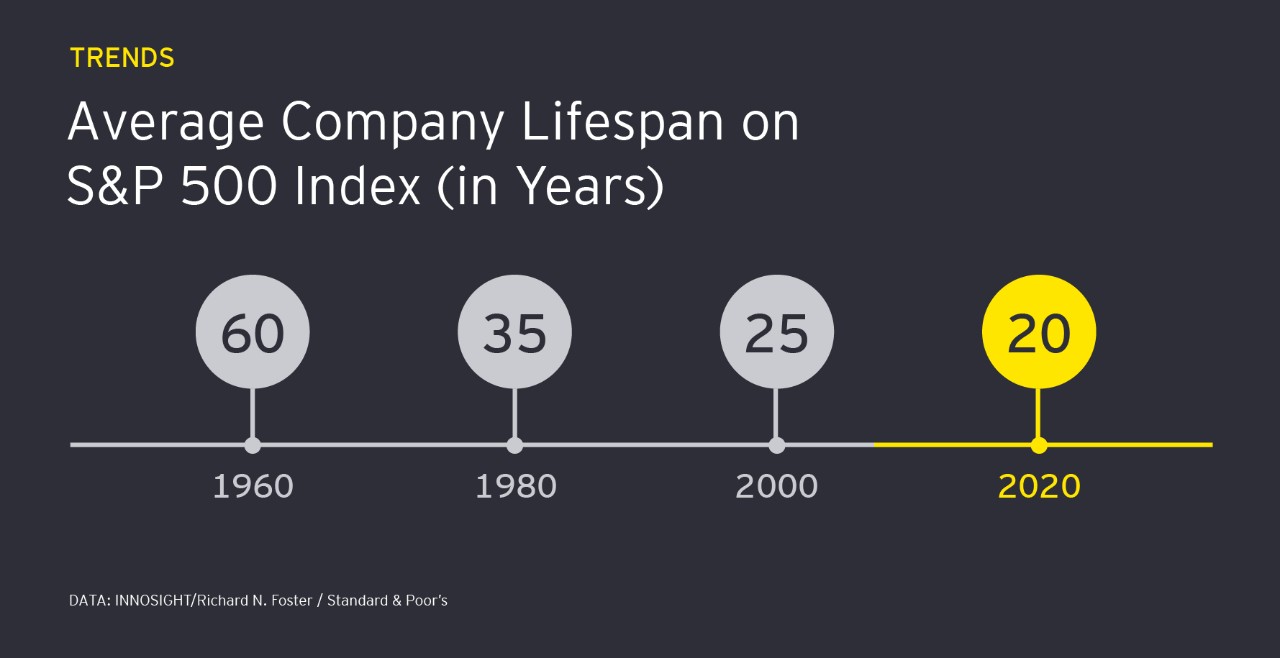

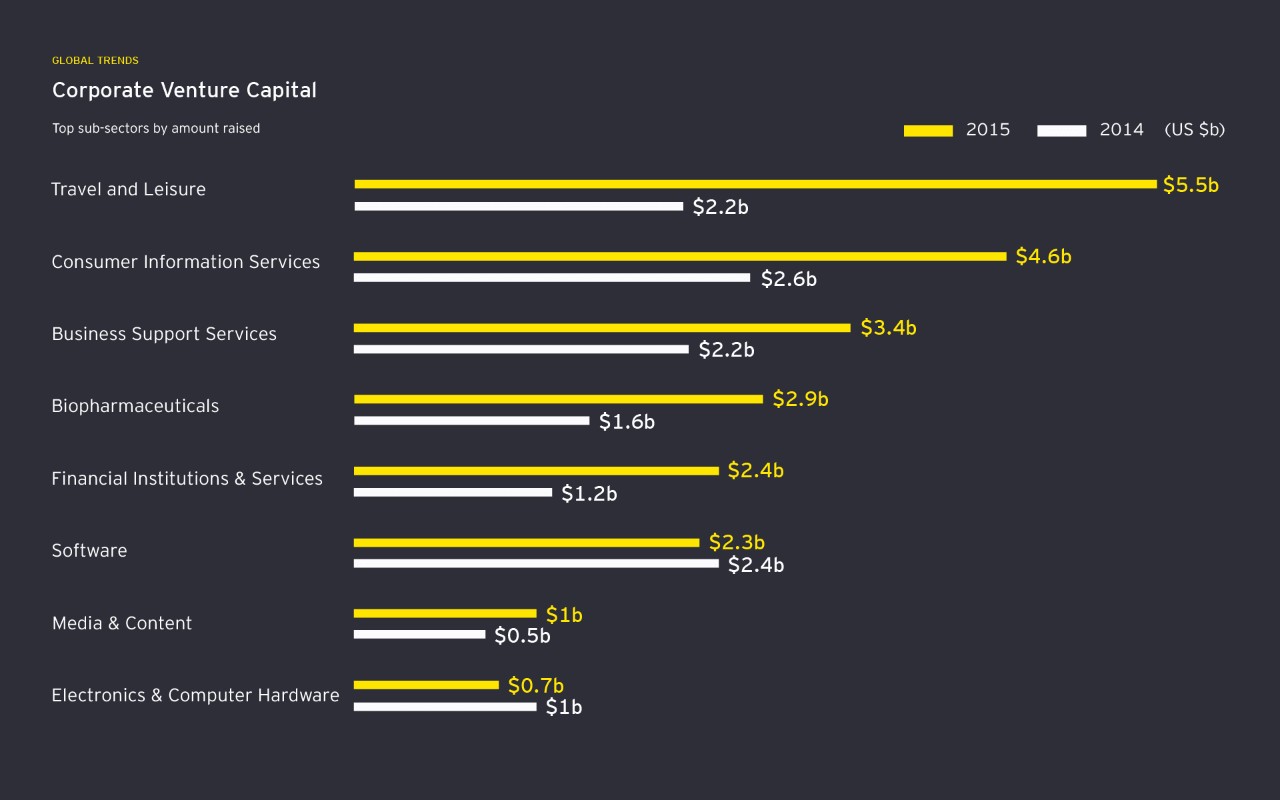

The number of active corporate funds has increased by 82% since 1Q 2012 and the majority of unicorns (or VC-backed private companies valued at over US$1b) have a corporate venture unit investor. DocuSign has a record ten corporate investors. There is no sign of slowdown: Aviva, Statoil and Campbell Soup have all launched corporate venture funds in the last few months.

The industry, while not new, is changing rapidly as more companies in more sectors learn from the past. Partly, perhaps, because of its youth compared to the largest venture capital firms in Silicon Valley, corporate venture is also significantly more diverse. Nine (45%) of Global Corporate Venturing’s 2016 ranking of top 20 corporate venture funds is run by a woman. According to Babson College, just 6% of partners at venture capital firms are women.

Corporate venture both encourages parent companies to adventure beyond their comfort zone but also can help bring a good idea from invention through to scale and eventual optimization and monetization.

It is the ability to create distance - or to access distant innovation - and bring that knowledge back into the parent organization that is corporate venture’s true test.

Chapter 2

Leadership

Size is an over-rated and under-examined attribute.

In David and Goliath: Underdogs, Misfits and the Art of Battling Giants, Malcolm Gladwell draws a parallel between how David’s agility and superior slingshot technology killed the myopic giant, Goliath, and the way in which small entrepreneurial startups are able to fell large, unseeing market leaders.

“While a decade ago, the challenge was in communicating the need for corporate venture to the C- Suite,” says Professor Gary Dushnitsky, Associate Professor of Strategy and Entrepreneurship at London Business School, “today, it’s the other way round. The CEO is driving the corporate venture.”

Size is an over-rated and under-examined attribute.

Malcolm Gladwell in David and Goliath: Underdogs, Misfits and the Art of Battling Giants.

When Jan Timmer, former CEO of Philips, became the electronics company’s President in 1990, one of his first moves was to dummy up a newspaper, dated a few years into the future. Its bold front page headline read, ’Philips Goes Bankrupt!’ Timmer built his senior team’s strategy around that headline.

Create a story about a future that you want to avoid and then make it detailed and graphic.

John Kao

“Create a story about a future that you want to avoid and then make it detailed and graphic,” advises John Kao. “You have to find a story that tunnels under all the intellectual shields, denial and complacency and rattles the emotions.”

Most corporate venture fund managers see their role as more about seizing opportunities for growth than mitigating the threats posed by David’s slingshot, however. “We leave the real threat questioning to our strategy division,” says Urs Cete of Bertelsmann Digital Media Investments, “but of course a lot of our investments are in potentially threatening positions. We like disruption. I am not sent out there to find stuff that might eat our lunch.”

Wells Fargo launched its Startup Accelerator program in early 2014 “to spur innovation for our customers’ benefits and expand our vision of the future of financial services beyond the boundaries of Wells Fargo and banking," says Bipin Sahni, SVP, Innovation, Research and Development at Wells Fargo’s Innovation Group. “When we pitched the idea to senior management, there was just one question: ‘Why aren’t we doing this already?’”

Fund managers all emphasize the need for buy-in from the top. If a CEO champions venture activity, it increases the chances that business units, whose main job is executing on the current business, give time and energy to portfolio investees. Corporate venturing can be a significant boon to fledgling companies, offering access to great R&D expertise, plugging them into large numbers of customers and providing expert support in business disciplines from HR and payroll to managing IP rights and navigating regulatory frameworks. Conventional venture capital can’t do that.

If, however, the CVC sponsorship is over-invested in a single individual, there is a danger that the parent corporation withdraws prematurely from its venture activity. Average CEO tenure among the S&P 500 from 2001 to 2014 was 8.7 years.2 Funds need broader C-Suite buy-in to confirm that strategic investments do indeed benefit from the more tolerant approaches to funding cycles, characterized as ‘patient capital’ and don’t die with the exit of an incumbent CEO.

“There has to be an awareness and acceptance within senior leadership that this is an absolutely vital ecosystem that we have to have a close relationship with,” says Wendy Lung of IBM Venture Capital Group. “The more practical issue is finding the senior leaders that have that forward thinking and incorporate that thinking into the management of their business. A lot of it is about finding success stories.”

In 2010, IBM acquired Cast Iron System, a Saas and cloud application integration provider. “They have played an absolutely critical role in our cloud suite, and we identified them as an innovative company to watch years before it was acquired,” says Lung.

Building a corporate narrative around such examples helps create the upside to what can otherwise feel like a vague investment activity that is hard to quantify.

“The key challenge is not so much moving from incumbent bureaucracy to razor-sharp new entrepreneurial culture, it’s about acknowledging there is a creative tension between those polar opposite priorities,” says John Kao.

A CEO’s role in corporate venture is not so different from his or her role in piloting the enterprise as a whole. “Large companies can afford to be experimental and informal in places and buttoned-up in other places,” says Kao. “It’s a juggling act. There’s no magic algorithm for this: it’s a finger feeling that really good leaders have.”

Chapter 3

What structure?

Where most CVCs differ from private VCs is in their mission. Most CVCs exist to make strategic investments. Financial return is often a secondary factor.

There are many ways in which an established enterprise creates a distinct arm or unit whose focus is to invest in external companies, usually at an early stage.

Optional structures include a unit that reports directly to the corporate leadership team; a sub-unit within Strategy; limited partnerships whose sole investor is the parent company and a completely distinct venture capital firm with a single LP - the parent company. Some invest from the balance sheet; others make off balance sheet investments. Most CVCs do not raise funds, but tap corporate treasury to finance their programs.

Some mirror conventional VC models and tend to take sufficient equity stakes in their portfolio companies to confirm a seat on the board. Others never take equity. Some will pursue a co- investment or syndication strategy, often working with a preferred handful of VCs; a policy that can help mitigate risks, especially in early stage investments. Some actively seek to acquire their portfolio companies, seeing the venturing unit as an extension of M&A; others cringe at the thought.

Large companies that have some history of corporate venture may have created more than one CVC arm to reflect a range of strategic objectives. A company may have an accelerator or incubator that nurtures a clutch of very early stage seed-funded startups as well as a bigger fund that invests in later stage proven entrepreneurs. Funded companies can graduate from an accelerator to a CVC- backed portfolio and eventually a trade sale to the parent, but this is not a definitive or even predominant model.

Where most CVCs differ from private VCs is in their mission. Most CVCs exist to make strategic investments. Financial return is often a secondary factor. The strategic element of corporate venture, while central to its role in accessing external innovation, is often difficult to measure or quantify, while for many it is the single most important factor.

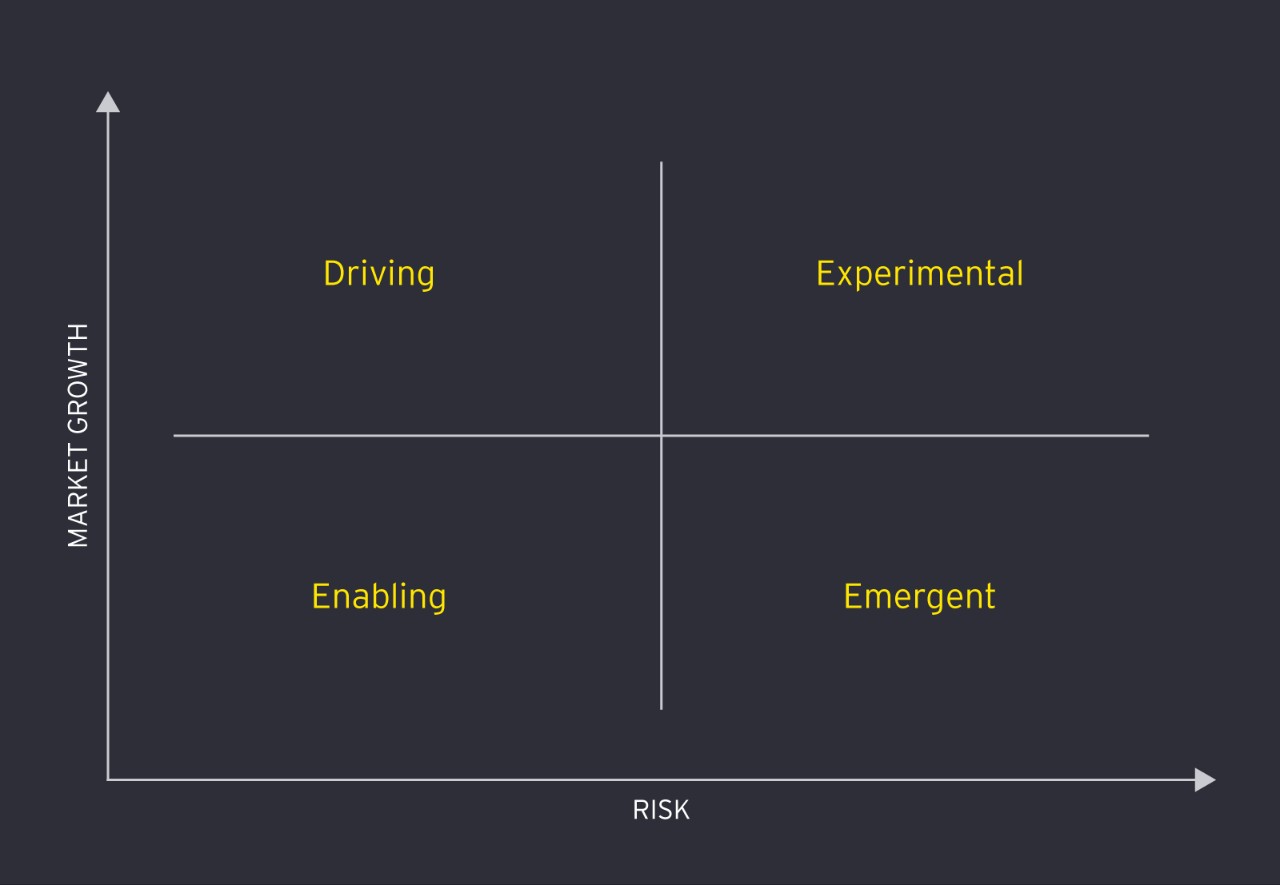

One way of looking at different approaches is in a 2x2 matrix that categorizes four major strategies.

Enabling

Enabling investments may include no financial investment at all. A technology company such as IBM or Microsoft allows developers to use the parent protocols, platform or hardware and supports developers with access to clients and its own business units. Enabling investments are focused on popularizing and extending the parent company’s platform, helping embed the technology in a network of applications and business processes. This type of venture is both low risk and focused on a parent’s current business. It is primarily investment in today, not tomorrow.

Emergent

Emergent investments solve an acknowledged customer challenge, apply a new business model to the parent, build in an adjacent sector or sub-sector to create foreseeable synergies that are nevertheless not part of the current business. Corporates may sponsor companies because they are able to move faster, iterate and create solutions more quickly and cheaply than internal R&D units can. Some corporates invest in emergent solutions outside their own business focus.

Diageo Technology Ventures, for example, seeks investments in technologies that can improve the user experience. “We don’t look at investment from a technology perspective: we are not interested in technology for technology’s sake because we are not a technology company. We’re not motivated to acquire,” says Venky Balakrishnan, who heads the fund.

I have done my job well if BMW acquires a portfolio company.

Dr. Ulrich Quay

BMW i Ventures

Driving

Driving categorizes investments that are future-focused but meeting strategic needs. A parent enterprise may judge that it can accelerate the speed to market by accessing external innovation.

“We look for products but also for business model innovations, because the world is moving at such an unprecedented pace,” says the fund manager for a leading consumer products enterprise. “We’re going to get disrupted. That’s what’s going to happen. This is about keeping us relevant. We crawl. We don’t move fast enough. We are way too corporate.”

Experimental

Experimental investments are very speculative lab-based pilots that test blue sky thinking. Startups tend to be at a very early stage and many corporate venture parents invest through an accelerator or incubator, making many small bets in a high failure rate environment. Not all corporate venture funds make these small seed investments, but they can pay off.

“None of the banks were talking about blockchain in early 2014, but we decided to experiment with cryptocurrencies to learn about the technology stack,” says Citi Ventures’ Debra Brackeen, “and quickly realized that the technology was transformative. We ramped up our exploration in late 2014 and built out a network of partners in 2015. In a relatively short span of time, we were able to rapidly accelerate the firm’s understanding of the risks and opportunities. Our efforts have had a slingshot effect.”

The degree to which the venture play is aligned to the parent company’s current business will dictate both how closely integrated the investment is with business units and the direction of the relationship as the portfolio company scales and matures. For some venture arms, acquisition by the parent is a desired outcome.

“I have done my job well if BMW acquires a portfolio company,” says Dr. Ulrich Quay of BMW i Ventures. “That means identifying and giving BMW early access to a potentially great investment and in doing so creating real value for our company. We don’t lock portfolio companies into offering us a first option but because we have a good relationship with them, they would always come to us first.”

Corporate venturing is one way to seed an M&A pipeline, to acquire talent or to accelerate growth into adjacent markets or subsectors, but not all are comfortable with the dual loyalties this places on fund managers.

“It’s not healthy to wear those two hats because there can be conflicts of interest,” says Urs Cete of Bertelsmann Digital Media Investments. “Investment managers with M&A in mind want a startup to develop differently than exit driven investment managers. Since I act in the best interests of the startup we are limiting or in some cases ending information flow in case Bertelsmann is a bidder for one of our portfolio companies.”

Other venture funds are strategically positioned to operate very independently of their parents and some spin off entirely.

Before January 2011, Sapphire Ventures (called SAP Ventures at the time) made on-balance sheet investments for its parent company SAP. “But if you want to look and walk and talk like Silicon Valley venture capitalists, “ says Sapphire Ventures’ Elizabeth “Beezer” Clarkson, “then you should be incentivized and judged on the same criteria.” Sapphire Ventures has invested in more than 135 companies across five continents.

In January 2011, Sapphire Ventures spun out of SAP and has since operated entirely independently. Although SAP remains its single LP, SAP is not part of Sapphire’s investment committee and doesn’t drive investment decisions. In fact, Sapphire Venture’s Growth Fund makes investments in both the enterprise and the consumer spaces.

Clarkson raises an interesting point regarding fund managers who head up corporate funds and those in independent venture. While an element of ‘carry’ is sometimes part of a CVC head’s remuneration, it is rarely a significant proportion. CVC managers are corporate employees with salaries and benefits that mirror those of other senior peers; VC fund managers live or die (financially) by the financial performance of their investment portfolio. Financial returns are front and center for venture capital; while they are a secondary, nice to have, for corporate venture.

Each company’s approach to its venture fund will vary according to its strategic needs. Parent companies no longer view venture investment as an extension of - or hedge against - their internal R&D activities. All agree that it is a way to build a channel into the ecosystem of the new; to accelerate knowledge transfer in exceptionally fast-moving sectors; to better understand how consumer behavior is changing.

For some this means co-investing with a select group of independent venture capital firms who are already plugged into the ecosystem and adept at selecting the winners of the future from the many hundreds of thousands of startups. For others, it means making strategic investments in sectors outside their own. For all, corporate venture is an investment in the unknown yet dynamic forces that are reshaping whole business sectors and the markets they serve.

These investments, when managed effectively, can help company leaders identify new opportunities for growth; new ways to find and excite their customers; new ways to transform a legacy business so that it is future-fit.

Chapter 4

Balancing current and future needs

Corporate venture is nearly always an investment in future needs – whether that’s new markets, new business models, new sector opportunities or new product.

“A lot of companies want to move to a new culture of innovation and entrepreneurship but there’s a reason that incumbent companies become incumbent,” argues John Kao. “They’ve mastered a lot of skills: managing complexity; managing resources; attracting talent. These are necessary for the today business but leaders need to understand that they are really managing two agendas and their job is to adjudicate between them.”

Corporate venture is nearly always an investment in future needs – whether that’s new markets, new business models, new sector opportunities or new products. Each of these small case studies shows how different companies approach this balancing act.

Cintrifuse

Cintrifuse connects and supports accelerators and incubators with ten Fortune 500 companies, academic institutions and other Cincinnati corporates. It also acts as a hub for startups realizing a mission to ignite innovation within the region. Investors in the US$57m fund include Procter & Gamble, Western & Southern, Cincinnati Children’s Hospital, Duke Energy and University of Cincinnati. The fund invests in early stage funds as well as making direct investments. It has additionally invested in 11 venture funds across the U.S.

“We’re about strategic connections, which is why we call it a ‘syndicate fund’,” says Tim Schigel, Fund Manager, Cintrifuse. “We’re not a fund of funds.”

Samsung

“When you make a television everything has to be perfect,” says Kai Bond who leads Samsung’s accelerator program. “There is no room for error when you make a piece of hardware. But software is different. You’re probably going to fail first time around. You’re going to rapidly deploy.”

Samsung invests in its accelerator, a venture fund, joint venture partnerships and has 40 internal R&D centers around the world. While some companies graduate from the accelerator to Samsung’s venture fund and indeed to eventual acquisition, each of these stages is managed independently. There is no formal graduation or linkage. Bond’s portfolio companies typically spend six to 18 months with funding in the US$200,000–US$500,000 range.

“We’re talking about the ability to fail fast and break things,” says Bond. “The challenge is internally that there is a focus rightly on the quality of the product that goes out the door.”

We’re talking about the ability to fail fast and break things.

Kai Bond

Samsung Ventures

Kai Bond started a company inside the Samsung accelerator - a Smart TV app called Pixie - sold it to Samsung and has watched it evolve into Samsung Extra, embedded in every Samsung Smart TV. “We were reaching some few thousands. Now we are reaching tens of millions,” he says. "We certainly could not have done that without the distribution and expertise of Samsung's TV team."

Bond’s strategic focus is on software that “builds the right end-user experience.” He doesn’t want his investee companies to be focusing on building for a solution – that would be too limiting. He has made six investments in virtual reality (VR) and believes Samsung offers the best user experience of all its competitors as a result. Other investment focuses are Internet of Things and wearables.

In addition to finance, Samsung offers its entrepreneurs help with all those “components that distract you from your core mission” - accounting, finance, payroll - and, critically, physical space. The accelerator occupies a pre-war building on 26th Street and Broadway in New York City. "You need to keep resources bountiful but also you want them hungry,” he says.

Bond sees corporate investment in innovation as many see personal finance. “You should have some bonds, some cash, some equities. Companies need to diversify their portfolios when it comes to innovation too.”

Diageo

Diageo, the premium drinks company, whose brands include Johnnie Walker, Smirnoff, Tanqueray, and Guinness, is a Fortune 2000 company with a US$71b market capitalization (May 2015).

The venture approach is channeled into two streams: one invests in the spirits industry (in craft startups such as Starward, an Australian single malt whisky maker); the other in technology through Diageo Technology Ventures.

Venky Balakrishnan, who heads the fund, says, “Our technology ventures activity is to ensure we remain at the cutting edge of all the disruptive technologies unfolding in front of us.” Investments range from “small checks” to “double digit million dollar equity stakes.” Some involve a “light level of involvement” while others are closely managed.

“Our R&D - and this is true of most companies - is tightly focused on the products we make and the business we are in,” says Balakrishnan. “It is extremely useful and critical but it’s one piece of how we respond to much bigger disruptions happening across the world. Our venturing is complementary: it doesn’t compete.”

All investments are focused on solving a business challenge; “the business unit has a massive skin in the game, even if the outcome isn’t predetermined.” Diageo looks at plays in online shopping, the user experience and “anything that removes friction from all stages of the discovery journey.”

“The answer to the innovation paradox - how to bring that innovation from the edge back into our business - is a million dollar question. We ask this every day,” he says.

Caterpillar Ventures

Caterpillar is a US-headquartered global manufacturer of construction and mining equipment, engines, turbines and related services. The company has its roots in California in the 1920s: its tractors erected the original Hollywood sign.

Caterpillar Ventures’ model is always to co-invest, never to lead and never to take a seat on the board. The corporate venture arm is a financial investor, but supports portfolio companies through a partnership with business units to plug them into the parent organization, “to help the guys succeed,” says Michael Young of Caterpillar Ventures. Investments are in US$500,000 - US$5m range and always in early rounds.

“I want to know about stuff I don’t know about,” says Young, who joined Caterpillar from Dell Ventures. His investment focus is on startups in 3D printing, robotics, analytics, digital and energy. “We’re very plugged in to the venture capital community in Silicon Valley,” he says.

Any financial return on investment over the six or seven year horizon is good, but the real payback is this: “business units want to learn what is happening. We can plug them into innovation at the edge.”

Caterpillar exercises no preference rights or first refusal rights over its investees. “If we really want a business to be proprietary then we should buy it - that’s not a venture deal,” Young says.

IBM

IBM Venture Group was formed in 2000. In terms of corporate venture groups, IBM was an early mover. The IBM venture group sits within Corporate Development, the part of IBM responsible for its M&A activity. This formalizes what has been a clear result of IBM’s approach to venture - since 2000, half of IBM’s acquisitions have been venture-backed companies.

“We identified early on that the value we would glean from the startup community would be strategic insights more than financial returns. For a near US$100b company, it can be difficult to move the financial needle,” says Wendy Lung, partner in IBM’s Venture Capital Group.

IBM launched a worldwide program, IBM Global Entrepreneur, that targets early stage entrepreneurs with less than US$5m revenues. The program offers mentoring, US$10,000 per month for a year of IBM Cloud Credit and introductions to VC firms that can help them scale. To date US$180m of venture capital has gone to program participants.

“Through our venture connections, we can identify great innovative startups that either become an IBM business partner and complement our solutions or become part of our acquisition pipeline,” says Lung. “By becoming an IBM business partner and rounding out our solution portfolio, we also build an ecosystem around platforms. Watson, our cognitive computing platform, is one such focus. We have built communities around our cloud, our Bluemix platform and ecommerce platform,” she says.

IBM’s internal innovation is managed through 12 research labs, networked together “to share knowledge and resources,” says Lung. “Our focus is on external innovation.”

For investee companies, not only do they get access to IBM’s technologies and platforms but also to its extended network of Fortune 500 customers.

“One portfolio company is operating in the area of mobile enterprise,” says Lung. “I had them speak with our CIO who has to manage over 400,000 employees and their devices. Operational experience can be of great value to a startup company.”

Chapter 5

The end?

Six lessons for mature enterprises from corporate venture.

Lessons all mature enterprises can learn from corporate venture:

- Think like a designer. Focus on the consumer: The toppled ruins of giant corporations are testament to the dangers of focusing exclusively on your immediate competitors. As technology-enabled innovation dissolves the barriers between sectors and starts to disrupt whole industry verticals, changing consumer behavior is a better place on which to focus your sights. Designers do this instinctively. Learn from them.

- Think of yourself as a challenger, not a market leader: Incumbent stasis is the single greatest threat to market dominance. By focusing relentlessly on winning new markets, seeking new opportunities for growth and developing an insurgent mindset, companies can beat the odds of becoming irrelevant before their 50th birthday.

- Experiential learning trumps data – the shock of the new: “It’s one thing for me to tell you that professional services firms will be different in the future,” says Professor Dushnitsky. “It’s another thing to take you physically to Silicon Valley, put you in front of ten startups all of them receiving more than US$150m investment from some of the best funds in the world, all of them with paying clients, doing what you have been doing for a hundred years, but with a different business model.”

- Experiment: Recognize the value of an ideas lab that is insulated from your current business, whose role is to question, to be fast, to iterate often and to bring the outside in. Build robust channels for bringing that unorthodox thinking back into your organization and learn to listen out for transformative signals from the sandbox. Every company needs to create an innovation strategy in its own image – there is no one-size fits all.

- Network: As open source innovation replaces proprietary know-how, the innovations of the future will rely more on web-like networks of players than vertical hierarchies. You need a new business model and new processes that can cope with that shift.

- Balance: Leaders must be willing to do the hard work of reconciling often contradictory agendas to come up with a suitable innovation approach that they must also be willing to change and adapt as a process of learning. Being able to balance resources in both present and future tenses is a rare but essential art. If in doubt, place more emphasis on the future. As the Chinese proverb teaches us, the best time to plant a tree is twenty years ago.

Resumen

Corporate venture can create R&D units insulated from the parent culture and plugged into networks in which innovation is thriving.