EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

How EY can help

-

EY-Parthenon energy strategy consulting teams help C-suites drive future value-creation. Learn more.

Read more

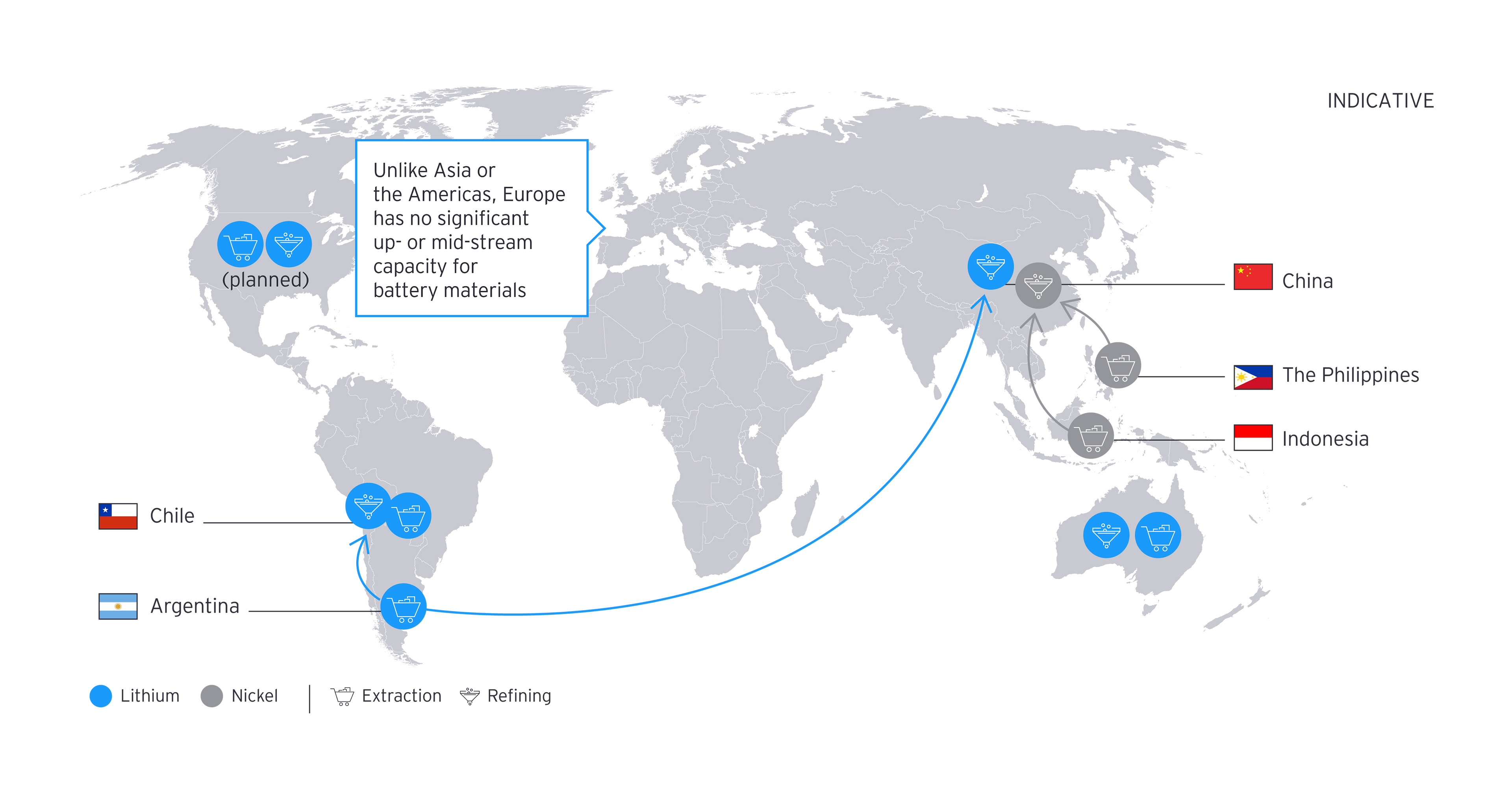

Asian investments in the battery value chain

China, and to a lesser extent, South Korea, dominate material trade flows today with significant infrastructure and capacity in controlling market dynamics and pricing.

Between 2009 and 2013, the Chinese government began providing subsidies to promote the growth of the EV sector, having identified EV manufacturing and lithium-ion battery production as strategically important sectors to the broader economy. The government offered cheap land for factories and significant capex subsidies to build plants. They offered tax breaks and subsidies worth up to one third of the cost of the EV, on the proviso that automotive OEMs used batteries from a list of approved battery suppliers, including entities such as CATL (Contemporary Amperex Technology Co. Limited) This initial support provided CATL with the platform to corner the market, particularly the LFP (lithium iron phosphate) cell market.

From a basis of scale, and an ability to deploy the cash flow generated from cell production, CATL has embarked upon a series of value chain investments that have allowed it to secure supply and move into the midstream. Some examples of their investments include:

- Building a plant processing nickel laterite ore in Indonesia which starts production in 2024

- Acquiring Pilbara Minerals, which plans to expand the Pilgangoora Lithium-Tantalum Project and processing facility to produce lithium hydroxide in South Korea

- Purchasing stakes in mining projects in the South American Lithium Triangle and in cobalt mines in the Democratic Republic of the Congo

US targets cleaner EV batteries through legislation

In August 2022, US President Joe Biden signed the Inflation Reduction Act (IRA) into law, containing incentives designed to develop a local supply chain targeted at encouraging domestic production and sourcing. To incentivize demand, the law provides tax credits based on the MSRP limits. From 2024, US vehicles cannot have any battery components sourced from a “foreign entity of concern”, and from 2025, EV batteries cannot have any critical minerals sourced from a “foreign entity of concern”.

Through this legislation, the US is localizing production within the area covered by its North and South American free trade agreements, which includes agreements with commodity-rich countries such as Chile. The US is aided by a slower adoption of EVs than Europe.

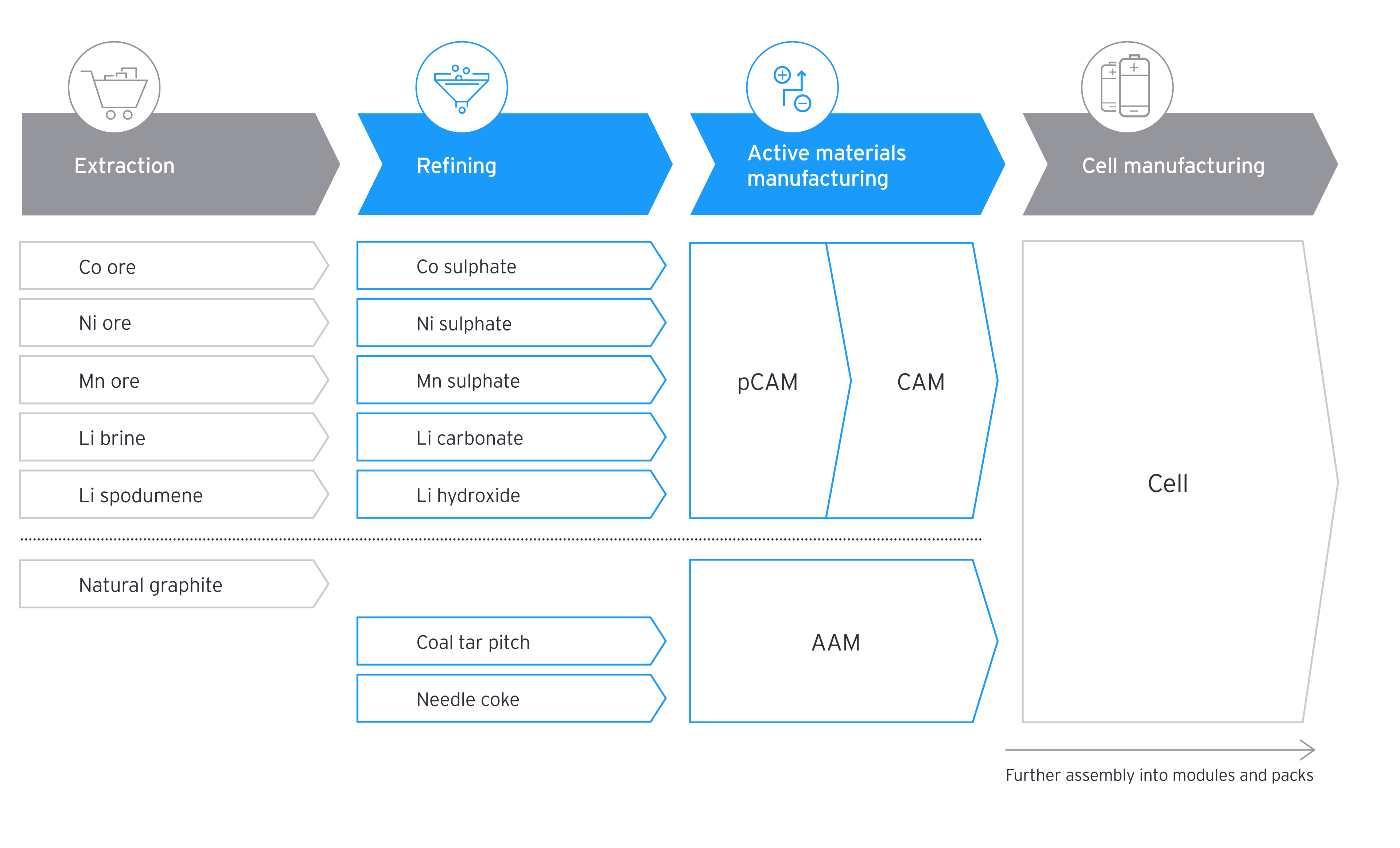

The US Department of Energy (DOE) has awarded $2.8b to around 20 companies across 12 states operating in its domestic battery supply chain through the US Bipartisan Infrastructure Law. This has driven $1.5b to be allocated toward materials separation and processing, and $1.3b allocated toward component manufacturing. Of the $2.8b, 30% has been allocated to anode investments and 25% to PCAM & CAM, covering NMC and LFP technologies.