Luxembourg market developments H1 2021

- Development of securitized assets (stock)

The stock in securitized assets increased in the year 2020 from EUR 302.0 billion to EUR 338.6 billion or plus 12%. H1 2021 shows a further increase to EUR 346.1 billion representing a slight increase of 2.2%. To that end, the market growth is relatively aligned with the growth in number of existing vehicles.

- Development of securitization vehicles

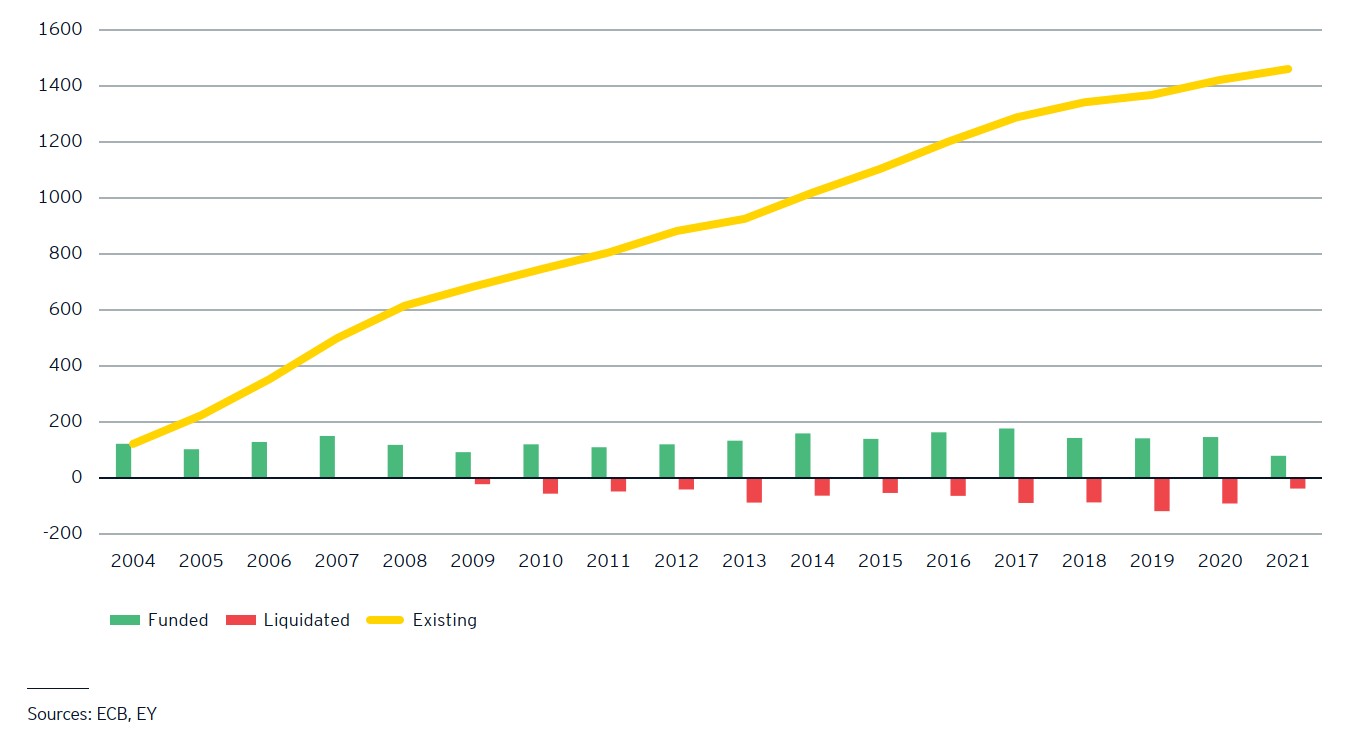

H1 2021 shows the number of foundations at 78 (H1 2020 = 71) new vehicles; a growth rate of almost 10%. Contrary, the number of liquidated vehicles reduced in H1 2021 to 39 (48 for H1 2020); a reduction rate of almost 19%. While the foundations increased and the liquidations decreased, there is a net increase of 39 vehicles or a growth of almost 3% compared to the existing vehicles at year end 2020.

Out of the 78 newly funded vehicles in H1 2021 there are 67 funded as securitization company and 11 as securitization fund. Hence, the number of newly funded securitization funds exceeds already the number of securitization funds newly created in the full year 2020, which is inter alia due to the fact that the securitization fund is not subject to ATAD I interest limitation rules. Nevertheless, the newly funded securitization vehicles are clearly dominated by the well-known securitization company, despite being subject to interest limitation rules. Out of those 67 securitization companies: 48 were created as a private limited liability company (societé à responsabilité limitée or S.à r.l.) and only 19 were created as public limited liability company (societé anonyme or S.A.). Other available legal forms were not utilized during H1 2021 and the trend to create mainly S.à r.l.’s continues since 2017.

- Development of compartments in Luxemburg

One of the key features of the Securitization Law, which remains unchanged by the draft law (Luxembourg bill 7825) amending the Luxembourg Securitization Law, is the compartmentalization feature representing the option to create fully separate and ring-fenced compartments within one securitization vehicle. In the absence of statistical data on compartments, an indication on the number of compartments in Luxembourg can derive from the ECB statistics on financial vehicle corporations, of course and without doubt with limitations. The number of reported transactions decreased from 7,981 in Q4 2020 to 6,477 in Q2 2021; a reduction rate of 19%1.