Chapter 1

Why would you use the Discounted Cash Flow method?

What is the main advantage of the DCF-method for your startup?

Before we dive into the details a bit of context might be useful: why would you use the DCF-method to value a startup? Well, the main advantage of the DCF-method is that it values a firm on the basis of future performance. In other words: perfect for a startup that might not really have realized any historical performance yet.

During the (pre-)seed stage it is not uncommon for startups to not generate revenues at all whilst discussions regarding equity transfers, ownership percentages and the accompanying valuation already arise. The DCF-method is then especially suitable as it weighs future performance more than the status quo of your startup.

However, please note that using the DCF-method for startup valuation also comes with disadvantages, so don’t forget to check the ‘disadvantages of the Discounted Cash Flow method’ section at the end of this article.

Chapter 2

What is the Discounted Cash Flow method?

The valuation method is based on the future performance and the value of future earnings is worth less today than in the future.

Before we scare you away with the formula of the DCF-method, it is important to understand the underlying assumptions of this technique. (Startup) valuation on the basis of the DCF-method is based on two main assumptions.

- The valuation is based on the future performance of the firm. Consider this example: assume you are producing 3D-printers. If you’re able to turn your company in a viable business then these 3D-printers will generate annual profits for the years ahead (after deducting all expenses). It therefore makes sense to state that the current value of your firm should also include the amount of future profits, right? Let’s say your company gets funded by an investor in return for a certain share today, then this investor will also pick the fruits of these future earnings. All you have to do is actually realize your forecasted performance… ;)

- Future earnings would be worth more today (if you could have them today), and due to uncertainty you need to discount them for future periods. This has to do with the time-value of money. This might sound strange but it is actually really simple. Assume that you can choose; I will give you €1,000 today or €1,000 in one year from now. What would you pick? Hopefully you will go for option one! Reason is that there is always some risk involved that I won’t pay you the amount (in full) in one year, despite what I told you.

Moreover, you could put the €1,000 that I will give you today on a savings account or invest it on e.g. the stock market. This would mean that the initial €1,000 could for instance increase to €1,050 in one year. We can also revert this notion. Say that the current interest rate, the rate which you will receive on your savings account, equals 5% (what a wonderful world it would be..). That would mean that the €1,000 that I promise to give you in one year is actually only worth €1,000/(1 + 0.05) = €952,38 today! If you would put €952,38 on a 5% interest savings account today, you would also have €1,000 in one year.

A long story short: when valuing a startup using the DCF-method, the value of future earnings will be discounted to their value of today. This is due to the inherent risk associated with future cash flows (will they actually be realized?) and the reduction of monetary value over time.

Chapter 3

How to apply the Discounted Cash Flow method?

Apply the DCF formula in six easy steps

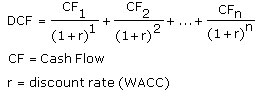

So far the theory behind the DCF-method. Below you can see what the DCF really is: a formula. Please don’t freak out when looking at it, as we are going to walk you through it step by step. In fact, in the previous section you have already read in common language how it works: the formula represents the value of all future earnings (the free cash flows), corrected for their worth today (the present value of the net cash flows). These are summed up to a total value.

Step 1: Create financial projections for your firm

In order to perform a valuation for your startup using the DCF-method you will need to forecast your future financial performance. In the DCF-method you present this performance as the future free cash flows (see step 2). This is usually done for the next five (or sometimes ten) years.

The calculation of the free cash flows is not complicated, but you need a couple of ingredients in order to be able to perform the calculation. If you want to perform a DCF-valuation you will need to create a financial plan/model in order to come with all the required elements.

In a financial model you project your revenue streams, costs, expenses and investments for the years ahead. These come together in a financial overview in which you present a prognosis of your financial statements (profit & loss, balance sheet, cash flow statement) and the predominant main Key Performance Indicators (KPIs) for your firm.

A financial advisor can help you with creating your financial model. However, if you feel confident doing this yourself it is good to know that there are many online Microsoft Excel templates available which you can modify and that there are also online tools (such as EY Finance Navigator) which can help you with this. If you want a deep-dive into financial modeling, you can check out our ultimate guide to financial modeling for startups.

Step 2: Determine the future “free cash flows”

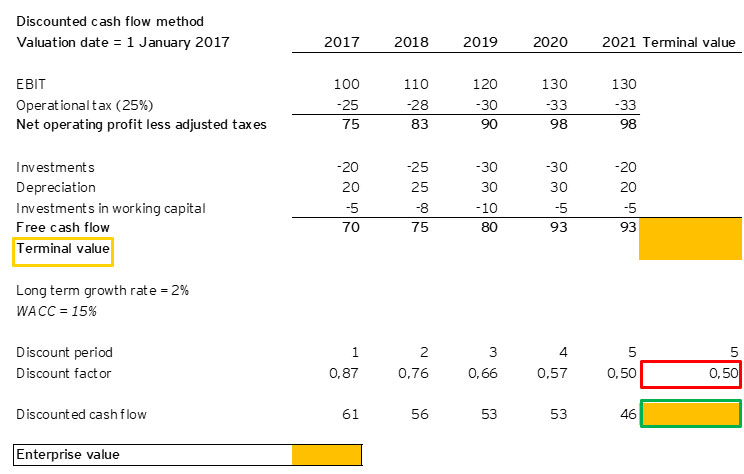

Below you will find an example of a valuation according to the DCF-method. The valuation (within the red borders) of this fictional example was made on January 1st 2017 on the basis of a five year prognosis.

In million euros. Source: EY, 2019.

In the above overview you will find the calculation of the “free cash flows” within the yellow borders. The free cash flows can be seen as the future financial achievements of your firm, which are used in order to determine the value of your startup today.

The DCF-method uses the free cash flows as these are corrected for the investments that are required to keep the firm running in the short term. This means that the free cash flows represent the cash that is readily available after all potential short term liabilities have been fulfilled: thus a good measurement for the performance of a firm.

As you can see in the yellow part of the above overview, the free cash flows are calculated as follows:

| Steps | Explanation | Where can I find this information? |

| 1: Start with the EBIT | EBIT represents your firm’s financial result: the profit before interest and taxes are deducted. | Profit & loss statement |

| 2: Deduct any operational taxes | Operational taxes are the taxes that have to be paid on the basis of the firm’s financial result. | Profit & loss statement |

| 3: Correct for any investments | Investments in assets such as property, plant and equipment (PPE) should be deducted. If your net investments are positive (for instance when you sell off any assets) you the positive value. | Statement of cash flows and/or the balance sheet |

| 4: Correct for depreciation | Depreciation is considered as a cost when calculating the EBIT in the profit & loss statement. However, depreciation is not a real cash flow (there’s no cash going in or out the company). As we use EBIT from the profit & loss statement to calculate the free cash flows you need to add back depreciation to EBIT to correct for the wrongfully deducted cash outflow. | Profit & loss statement and/or the balance sheet |

| 5: Correct for investments in working capital | 5. Correct for investments in working capital | Is calculated based on current assets and liabilities (balance sheet) |

Et Voilà! The most time consuming step in the process of valuing your startup by using the DCF-method has been performed: the calculation of free cash flows. Now you know the future earnings that are the basis for your valuation.

As you may have noticed, you can find the ingredients required for such a calculation in various parts of your financial statements (profit & loss statement, balance sheet and statement of cash flows). That is why a complete financial model is crucial when applying the DCF-method for valuing your startup.

Step 3: Determine the discount factor

As explained earlier in the example where I said I will give you €1,000 (disclaimer: I am not planning to honor that promise ;) ), the value of money deteriorates over time: future money is worth less today. So how do you determine today’s value of the future cash flows that we have calculated in step two?

You do this with the help of the discount factor (see the blue lined part in the valuation example above), which you calculate based on the WACC, the Weighted Average Cost of Capital. The calculation of the WACC might be even more difficult than remembering what the abbreviation stands for. That is why won’t do a deep-dive into the WACC right now.

In essence the WACC is a percentage and is (in the context of valuating a startup) a way to define the risk an investor is taking when he/she invests in a firm. The higher the WACC percentage, the higher the risk and the lower the valuation of your firm. As investing in startups is risky to begin with, it is not strange to see high WACC percentages for such firms.

So, what do you need the WACC for anyway? With the WACC you calculate the discount factor. The discount factor determines the present value of your future cash flows, in other words: your valuation! The discount factor is calculated using the formula below, per year:

Discount factor = 1 / (1 + WACC %) ^ number of time period

The number of the time period is in this case the specific year of your forecast. In our valuation example above 2017 is time period number one, 2018 is number two, and so on. In the blue-bordered section you will see that when the WACC is 15% (using the formula above), the discount factor is 0.87 in 2017 and 0.50 in 2021.

Observe how the discount factor decreases over time. This clearly shows the essence of the decrease in monetary value over time. The further away your future earnings are generated, the less they are worth today.

Moreover, given the discount factor formula above, the higher the WACC %, the lower the discount factor, which in turn means a lower monetary value of the cash flows. This illustrates how a higher risk of investing (a higher WACC) also reduces the value of the cash flows and thereby the valuation.

| Free cash flow 2017 70 |

* discount factor 2017 * 0,87 |

= present value 2017 = 61 |

Add up the present values for all five years of the forecast (61 + 56 + 53 + 53 + 46 = 269) and you have the valuation for the period 2017 – 2021 (marked with the red lines in our example). Easy peasy lemon squeezy, right…?

Unfortunately you’re not done yet! This valuation is based only on the value that your startup creates in the period from 2017 to 2021. But what about the years thereafter? You are not planning on terminating your thriving business by 2021, are you? Of course you’re not!

Besides calculating the net present value in the period 2017 – 2021, you also need to calculate the value for the cash flows generated in the years thereafter; that is, all the years after 2021. This is called the “terminal value”. In the example below you can see (in the orange marked fields) which elements of your valuation are affected by this terminal value.

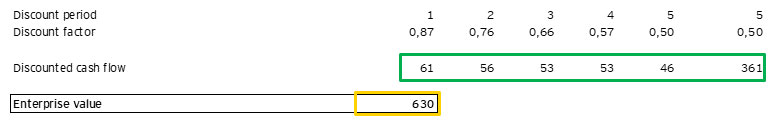

In million euros. Source: EY, 2019.

The calculation of this terminal value is in fact rather easy if you have gone through steps one to three already. First, you calculate the earnings that you expect after 2021 (the free cash flows). You can do this by taking the cash flows of 2021 and multiplying them with a growth rate. For this purpose you can use the following formula:

Free cash flows after 2021 = Free cash flow for the last projected period (in this case 2021) * (1 + growth factor).

If you want to use a conservative approach, you use the inflation percentage as growth percentage. However, if you are feeling optimistic you could also use the projected yearly growth rate of the free cash flows of your firm. After making your decision you can calculate the terminal value (in the yellow borders in the above example) as follows:

Terminal value = Free cash flows after 2021 / (WACC – growth rate)

Thereafter the terminal value for the period after 2021 is discounted in the same manner as the cash flows for the period 2017 – 2021. So the terminal value is multiplied with the discount factor. Since you are assuming that the terminal value is calculated as of the last year of your prognosis (in this case five years and hence 2021), you use the discount factor of year five; in our example 0.50 (as shown in the red bordered section above). This is used to calculate the net present value of your terminal value (indicated in the green lined section in the above example).

Step 5: Aggregating all your calculations’ results

The hard work is over! One last sum and your startup valuation is finished. In step four you have calculated the net present value of all future cash flows (including the Terminal Value). When you add all these values (as done in the green section below) you arrive at the value of your startup on the basis of the DCF-method (orange bordered in the overview below).

In million euros. Source: EY, 2019.

Step 6: (for the pro’s): create different scenarios and analyses

Finished, right? Well, not quite.. For the pro’s there is another step to take. As the DCF method is a formula and therefore very sensitive to the input variables, it is a good idea to create different scenarios and analyses. In doing so you gain a better understanding of the possible valuation results when you are tweaking your forecast and the input variables of the formula.

As the valuation is based on the free cash flows and these cash flows result from the forecasted performance of your startup, it is smart to create multiple version (“scenarios”) of your forecast. It is common practice to create a worst case, base case and best case scenario.

This provides you with insights in the performance of your firm when things do not go as expected, for better or worse. This influences your valuation as the underlying free cash flows change based on the scenario you use.

The valuation based on the DCF-method is also heavily dependent on the adopted WACC percentage (recall: the risk indicator) and the growth rate that you use for the calculation of the terminal value. As the risk of not achieving the expected earnings is relatively high for a startup (unless you have a stable business with positive financial results for a few years already) it’s better to set your WACC higher than lower (> 25%).

You can find an example of WACC percentages (cost of capital) per sector in the U.S. here. These percentages are in the range of five to eight percent, but are based on large stable corporations which generally have a much lower risk compared to startups. You can play with the WACC and the expected growth rate to see how it affects your startup valuation.

Chapter 4

Disadvantages of using the Discounted Cash Flow method

What should you take in account when you’re using the DCF method?

The previous two paragraphs actually already describe the main disadvantages of using the DCF method when valuing startups: the DCF is nothing more than a formula, a mathematical operation. This means that the quality of your valuation is extremely sensitive to the input variables of the formula (such as the WACC and the growth rate), yet also on your ability to create an accurate forecast of your firm’s future performance. After all, the future earnings (free cash flows) are the foundation of the valuation.

And that precisely illustrates the challenge of performing startup valuations. For well-established firms it is easier to create forecasts as you can extrapolate historical information that provides a reasonable level of certainty. A startup generally does not have much historical financial information yet. A pre-revenue startup even has no revenues yet. So how can it predict future earnings without having achieved one sale yet? For this reason it is crucial to create a proper financial model.

Chapter 5

Conclusion

The DCF method is convenient for startup valuation as it uses future earnings, but the valuation is also highly dependent on the quality of the financial forecasts and choices

On the one hand the DCF method is convenient for startup valuation as it uses future earnings. Perfect for a startup where most financial value is generated in the future. However, there are also startup-specific disadvantages related to the use of the DCF-method: the valuation is highly dependent on the quality of the financial forecasts and choices related to input variables such as the WACC and growth rate.

Now let’s assume that, given the disadvantages, you still want to value your startup according to the DCF-method. Then please do not anchor too much on the eventual result of the calculations. Perceive the valuation as a ballpark figure and nothing more than that. Make sure to create different scenarios of your forecast so you can see what happens with the valuation when things go better or worse than anticipated. Even better is to adopt different valuation techniques in order to obtain a range of valuations. You can then take an average or median value and keep that in mind when speaking to potential investors. A tool like Equidam could help you with this.

Before concluding this article we would like to stress that a DCF valuation is not the same as the actual sales price of your firm when you try to raise equity funding! Despite all your efforts and research in applying the different valuation techniques available, the value of (a share of) your startup is eventually determined by the negotiations with an investor and the share he/she receives in return for investing in your company. Hence do not anchor too much on the results of performing a mathematical exercise.

Instead use it in order to gain a better understanding of the potential and value of your firm. An investor is likely to hold a different opinion regarding the value of your firm than yourself, so enter such conversations with an open mind. Valuation techniques can easily be learned, yet your negotiation skills might be even more important… ;)

Disclaimer: this article is of informative nature and aims to inform the reader about the method/process behind a valuation based on the Discounted Cash Flow method. No rights can be derived from the use/application of the method as described in this article. The DCF method can be applied in various ways. For more information about company valuation, contact a professional financial advisor/expert. If you are interested in an official company valuation, contact a certified Register Valuator.

Summary

A question that many entrepreneurs ask themselves often is: What is the valuation of my firm? But how do you define the valuation of a startup? There are multiple methods to value a startup and one of them is called the Discounted Cash Flow (DCF) method. The main advantage of the DCF-method is that it values a firm on the basis of future performance. Create different scenarios of your forecast to see what happens with the valuation when things go better or worse than anticipated. Or adopt different valuation techniques in order to obtain a range of valuations. If you need help, reach out for us here.