Take a seat

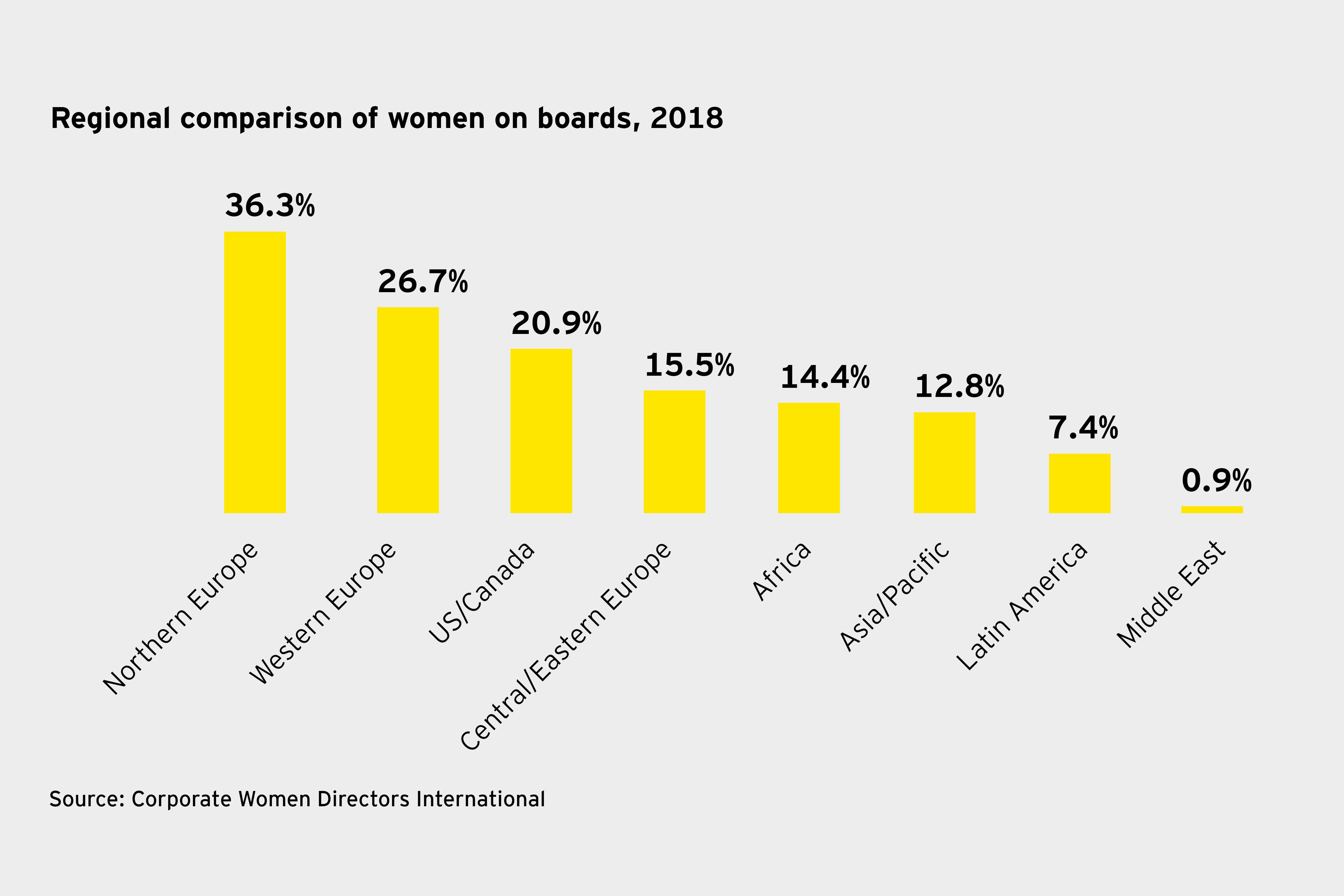

Looking specifically at gender diversity (where the greatest amount of data is available), 2018 data from Corporate Women Directors International shows that women hold just 16.7% of public company board seats globally. Northern and Western Europe are leading the way, with averages of 36.3% and 26.7% respectively, followed by the US and Canada with 20.9% and Central and Eastern Europe with 15.5%. (See graph below.)

These variances are largely the result of the quotas for the proportion of women on boards that have come into force in some countries in recent years. The countries without quotas generally fall to the bottom of the ranking. The European markets that currently use a mandatory approach are Belgium, Finland, France, the Netherlands and Norway.

In France, for example, women hold 42% of CAC 40 board seats and 40% of SBF 120 seats, and 40% of new board members are women. The 40% quota came into effect in 2017, with penalties for non-compliance; boards risk the appointment of a male being nullified – and the directors risk losing their board fees. However, the quota effect only goes so far: just 1% of French CEOs and 2.7% of board chairs are women.

Elsewhere, 26% of board members of ASX 250 companies in Australia are women, while India now requires at least one woman on each company board. They haven’t achieved that yet, but at least they’re focused on it.

As for the US, it has fallen from the top spot in the world to number 12; only 22% of S&P 500 board members are women. However, during the 2017 proxy season, 36% of the new board members were women, which represents good progress. Even so, unless every other new board member is a woman, the situation is never going to improve significantly.

The ICGN supports voluntary initiatives such as the UK’s 30% Club and 2020 Women on Boards in the US. These initiatives are having an effect even in countries where there is no national approach to diversity. Market-led initiatives have an advantage over quotas, as the latter tend to become ceilings rather than floors.

Related article

Diverse boards are less prone to 'groupthink' and more likely to embrace new approaches to meet future threats and opportunities.

Action points

There are a number of actions that can be taken to improve diversity on boards, and particularly, gender diversity:

- Mandatory disclosure: A board’s approach to diversity should be described in a publicly disclosed diversity policy, including measurable targets and a time period over which such targets will be achieved. While it is now commonplace for companies to publish a board diversity policy or statement, this type of disclosure does not necessarily provide insights into the diversity of board members. Boards should disclose a skills matrix, aligned with the company’s long-term strategic needs and succession planning. In 2017, just 16% of US S&P 500 companies disclosed a board matrix showing how individual directors’ skills connect to the company’s strategy and risk profile.

- Measurable targets: Boards should set targets over a three- to five-year time horizon and report on progress in meeting them by identifying the specific proportions of women at board and senior management level.

- Board refreshment: Lengthy director tenure can be problematic and is a major barrier to board quality. Board service should be contingent on performance and annual re-election premised on satisfactory evaluations of the director’s contribution. This allows for long-serving directors to be retired and unlocks vacancies.

- Nomination committee leadership: The role of the nomination committee includes developing diversity criteria, engaging search firms and considering candidates based on their experience and skills. A report from the nomination committee explaining how it considered the representation of women in director selection and board evaluation is useful.

- Investor engagement: Investors are increasingly engaging with boards on this subject to build mutual understanding and, where necessary, encourage change. They want to know about the board’s approach to diversity and gain further insights into the diversity of the existing board where disclosure appears insufficient. Investors also want to assess progress and, as appropriate, discuss the board evaluation process, director performance and tenure.

- Investor voting: Investors publish their own voting guidelines that incorporate the consideration of how they take diversity into account when re-electing directors. They are increasingly holding boards to account; for example, State Street Global Advisors contacted 281 Japanese companies this year and voted against 172 resolutions because of poor diversity.

- Positive recognition: Awards given by prestigious organizations to the board chairs of companies with over 30% diversity create the concept of “corporate champions” that will lead peers to emulate their practice.

- Negative recognition: Naming and shaming of companies with poor performance can be equally effective. In the UK, a public register lists companies that receive more than 20% dissenting votes on any resolution. There are now 120 companies on the list, largely because of votes against individual directors on issues such as executive pay, diversity and over-boarding (where an individual takes on too many boardroom roles). To be removed from the list, companies must explain what actions will be taken within six months after the dissenting vote and in the next annual report.

- Professional development: A Harvard University study showed that 93% of female directors (and 64% of male ones) believe there is an abundant pool of qualified, diverse candidates to choose from. Boards need to avoid rotating candidates from within the same elitist group – particularly former CEOs – to truly diversify the director candidate pool, and therefore boards. To achieve this, it is important to train women and give them confidence in their ability to join a board.

Diverse boards take better decisions, which ultimately leads to better financial returns and long-term value creation. Achieving that diversity requires a commitment from company leadership, investors and policy-makers alike, and the ICGN will continue to encourage all relevant parties to take the necessary steps.

The views of third parties set out in this article are not necessarily the views of the global EY organization or its member firms. Moreover, they should be seen in the context of the time they were made.

Summary

Kerrie Waring, CEO of the International Corporate Governance Network, says that greater diversity improves the quality of boards’ decision-making. However, the data available on gender diversity shows that, globally, women only hold 16.7% of public company board seats, with significant variations between regions. She proposes a number of measures to improve this situation which would require action from company leaders, policy-makers and investors.