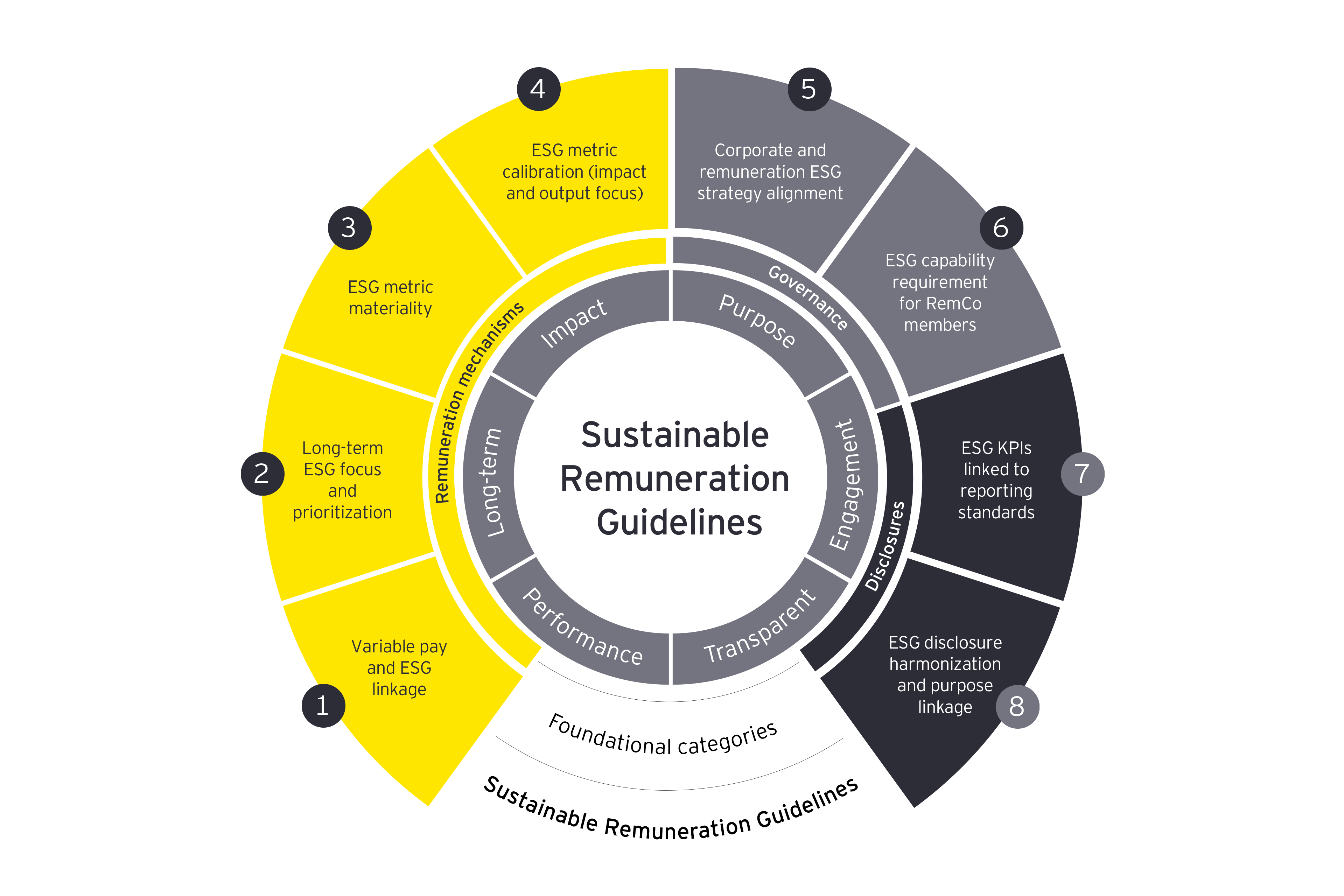

Sustainable Remuneration Guidelines

EY, along with leading CSOs, have developed and launched global SRGs at the 2023 World Economic Forum in Davos.

What EY can do for you

Incorporating sustainability into remuneration frameworks will help enable organizations to elevate the prioritization of their ESG commitments, while operationalizing the ESG agenda and encouraging positive societal change.

EY teams, along with Chief Sustainability Officers from market leading global organizations, have developed Sustainable Remuneration Guidelines (SRGs) to enhance the linkage between sustainability, purpose and pay, while attracting, retaining and engaging employees and enhancing business outcomes.

Given the role that incentives play in influencing behavior, and therefore corporate decision-making, it is important to have sustainability front and center in the boardroom. The SRGs focus on how to enhance sustainability linkages:

- Link ESG KPIs within variable pay: Incorporate ESG KPIs in variable pay (either by means of balanced scorecards, multiplier or underpin/threshold.)

- Prioritize ESG KPIs within long-term incentives: Emphasize LTI (long-term incentives) within executive remuneration mix to reinforce ESG’s long-term and strategic implications.

- Select material ESG metrics: Develop ESG KPI/metric materiality thresholds for incorporating ESG into variable pay programs – STI (short-term incentives) and LTI plans.

- Identify impact-focused ESG metrics: Establish short-term ESG KPIs that are based on output assessments in support of long-term ESG goals and KPIs that are based on impact assessments.

- Align corporate ESG and total remuneration: Align corporate ESG strategy with total remuneration strategy to support organizational purpose and strategy.

- Include ESG competence for Remuneration Committee selection criteria: Prioritize ESG as a core competency for Remuneration Committee membership selection criteria.

- Link ESG metrics to reporting standards: Align ESG remuneration KPIs/metrics with reporting standards to support transparency and comparability.

- Harmonize ESG disclosures and align with purpose: Harmonize and simplify all corporate ESG disclosures (e.g. strategic, sustainability and remuneration reports.)

The guidelines are designed to support organizations wherever they are in their sustainability journey, big company or small company, public or private – they enable organizations to take immediate, focused action and make incremental progress.

To support organizations on their sustainable remuneration journey EY teams have developed a Sustainable Remuneration maturity assessment to evaluate the alignment of current ESG practices, policies and programs with our Sustainable Remuneration Guidelines and develop a roadmap for potential intervention, activation and transformation, via the following phases:

Our latest thinking

Contact us

Like what you’ve seen? Get in touch to learn more.