Chapter 1

Climate change rising on the management agenda for FIs

Existing capabilities can be a springboard to analyze the impact of climate change scenarios.

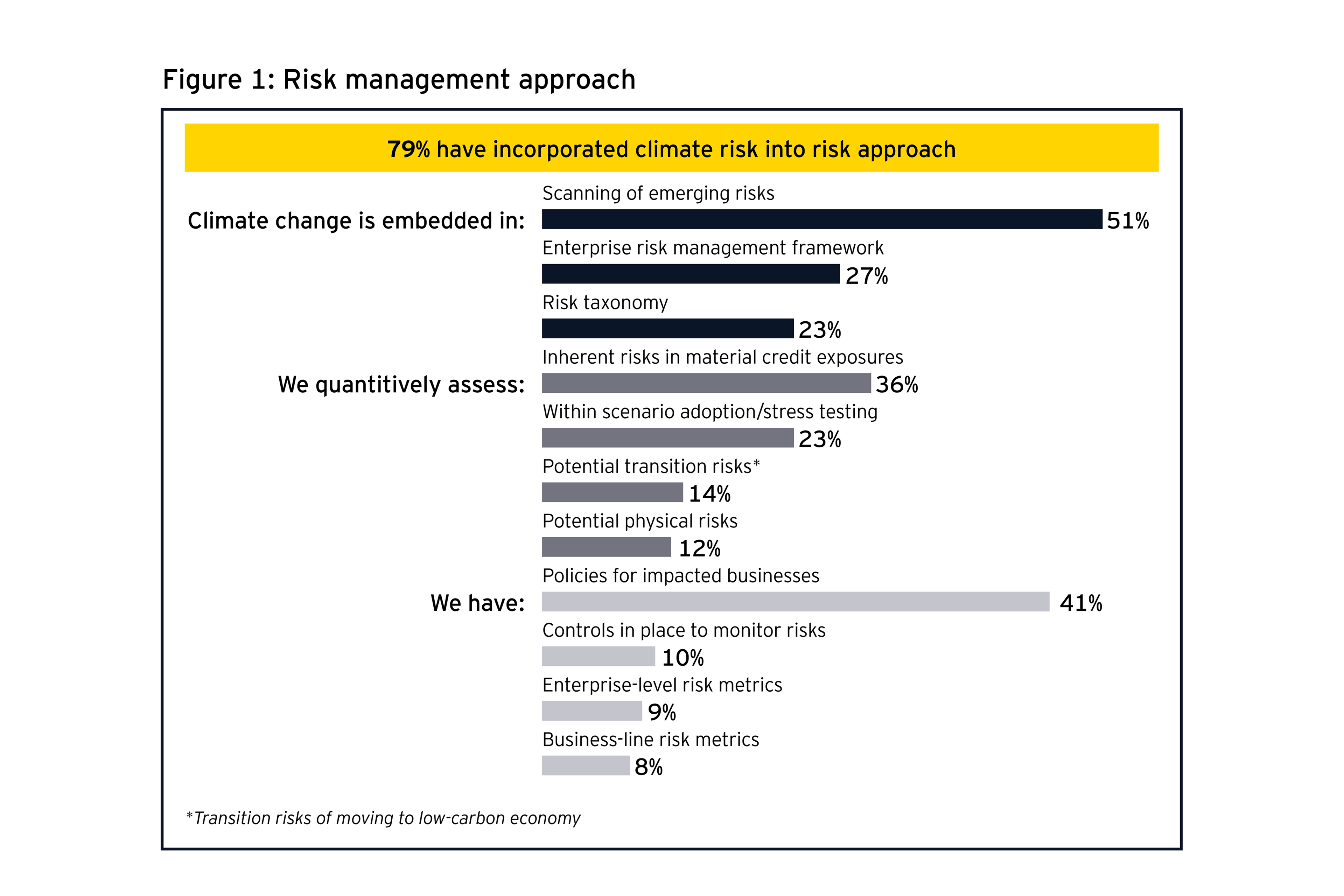

Over half (52%) of banks who participated in the tenth annual EY/IIF global bank risk management survey cited environmental and climate change as key emerging risks over the next five years, up from just over a third (37%) a year ago. Four in five (79%) banks have already incorporated climate change, in some way, into their risk management approach.

To leverage their capabilities in the context of climate change, financial institutions must take a view on assumptions, such as the scale and pace of environmental change and the future cost of carbon, water and electricity. Typically, this means looking out over 10 to 50 years and looking at the interplay between macroeconomic and environmental factors. As our survey shows, 43% identify material risks on an ongoing basis.

Chapter 2

Critical steps that firms should take to address climate change

The industry does not have a decade to make substantive changes to its strategies and operations.

1. Establish board and senior management governance and oversight

A strong governance structure is needed to drive climate-change risk management strategy.

Governance starts with the board of directors determining how it will oversee strategy and executive leadership deciding how the strategy will be managed – cross-functionally, across many parts of the firm.

The focus on climate-change risk management is quickly changing the role and stature of those overseeing sustainability – chief sustainability officers (CSO), sustainable finance directors, and environment, social and governance (ESG) directors are being created or having their role materially broadened and elevated. This new breed of CSO is being charged with driving climate-change risk into the fabric of a firm’s strategy and operations, working closely with business lines to capitalize on climate-related opportunities.

2. Develop a firm-wide, CEO-led climate-change-related strategy

Clear purpose and vision will empower collaboration and unlock new opportunities.

A firm-wide strategy is paramount. It has to be cohesive, consistent, and driven from the top, with a clear purpose and vision through which the CEO and senior management define objectives and mandates. A clear, CEO-led strategy should empower collaboration in addressing climate change, to avoid management-by-silos and barriers to uniting the organization. It must include business heads to the various risk management functions in order to unify the firm’s climate-change objectives and approach to implementation.

3. Agree and adopt a common language

Terminology can be challenging, so terms relating to sustainability or environmental projects should not undermine the language for climate-change risk.

Two basic concepts emerge:

- Physical risk arises from the direct effect of weather events and longer-term climate shifts, such as floods, wildfires and droughts. Financial instititutions feel the impact on their operations, branch offices, third parties and financing.

- Transition risk arises from the effects of shifting toward a low-carbon economy. The impact is more indirect in that it relates to how the bank’s customers migrate to this new environment.

A common vernacular will enable a more precise analytical approach to identifying climate-related risks and opportunities.

4. Embed climate-change risk management across the three-lines-of-defense

Banks are most effective when they address material risks across the firm and clearly define the roles of the three-lines-of-defense in managing those risks.

A three-lines-of-defense model to climate change exhibits key features:

- First-line business ownership, managing the firm’s operations and relations with third parties, and owning customers, clients, corporate communications and investor relations.

- Second-line risk management, where the chief risk officer is tasked with embedding climate change risk into core capabilities and the enterprise risk management framework.

- Third-line oversight, which expands the previous limited role of the internal audit function to assess the impact of climate change on risk governance.

5. Treat climate change as a business opportunity to support customers, clients and communities

Climate change offers financial institutions numerous business opportunities and is expected conservatively to generate US$2.1t worth of opportunity

Financial institutions have developed and continue to innovate an array of new products and services, such as auto loans, home mortgages, and credit cards, as well new types of insurance or investment choices. In October 2019, issuance of sustainable debt surpassed US$1t with 77% represented by green bond issuance and 10% represented by issuance of sustainability-linked loans. This is to be applauded, and shows financial institutions are responding positively to changing customer and client demands.

6. Embed climate-change risk deep into enterprise risk management

Chief risk officers will need to develop an independent view on how the firm is managing the climate-change risk and provide counsel to the board and senior management on how well the firm is adapting.

Risk identification, risk taxonomies, risk reporting and risk mitigation are essential ingredients that must be built into the firm’s risk management framework.

7. Conduct climate-change scenario analysis to inform decision-making

It would be incredible if financial institutions could accurately predict physical and transition risks across customers, clients and regions over a five-to-20-year period.

While that may not be plausible to be so accurate, firms are beginning to use scenario analysis to understand and quantify climate risks. Most are in the process of building capabilities to conduct robust scenario analysis to stress test their balance sheets. As seen from the tenth annual EY/IIF global bank risk management survey, 43% of North American banks conduct climate change risk-related scenario analysis and stress testing. To leverage these capabilities in the context of climate change, financial institutions must develop a view on the scenario to be tested, drawing on those that have been promulgated by various public or private sector groups, or developing their own.

8. Incorporate climate-change analysis into underwriting

Ultimately, climate change analysis must influence underwriting for financial institutions to really know their customer and gain an improved understanding of a firm’s carbon footprint.

It will take time for firms to refine their underwriting practices to integrate climate change. The science behind climate change is changing every day, making analysis over extended periods challenging. The available data – whether from customers and clients, or from third-party data providers – is also nascent and difficult to compare.

However, it is important that financial institutions start the process of factoring climate-risk considerations into the credit or insurance underwriting process to prepare for increasingly challenging questions from credit-rating agencies on how firms are building climate change into the underwriting and credit process.

9. Enhance the firm’s resilience to physical risks

Weather is directly testing whether firms can continuously deliver services to customers and clients when they or their providers experience weather events.

Within a broader rethink of how firms strengthen operational – or enterprise – resilience, firms are taking a number of steps to be prepared. Their efforts range from consolidating crisis-management and incident-response frameworks and enhancing communication protocols to assessing and testing resilience in house and with third parties, especially those supporting critical business services.

10. Deliver a consistent, credible firm-wide climate-risk story to stakeholders

Financial institutions, like firms in other sectors, are now issuing an abundance of information related to the environment and climate change.

However firms disclose commitments or commentare on their climate-change risk management strategies, it is important that disclosures are consistent, credible and validated by a credible sources across the firm. In the end, each financial institution has to communicate a narrative to internal and external stakeholders that shows their commitment and governance on how they are managing through the effects of climate change on their firm, customers and clients, and the communities within which they operate.

Chapter 3

Why act now rather than push back the timeframe?

The climate is changing rapidly – broadly affecting customers, clients and their supply chains.

The increasing short and long- term effects of climate change represent a major risk and opportunity for financial institutions.

The number and severity of extreme and not-so-extreme events can be felt by everyone across the globe. At a minimum, they affect how firms conduct their business-continuity and crisis-management planning and testing. As financial needs change, those firms that more quickly to address those needs will gain market share and be viewed as partners in supporting the sustainable revolution that is unfolding across the globe. These firms will be better placed to build climate-related analysis in core risk management disciplines and portfolio and pricing decisions, and thus align risk and return appropriately. They can also identify and pursue the commercial opportunities presented in supporting their clients and communities transitioning to a low-carbon economy and in managing the increasingly frequent and intense effects of climate change.

Summary

Some industry leaders are moving quickly to build climate-change into the fabric of their organization.Those firms are giving themselves 12 to 24 months to make substantive changes in their strategies and operations. They understand that the industry cannot afford to wait a decade or more to adopt. The question is, how quickly and ably will your firm adapt?