Chapter 1

Most companies are lacking high quality disclosures

Sectors with the most significant exposure to transition risk, generally appeared to have improved level of disclosure.

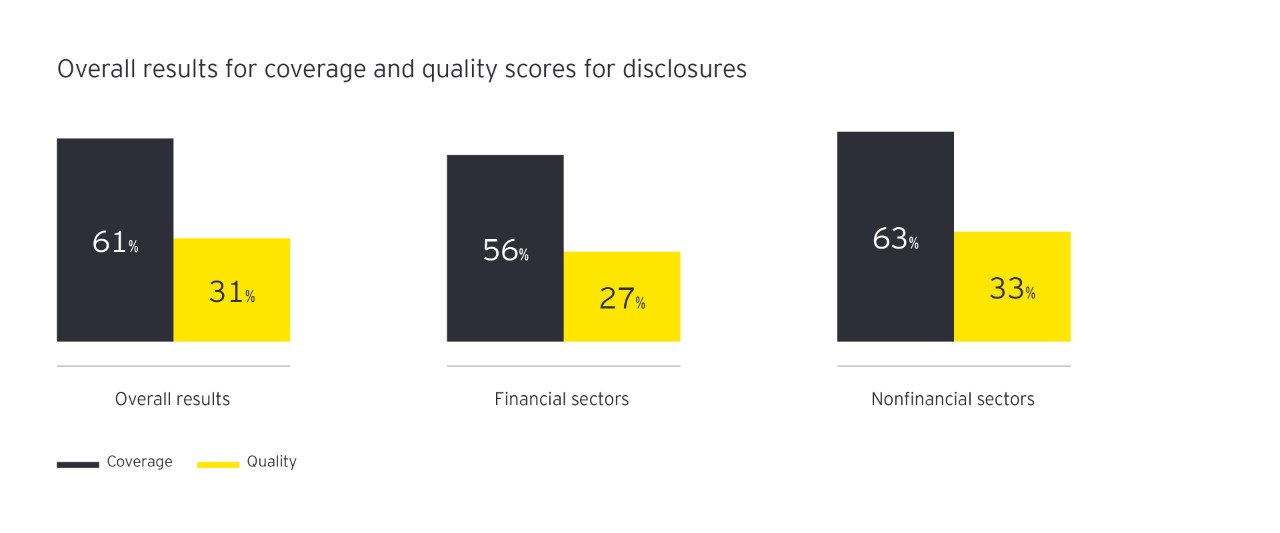

The good news is that this analysis shows two out of three companies assessed have started to disclose climate change-related risks. However, the downside is that the quality of the disclosures were relatively poor, with the average score being 31%.

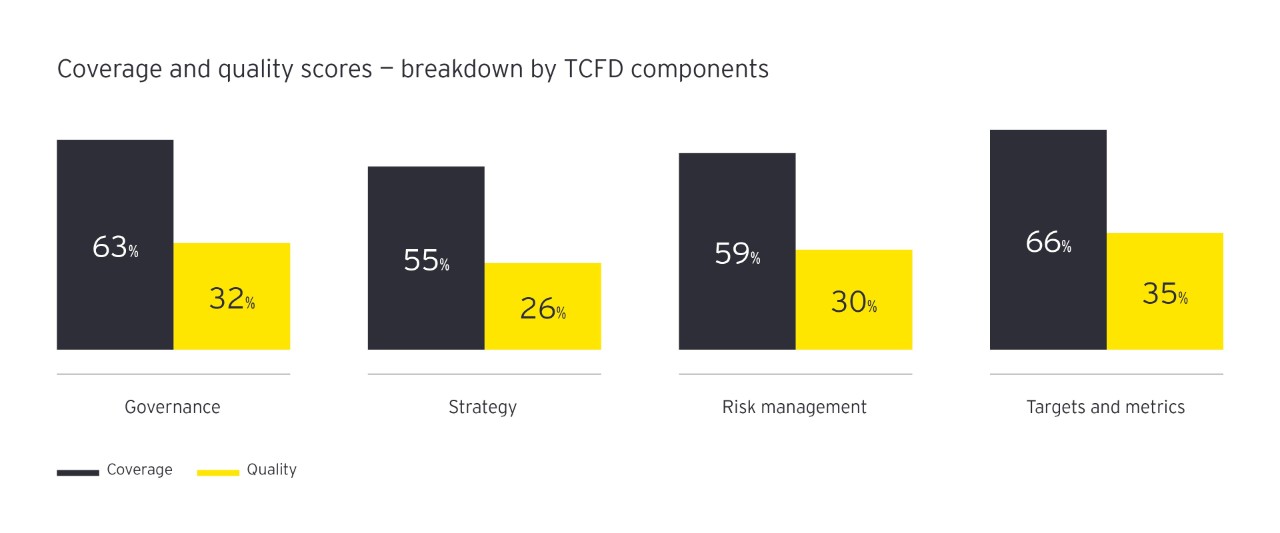

Across each of the TCFD elements – governance, strategy, risk management and metrics and targets – results show that, on average, companies reported better on “targets” and “metrics” (mainly driven by reporting on Scope 1 and 2 greenhouse gas (GHG) emissions) and “governance.” Disclosures relating to “strategy” and “risk management” were the least developed. Arguably, as these components are more complex, they require detailed analysis on how climate change will impact a business and how the business is responding.

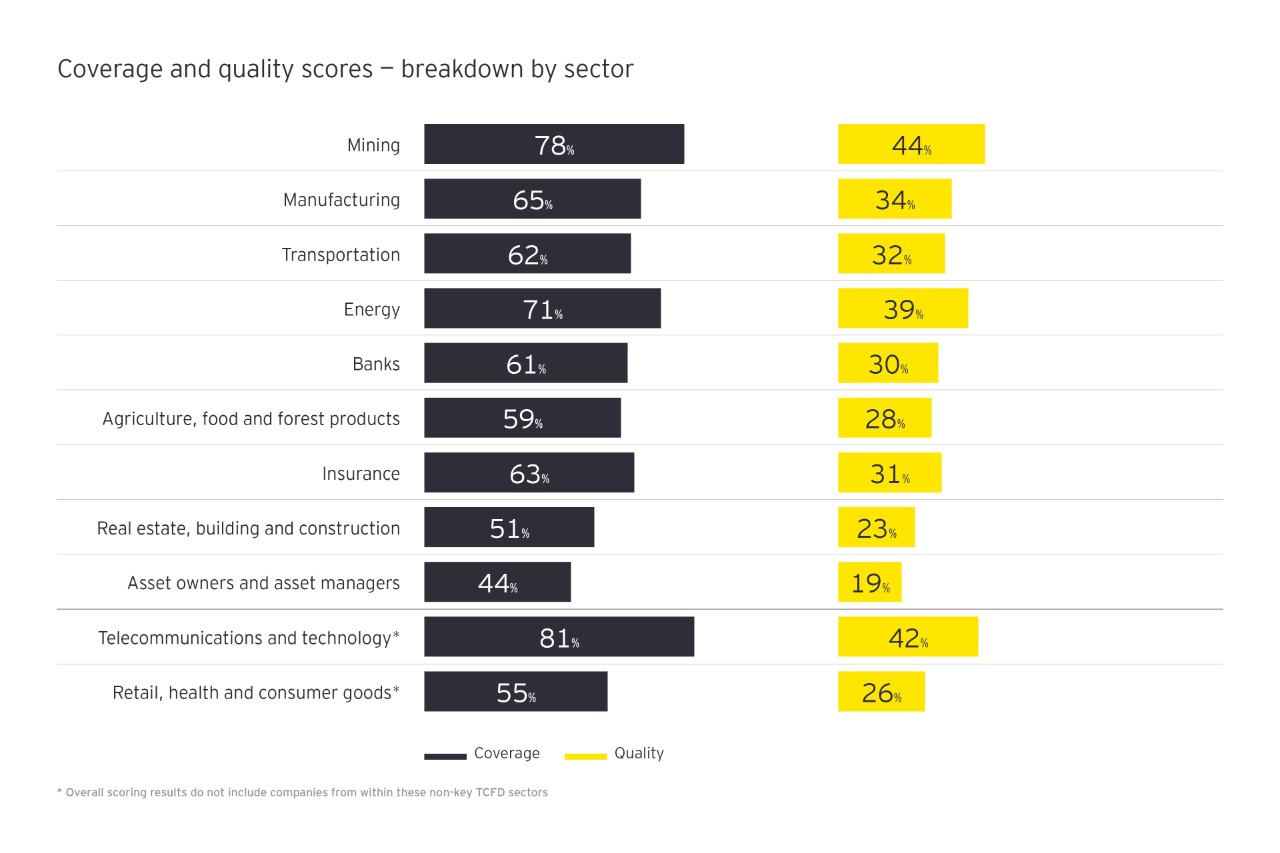

The sectors with the most significant exposure to transition risk (i.e., sectors with direct exposure to fossil fuel supply chains or with readily accessible low carbon substitutes), namely mining, manufacturing, transport and energy, generally scored higher. These sectors have faced the bulk of stakeholder activism around improved climate disclosures. Actions, such as lawsuits and shareholder resolutions relating to climate risk, have been directed toward the largest global organization within these sectors. These actions appear to have improved the level of disclosure compared with the other sectors in this analysis.

The manufacturing and transport sectors are large contributors to global fossil fuel emissions. Certain industries within these sectors are also exposed to competition from low-carbon technologies, such as electrification and resource-efficient manufacturing. Responding to the challenges from these disruptive technologies appear to have led to better risk management and strategy disclosures from some companies within these sectors. These sectors had better-defined climate risks and opportunities and, in some cases, they had included disclosures around time frames and quantification of the potential impacts.

Interestingly, the telecommunications sector scored the highest for coverage and second-highest for quality. This may be because of the industry, more than any other, embracing the opportunities associated with an economy-wide low-carbon transformation, as well as the potential impacts on the sector’s physical networks. Hence, the incentives for disclosure are as much about the upside as the downside.

At the other end of the spectrum, asset owners and managers were the underperformers. This finding is consistent with the findings of the EY Australian Climate Risk Disclosure Barometer report and highlights a global issue with the climate risk disclosures of companies within this sector. This is despite well-established initiatives targeted at investors, including the Montreal Pledge and the Portfolio Decarbonization Coalition.

There are a number of potential reasons for this sector lagging behind others. A traditional focus on the disclosure of short-term risks and complexities in aggregating climate change risks across industries or organizations in a portfolio may have contributed to the sector’s slow response. There may also be a view that the sector can more easily and rapidly respond to the risks. For example, it is easier to rebalance a portfolio for an asset manager than it would be for a fossil fuel-based power generation to shift to a lower carbon profile. However, the slower this sector is to respond to the systemic economic implications of climate change, the less likely it will be to manage the required transition. Asset owners and managers that respond early are more likely to derive value from this transition.

Chapter 2

Quality of climate change disclosures varies by country

Scores for climate change disclosures in mature markets are highest primarily due to regulation but there may be other factors.

On average, coverage scores for companies from markets where climate change disclosures are relatively mature, such as the UK, France, Germany, Switzerland and Australia, were the highest. Interestingly, the US scored highly, despite a lack of coordinated economy-wide policy directives.

One of the key questions coming out of the analysis is whether the high scores are primarily because of an economy being more developed, or whether there are other factors at play. The fact that Scandinavian countries scored noticeable lower, while South Africa scored comparatively higher suggests there is more to it that the maturity of the economy. UK, France, Germany, Switzerland and Australia have had mandatory reporting regulations in place for some time, while South Africa has also implemented mandatory integrated reporting requirements. Although the driver in the US hasn’t necessarily been regulation, the prevalence of shareholder resolutions and the threat of class actions has had a similar impact.

So, perhaps prior regulations for nonfinancial reporting is the critical factor. This is likely true in economies, such as India and UAE. However, this is perhaps not the full story.

In countries or regions, such as mainland China, Singapore, Hong Kong and South Korea, companies scored on average significantly lower than other regions, despite having some mandatory requirements. It also doesn’t explain with the Scandinavian countries’ scores are lower. The reality is that other contributing factors include:

- The maturity of the regulation and whether it is specific to climate change (e.g., mainland China, Singapore and Hong Kong, where the mandatory reporting requirements are quite general)

- The maturity of reporting across companies, rather than just the market leaders (e.g., in Australia, France, UK and Germany, where there is more depth in maturity of reporting)

- The potential risk of litigation in an economy (e.g., why the litigation risk is high in the US and low in China)

The story for quality is not nearly as good as it is for coverage. Even in highest-performing countries, such as Australia and France, there is a long way to go for companies to meet the majority of the TCFD recommendations. The extremely low scores in critical countries, such as India, mainland China and South Korea, as well as even lower scores in parts of Europe, US and Canada mean that investors are unlikely to have the information they need to make decisions for the bulk of their portfolios.

Chapter 3

Physical risk disclosures fall behind transition risk

Physical risks are overlooked in valuation models and often omitted from strategic and risk management disclosures.

The most common disclosures identified were related to the monitoring and management of an entity’s own emissions. Many companies also identified transition risks that either directly impact their sector or the supply chains they rely upon. These transition risks were generally the risks modeled in scenario analysis (where undertaken). One of the key reasons for a more consistent consideration of transition risk is that the time–scales over which companies and sectors are likely to feel the consequences are more immediate. Transition risks are generally associated with “mitigation” action, which by definition means more actions taken to reduce the likelihood and consequence of future physical consequences. So, although in some sectors, companies have considered the physical implications of a changing climate, they are yet to fully integrate these risks into their valuation models.

Our analysis identified, however, that the physical risks are not only overlooked in valuation models, but often completely omitted from forward-looking strategic and risk management disclosures. Physical risk is the key risk to many high-risk sectors over the long-term, and this lack of understanding and disclosure highlights a significant gap in the quality of current disclosures.

Scenario analysis was mentioned in the disclosures of many of the larger global entities. Nevertheless, it was mostly in the context that they expected to conduct the analysis in the future. In other cases, no detail was given around the scenarios analyzed or the results of the modeling. Several organizations also disclosed their support for a 2˚C future, but did not state how their business aligned with such an economy. Where companies had undertaken detailed scenario analysis, generally, the scenarios only dealt with transition risks. These omissions reduced the scores for quality of strategic disclosures.

Chapter 4

Disclosures have not yet been incorporated in financial filings

Despite the TCFD recommendations, there are a number of reasons why most companies have not included disclosures in their annual reports.

The TCFD recommendations ask for disclosures to be made in financial filings, alongside other financial disclosures. This element of the TCFD recommendations is yet to be widely implemented.

Some companies did include their disclosures within the annual report as part of a discussion on the business strategy, as part of the directors’ report or within the operating and financial review (which includes a description of the future prospects of the business). However, the overwhelming majority reported within either nonfinancial reports, e.g., sustainability reports or Carbon Disclosure Project (CDP) reporting.

Despite the TCFD recommendations, there are a number of reasons why most companies have not taken the step to include disclosures in their annual reports or directors’ reports. The relative immaturity of processes to capture and report on climate change risks is likely one reason, as well as the difficulty in setting timeframes on the potential implications of either transition or physical risks. It can also be difficult to translate these risks into financial implications. However, shareholder resolutions, enforcement of listing rules and regulator focus is likely to force companies to change this in upcoming reporting periods.

Chapter 5

Sector overviews

Overviews by key sector on the coverage and quality of climate risk disclosures.

For full details of our findings, please download our full report.

Banks

Banking

61%of TCFD recommendations have been addressed, with a quality score of 30%.

- Overall, the quality of banks’ climate risk disclosures lagged behind leading sectors, such as telecommunications and energy, but received the highest score for quality in the financial sector.

- Australian banks’ disclosures were substantially ahead of disclosures from banks in other regions, mainly because of their inclusion of disclosures around scenario analysis.

- Banks from Finland, mainland China and UAE were the underperformers, scoring below 10% for quality of their climate risk disclosures.

- The United Nations Environment Programme Finance Initiative’s TCFD pilot project, targeted at banks, appears to have improved the disclosures of the members of the program with their peers.

- Most banks submitted CDP responses, which was the most common source of disclosures.

- The best-performing banks were those that included TCFD structured disclosures within standalone reports or sustainability reports.

- Disclosures generally excluded physical risks, which could be a significant risk to the banking sector, given their large mortgage portfolios.

Insurers

Insurance

63%of TCFD recommendations have been addressed, with a quality score of 31%.

- Insurers’ climate risk disclosure scores were, on average, similar to banks and below leading sectors, such as energy and telecommunications. However, insurers scored relatively high on strategy.

- Insurers from mainland China, Singapore, Hong Kong and India were under performers, scoring below 10% for the quality of their disclosures.

- Insurers that received the highest scores for quality tended to have separate climate risk reports or webpages and were signatories to the TCFD recommendations.

- Physical risks disclosures were more commonly referenced than in other sectors, which is not surprising because of their materiality to the insurance sector. However, these disclosures generally provided very little detail into how the risks were monitored and managed.

Asset owners and managers

Asset owners and managers

44%of TCFD recommendations have been addressed, with a quality score of 19%.

- Asset owners and managers scored the lowest on quality for climate change risk disclosures across all sectors assessed.

- Asset owners and managers from most countries received scores for quality between 20% - 30%, with those from Finland, Italy, mainland China, India, South Korea and the UAE scoring below 10% on average.

- Some large pension funds, mainly overseeing the pensions of public sectors, performed better on average that their peers. This may be because of increased pressure and awareness of their stakeholders and a longer-term outlook for investment strategies.

- The poor scores for both the coverage and quality for asset owners and managers is surprising, as the sector typically advocates for broader and more consistent disclosures. This has, however, not translated to reporting on their own risks and opportunities.

- Reporting on transition risks to investments and portfolio emissions, footprinting undertaken were referenced by the better performers.

- Physical risks to investments were seldom mentioned in the disclosures.

Agriculture, food and forest products

Agriculture, food and forest products

59%of TCFD recommendations have been addressed, with a quality score of 28%.

- Overall, the agricultural sector showed good coverage of all four components of the TCFD recommendations (all above 50%). However, the overall level of quality was much lower, especially around the aspects of governance and strategy. The gap observed between coverage and quality can be partly explained by companies from countries, such as South Africa and Denmark who addressed most of the TCFD recommendations, with low quality of disclosure.

- Countries identified as top performers in this sector are Australia, France and Japan, which is likely because of the regulations in place for this sector in these economies.

- Most companies from Asia (South Korea, Hong Kong, India and mainland China) as well as Canada and Italy were the lowest-scoring performers with close to 10% or less in quality.

Energy

Energy

71%of TCFD recommendations have been addressed, with a quality score of 39%.

- Overall, energy is one of the best-performing sectors alongside mining, manufacturing and transportation sectors. It has the highest score for strategy in terms of coverage and second highest score for strategy in terms of disclosure (behind mining).

- Despite the scale of the risk to this sector, the quality scores were still comparatively low.

- France and Japan were clear leaders, but other good performers including Australia, South Africa and Italy. UAE and Singapore were the underperformers, scoring below 10% in quality.

- The overall good performance of the energy sector can be explained by the fact that this panel includes major oil and gas companies, as well as energy utilities, who have been increasingly challenged by investors and civil society on their exposure to climate risks. They have had to provide transparent information on their action to address climate-related risks (particularly, transition risks.) These risks have affected their core business model for several years and, therefore, are quite mature on climate-related disclosure, with some of them even performing scenario analysis.

Manufacturing

Manufacturing

65%of TCFD recommendations have been addressed, with a quality score of 34%.

- Overall, manufacturing has the third-best scores of the key TCFD sectors in terms of both coverage of the key TCFD recommendations and quality of disclosures, behind mining and energy sectors.

- Companies from France and US were slightly ahead of the others in terms of quality of disclosures, and were the best aligned with the TCFD recommendations on the aspects of risk management, and targets and metrics.

- Manufacturing companies from mainland China, Hong Kong and Singapore are not advanced in their disclosures, and they have hardly addressed the TCFD recommendations. Canadian companies also performed poorly in this sector, scoring below 5% for quality.

Real estate, buildings and construction

Real estate, buildings and construction

51%of TCFD recommendations have been addressed, with a quality score of 23%.

- Overall, building companies score the second lowest – both in terms of coverage and quality of responses (and of the nonfinancial sectors scored the lowest).

- France was the clear top performer with companies covering all TCFD recommendations and providing detailed, well-articulated information on climate-related risk management processes and strategy.

- Out of the 47 companies, 16 scored below 5% for the overall quality of their climate risk disclosure. These companies are mainly located in Singapore, Hong Kong, UAE and China.

- Some of the top scorers performed scenario analysis. CDP responses were typically the source of information. Only a handful of companies in the panel explicitly mentioned physical risks, which could be significant to the buildings sector, with increasing needs to resilient buildings and infrastructure.

Mining

Mining

78%of TCFD recommendations have been addressed, with a quality score of 44%.

- The mining sector was the top performer of the key TCFD sectors in terms of both coverage of the TCFD recommendations and the quality of disclosures.

- Companies from Australia and Canada obtained the highest scores in both quality and coverage, which is not surprising given the fact that the largest global mining companies are headquartered there. These companies scored particularly well compared with others in strategy and targets and metrics.

- UK and South Africa also addressed the majority of the TCFD recommendations, achieving a high score in coverage. However, the quality of disclosures was lagging behind in comparison with Australia and Canada.

- Mining companies from Singapore and South Korea were the underperformers, scoring below 10%.

Transportation

Transportation

62%of TCFD recommendations have been addressed, with a quality score of 32%.

- Overall, the transport sector was one of the highest key TCFD sector performers in quality, behind mining and manufacturing.

- France, Germany and the US appeared as leaders in this sector compared with other countries, schieving high scores in quality for the four TCFD components.

- Least-detailed disclosures came from companies in Asia (e.g., China and Singapore), with quality scores below 10%.

- Half of the assessed companies responded to the CDP, and tended to obtain better quality scores compared with companies that did not respond.

Telecommunications and technology

While not a key sector under TCFD recommendations, telecommunications and technology has emerged as a leader in response to climate change. We see it outperforming other sectors in two main areas:

- Identification of climate risk: commonly regulatory risks leading to increased electricity costs and physical risks from increased damage to networks exposed to extreme weather.

- Emissions reduction targets: the sector has been the focus of several initiatives to reduce GHG emissions which appears to be having an impact on the quality of targets set by the sector.

Retail, health and consumer goods

Again while not a key sector under TCFD recommendations, these companies have complex supply chains that are exposed to both physical and transition climate change risks. While the overall quality of disclosers were average, there were some leaders and week performers worth highlighting:

- Leaders consist of French, German and UK retail and pharmaceutical companies. These have established governance processes to manage supply chain risks and developed strategies to manage climate risk in their supply chains. These companies also did well in developing metrics and targets to incorporate ESG performance into remuneration calculations, and measure and manage the impact of their broader supply chain.

- Weak performers were mostly Asia domiciled companies, with several from China and India reporting no climate risk disclosures.

Chapter 6

What next?

An organization should have a clear understanding of the range and magnitude of the financial impacts from climate change.

So where to start?

Disclosing climate-related risks likely requires changes to the governance and risk assessment processes (as per the TCFD recommendations). It may require several years for an organization to be in a position to generate valuable information for investors and shareholders to help them make informed decisions. The earlier your company embarks on this journey and provides a platform to help educate directors and management about climate risks, the better positioned your company will be to engage with investors and shareholders on the impacts and opportunities for your organization.

Companies that seek to understand their climate risks exposure can ask themselves the following questions:

- What are the biggest emission sources in my value chain?

- What are the incentives, instruments or indicators that can help me align my strategy with the 2°C road map (e.g., internal carbon price on CAPEX and OPEX, and company-specific targets)?

- What are my stakeholders' expectations in terms of climate footprint and carbon performance (e.g., lead the development of low-carbon products and services, or disclose information required by investors)?

- What type of climate risks is my business exposed to in the long run?

- How will my products and services be affected by carbon policies and targets? What are the right anticipation and adaptation strategies?

- Are the international climate policies and national commitments integrated into my business strategy, supply chain or sourcing strategy?

- What is the potential exposure to new regulations (e.g. carbon taxationor carbon pricing)? What assets are at risk (e.g., supply chain, products or activites) and in which geographies?

- Are some of my products or activites at risk regarding the 2°C road map? How can I turn this into a competitive advantage?

Summary

TCFD recommendations have provided guidance on climate-related financial disclosures and the response to these have varied by region and sector. This snapshot of climate-risk related disclosures by over 500 companies in 18 countries offers insight into the differences into reporting across regions and sectors. The findings raise questions about the coverage and quality of the disclosures. This is particularly evident in the area of strategy.