Perspectives on the Economic Stimulus Package 2020

The Economic Stimulus Package 2020 is Malaysia’s response to the Covid-19 outbreak. This RM20b economic stimulus package is anchored on three strategies:

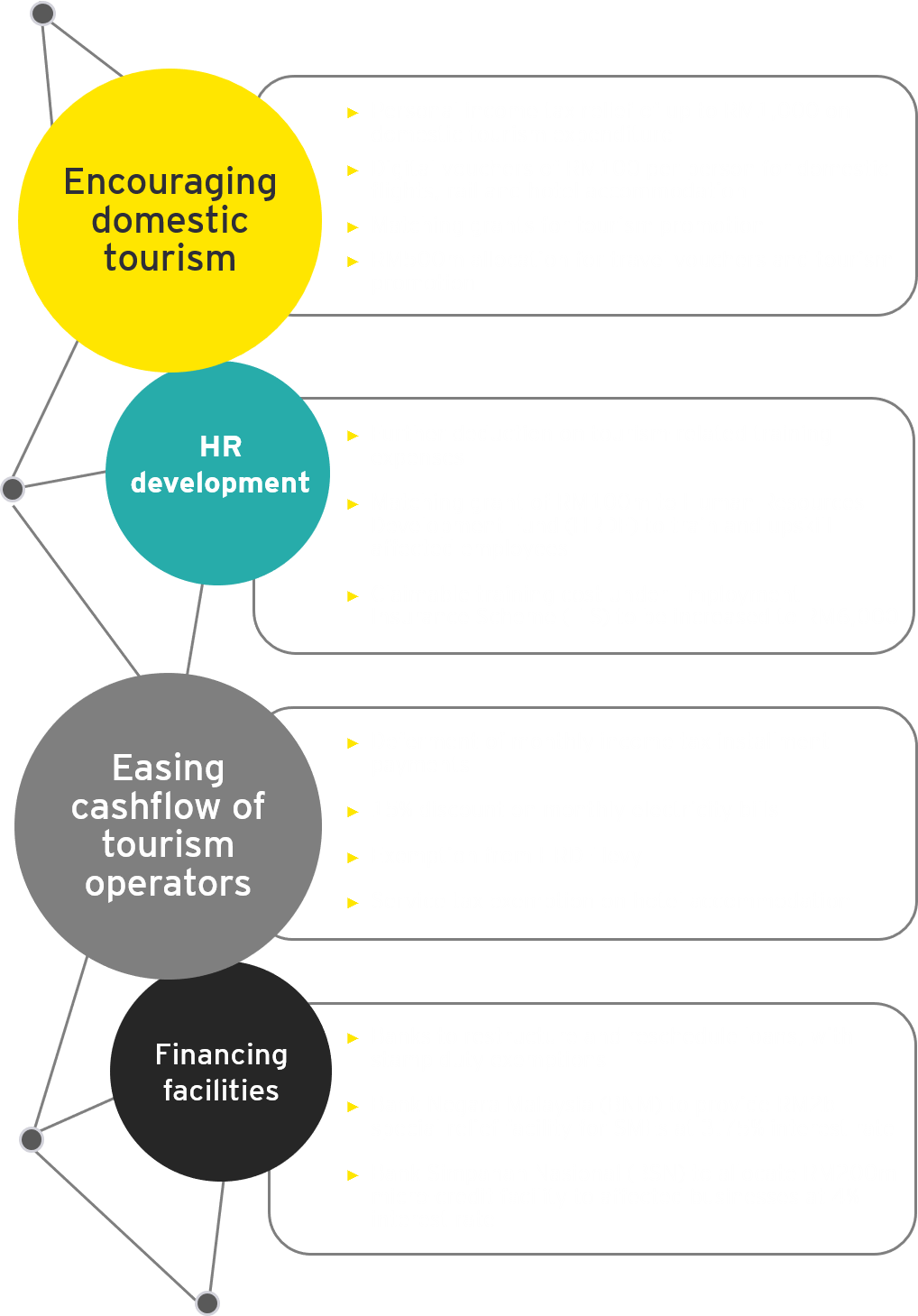

Strategy 1: Mitigating impact of Covid-19

- Ease cashflow of businesses

- Assist affected individuals

- Stimulate demand for domestic “travel and tourism” sector

Strategy 2: Catalyzing rakyat-centric economic growth

Strategy 3: Promoting quality investment.

Notably, the measures are not mainly reliant on Government spending. Private sector support from GLCs such as Tenaga Nasional Bhd and Malaysia Airports Holdings Bhd will play a significant role.

Increased spending by individuals from additional disposable income, arising in particular from the reduced EPF contribution, is expected to unlock some RM10b to shore up domestic consumption. Importantly, this will not strain the budget deficit position.

Malaysia’s 2009 stimulus package resulted in a budget deficit increase from 4.8% to 7.6%. In comparison, the 2020 package is expected to increase the fiscal deficit by 0.2 percentage point, to 3.4%. On balance, these proposed measures should provide a much-needed boost to the economy in these challenging times, while safeguarding the fiscal position of the country.

Mitigating economic risks from the Covid-19 outbreak

Tax-related measures

| Key personal tax proposal | |

| Tax relief for domestic travel expenditure |

|

Key corporate tax proposals |

|

| Deferment of instalment tax payments |

|

| Revision of estimate of tax payable |

|

| Accelerated capital allowance (ACA) for the purchase of machinery and equipment |

|

| Deduction for cost of renovation and refurbishment |

|

| Double deduction for the establishment of regional operations by international shipping companies |

|

| Key Indirect tax proposals | |

| Boosting domestic tourism |

|

| Incentives for port operators and manufacturers |

|

Non tax-related measures

| Sectors | Measures |

| Tourism |

From April to September 2020:

|

| Education and training |

|

| Infrastructure | RM2b allocated to federal, state, and local governments for small-scale projects including:

RM50m allocated for repair and maintenance of jetties, irrigation feeder/plantation roads and Malaysian Quarantine and Inspection Services (MAQIS) equipment RM50m allocated to maintain retention ponds, bunds, riverbanks and rivers RM50m allocated for maintenance of Armed Forces Family Housing/ government quarters and government buildings RM75m allocated to organize sports events and maintain sports facilities RM185m allocated for Mesra Rakyat Projects |

| Healthcare |

|

| Financial services and capital markets |

|

| SMEs |

|

| Employee matters | RM1.1b allocated to EIS fund to assist retrenched workers:

From April to December 2020:

|