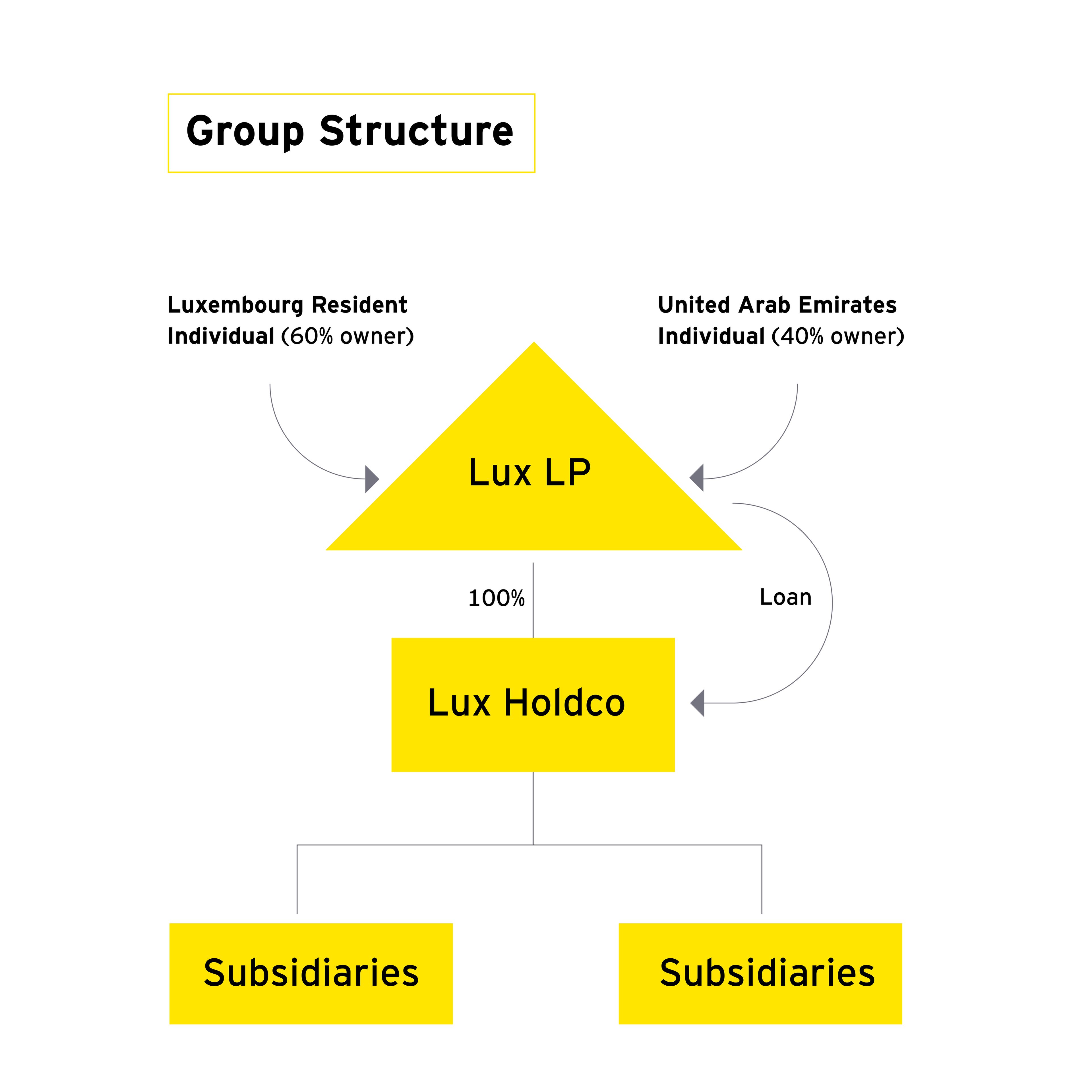

For the Luxembourg individual partner, the income is subject to Luxembourg income tax at a rate of at least 15%, however this would not be the case for the UAE partner. As a result, 40 of the income remains at the level of the Lux LP as GloBE income for Pillar 2 purposes without any associated tax. This would result in a 15% top-up tax on the income of 40 to be levied on the Lux LP.

Absent of any specific language in the Lux LP agreement to that effect, it may well be that the newly enacted top-up tax of 6 (40 x 15%) needs to be split in proportion to the LP ownership. As a result of no tax being paid in the UAE on the interest income, the Luxembourg partner will now have to suffer an additional tax liability on the UAE partner’s behalf of up to 60% of such amount.

What would you do if you were this Luxembourg resident partner? The sensitivities around this brings with it a whole new set of questions. Would you agreeably pay a potentially sizable tax that is caused due to the tax regime applicable to your partner, or would it cause controversy? Are there any possible ways to remediate this situation? These are the situations that numerous high-net-worth individuals may have to face in the future, and may be better handled with eyes wide open.

*This tax is also known as a “top-up tax” that is being introduced by the BEPS Pillar 2 project.

This article was written by Vincent Remy and Alex Pouchard, with guest contributions from Adrian Grew, EY New York Tax Manager on the Irish Desk.