While the current focus on most investment and publications has been on how digital agriculture will change farming, little has been written on how this same data will impact the various agribusiness stakeholders.

Digital agriculture and big data will help feed a growing world

According to a report published by the Food and Agriculture Organization of the United Nations, titled “How to feed the world in 2050,” the global population is expected to increase to 9.6 billion people by 2050. To feed this drastically increasing population, the agriculture industry will need to produce 70% more food while using only 5% more land. This, coupled with growing environmental and regulatory pressures, poses a daunting challenge for the industry. Current production rates and distribution methods will not be nearly enough to feed the population. It is generally acknowledged that digital agriculture and big data will be needed to meet these demands.

Data collection is evolving from handwritten notes and manual field analysis to automatic data capture via equipment, software, remote sensors and aerial drones.

Digital agriculture will change farming

The impact of digital agriculture on the field is well-documented and researched. From variable rate application to real-time NDVI visualization (i.e., the index for visualizing vegetation health), farming will forever be changed. In the future, data creation, analysis and decision-making will almost certainly increase at the field level. Farming operations will have the opportunity to prosper from targeted field solutions, data-driven agronomic advice and smarter inputs. Software is being developed to help propel developing countries toward modern farming practices. Farms are consolidating at an increasing rate as technology supports automation and economies of scale. Input applications are based on factual data, and investments into farming tech are funded by profits saved by data-driven efficiency.

While the benefits of digital agriculture are compelling, it has been met by significant challenges — for example, difficulty using software, data usage concerns, disparate and propriety data formats and an unclear return on investment. Agribusiness has struggled to provide immediate, tangible results from digital agriculture equipment and software. Challenges around gathering and standardizing data make adoption difficult across all stakeholder groups. Undeveloped countries lag in adoption because of weak network infrastructure and limited capital. The gap between modern, advanced farming and subsistence farming is growing at an alarming rate. These factors raise important questions for the industry. Producers face problems and decisions every day, both on and off the field. These decisions are projected and magnified up and down the entire value chain — from field to fork. What does this mean for the various stakeholders in that value chain?

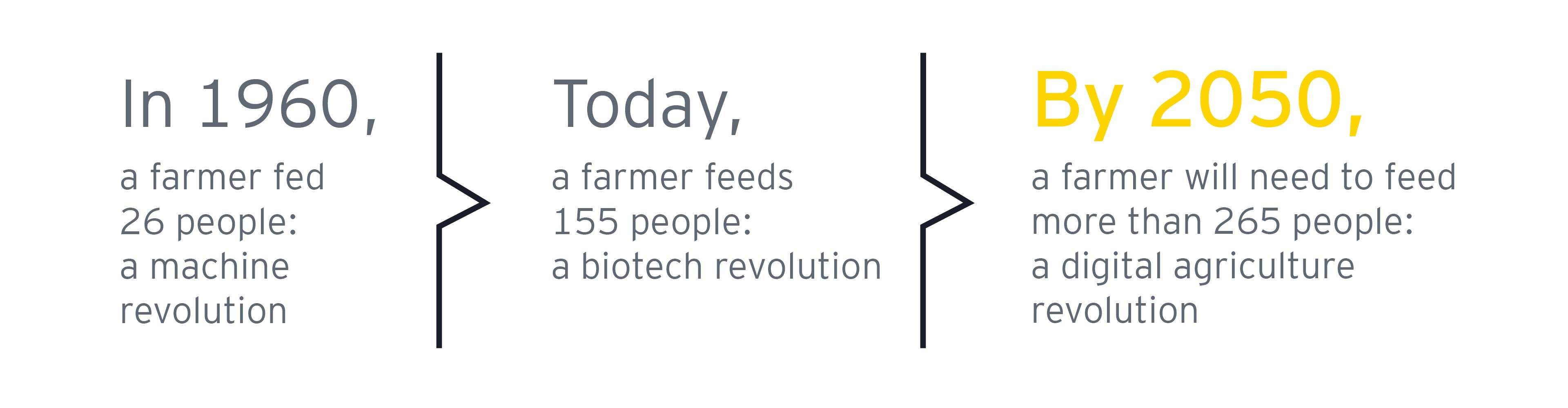

The third agricultural revolution

Digital agriculture is widely recognized as the third great revolution of modern agriculture. The introduction and implementation of mechanization (1900 to 1930) and genetic modification (1990 to 2005) are referred to as Ag 1.0 and Ag 2.0 respectively. Both revolutions drove efficiency, yield and profitability to levels previously unattainable, and are now conventional in developed countries.

While Ag 1.0 and Ag 2.0 drove significant changes in agriculture, we believe Ag 3.0 will be the most transformative and disruptive, not only on the farm but across the entire agriculture and food value chain.

Digital agriculture will fundamentally change agribusiness

While the first two revolutions in agriculture — mechanization and biotech — had a major impact for farmers and select agribusinesses, digital agriculture will fundamentally transform every part of the agribusiness value chain. Seed companies were not drastically changed from the bottom up to accommodate advanced machinery. While significant innovation occurred in equipment design, it was not altered to specifically accommodate genetically modified seeds. However, Ag 3.0 will affect producer buying behavior, and seed and equipment product design, and could enable dynamic pricing at the consumer retail level. These implications will gradually affect multiple business functions across a single company. For example, digital agriculture and big data will change the way seed and agrichemical companies market, price and sell products, select and invest in their R&D pipeline, recommend and technically support product sales, manufacture and distribute products, and manage credit and financial risk. Business strategy, product design, customer preferences and even organizational structure will change as more digital agriculture data is available.

Digital agriculture is creating competition among both traditional and nontraditional competitors.

As technological advancements in equipment and inputs slow, companies will need increasingly to compete on digital strategy. Being able to support digital agriculture becomes ever more important. This revolution will also challenge traditional company roles, intercompany relationships, reward systems and, potentially, entire business models. Digital agriculture is creating competition among both traditional and nontraditional competitors. The industry is in a storming phase, and agribusinesses are working to solidify their place in Ag 3.0. Several companies are investing heavily in internal data activities such as standardization, storage, software and analytics. Others are focusing on outsourcing strategies or licensing software from other companies. Still others are taking a wait-and-see approach. As the industry evolves, disruption will follow. It is essential for agribusinesses to transform their business and themselves to differentiate and provide more value to customers.

How will digital agriculture and big data impact agribusiness?

It is imperative to start thinking about the next step, the next strategy.

Although the challenges are concerning, they present thought-provoking opportunities to all stakeholder groups. How do agribusinesses begin to explore these opportunities, understand the goals of other stakeholders and collectively move the industry forward in Ag 3.0?

As technological advancements in equipment and inputs slow, the need for companies to compete on digital strategy will increase.

Our goal is to provide insights and help the industry ask the right questions to spur conversations that develop strategies for their businesses.

Summary

Digital agriculture will fundamentally change multiple business functions for agribusinesses around the world. Business strategy, product design, customer preferences and even organizational structure will change as more digital agriculture data is available.