How can two divergent models succeed in open banking?

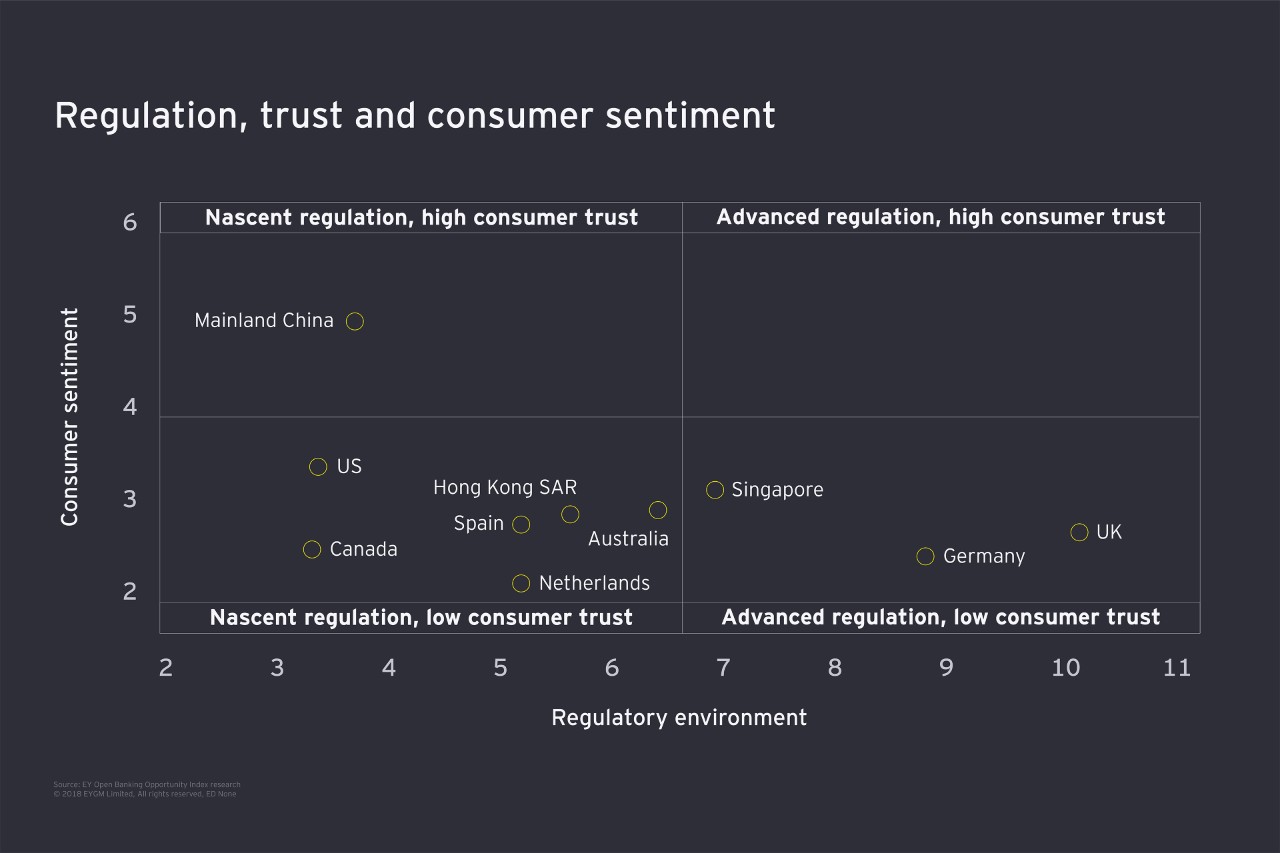

The overall index leader board paints a revealing picture of how open banking is evolving. The UK and mainland China are clear leaders, despite being poles apart in policy and with markets that contrast sharply in key areas.

Divergent regulatory models can deliver strong open banking environments

| UK | Mainland China |

| A prescriptive model | An organic model |

| Banks mandated to use open APIs | Open banking not mandated by legislation |

| Mandatory API specifications and standardized formats | No mandatory API specifications, but financial services industry using open APIs |

| Strong innovation environment and adoption potential | Strong adoption potential and innovation environment |

| Consumers cautious about sharing data | Less data protection, but consumers comfortable sharing data |

Both countries share strong consumer adoption potential and innovation environments. But while UK consumers still have doubts about security and data protection, customers in mainland China are more comfortable opening up their banking data in exchange for better services.

Regulatory environment – push or pull?

Index results demonstrate that there is no single regulatory recipe for open banking success.

In the EU, the Revised Payment Services Directive (PSD2) mandates banks to share data with third-party providers (TPPs), once consumers consent. UK and German regulators have been the most proactive, with both involved in determining standards for the application programming interfaces (APIs) that will connect banks and TPPs. The UK’s Open Banking Implementation Entity (OBIE) is also closely overseeing the development of the market’s open banking ecosystem.

Other countries favor a market-driven approach. Mainland China demonstrates this best. Here, banks and FinTechs are already making significant use of open APIs, even though there is no legal mandate to drive this, nor are there any standards in place.

The US also wants the market to drive open banking adoption, although a July report from the U.S. Treasury discusses how changes to the regulatory environment can also support FinTech innovation.

Will consumers embrace or avoid open banking?

Open banking will only succeed if it wins the trust of customers and makes them feel comfortable about sharing their data with third parties. But our research shows that, in most markets, consumers still need winning over.

Consumer worries

48%of negative discussions worldwide around open banking centered on consumers’ data protection and cybersecurity concerns

Consumer trust remains low or moderate in nine of the 10 markets we surveyed, irrespective of the regulatory environment. Only customers in mainland China score strongly in their willingness to share information with third parties – about half (49%) say they are comfortable sharing transaction data with FinTechs for better services. Forty percent of Chinese consumers’ online discussion of open banking was positive. Technological innovation in digital payments, as well as government-mandated sharing of personal data, may help explain positive consumer sentiment in mainland China.

A matter of trust

Realizing the true potential of open banking – both for consumers and financial institutions – hinges on gaining consumer trust. Regulators can play their part by building environments that support innovation and reassure consumers but, as the Chinese experience demonstrates, it is ultimately the ability to engage customers that will determine whether open banking succeeds.

Consumer education about risks and benefits can help accelerate adoption – but perhaps the greatest lever to shift consumer sentiment will be showing customers the payoffs that open banking can bring. As seen with the adoption of popular social media platforms, people will willingly share information if they perceive benefit and if they can do it via easy-to-use, fun apps. Innovation by financial institutions, particularly in market-driven environments such as the US, may convince consumers of the value of open banking and accelerate its adoption across global markets.

Summary

Realizing the potential for open banking to thrive depends on getting the right conditions in place.