EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

VAT, GST, sales and other consumption taxes

We consult on, assist with and help implement indirect taxes throughout the tax life cycle, including planning, risk management, systems and automation, compliance, and controversy, helping you to meet your business goals around the world.

What we can do for you

Around the world, businesses are increasingly being challenged to meet their multiple obligations for value-added tax (VAT), goods and services tax (GST), sales and use taxes (SUT) and other indirect taxes, in a period of rapid and unprecedented change.

Our globally integrated teams give you the perspective and support you need to manage VAT, GST and SUT effectively. We provide you with high-quality advice, hands-on assistance and efficient processes to help improve your day-to-day reporting, thereby reducing attribution errors, reducing costs and helping you handle your indirect taxes correctly.

We can support full or partial VAT, GST and SUT compliance outsourcing on a worldwide basis, including task and controversy management, diagnostic tests, exception reporting and data improvement.

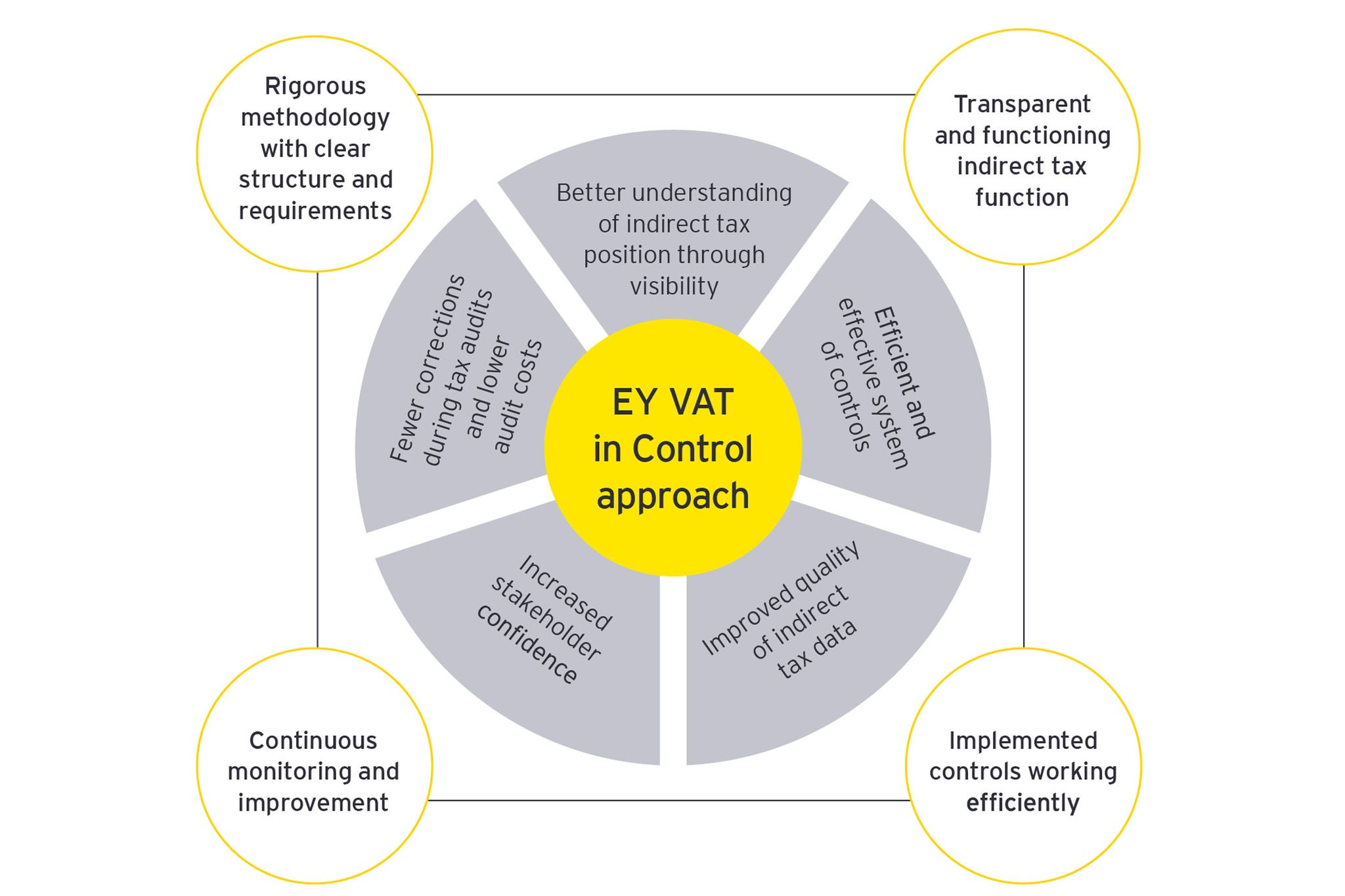

VAT in Control

Your indirect tax function must be in control of every stage of transactional reporting in every part of your business. You need consistent processes and dashboards to manage your indirect tax profile and respond to shifting regulatory requirements and inquiries. But your efforts do not just need to be defensive — with smarter processes, you can also identify efficiencies, save money, improve working capital and even be better positioned to predict the impact of business decisions.

Download the VAT in Control brochure

The team

Kevin MacAuley

Longtime authority on VAT and its impact on global supply chains. Digital thinker skilled in designing and implementing systems. Regular speaker at conferences around the world.

Jeroen Scholten

University lecturer. Podcast enthusiast. Global trade account leader across multiple sectors.

Yoichi Ohira

Providing practical, results-oriented services that companies can immediately put into action.

Tracey Kuuskoski

Redesigning operating models, exploring the art of the possible and innovating what comes after what is next. Flexible. Family. Nomad.

Gino Dossche

Indirect Tax Partner. Passionate about leading teams. Helps companies navigate change. Frequent traveler. Innovator. Former European Archery Champion. Husband. Father of boys. New Yorker. Belgian.

Ros Barr

Seeking to communicate information, insights and knowledge about indirect taxes in a direct and innovative way.

Our latest thinking

How three global trends are shaping indirect tax

Indirect tax leaders need to comply and spot the opportunities in the megatrends affecting indirect tax policies and international trade. Find out more.

How transformation is shaping global indirect tax

The trends that are driving transformation at a global scale and how indirect tax functions can best prepare and add value. Find out more.

How disruption is shaping opportunities for global trade

In the face of continued geopolitical uncertainty, indirect tax and trade functions have an opportunity to show their real value. Find out more.

How sustainability is shaping global indirect tax

Indirect tax leaders need to not only comply but spot the opportunities in the ever-evolving group of sustainability taxes and incentives. Find out more.

How to navigate global sustainability compliance challenges

Staying ahead of ESG regulations on a global scale can be a challenge but, businesses cannot risk falling behind on supply chain policies. Learn more.

What ViDA means for the rise of global e-invoicing

Commission’s VAT in the Digital Age (ViDA) proposal is a game changer for global businesses and their tax functions. Learn more.