Growth drivers spurring ASEAN6’s sustainable investment growth prospects

The COVID-19 pandemic and regulatory focus on ESG has accelerated opportunities for ASEAN6 countries to build greener and more sustainable economies. In tandem, corporates and investors in the region are reshaping strategies to mitigate risks and explore new investment opportunities in sustainable businesses and practices.

Among the growth drivers propelling SRI development in the ASEAN6 markets include:

Corporates are moving into long-term ESG value propositions

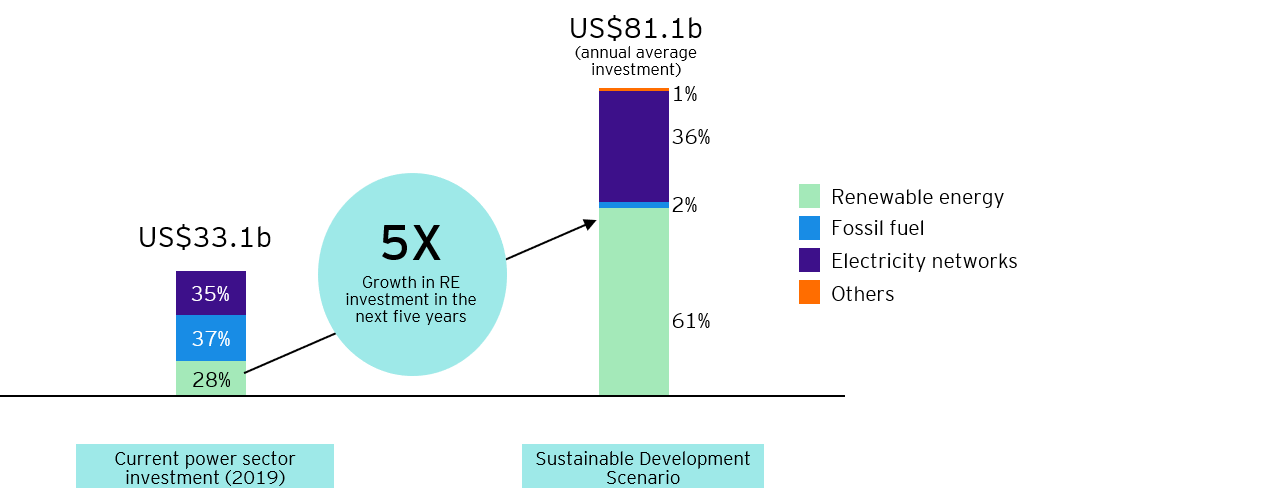

Leading ASEAN6 corporates and organizations are developing ESG propositions to build their resilience and create long-term value. Business sectors, such as transport, energy and utilities, are considering low-carbon measures, investment in RE alternatives and adopting initiatives to reduce GHG emissions.

Investors are increasing their focus on corporates with leading ESG practices

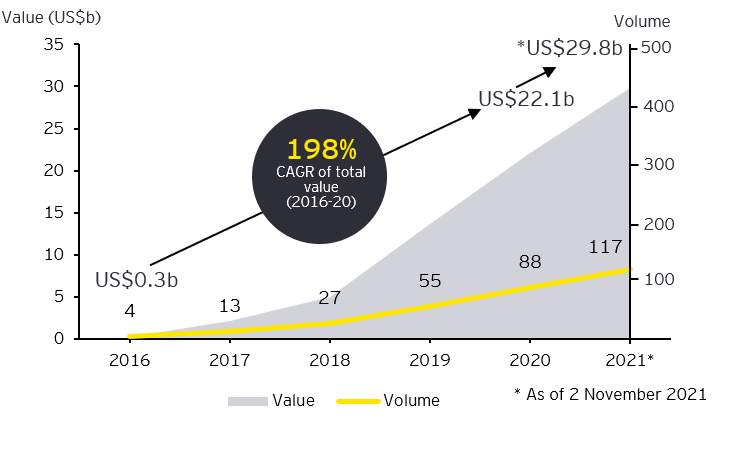

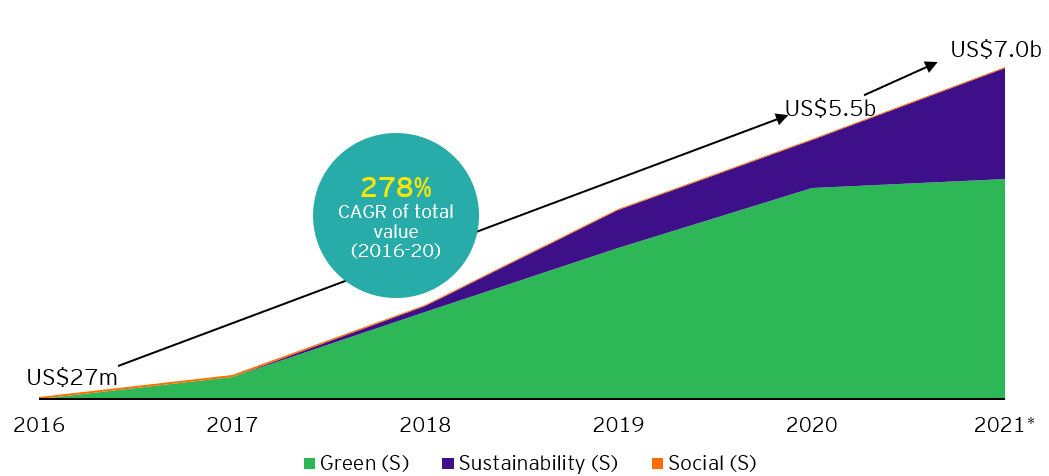

The demand surge in ASEAN green, social and sustainable bonds highlight investors’ strong interest and marked shift toward financing projects with environmental and social benefits.

Regulators are progressing alignment with global policy developments on ESG and sustainability

ASEAN6 policymakers and regulators are formulating national roadmaps, blueprints, policies and action plans anchored on sustainability, climate change and low-carbon to catalyze sustainability initiatives among local businesses. ASEAN6 bourses have also issued sustainability reporting guidelines to complement the financial reporting for public-listed companies.

Consumer behaviors are driving ESG and sustainability practices

Regional consumer surveys highlight increasing consumer awareness on the impact of climate change and their trending preference to support and work for companies that care about and act on ESG issues. With the rising middle-class population in ASEAN6, from 33% of the total population in 2020 to the projected 50% by 2030, the adoption of ESG practices are likely to take-off.

Looking ahead, the progressive ESG policy developments of the ASEAN6 countries and their increasing commitment towards net zero carbon are fast-tracking the regional growth of sustainable responsible investment into the next decade.