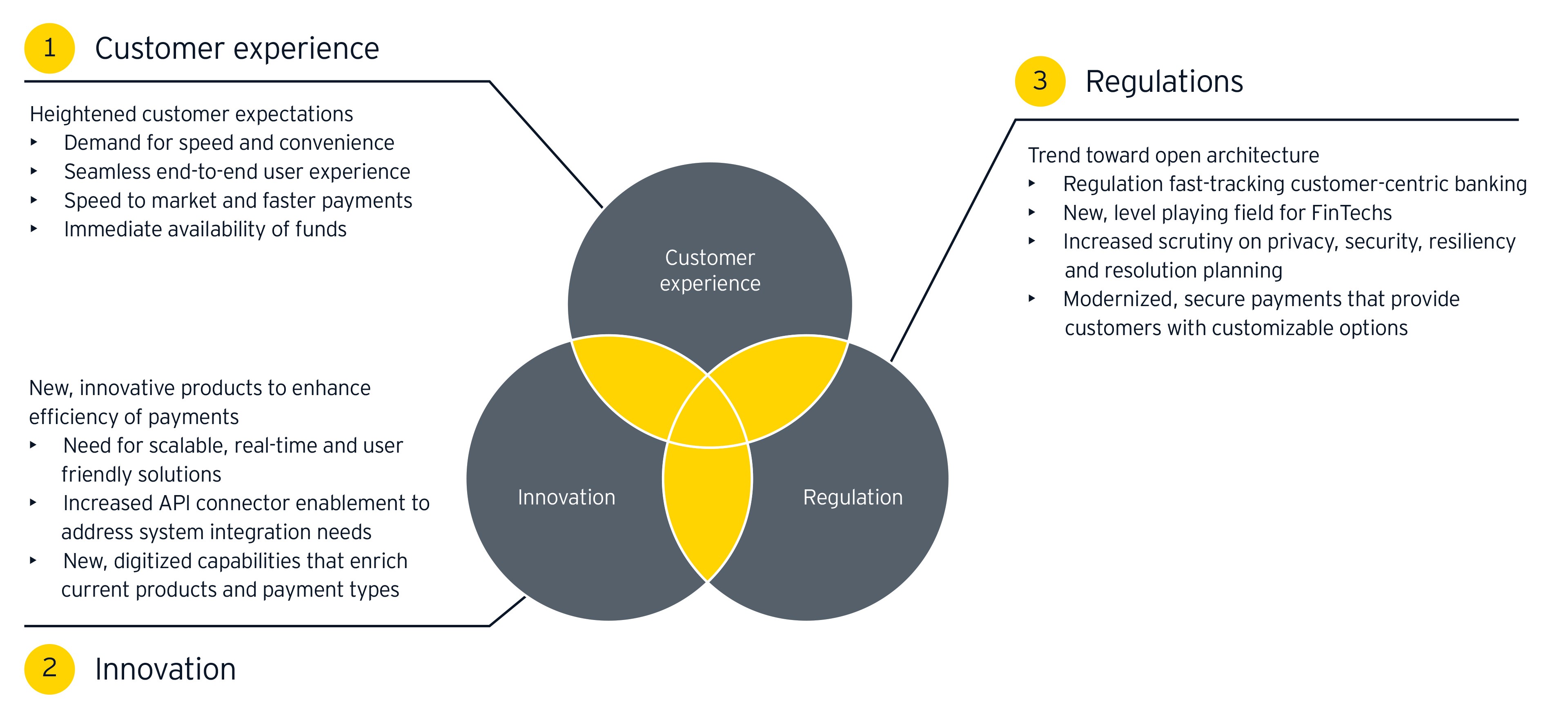

3. Regulation

Following the financial crisis of 2008, regulators have held financial organizations to a new, higher level of accountability. Recently, key regulators have appeared to indicate that financial organizations not only need to provide end-to-end payments reporting, but also must demonstrate end-to-end payments operations that treat critical functions as a business.

At the same time, the growing adoption of open banking and implementation of the Revised Payment Services Directive in Europe are driving a move toward standardization to govern the consistent use of application program interface (API). In the EU, the Berlin Group—a collection of more than 40 financial organizations, associations and payment service providers—is leading the creation of interoperability technical standards and harmonization initiatives, and we expect to see similar activity in the US and other markets.

For financial organizations, meeting these obligations will require payments systems with the ability to track transactions to provide the consistency and transparency regulators demand and the options customers expect.