The ability to create a 5G road map informed by the broader context of digital transformation is not just a nice-to-have — it’s mission critical.

EY teams believe there are three important steps 5G providers should take to help their business customers make the most of a 5G-IoT world.

1. Prioritize the reimagining of industries

Educate and inspire enterprises to think big in 5G:

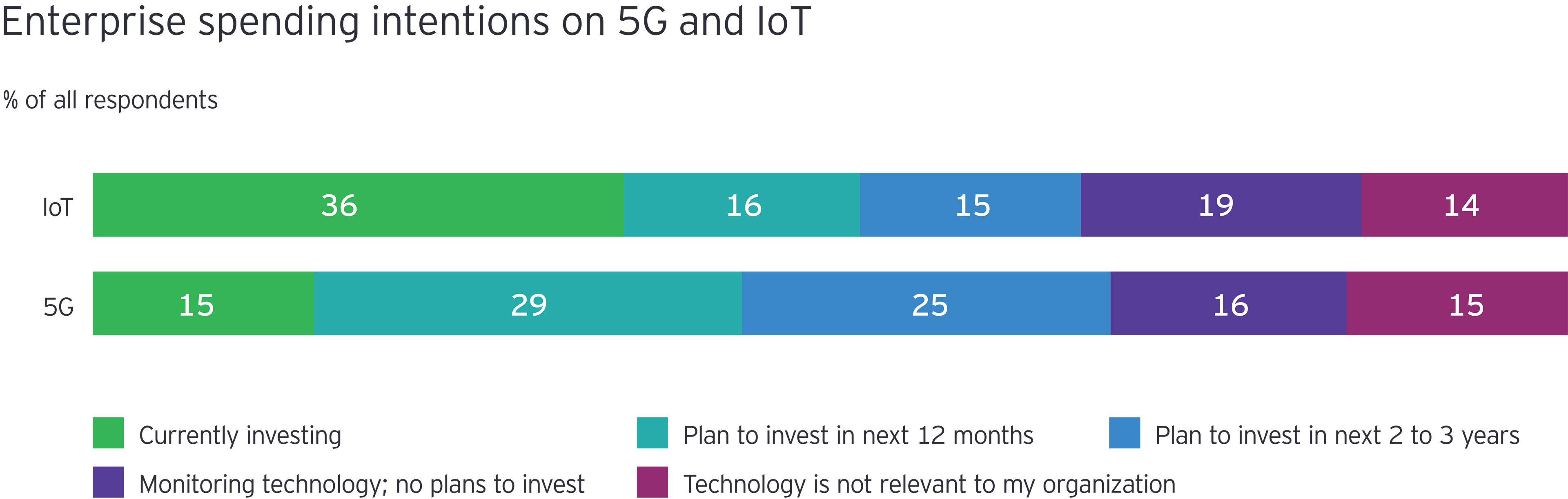

The investment outlook in both 5G and IoT is fundamentally positive, and enterprises already have a range of 5G use cases in mind. However, overarching IoT drivers remain efficiency-driven while organizations are grappling with both 5G’s impact on their services portfolio and wider corporate strategy.

In this light, service providers should articulate a more compelling vision of what 5G can offer organizations, one that is sensitized to vertical needs. Educating enterprise customers on the business value of 5G, and how this can translate into game-changing use cases, will be essential.

2. Adapt 5G to the enterprise transformation agenda

Ensure that your 5G offerings are linked to wider emerging technology needs:

Anxieties around technology integration and maturity stand out as 5G challenges for enterprises. As a result, 5G providers should help their customers formulate the right linkages between 5G and IoT access technologies, and between these and related developments in edge computing and artificial intelligence (AI).

Only this kind of holistic perspective can help organizations surmount the pain points they feel amid a backdrop of ongoing budget pressure. The ability to create a 5G road map informed by the broader context of digital transformation is not just a nice-to-have — it’s mission critical.

3. Reinvent yourself as a partner, not just a provider

Deliver end-to-end solutions through more meaningful 5G ecosystems:

Perceptions of service providers are undergoing a pervasive shift. The era of technology push and transactional interactions is disappearing, and enterprises want consultative dialogue that delivers business outcomes through end-to-end solutions. No single type of supplier is trusted to provide all the proficiencies businesses need in a 5G world: telcos lead as IoT experts but rank lower as authorities on digital transformation.

5G providers should prioritize access to an ecosystem of competencies that can deliver 5G-IoT at scale over the next decade. Delivering actionable solutions that embrace the full spectrum of enterprise needs — from creating use cases and building business cases to addressing cybersecurity and data compliance — will be critical in the long term.

Detailed survey findings follow.

Chapter 1

Prioritize the reimagining of industries

Educate and inspire enterprises to think big in 5G.

5G: the critical catalyst for the next wave of IoT

5G has the potential to reinvent industries across all geographies. While previous generations of mobile technology relied on consumer adoption to fully blossom, 5G can deliver a step change in growth and efficiency for businesses. By entering the very fabric of business processes, 5G can supercharge IoT to deliver the next wave of industrial transformation.

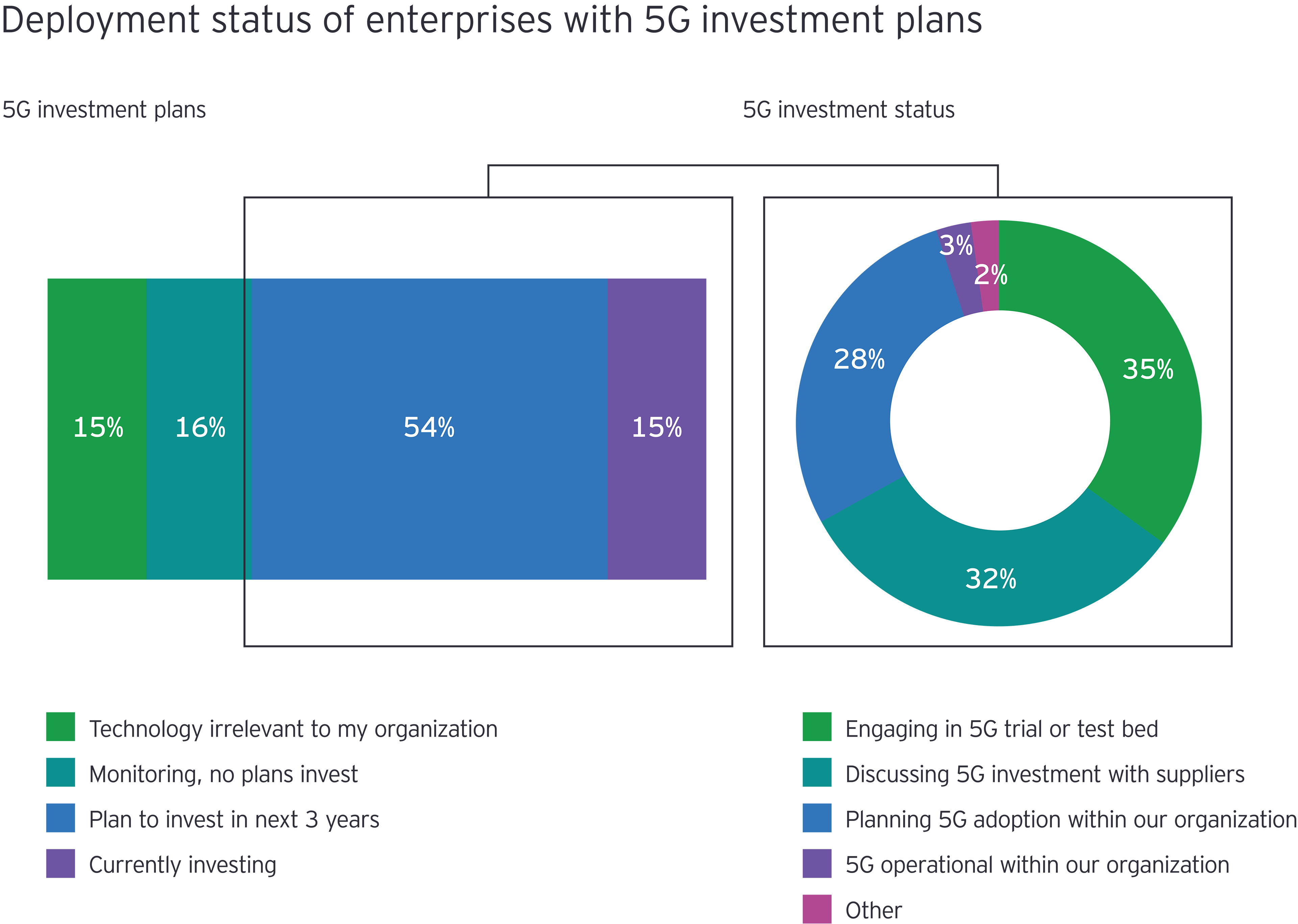

5G is only just now appearing in many markets, but adoption levels will grow substantially in years to come. Currently, 15% of enterprises are investing in 5G, with an additional 54% planning to invest in the next one to three years. By the end of 2022, levels of 5G investment will be on par with IoT.

Yet despite positive investment intentions, most enterprises remain at the very beginning of their 5G journeys. Only 3% of companies with current or future investment plans currently have 5G operational within their organizations; 67% are engaging in 5G trials or discussing 5G investment with their suppliers; and a further 28% are planning 5G deployment within their organizations.

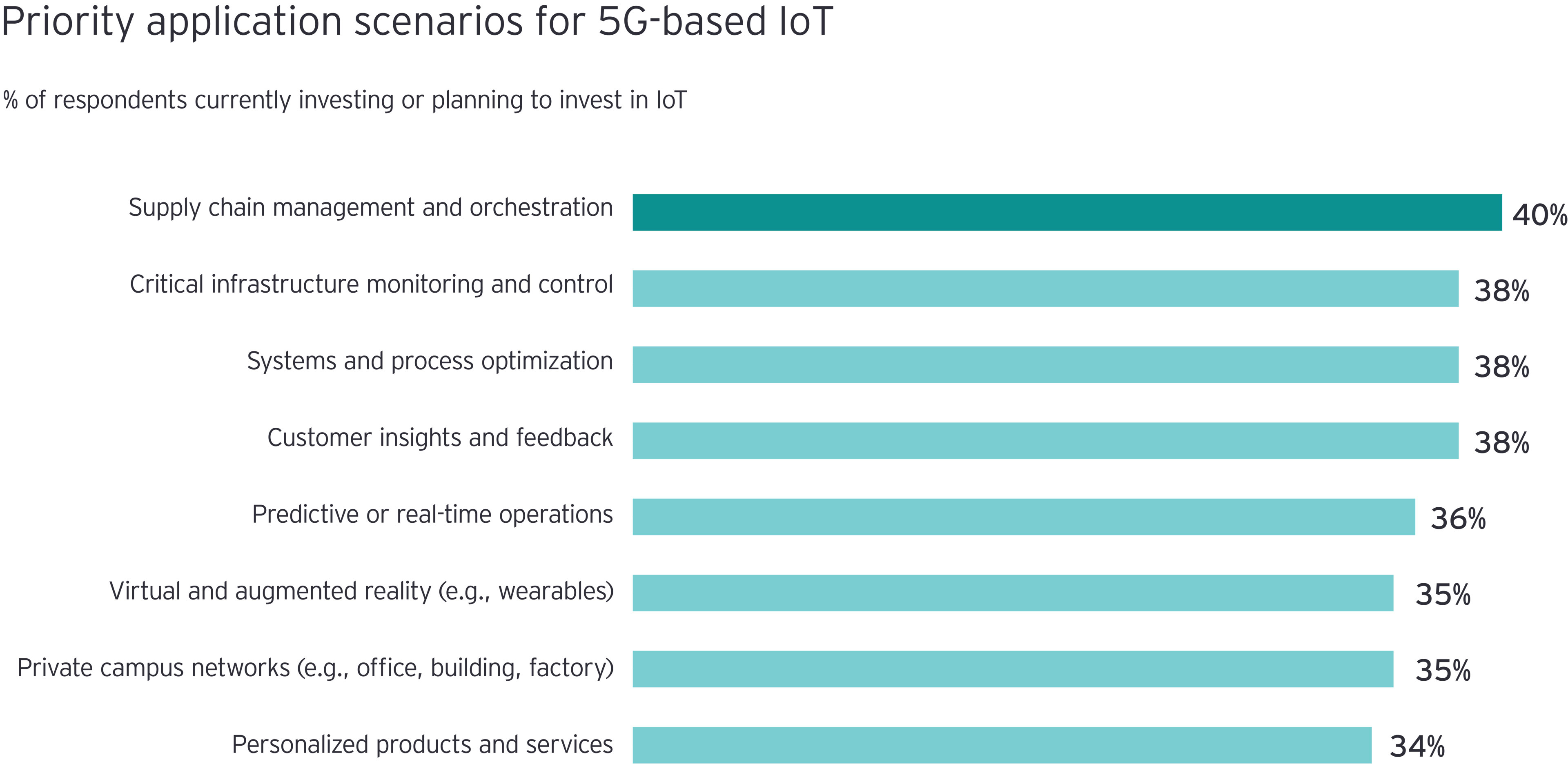

Organizations have a range of 5G-IoT applications in their sights

Enterprises are already conscious of the role 5G can play in unlocking new IoT propositions, and those currently investing or planning to invest in IoT cite a range of use cases. Supply chain management and orchestration lead the way, while personalized products and services rank further down, alongside more nascent concepts such as private networks and virtual or augmented reality applications.

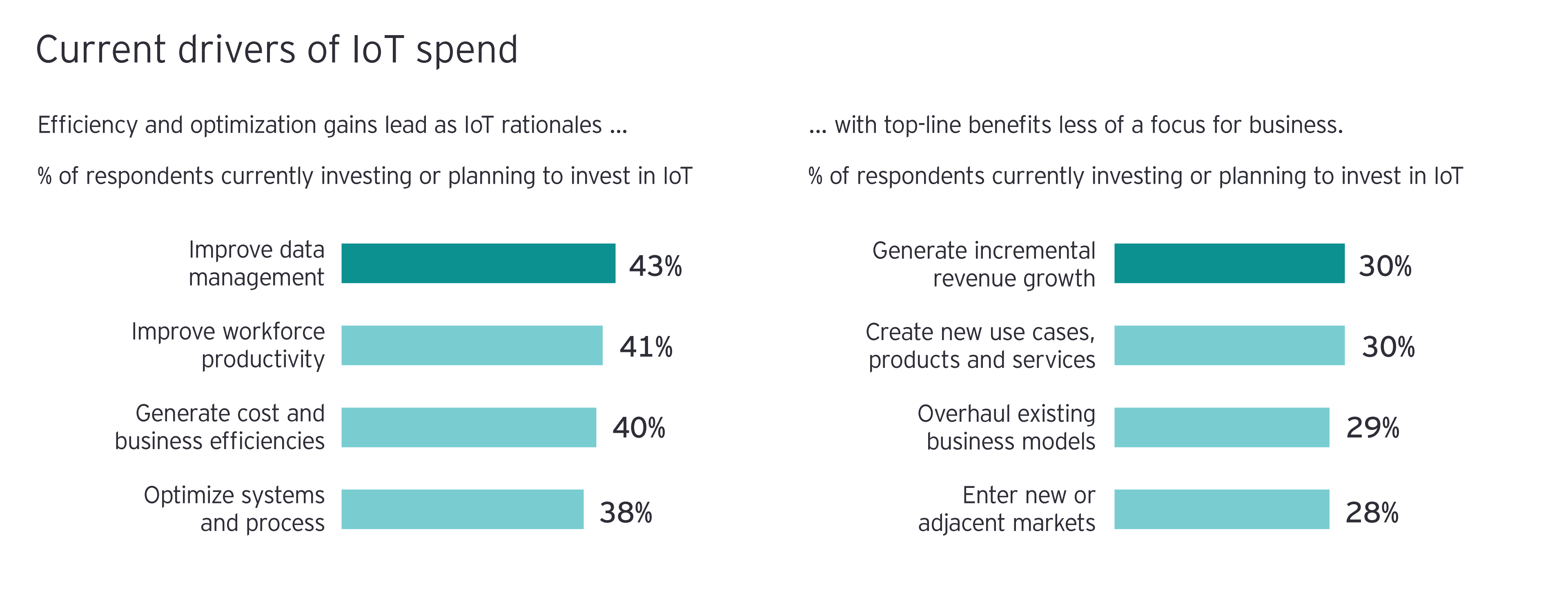

Limited ambition levels? Leading IoT rationales focus on efficiency gains

While enterprises are taking a broad view of the upside 5G can provide in terms of applications, overall drivers of IoT spend remain largely efficiency-driven. Improved data management, higher workforce productivity and cost control lead as IoT rationales, while objectives that enhance the top line — such as creating new services and overhauling business models — rank further down. 5G offers more scope for growth-oriented goals, yet current IoT drivers have yet to reflect this.

Chapter 2

Adapt 5G to the enterprise transformation agenda

Ensure that your 5G offerings are linked to wider emerging technology needs.

5G pain points: technology integration and maturity alongside limited budgets and awareness

Enterprises view 5G as an enabler of their evolving IoT agendas and have various application scenarios in mind. But challenges are mounting that complicate a positive prognosis. Whether strategic, financial or operational, organizations voice a range of pain points that may derail their emerging 5G-IoT ambitions.

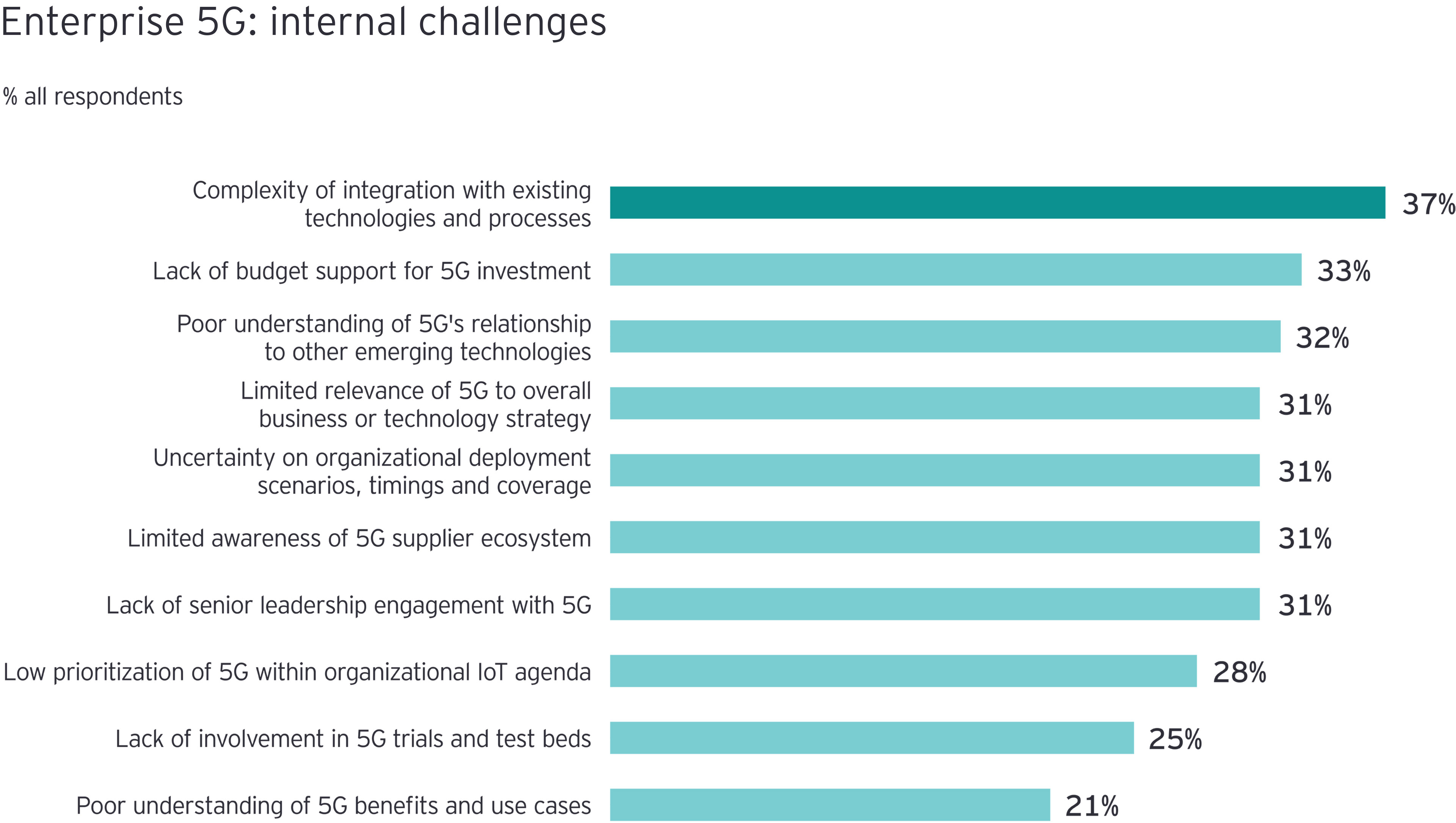

The perceived complexity of technology integration, budget pressure, low levels of organizational understanding and concerns regarding strategic relevance are all prominent as internal challenges — those that organizations can control.

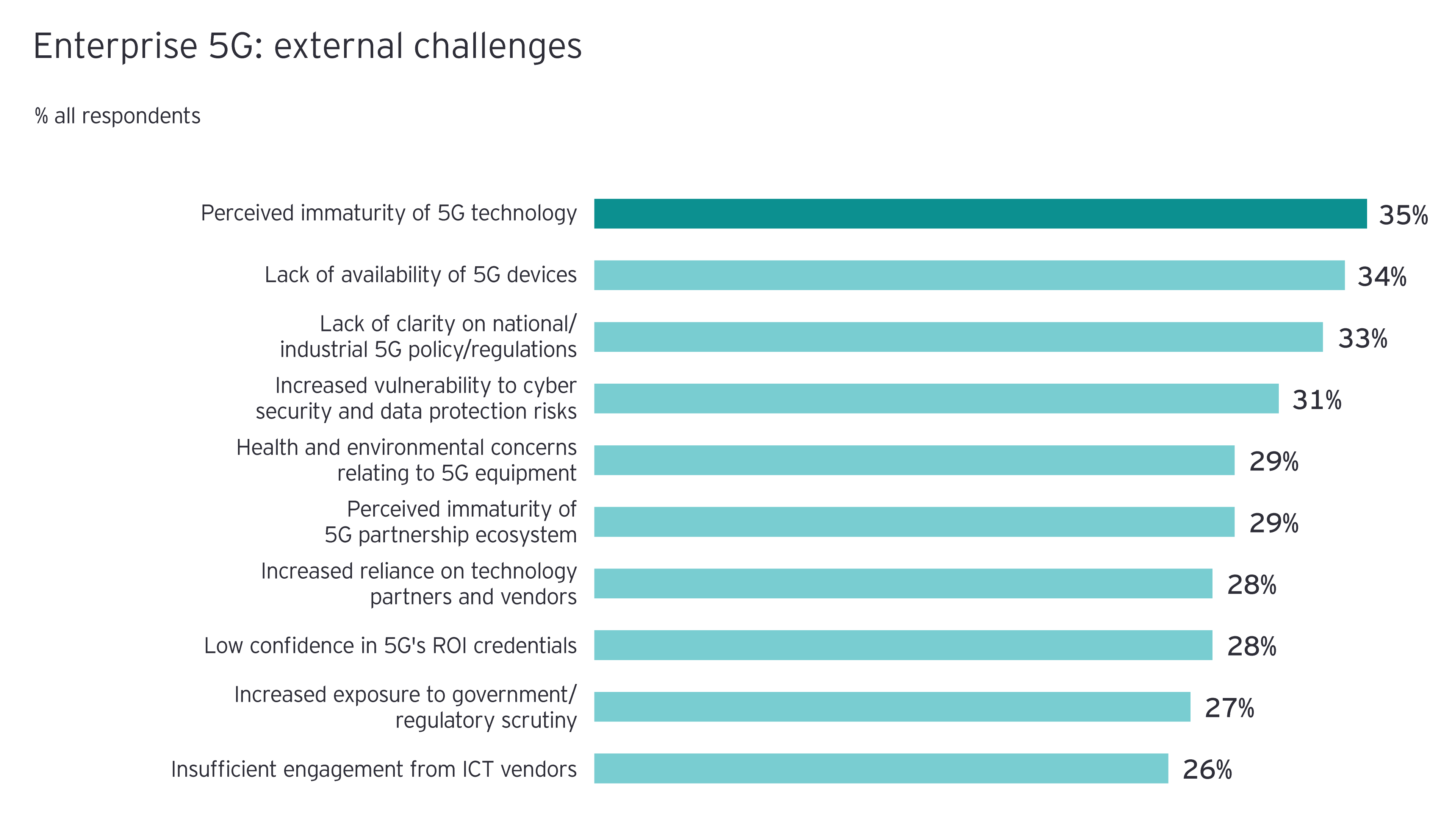

Leading external challenges present within the wider ecosystem include the perceived immaturity of 5G technology, allied to anxieties around regulation, cybersecurity and the emerging partnering and collaboration ecosystem.

Enterprises are seeking a symbiotic relationship between 5G, IoT and other emerging technologies

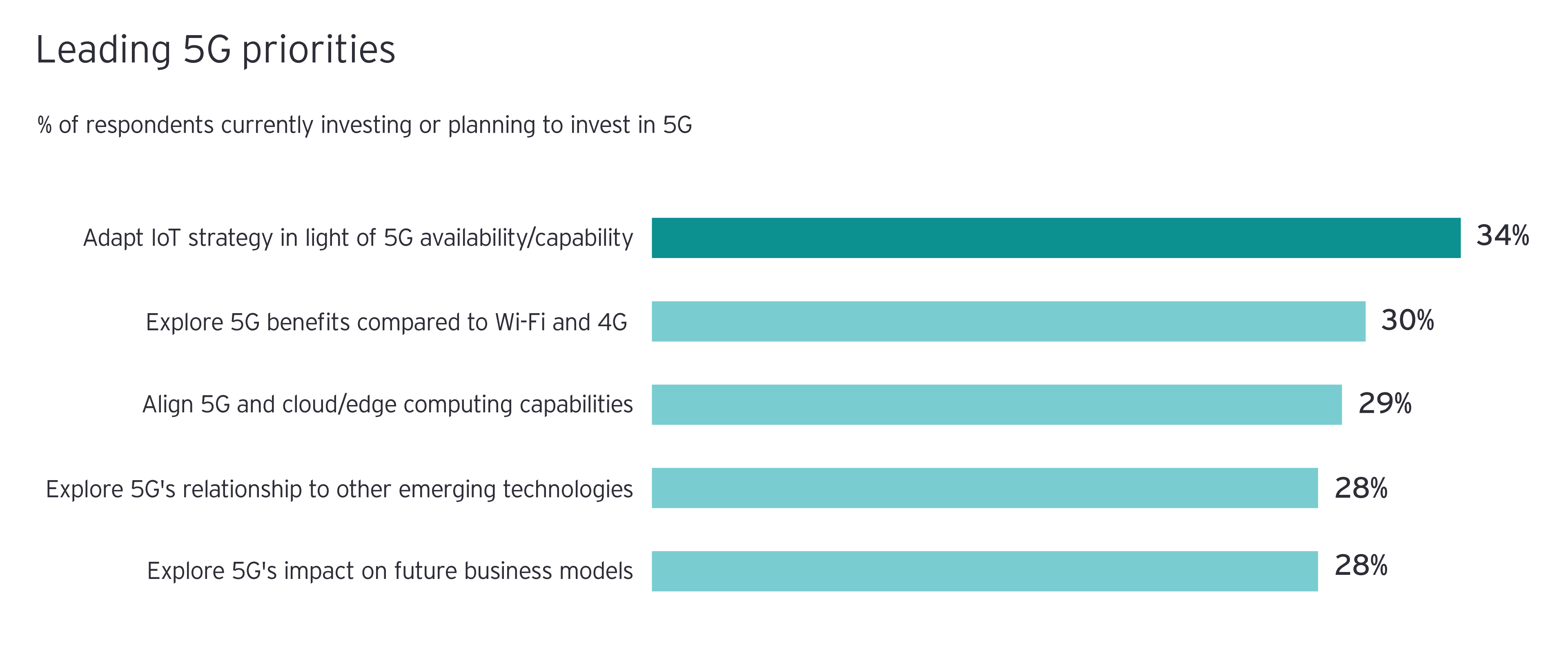

With these challenges in mind, enterprises are already formulating a set of 5G priorities that can help them turn a nascent technology into the lifeblood of long-term transformation. Adapting their existing IoT plans to cater for 5G leads as a priority going forward, while exploring 5G’s relationship to other emerging technologies is also a front-running consideration, reflecting the integration and alignment challenges voiced by enterprises.

Assessing how 5G can inform future business models also emerges as a top-five priority. This is instructive since efficiency gains lead as current drivers of IoT investment, with business model overhaul muted by comparison. 5G has the potential to put top-line growth at the heart of the IoT agenda, and organizations are starting to recognize this.

5G: the engine of far-reaching enterprise transformation

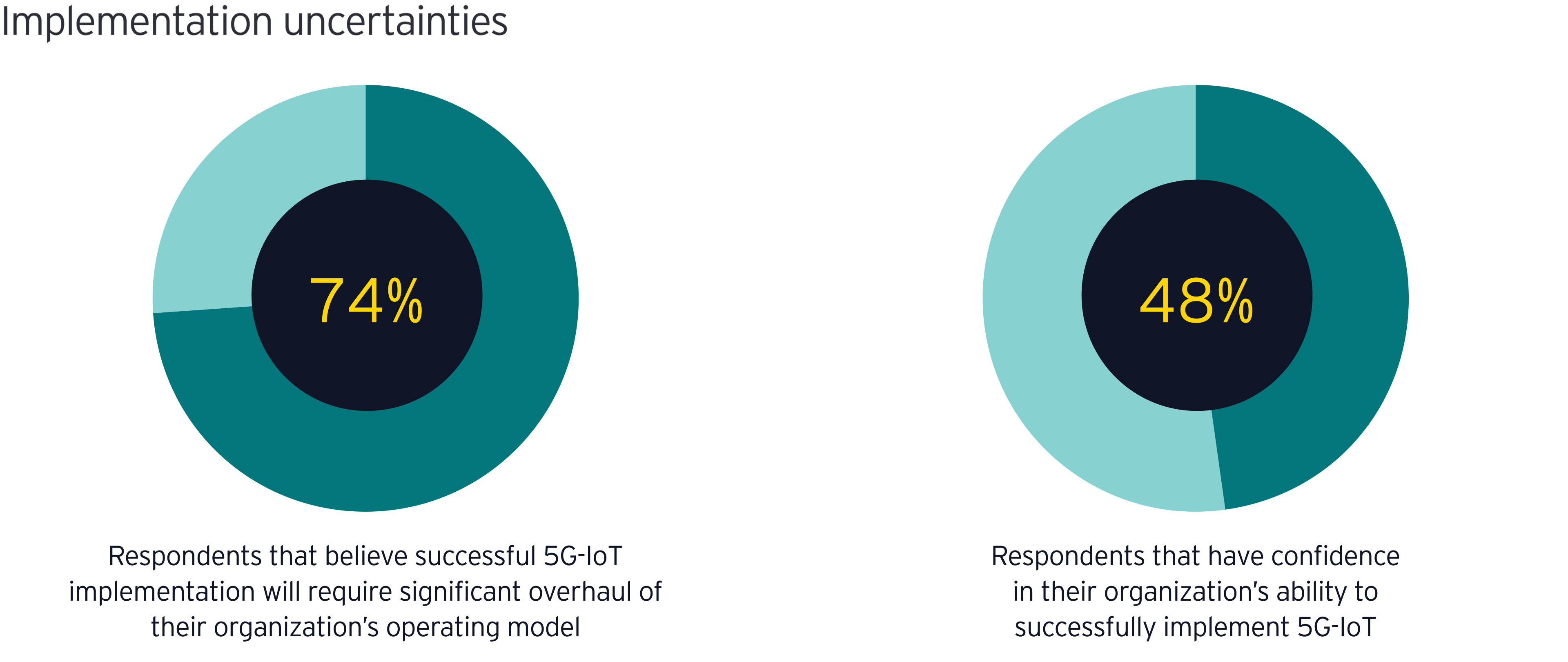

Enterprises are aware that 5G can fundamentally reshape their organizations. Alongside their interest in exploring 5G’s impact on new business models, organizations foresee the need to overhaul their operating models in a 5G world. Yet this is another potential source of anxiety — while three-quarters of enterprises agree this is a prerequisite for successful implementation, less than half are confident that their organizations can successfully transition to 5G-based IoT.

Chapter 3

Reinvent yourself as a partner, not just a provider

Deliver end-to-end solutions through more meaningful 5G ecosystems.

The view of the vendor is changing as end-to-end solutions come to the fore

As enterprises refine their strategies to cater for a world of 5G-enabled IoT, their supplier needs are also changing, with desired attributes sought in vendors set to evolve in years to come. While competitive pricing and understanding of broader business or industry needs will endure, other attributes are gaining ground. Notably, the ability to provide end-to-end solutions will rise relative to others, ranking second in the future.

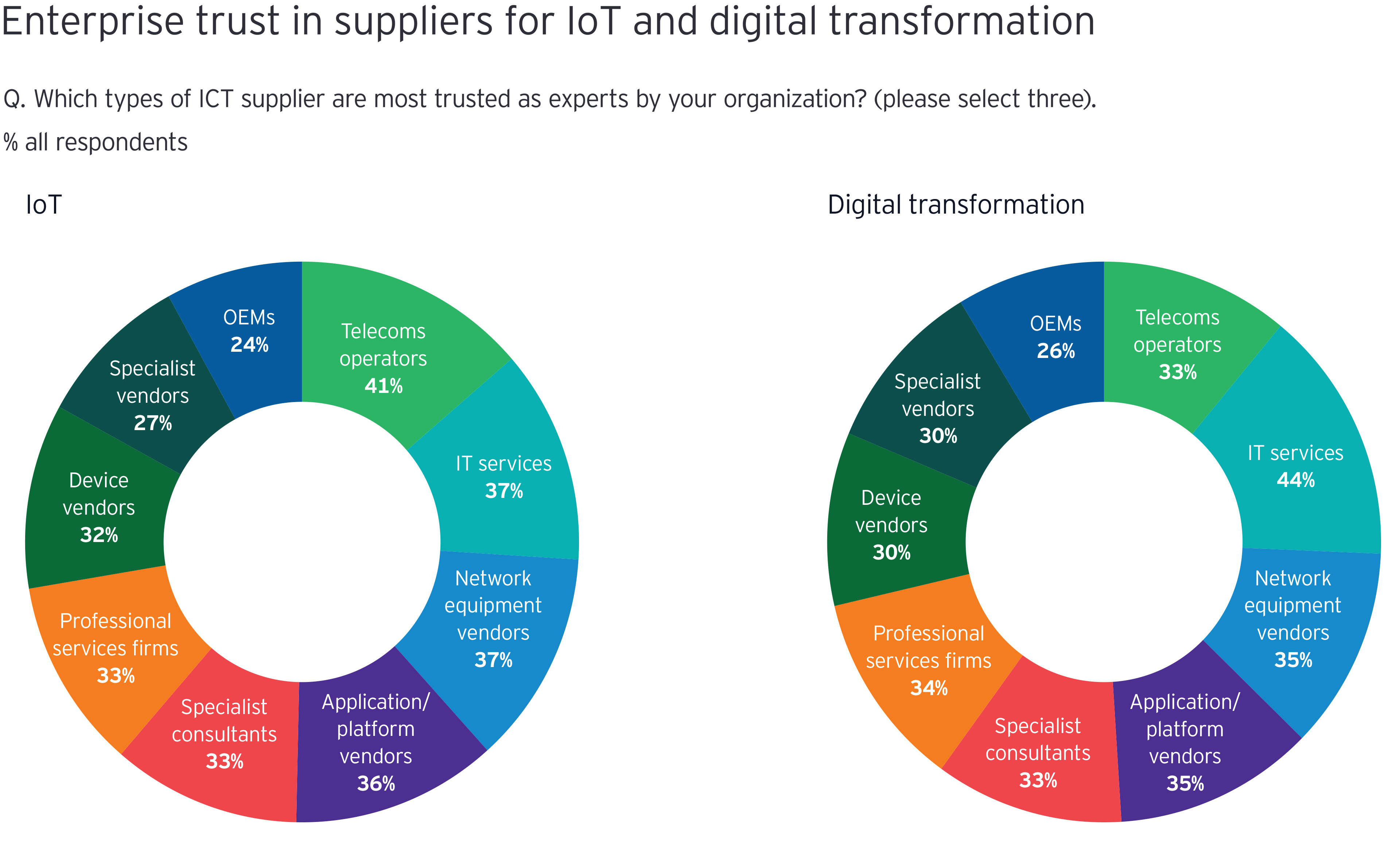

Enterprise mind share is split between different suppliers

Despite the rising importance of end-to-end solutions, no single type of vendor dominates as a trusted provider across the different activities demanded by enterprises. Telcos rank ahead of other suppliers as trusted experts in IoT. However, IT services providers lead the way as digital transformation experts, with telcos ranking behind both these companies as well as equipment and application vendors.

Given enterprises’ need for a holistic and integrated approach to 5G, IoT and other emerging technologies — and their growing desire for end-to-end solutions — these findings strongly underline the need for suppliers to collaborate and forge partnerships across the vendor ecosystem.

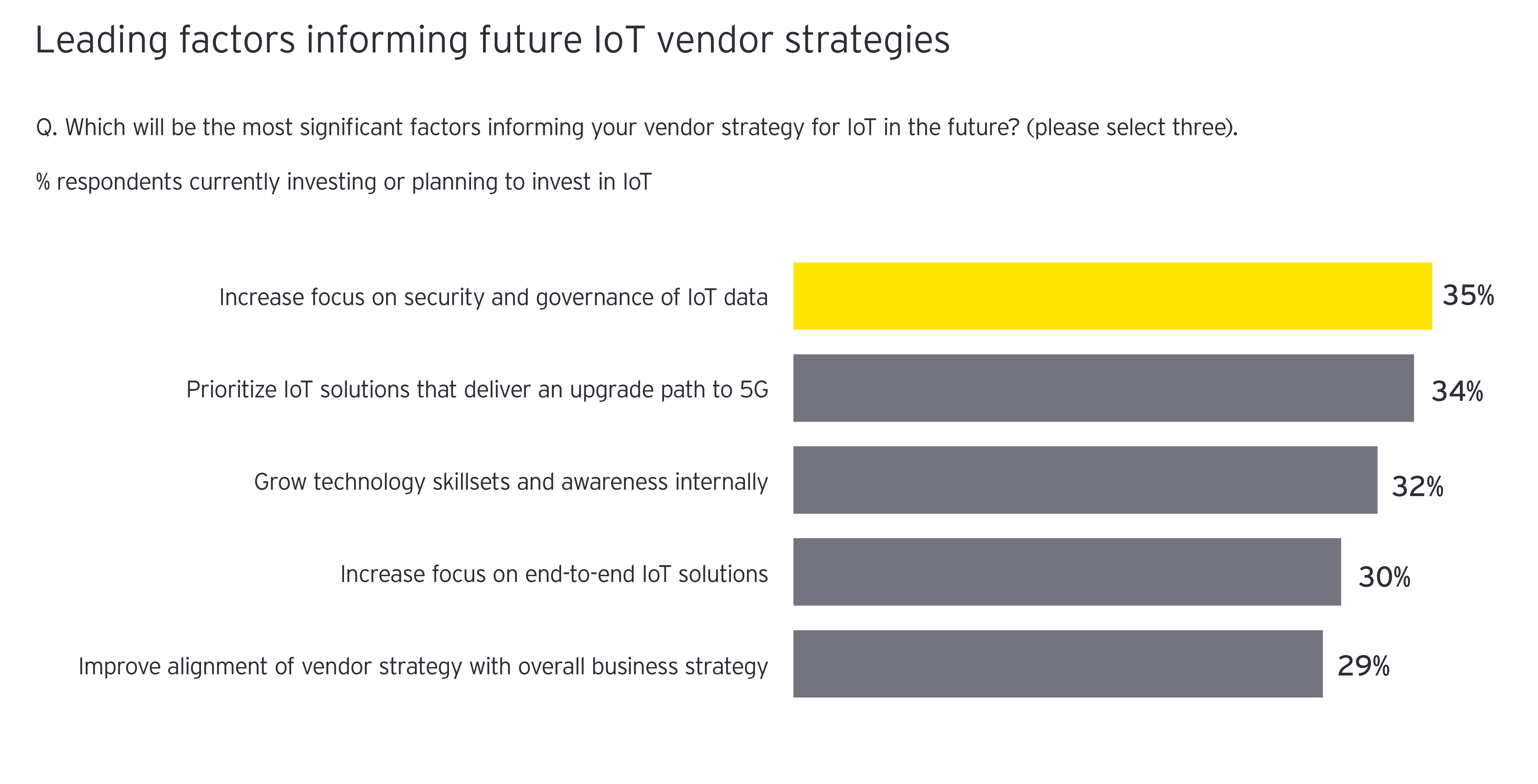

5G is much more than a new type of IoT connectivity solution. Looking ahead, organizations require vendors that can deliver guidance around data management as much as technology upgrade paths from legacy IoT infrastructure to 5G-based IoT. In fact, both these considerations will drive enterprise IoT vendor strategies going forward. As enterprises also close the gap between vendor strategy and overall business strategy, suppliers that understand overarching transformation imperatives will benefit.

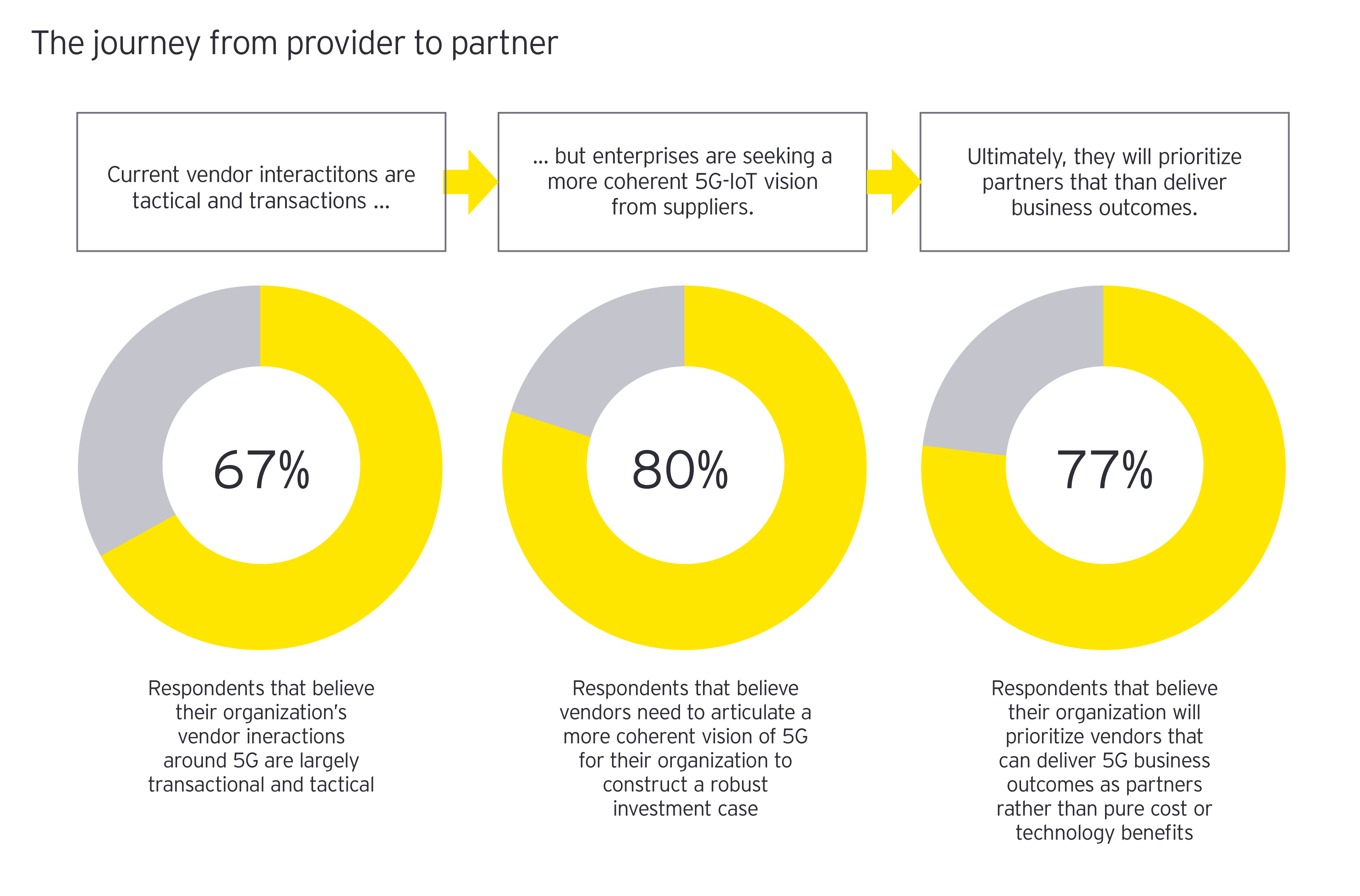

The enterprise ask: trusted partnerships that deliver business outcomes

Enterprise responses to the agreement statements in the EY survey underline the fundamental challenge facing 5G-IoT providers. Organizations are struggling to identify the right type of 5G providers. Two-thirds think their interactions with suppliers regarding 5G are too tactical and transactional, and 77% will prioritize vendors that can deliver business outcomes as partners.

Moving beyond the era of technology push is vital — the EY agreement statements also highlight that more than 7 in 10 organizations will prioritize vendors that have deep industry, financial, legal and risk management experience. The onus on 5G-IoT providers to create a more purposeful and productive dialogue with their enterprise customers — one that is backed by specific skills in specific domains — is clear.

Summary

This EY survey of 1,000 organizations explores changing enterprise needs and attitudes as organizations evaluate the 5G opportunity. There are promising indicators of the critical role 5G will play in the next wave of IoT, but optimism is accompanied by anxiety. Organizations are looking for much more from their suppliers as 5G comes of age. Simply put, the old world of customer engagement is not fit for purpose — 5G providers must fundamentally adapt if they are to thrive.