Chapter 1

AM moves into the operational mainstream

Among individuals and businesses, levels of awareness and adoption of the technology have surged.

One in four of all companies in the 2019 EY survey are in the very early stages of their AM journey, still testing or experimenting with the technology. However, there is a huge increase in the number that claim that AM is strategically important to them and that have a clear plan for integrating it in their business — up from 4% three years ago to 20% in 2019.

Rising interest

27,000attendees at world’s premier annual fair on industrial 3D printing, Formnext in Frankfurt, Germany, in 2018 — up from 8,982 in 2015.

While awareness and use of 3DP technologies increased globally, enthusiasm and interest vary significantly between different regions and countries. In 2016, German businesses exhibited the highest level of experience with AM, at 37%. Today, although that percentage has risen to 63%, Germany has become one of the three countries with the lowest level of experience.

On other hand, exposure to the technology among Asian businesses has spiraled upward, especially in South Korea and China. Of the South Korean and Chinese companies surveyed, familiarity with AM grew from 24% in 2016 to 81% and 78%, respectively, in 2019, making them the nations with the most AM experience, possibly a reflection of their improved economic development.

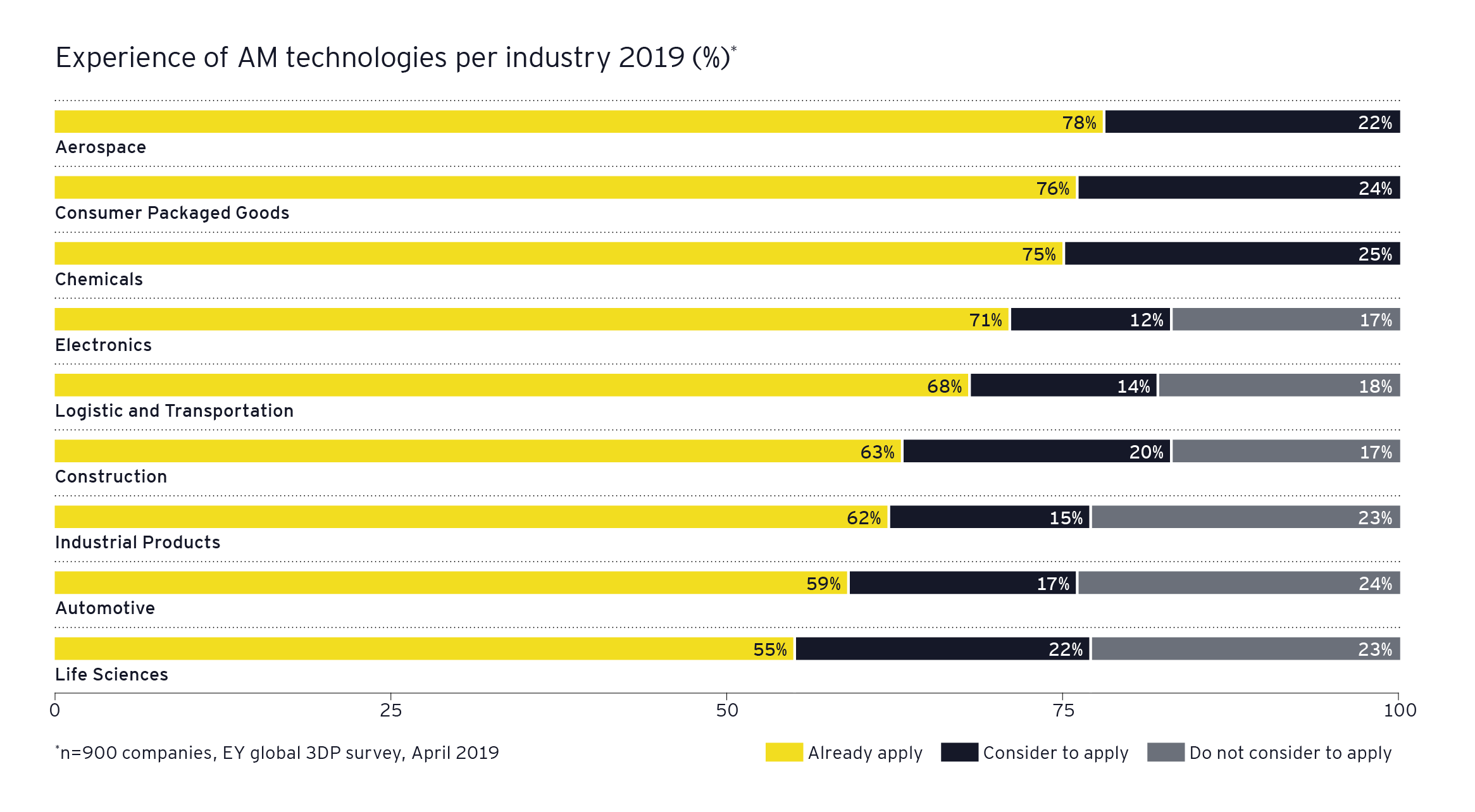

Within specific sectors, the aerospace industry has the highest AM experience, with 78% of companies claiming they have used the technology. Even industries with limited use of AM — and in which its application would mean whole new business models, such as logistics and transportation or construction — demonstrate high awareness of the technology. The interest in and experience of AM among logistics and transportation companies, for example, is now six times higher than in 2016.

Driving the adoption of AM is the understanding that the technology has evolved beyond prototyping and can be used to make functional parts. Let’s look at how AM has evolved from the lab to the shop window.

Chapter 2

AM serial production takes off

Once the focus of enthusiasts and visionaries, the technology now has broad applications.

Almost one-third of surveyed companies apply 3DP to produce at least one of three types of functional parts:

- End-use components and final parts used by the ultimate client or consumer (18% of companies surveyed, up from 5% in 2016) — for example, titanium alloy brackets

- Tools, molds and more, for use in traditional manufacturing (15%)

- Spare parts made on demand from digital warehouses (14%)

When it comes to spare parts production, AM addresses several major aftersales and repair cost drivers: high inventories, older spare parts that become special request items, outdated or non-mover parts in warehouses, and transportation.

Technology

17%of all automotive companies now apply AM for tooling because it offers the potential for enormous cost savings.

Our survey shows that AM has reached — and exceeded — a crucial tipping point, from being the focus of enthusiasts and visionaries to becoming a technology with broad applications. This adoption and growth appear set to continue: 46% of surveyed companies expect to apply the technology for their serial products by 2022, with Asian companies again leading the way. Among sectors, life sciences and chemicals lead the field: 22% of surveyed companies use AM for end products.

We see two scenarios: AM will replace traditional manufacturing technologies, or it will become an additional production technology. If it replaces other technologies, it is likely to be because it enables more economic production or, on the other hand, validates more expensive production processes by delivering added value to products that better meet customer needs. If it continues to co-exist with other production technologies, this would probably be an application-driven decision.

Among our survey respondents, 34% believe that AM will become an additional production technology, while only 12% thinking it will replace other technologies.

Regardless, the growing interest and use of AM are based on a number of significant benefits that are worth exploring in greater detail.

Chapter 3

How AM can give businesses a competitive edge

Respondents cite better ways to meet customer requirements and create prototypes rapidly — and see more perks ahead.

Companies increasingly recognize that AM is not just another way to make the same old parts. They appreciate that the technology allows them to design and produce parts that are much more complex and enabling than ever before.

For example, they can create different types of geometrical structures honed to meet specific needs, make lightweight products with bionic structures, and produce one-piece parts that were formerly assembled from multiple pieces – even integrating internal structures that were previously within inaccessible spaces.

AM could deliver three ascending levels of benefit for businesses:

- Efficiency. AM is applied within the existing supply chain and operations to improve efficiency (for example, with better prototypes, molds and machine parts, or as a production strategy for lot size one parts). Products are not redesigned at this level.

- Growth. AM enables the (re)design and creation of end-use products with improved functionality or ones that could not be made previously, so satisfying unmet customer needs and winning new markets.

- Transformation. AM provides the opportunity for companies to extend or change their business models, reposition themselves in the value chain, or even gain competitive advantage from the technology by becoming an AM vendor.

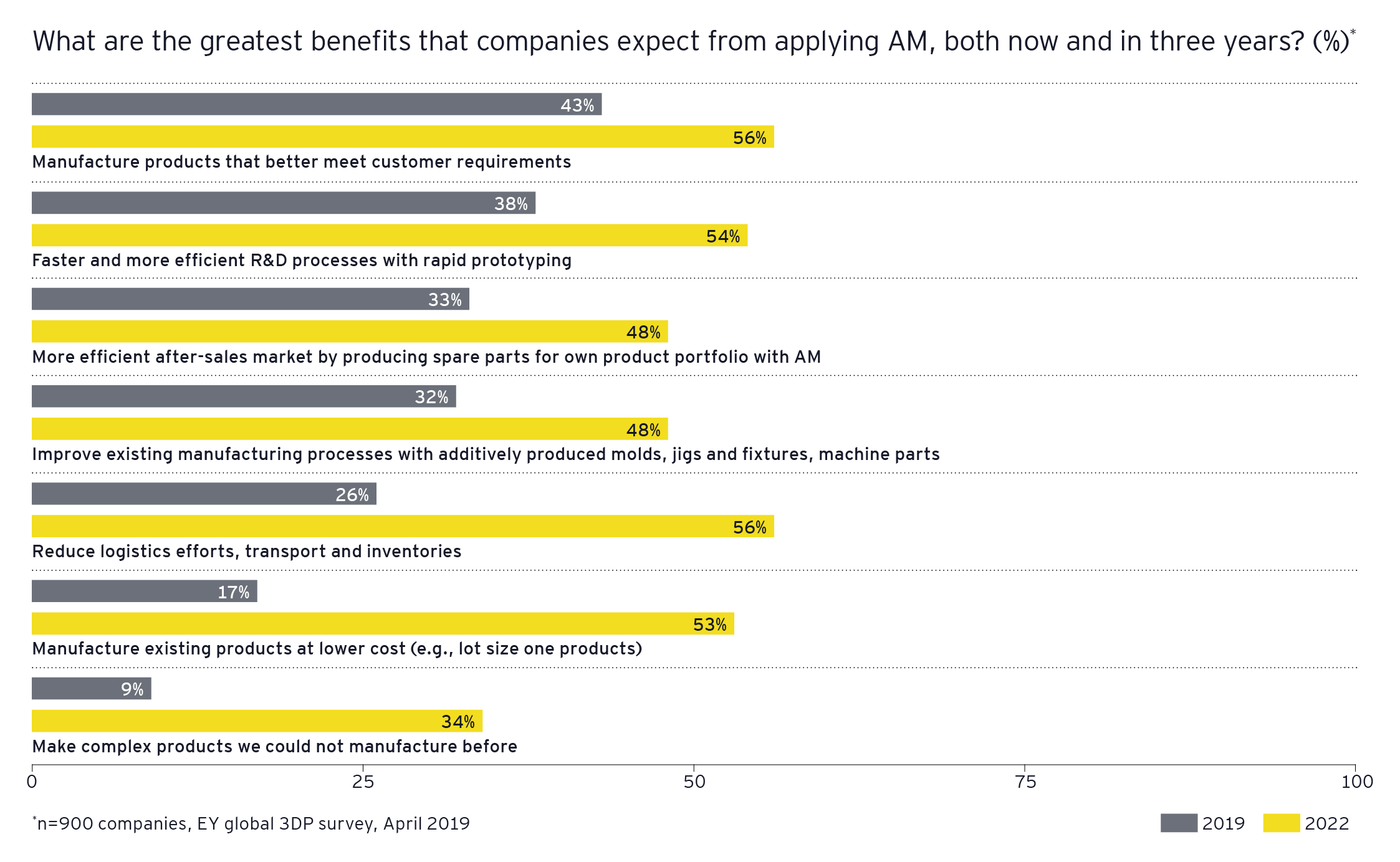

These capabilities give companies a competitive edge: 43% of those surveyed claim that AM helps them to better meet customer expectations. This has undoubtedly contributed to the rise in the number of organizations now using the technology to produce end‑use components.

And the figure seems destined to rise even further, as by 2022, 56% of those surveyed expect to better fulfill customer demands via AM. Moreover, by this date, 34% expect to be using the technology to manufacture complex products that they could not make in the past.

AM’s original value, as a prototyping technology, is still relevant for many businesses. Thirty-eight percent of companies surveyed see faster and more efficient R&D processes as a benefit of the technology, and 54% believe this will still be the case in 2022.

Besides prototyping, companies traditionally used AM to improve existing production processes. By enabling them to make dies and molds with internal structures and customized tools and machine parts, jigs and fixtures, the technology enhanced their traditional manufacturing and maintenance systems. This is still a major draw: 32% of businesses surveyed cite this as one of the primary benefits of AM.

The ability to manufacture products wherever and whenever they are needed will significantly impact company logistics, enabling organizations to reduce their warehouse inventories, handling efforts and transportation. More than one-quarter (26%) of those surveyed claim to have already experienced these benefits.

In the rapidly evolving Transformative Age, you can expect additive manufacturing to continue to grow in importance, with new players entering the market and new use cases being developed. In our full report, 3D printing: hype or game changer? (pdf), you can find more about AM trends, developments and challenges — and what you can expect in the future.

Summary

With almost one in two surveyed companies expecting to make products additively by 2022, the industrial landscape is facing a rapid metamorphosis. Manufacturing and product design will be transformed, a fresh supply chain will develop and new, innovative business models will emerge.