How is Luxembourg positioned within the Euro Area?

Analyzing the European Central Bank Financial Vehicle Corporations statistic reported each quarter, it turns out that Luxembourg is one of the most favorable countries for domiciliation of securitization vehicles within the Euro Area with its main competitor being Ireland. Other markets in the Euro Area are more domestic markets without attracting international players too much. Hence, we focus our comparison to Ireland, Luxembourg’s most relevant competitive market. Since many years, Luxembourg was leading the Euro Area market

while the situation changed for the first time at the end of the year 2020. The total Euro Area market sums up to 4,589 vehicles as at end of 2020 out of which 1,340 or 29.2% were domiciled in Luxembourg and 1,396 or 30.4% were domiciled in Ireland. This market segment has grown by 4.1% to 4,775 vehicles at the end of Q3 2021. At end of Q3 2021 Ireland had a stable market-share of 30.4% while Luxembourg finds its market share at 29.4% slightly growing. However, Luxembourg and Ireland together still represent 59.8% of the entire Euro Area market and Luxembourg clearly remains being one of the most beneficial domiciles for securitization vehicles.

Luxembourg market developments end Q3 2021

Development of securitized assets (stock)

The stock in securitized assets increased in the year 2020 from EUR 302.0 billion to EUR 338.6 billion or plus 12%. End of Q3 2021 shows a further increase to EUR 355.5 billion representing an increase of 5.0%. The 5.0% growth in market size is relatively aligned with the 4.0% net growth in the number of existing vehicles.

Development of securitization vehicles [1]

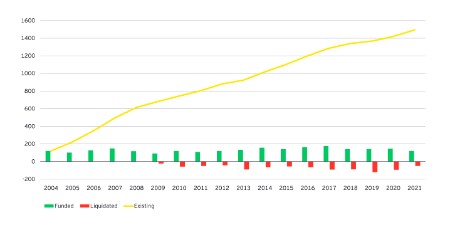

End Q3 2021 shows the number of foundations at 117 (end Q3 2020 = 116) new vehicles; a growth rate of 8.7%. Contrary, the number of liquidated vehicles reduced by end Q3 2021 to 48 (63 by end Q3 2020); a reduction rate of almost 23.8%. While the foundations slightly increased and the liquidations decreased, there is a net increase of 69 vehicles or a growth of almost 4.9% compared to the existing vehicles at year end 2020 – lifting up the number of existing vehicles to 1,491. Out of the 117 newly funded vehicles by end of Q3 2021 there are 105 funded as securitization company and 12 as securitization fund. Hence, the number of newly funded securitization funds exceeds already the number of securitization funds newly created in the full year 2020, which is inter alia due to the fact that the securitization fund is not subject to interest limitation taxation rules. Nevertheless, the newly funded securitization vehicles are clearly dominated by the well-known securitization company, despite being subject to interest limitation rules. Out of those 105 securitization companies: 79 were created as a private limited liability company (societé à responsabilité limitée or S.à r.l.) and only 26 were created as public limited liability company (societé anonyme or S.A.). Other available legal forms were not utilized during the 9 months until end Q3 2021 and the trend to create mainly S.à r.l.’s continues since 2017.

Development of compartments in Luxembourg

One of the key features of the Securitization Law, which remains unchanged by the draft law amending the Luxembourg Securitization Law published in May 2021, is the compartmentalization feature representing the option to create fully separate and ring-fenced compartments within one securitization vehicle. In the absence of statistical data on compartments, an indication on the number of compartments in Luxembourg can derive from the ECB statistics on financial vehicle corporations, of course and without doubt with limitations. The number of reported transactions decreased from 7,981 in Q4 2020 to 5,945 in Q3 2021; a reduction rate of 25.5% [2].

Outlook 2021

The existing Securitization Law continues to provide for a robust and reliable legal framework for securitization in Luxembourg and the additional structuring options provided for in the recent draft law amending the Securitization Law will give a further push to the market and makes it more interesting than ever before. The “Technical position paper on deductibility of payments by securitization companies financed by debt” dated October 2020 and prepared by the Luxembourg Capital Market Association as well as the general guidance “Limitation de la déductibilité des intérêts” published by the Luxembourg tax authorities on interest limitation rules in January 2021 help to remove taxation uncertainty from the markets. The creation and liquidation situation in the first nine months of 2021 confirmed the positive trends since the beginning of the year 2021. Therefore, our outlook for the full year 2021 is clearly positive and we expect that 2021 will see more new securitization funds than ever and we also expect to see many more new securitization companies and compartments. In terms of liquidations we expect a further slight decrease in number. Overall, Luxembourg continues to be a main domicile for securitization within the Euro Area.

What does it mean for you?

Structuring and securitization setup

Luxembourg continues to be a preferred domicile to host your securitization transactions and it doesn’t matter if you plan as an originator to utilize a securitization vehicle or if you plan to create a structured product for your clients, for example in the asset management industry. There are solutions for all purposes.

How EY can help?

We can offer our services in following areas:

- Financial statements audit of securitization vehicles

- Feasibility assistance on a contemplated securitization project

- Impact assessment of new tax regulations and assistance in choosing the most efficient structure

- Corporate advice and assistance in connection with the SV business cycle

- Financial due diligence to assist in the portfolio acquisition process

- Financial modelling services (e.g., cash flow modelling forecasts)

[1] EY research based on ECB Financial Vehicle Statistics

[2] It should be noted that the number of reported transactions within the statistical FVC reporting regime fluctuate significantly during a year, which causes us to believe that there are reporting issues and the statistical transaction reporting should be considered carefully.