- The impact of COVID-19 pandemic drove YTD deals and proceeds down year-on-year

- Asia-Pacific IPO activity remains stable; however, Asean IPO activity significantly declined

- A notable rebound of IPO activity is expected in 2H 2020

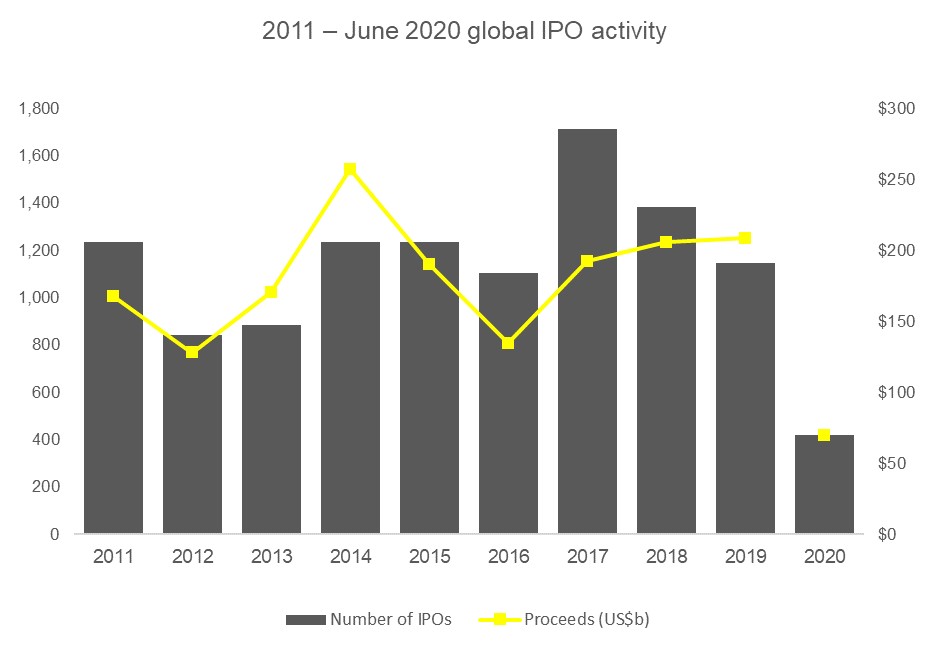

The impact of the COVID-19 pandemic continued to play a significant role in declining IPO activity in the first half of 2020. Overall, Q2 2020 saw a decline in IPO activity from Q2 2019 across all regions by deal numbers and for the Americas and EMEIA by proceeds. Global IPO activity slowed dramatically in April and May, with a 48% decrease by volume (97 deals) and a 67% decrease in proceeds (US$13.2b) compared to April and May 2019. This dragged down 1H 2020 regional activities compared with 1H 2019 and overall YTD deal volume (419 deals) and proceeds (US$69.5b) decreased 19% and 8%, respectively, from YTD 2019.

Despite a late flurry of deals in June, global IPO activity was sluggish on Americas and EMEIA stock exchanges YTD, while Asia-Pacific IPO activity increased. Americas deal volume (81 deals) and proceeds (US$24.5b) both fell by 30% compared with YTD 2019, while EMEIA IPO deal volume (68 deals) and proceeds (US$10.1b) fell 50% and 44%, respectively. Asia-Pacific IPO activity rose 2% by deal numbers (270 deals) and rose 56% by proceeds (US$34.9b) compared with YTD 2019. The technology, industrials and health care sectors dominated in YTD 2020. Technology saw 87 IPOs raise US$17.2b, industrials saw 83 IPOs raise US$9.6b and health care had 76 IPOs that raised US$15.9b. These and other findings were published today in the EY quarterly report, Global IPO trends: Q2 2020.

Paul Go, EY Global IPO Leader, says:

“Although IPO activity declined in April and May 2020 because of the economy lockdown in most markets, we began to see a strong rebound in June. Well-prepared companies, in the right sectors and business models, can successfully adjust during the pandemic, and will find the right window of opportunity amid turbulent capital markets for the rest of 2020.”

Asia-Pacific IPO activity remains stable

Although year-on-year YTD 2020 IPO activity in Asia-Pacific rose by deal number (2%) and proceeds (56%), Q2 2020 saw a decline of 18% compared with Q2 2019 by deal number, while proceeds rose by 28%. Asia-Pacific exchanges accounted for four of the top five exchanges by deal volume and three of the top exchanges by proceeds. Globally, by proceeds, NASDAQ led YTD 2020, followed by the Shanghai Stock Exchange and Hong Kong Stock Exchange. By deal volume, Shanghai, Hong Kong and NASDAQ markets led the way.

In Greater China, IPO activity was up 29% by volume (179 deals) and 72% by proceeds (US$30.9b) YTD 2020 compared with YTD 2019. In Japan, IPO volume (34 deals) declined 17% YTD 2020, while proceeds (US$625m) dropped by 53%. Australia and New Zealand IPO activity was also down YTD – 41% by volume and 82% by proceeds.

In Asean, year-on-year YTD IPO volume dipped 12% but saw a rise in proceeds by 72% on the back of a strong Q1 2020, which also saw the largest IPO in Thailand’s history. There was a total 11 IPOs across Asean in 2Q 2020. With 9 IPOs raising a total of US$56m, Indonesia Stock Exchange was among the top 12 exchanges globally in deal volume. Other listings in Asean in the same quarter include one IPO on Philippines Stock Exchange, which raised US$31m, as well as one IPO on Cambodia Stock Exchange, which raised US$87m.

Max Loh, EY Asean IPO Leader, says:

“With the COVID-19 pandemic, Asean IPO activity has significantly declined across the various markets. Companies continue to want to tap the capital markets for funding and growth while there is ample liquidity searching for yield and investment opportunities in quality companies. However, with the global economic challenges, IPO sentiment is expected to remain fairly tepid in the short term. With so much uncertainty and volatility, companies are evaluating the impact on their businesses and how they can de-risk their IPO plans and timing. Taking into account that Q3 is typically a slower time of the year, it does look like there may only be more robust IPO activity in late 2020 and 2021, as the market attempts a reset and the pipeline looks for IPO windows.”

Americas deal landscape slows

US exchanges still accounted for the majority of IPOs in the Americas in the first half of 2020, with 79% by deal volume (64 deals) and 91% by proceeds (US$22.3b); this included five unicorn IPOs. The health care and technology sectors continued to have the highest level of IPO activity in the US in YTD 2020, representing 55% and 25% by deal volume, respectively. The health care sector dominated in proceeds (US$10.2b), contributing 46%, from 35 IPOs.

The Mexican stock exchange posted one IPO valued at US$1.1b, making it the eighth-largest IPO globally in Q2 2020.

Jackie Kelley, EY Americas IPO Leader, says:

“With stock prices rebounding and market sentiment improving, we are seeing signs of recovery in the IPO market. Over a third of the IPOs in the first half of 2020 occurred in June. IPO pipeline continues to build as issuers look to go public in the second half of 2020 or early 2021.”

EMEIA also sees IPO deal slowdown

After a strong start to 2020, YTD IPOs (42) and proceeds (US$7.8b) declined 47% by volume and 48% by proceeds in Europe, as the COVID-19 pandemic significantly curtailed IPO activity from March through to May. In the Middle East and North Africa (MENA), IPO activity was down 11% by volume (8 IPOs) and down 43% by proceeds (US$0.9b) YTD 2020. Indian exchanges saw 16 IPOs, which raised US$1.4b YTD 2020, a decline of 61% by deal number and 9% decrease by proceeds. There was also one IPO each on the Malawi and Bangladesh exchanges, which raised US$29m and US$7m, respectively.

Dr. Martin Steinbach, EY EMEIA IPO Leader, says:

“During the COVID-19 pandemic, we have seen a new remote IPO environment, with virtual investor meetings, real-time feedback and shortened roadshow periods to limit the short-term market risks. With volatility levels trending down and rebounds in main indices, markets are adaptable, resilient and supportive for IPO activity to pick up in the second half of 2020, especially in technology, pharmaceuticals and life science sectors.”

H2 2020 outlook: IPO rebound expected

Given the COVID-19 outbreak and its negative impact on global economic activities, in the short to medium term, governments around the world will continue to implement policies and stimulate economies against rising unemployment. At the same time, central banks will inject more liquidity into the financial systems. Both actions bode well for equity markets and IPO activity in 2H 2020.

-ends-

Notes to Editors

About EY

EY is a global leader in assurance, tax, transaction and advisory services. The insights and quality services we deliver help build trust and confidence in the capital markets and in economies the world over. We develop outstanding leaders who team to deliver on our promises to all of our stakeholders. In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. For more information about our organization, please visit ey.com.

This news release has been issued by Ernst & Young LLP, a member of the global EY organization.

About EY’s Growth Markets Network

EY Growth Markets professionals connected across the globe are trusted business advisors to CEOs, owners and entrepreneurs leading private and family enterprises, including those managing increasing flows of private capital worldwide. We have a long legacy advising these ambitious leaders in realizing their ambitions, faster. With private entities making up more than 90% of EY clients, our professionals appreciate the owner mindset and possess the know-how needed to think differently about delivering business results, practically and sustainably. ey.com/private

About EY’s Initial Public Offering Services

Going public is a transformative milestone in an organization’s journey. As the industry-leading advisor in initial public offering (IPO) services, EY teams advise ambitious organizations around the world and helps equip them for IPO success. EY teams serve as trusted business advisors guiding companies from start to completion, strategically positioning businesses to achieve their goals over short windows of opportunity and preparing companies for their next chapter in the public eye. EY advisors served on companies that raised 67% of all IPO proceeds in 2019. ey.com/ipo

About the data

The data presented in the Global IPO trends: Q2 2020 report and press release is from Dealogic and EY. YTD 2020 (i.e., January-June) is based on priced IPOs as of 23 June 2020 and expected IPOs up to 30 June 2020. All data contained in this document is sourced from Dealogic, CB Insights, Crunchbase and EY unless otherwise noted.