Chapter 1

Turning a hurdle into an opportunity

EV batteries are costly, but their value chain — use, reuse, recycle — offers revenue potential.

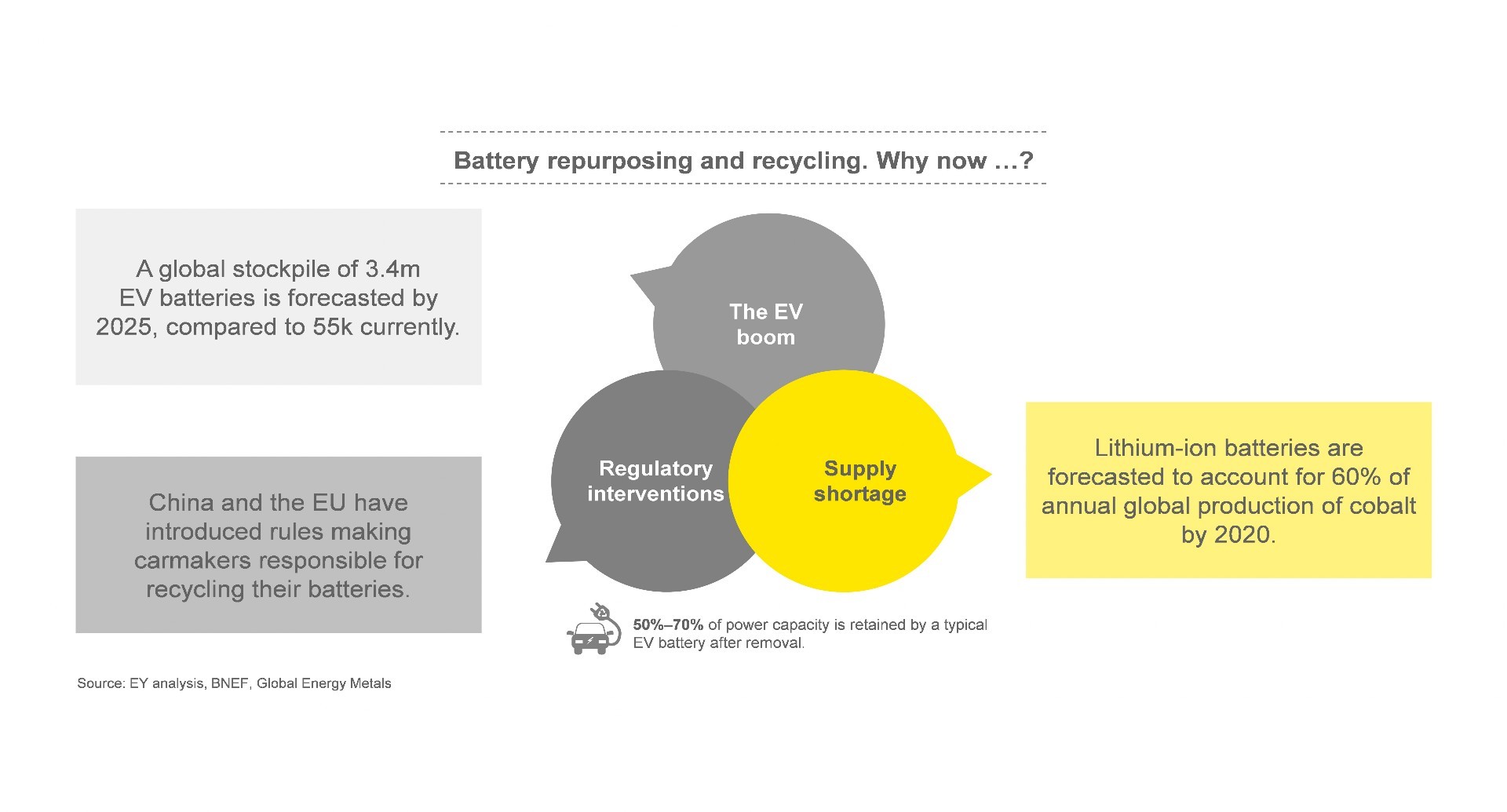

Simply throwing away battery packs that are no longer fit for their original purpose is clearly a nonstarter for any sustainable technology. EV batteries are expensive, packed with scarce raw materials and are environmentally tricky to dispose of, and disposal economics are currently unattractive.

Battery life cycle management is a huge emerging opportunity that could solve the issue of how to stop EV batteries ending up as expensive and toxic landfill waste. However, making the most of the opportunity will require new levels of collaboration within not only the battery manufacturing, automotive, utilities, and metals and mining sectors but also R&D institutes and the startup community.

But the prize is attractive: battery life cycle management offers a great chance to flip what looks like a brake on the progress of EVs into something that could accelerate and increase EV sales in the future.

The battery is an asset too

The battery is an asset and should be recognized as such, rather than as a component of a vehicle. This recognition would ensure that it is developed as an important source of additional revenues over a full life term, one that could last several decades.

Consider, for example:

New batteries currently cost around US$200 per usable kWh (with the battery accounting for over 50% of the cost of an EV). Second-life batteries repurposed from EVs could slash that cost to only US$49 per usable kWh.

Such dramatic savings are achieved by:

- Managing the battery through its full life, with separate ownership and tracking models for the vehicle and battery pack – potentially leveraging blockchain and smart contracting

- Creating a marketplace to enable easy movement into other economically viable alternative uses, including storage of power generated by solar and wind, grid stabilization, backup power supplies and even EV charging

- Enabling new business models, such as “storage on demand” and “storage as a service,” would allow emerging energy companies to generate new revenue streams without spending on asset building

Thus, automakers could access new commercial opportunities arising from the reuse of the EV batteries and could use the present value of these to reduce the up-front costs of EV ownership, ultimately driving more rapid uptake. For utilities, some of whom are already setting up and acquiring second-life battery businesses, EVs are nothing but storage on wheels and a potential way to keep customers’ bills as low as possible.

The critical part of this shift calls for a collaboration between companies from the automotive, utilities, and metals and mining sectors to create a commercially viable marketplace to capture the full economic benefit of the battery life cycle. To achieve this, these sectors will need to collaborate and shift away from traditional linear value chains and move toward a circular economy ecosystem model.

The virtuous circular value chain

The battery value chain of use, reuse, recycle is a circular economy model. Eventually, spent EV batteries really are spent: when they are no longer suitable for even basic storage applications, they are recycled and their raw components can re-enter the process once again.

A circular value chain is less wasteful but more complicated than a traditional linear one because whole-life considerations are factored in from the start, rather than being ignored or regarded as someone else’s problem.

But, if the complexity around the reuse of EV batteries is largely due to the need for new commercial partnerships and business models centered on future uses, the challenges of recycling are more multifaceted.

Chapter 2

A market with huge potential, but several constraints

Some battery types are not suited for recycling, which is complex. But change is on the horizon.

Although recycling presents a substantial opportunity, it is currently underrealized. Only around 5% of li-ion batteries are recycled at present, and some 11m tons of li-ion batteries will be discarded by 2030, according to Bloomberg NEF.

The market for recycling holds huge potential, but it is constrained by several factors: not all battery chemistries are equally suited to recycling, and there is a wide range of different chemistries and battery pack types currently in use. Furthermore, the process itself is complex and expensive: commercial smelting produces a mixed product from which the vital lithium must then be extracted via further treatment at additional cost. The economics are therefore not favorable at present (the value of raw material reclaimed is approximately one-third of the cost).

As the supply of EV batteries requiring recycling grows, the commercial incentive will result in overcoming many of the current costly complexities in recycling. Even now, there are startups and process innovators working on much-improved recycling technologies with 90%-plus retrieval rates for key minerals lithium and cobalt.

However, to be most effective and efficient, the standardization of battery types will be required at an industry level, and batteries will need to be designed with recycling in mind from the start.

Regulation could help shape the market

Regulatory changes tend to put the onus for dealing with spent EV batteries on the automaker – such rules are already in place in China, the EU and several US states, including California, Minnesota and New York.

US federal law only mandates recycling of nickel-cadmium and lead-acid batteries. Only some US states have disposal requirements for li-ion batteries. European regulations require the makers of batteries (including carmakers) to finance the costs of collecting, treating and recycling all collected batteries. China has also passed interim rules making carmakers responsible for recovery and recycling of batteries.

What to expect

It should be clear by now that no single player, however large, can provide the very broad range of capabilities and expertise that battery life cycle management requires.

For starters, wondering how they should proceed and what to expect, there are several initiatives underway that point to the likely shape of things – and business models – to come.

Automakers are looking at various approaches to harness the opportunities presented by the emerging value chain. These range from establishing in-house energy businesses, to developing a three-stage circular economy model for their batteries with partnerships covering reuse and recycle applications.

The battery life cycle management space is also witnessing the emergence of startups that are partnering with automakers and managing the EV battery (on behalf of the automaker) across its life, looking at aspects such as repair, repurposing, recycling and logistics management of batteries.

This neatly demonstrates the diversity of approaches and partnerships and the collaborative thinking that is required to make battery life cycle management a reality.

Companies must identify and develop suitable commercial partners, whether they be small innovative startups or large established corporates. And, they shouldn’t forget to invest in the future through cross-sector industry and academic R&D collaborations.

Several other automakers across the world have repurposing deals where second-life batteries are being used for many applications, including renewable energy storage, grid stabilization, power backup and EV charging.

Still others are working with recyclers, while some are putting in place long-term supply deals to secure either battery supplies and/or access to raw materials.

Although it is still early on in terms of the widespread industry application of battery life cycle management, the number of these initiatives will only increase. They will also become more integrated and scalable as new markets and players evolve.

Chapter 3

Leading the charge for battery life cycle management

Through partnerships and new business models, automakers can deliver consumer value and stand apart.

To make the most of the opportunities presented by battery life cycle management, there are three key aspects for industry participants to bear in mind.

- Alliances hold the key. Automakers should partner with a variety of industries, including battery manufacturers; those in the battery repurpose space, such as utilities and smart-power startups; recyclers; and tech providers, to track, record and reconcile the whole process. Identifying and implementing these alliances will call for new skill sets and a new, more open mindset because in a circular value chain, no one is at the top of the pile, and no one is on the bottom.

- New business models. The trend toward decoupling the ownership of the EV and the battery must accelerate. New, more flexible and multistage leasing deals not only for first-life applications but also for second, third and fourth lives must be developed This will need new management and information systems to handle battery tracking, including charging history, ownership and related transactions. Here, its envisaged that blockchain platforms with smart contracting would be deployed.

- Customer value. The revenues that will accrue from the reuse and ultimate recycling of spent batteries must be priced in and used to improve value offered to new EV customers. Reducing the up-front cost of EV ownership and use is vital to boosting affordability, which will also increase consumer confidence and sales.

Developing a used battery market presents a major opportunity for industry participants to create new assets, access valuable new revenue streams, secure supplies of raw materials and drive EV use. It’s a critical aspect of the future viability of EVs and will be a major competitive differentiator for those that drive the market as opposed to those that sit on the sideline.

Summary

Developing a used battery market presents a major opportunity for industry participants to create new assets, access valuable new revenue streams, secure supplies of raw materials and drive EV use. It’s a critical aspect of the future viability of EVs and will be a major competitive differentiator for those that drive the market as opposed to those that sit on the sideline.