Key findings

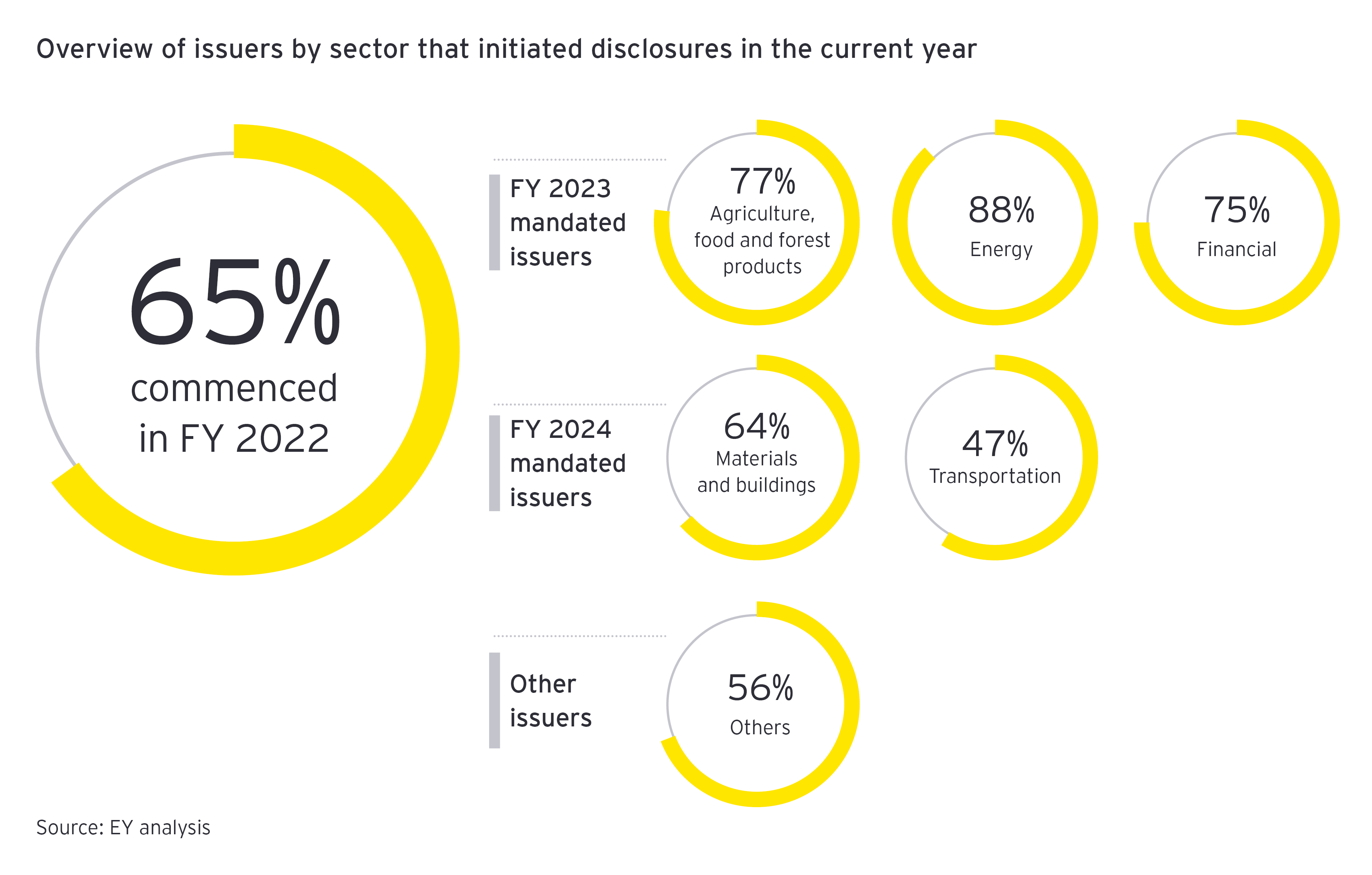

Sixty-five percent of the 240 issuers in the study commenced their climate-related disclosures in FY 2022. Many issuers slated for FY 2023 mandatory reporting have initiated their climate-related disclosures in the current year. Specifically, 77% of the issuers in the agriculture, food and forest products industry, 88% in the energy industry and 75% in the financial industry began climate-related disclosures reporting in FY 2022.

Of the 130 issuers that have not commenced climate-related disclosures, 46% did not mention plans to comply, 25% stated that they will aim to comply in the future and 29% committed to either comply by next year or the following year.

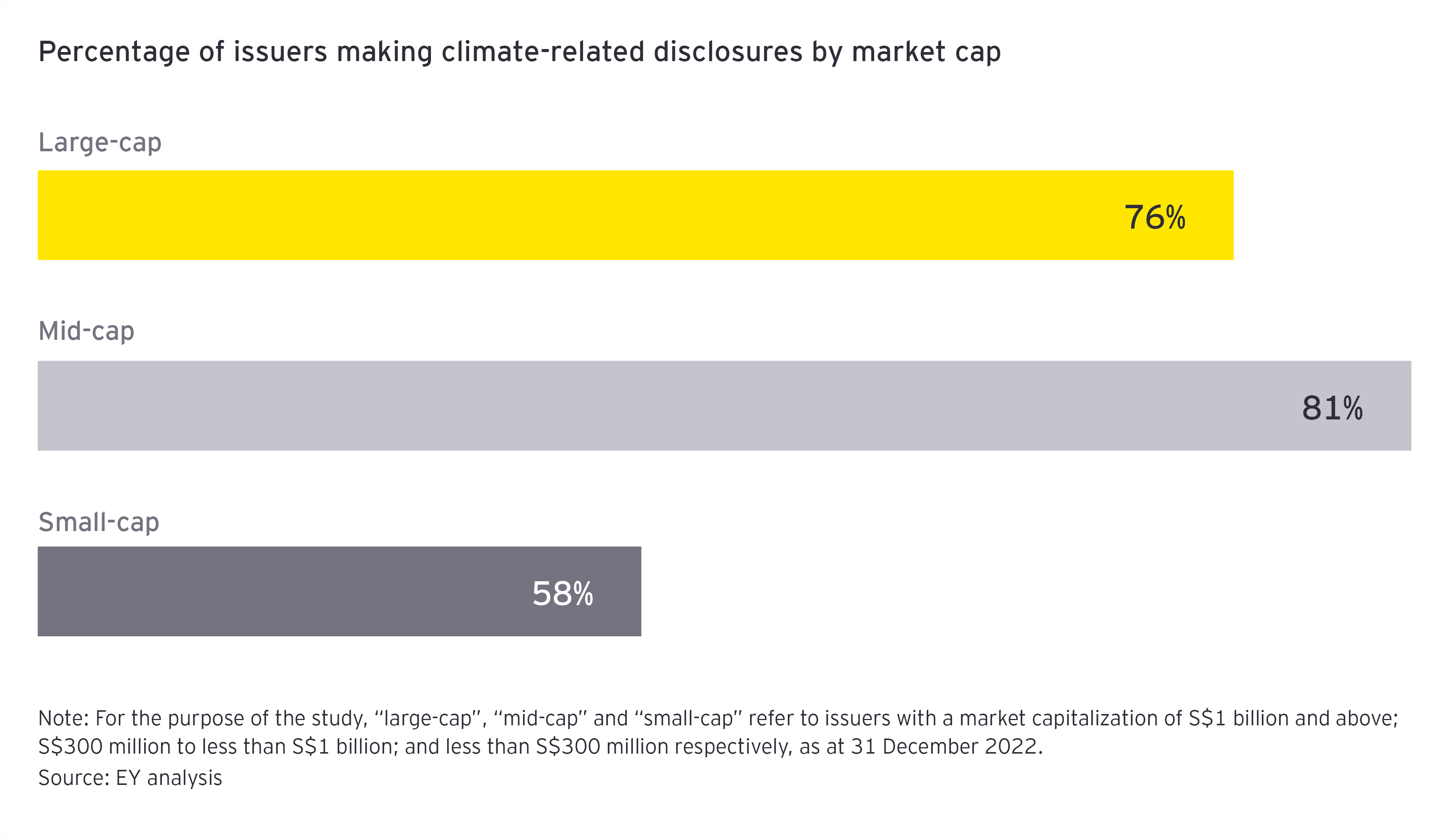

Large-cap (76%) and mid-cap issuers (81%) have taken the lead in making climate-related disclosures, setting an example for others to follow.

Of the 240 issuers that included climate-related disclosures in their sustainability reports, 10% sought external assurance, with three issuers incorporating climate-related disclosures as part of their external assurance review process.

In addition, 98% of the issuers disclosed the board’s oversight of climate-related risks and opportunities. The board discussed climate-related considerations in various matters, with the highest level of discussion in the areas of strategy (70%) and performance objectives, monitoring implementation and performance. Board discussions on climate-related considerations were comparatively lower in the area of annual budgets (6%).

The study also found that 79% of the issuers discussed climate-related risks, while only 47% discussed climate-related opportunities. Fifty-nine percent of the issuers set targets used to manage climate-related risks and opportunities. However, it is noteworthy that a considerable number disclosed qualitative targets at a higher level, such as “maintain or reduce”. Issuers should strive to set quantitative targets in the future and measure their actual performance against these targets. In addition, 68% of the issuers have yet to commence scenario analysis on the impact of climate change.

There is a need for issuers to set quantitative targets beyond qualitative ones and measure their actual performance against such targets.

The way forward

Despite the issuers’ diverse approaches to climate-related disclosures, the study has identified five areas of improvement that are relevant and applicable to all issuers:

- Engage with stakeholders proactively in preparation for new climate reporting requirements.

- Strengthen understanding and assessment of the financial impact of climate-related risks and explore climate-related opportunities for long-term resilience.

- Leverage scenario analysis for better assessment of climate-related risks and opportunities.

- Embed climate change considerations into budgeting and strategic planning.

- Set meaningful quantitative targets and track performance.

Given the urgency of addressing climate challenges, the need for credible and transparent climate reporting is now more crucial than ever. Robust climate disclosures provide sophisticated insights into both material risks and value opportunities as well as help organizations transform and accelerate their decarbonization journey.

Our related articles

Summary

The majority of SGX-listed companies in an EY-CPA Australia study have commenced their climate reporting efforts. Few have sought external assurance, which can provide greater confidence to stakeholders. While most discussed climate-related risks, less than half discussed climate-related opportunities. In addition, the majority have yet to commence scenario analysis on the impact of climate change, which is necessary to better assess climate-related risks and opportunities. It is also crucial to set more specific, quantitative targets to demonstrate a more measurable commitment to addressing such risks and opportunities.