Chapter 1

Key findings about digital deals

Digital Deal Economy Study

Strategy and ecosystem

Understanding the evolving external environment and aligning strategic digital goals are the primary components for success. Acquisitions are clearly an important part of the mix, and we see 74% of our respondents looking outside their own companies for digital growth. Organizations are still placing significant reliance on corporate M&A departments, which often specialize in identifying and pursuing traditional targets in the company’s “home” sector. But finding targets for digital M&A requires a different approach. Building new digital ecosystems is critical to enable companies to identify new partners and targets.

Capital and portfolio review

Our survey respondents clearly understand there is a cost associated with digital transformation. However, many are challenged to get their capital allocation balance right. When asked if they have a coherent and aligned “buy” and “build” approach to digital, only 48% agreed. While organizations may be trying to respond to the fast-changing technological landscape, it is important not to make hasty decisions or prematurely react to short-term forces. Continuously reviewing the business portfolio to sustain ambitious acquisition and investment goals is key to future-proofing the business.

Deal process

Our findings suggest an overall level of confidence around the processes companies are using to evaluate targets. However, looking at the deeper analysis of the new types of diligence, it is apparent that few are actually employing innovative methods. For example, only 38% are applying intellectual property analysis and just 22% are undertaking cyber diligence. Rebooting M&A capabilities and processes to meet the specific deal demands of the digital environment is key to success.

Integration

Many organizations continue to use the approaches they employ for post-merger integration of brick-and-mortar assets for digital transactions. But digital M&A requires a much more nuanced approach. Companies may also be targeting a number of digital assets at the same time, so the ability to integrate multiple digital assets simultaneously will be key to delivering potential. Realizing maximum value requires strategic integration approaches tailored to digital transactions.

24%

Companies that are ‘highly confident’ about their ability to retain talent following an acquisition

Chapter 2

Three levels of digital M&A maturity

Digital Deal Economy Study

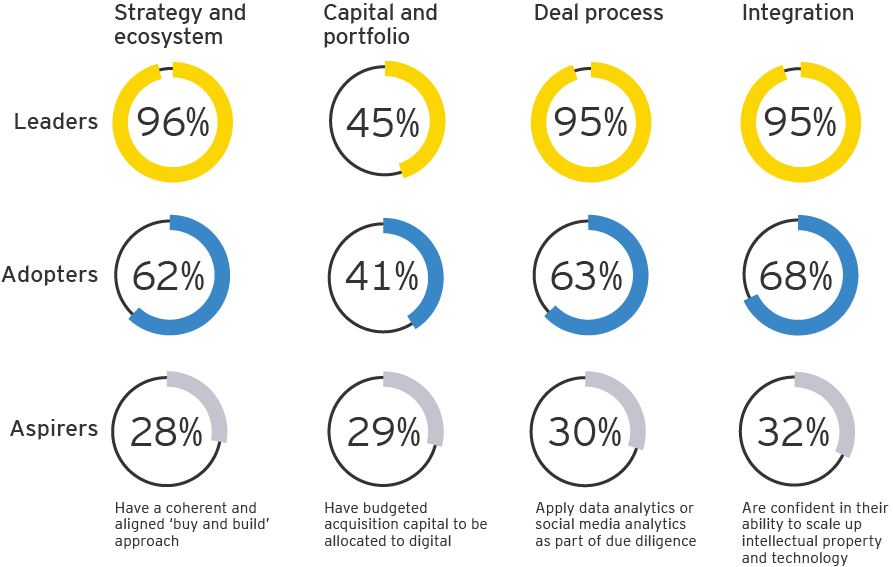

On the basis of our research, we identify three levels of digital M&A maturity:

Leaders

A small and elite group of companies (14%) that have undertaken a significant transformation of their M&A strategy and approach. These are experienced digital deal-makers who have been prepared to question and update their M&A approaches for the digital economy, across strategy, capital, diligence and valuation, and post-merger integration.

As a result, they are building a clear digital advantage. Well over half of Leaders say that digital advances have improved their revenue, share price and market share over the past two years.

Adopters

Another group of companies (29%) that understand their own weaknesses. They are beginning to update their approaches to cater for the unique challenges of digital M&A and are building the infrastructure and skills required to fully succeed.

For example, while they continue to rely heavily on corporate M&A departments to identify digital ecosystem partners and targets, they are also increasingly turning to additional innovative vehicles.

They also understand the need for new forms of due diligence and integration KPIs but have not yet acquired the full toolkit.

Aspirers

The majority of companies (57%) are finding key aspects of digital M&A challenging. They are struggling to build effective ecosystems, adapt due diligence to digital dealmaking and integrate their investments without destroying value in acquisitions.

They may be beginning to accept that digital M&A is different from traditional M&A but have not yet modernized their approaches.

One of the risks they face is overpaying for digital assets, making a bet on future growth but facing significant uncertainty about whether the investment will pay off.

Related Article

Chapter 3

Seven questions for CEOs and boards

Digital Deal Economy Study

To build a better digital future in the transformational age, here are some questions CEOs and boards can ask themselves:

Buy versus build: future proofing the business

Do you identify gaps in digital capabilities as an explicit part of your strategic planning?

Digital capital strategy: establishing a capital strategy to invest in digital

Are you explicitly considering digital priorities in your capital allocation planning for the next two years?

Strategic portfolio review: deciding when to divest to invest in digital

Do you have a clear long-term divestment strategy as part of your transition to a digital model?

Origination: building a digital ecosystem

Are you making significant and sustained investments in building a digital ecosystem?

Digital valuation: valuing a digital business

Are your valuation approaches for acquiring digital assets up-to- date and effective?

Digital diligence: protecting acquisitions from digital disruption

Do you carry out cybersecurity and technology due diligence?

Strategic operating model: maximizing return through smarter integration

Are you integrating acquired digital assets to fully benefit from all value creation, including managing change in the parent company to embrace all opportunities?

Summary

In the hunt for digital growth, four priority areas can help organizations through their M&A journey.