- Global IPO volumes rose 64% and proceeds rose by 67% year-on-year (YOY)

- Asia-Pacific sees modest gains in 2021; Asean exchanges performed commendably

- COVID-19 vaccine rollout, economic rebound and high liquidity buoyed 2021 initial optimism

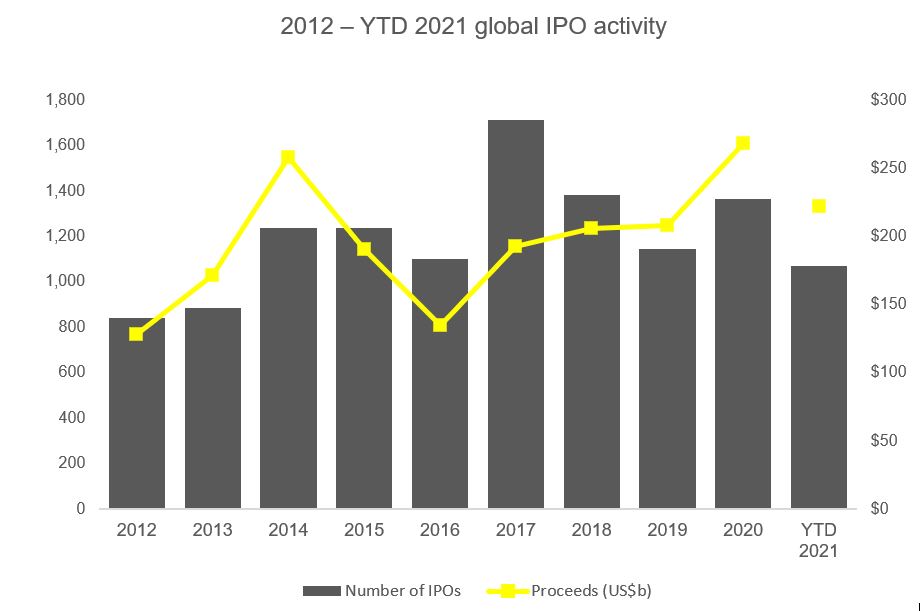

In the face of the uncertain environment that 2021 promised, the global IPO market had an exceptional year, breaking records by IPO volume and proceeds consistently into the fourth quarter. Overall, 2021 saw a total of 2,388 deals raising US$453.3b in proceeds, a 64% and 67% respective increase YOY. These and other findings were published today in the 2021 EY Global IPO Trends Report.

2021 began with COVID-19 vaccine rollouts, a rebound of global economies and ample liquidity in the market hastened by government stimulus programs resulting in optimism for global IPO markets. Q4 2021 was the most active fourth quarter by deal numbers since Q4 2007, seeing a 16% (621) and 9% (US$112.2b) increase by both total IPOs and by proceeds respectively, compared to Q4 2020.

All global markets experienced overall increases by both IPO volume and proceeds, but Europe, the Middle East, India and Africa (EMEIA) exchanges produced the highest growth, seeing a 158% increase by number of IPOs (724) and a 214% increase by proceeds (US$109.4b). The Americas remained hot as well, ending the year with 528 IPOs raising US$174.6b by proceeds, an 87% and 78% increase respectively. The Asia-Pacific region experienced relatively modest growth, resulting in 1,136 IPOs (28% increase) and raising US$169.3b by proceeds (22% increase).

Globally, the technology sector saw the highest number of IPOs (611) for the sixth consecutive quarter (since Q3 2020) and raised the highest proceeds (US$147.5b) for the seventh consecutive quarter (since Q2 2020). Health care raised the next highest number of IPOs by volume and proceeds, seeing 376 IPOs raise US$65.4b by proceeds. Industrials was close behind health care, with 310 IPOs raising US$63.1b by proceeds.

Paul Go, EY Global IPO Leader, says:

“2021 was the most active year for the IPO market over the past 20 years. Initial optimism from rebounding economies, COVID-19 vaccine rollouts, and rolling liquidity from government stimulus programs provided strong tailwinds. In Q4 2021, however, the winds shifted with the surfacing of the COVID-19 omicron variant, continuing geopolitical tensions, slowing IPO activity and increased market volatility. Whether or not IPO-bound companies press pause or forge ahead in 2022, they will need to satisfy investor demands for resilient growth strategies and well-articulated environmental, social and governance (ESG) plans.”

Asia-Pacific sees modest gains in 2021

IPO activity in the Asia-Pacific region maintained a steady pace through 2021 with deal numbers (1,136) and proceeds (US$169.3b) rising 28% and 22% respectively YOY. While these gains are impressive, they are modest relative to the record-setting IPO activity that the Americas and EMEIA experienced this year. As for sectors, technology saw the highest number of deals (257) and raised the most proceeds (US$45.4b) through the year.

Greater China experienced a slow-down following Q3 2021, partly due to Mainland China’s tightened cybersecurity review requirements for cross-border IPO-bound companies that fall into certain criteria. This, combined with US SEC guidelines mandating that foreign issuers in the US must comply with US SEC and Public Company Accounting Oversight Board (PCOAB) inspection rules, dampened sentiment and resulted in several Chinese mega-IPOs delaying or changing their IPO plans. Overall Greater China saw an 11% increase in IPOs (593) and 3% increase by proceeds (US$122.8b).

In other parts of Asia-Pacific, Japan had the highest number of IPOs launched in a single year since 2006, with 128 IPOs raising US$6.8b by proceeds in 2021 – a 38% and 104% respective increase YOY. Australia and New Zealand also performed well with a 159% increase in IPOs (197) and a 144% increase in proceeds, raising (US$9.2b).

Across Asean, IPO markets performed relatively well in 2021, with Indonesia (55 deals raising US$4.8b) and Thailand (40 deals raising US$4.1b) taking the lead in proceeds raised, followed by Philippines (6 deals raising US$2.4b), Singapore (8 deals raising US$1.2b) and Malaysia (23 deals raising US$0.6b).

Max Loh, EY Asean IPO Leader and Singapore and Brunei Managing Partner, Ernst & Young LLP, says:

“In Asia-Pacific, IPO markets grew at a more modest level in 2021. In Greater China, IPO candidates had to grapple with new cross-border regulations, tightened guidelines and more volatile post-IPO market performances, which somewhat affected IPO activities.

“Asean exchanges performed commendably in 2021, with 132 deals raising US$13.1b, up from 111 deals raising US$7.7b in 2020. Amid ongoing challenges, Asean economies continued to show promise with vibrant entrepreneurial, start-up and private equity ecosystems. This bodes well for IPO activity, as invariably, growing companies will continue to tap the capital markets to fuel development and expansion. Like other markets, long-term value and sustainability considerations will feature more prominently for IPO candidates going forward.”

Optimism, liquidity and COVID-19 vaccines drive a banner year for the Americas

The Americas experienced a bullish year, bolstered by low interest rates, high liquidity, buoyant stock markets, improved consumer sentiment and overall optimism driven by the COVID-19 vaccine rollout in some countries. Overall, the region saw 528 IPOs raise US$174.6b by proceeds, an 87% and 78% respective increase. Health care remained the region’s top sector by volume with 172 IPOs raising US$32.2b by proceeds, however, technology was the top performer by proceeds with 152 IPOs raising US$72.2b. Moving into the new year, as the Americas markets continue to evolve and test the traditional IPO model, the structure and format of IPOs are set to continue to evolve, helping issuers better achieve their goals in pursuing a public listing.

The US IPO market remains red hot with 2021 overall on track to be the most active in the 21-year history of this report, with 416 IPOs raising US$155.7b by proceeds, representing an 86% and 81% YOY increase. US special purpose acquisition company (SPAC) IPOs claimed fame in 2021, with US exchanges seeing more SPACs than traditional IPOs. SPACs have shown remarkable resilience, and the US will likely continue to dominate the SPAC space.

Elsewhere in the Americas, Brazil’s B3 exchange experienced a record year with 45 IPOs raising US$11.9b by proceeds – the country’s highest activity level since 2007. Canada’s TSX and Venture exchanges continued to see a robust pipeline of deals as well, raising US$5.9b by proceeds from 47 IPOs.

Rachel Gerring, EY Americas IPO Leader, says:

“2021 was a record-setting year for the Americas IPO market. The surge in new public companies was driven by high valuations, an extended low interest rate environment and strong investor appetite for equities. As we head into 2022, there is cautious optimism that the equity market will remain healthy for new issuers to come to market. Companies looking to go public should continuously consider all options. While a traditional IPO is the most tested form of achieving a public listing, alternative structures are evolving and giving companies more routes to gain access to public markets.”

EMEIA IPO markets experienced the highest year-on-year growth

EMEIA experienced a groundswell of highs and lows through this year. Thanks to a positive environment for entrepreneurs providing high returns and low risk, EMEIA exchanges performed extraordinarily well, resulting in the highest growth rate among all three regions with a 158% increase by IPOs (724 deals) and 214% increase by proceeds (US$109.4b). The region’s continual waves of COVID-19 infections and an upended supply-chain may pose risks heading into Q1 2022.

Europe saw gains with 485 IPOs (154% increase), raising US$81.1b by proceeds (195% increase). The Middle East and North Africa (MENA) also saw significant increases with deal numbers and proceeds rising 205% and 281% respectively (113 IPOs, US$11.0b). As economies in these areas rebound, oil prices remain favorable and companies with strong fundamentals continue to receive ample investor interest. In India, 2021 IPO activity increased 156% by deal number and 314% by proceeds YOY (110 IPOs, US$16.9b). Activity in the UK also remained strong, seeing a 223% increase in deals (97 IPOs) and an 81% rise by proceeds (US$21.2b).

Dr. Martin Steinbach, EY EMEIA IPO Leader, says:

“EMEIA IPO markets closed in 2021 with the highest deal numbers since 2007. The waves of high valuations and low volatility, which offered higher returns and lower risk for entrepreneurs, resulted in exceptional IPO activity across fast-moving markets, including the renaissance of SPACs. While IPO waters are expected to continue to flow, 2022 will be a year of change as ESG and long-term value investors could shift the tides for IPO candidates.”

Q1 2022 outlook: prepare for headwinds but capitalize on high valuations for now

Looking ahead to the new year, both headwinds and tailwinds are in sight, which will likely impact IPO activity. A combination of geopolitical tensions, inflation risks and new waves and variants of the ongoing COVID-19 pandemic that hamper full economic recovery are all at play. Despite all of this, relatively high valuations and market liquidity are for now keeping the IPO window open in 2022. IPO candidates can expect higher market volatility and should therefore remain flexible with a plan B in place to meet financing needs in case the IPO timetable is delayed.

Go says: “While the positive momentum of 2021 is expected to carry into 2022, it will be imperative for IPO-bound companies to adopt a resilient and flexible strategy that is able to adapt to shifting market conditions, evolving regulations and geopolitical tensions.”

-ends-

Notes to Editors

About EY

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets.

Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate.

Working across assurance, consulting, law, strategy, tax and transactions, EY teams ask better questions to find new answers for the complex issues facing our world today.

EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients. Information about how EY collects and uses personal data and a description of the rights individuals have under data protection legislation are available via ey.com/privacy. EY member firms do not practice law where prohibited by local laws. For more information about our organization, please visit ey.com.

This news release has been issued by Ernst & Young LLP, a member of the global EY organization.

About EY Private

As Advisors to the ambitious™, EY Private professionals possess the experience and passion to support private businesses and their owners in unlocking the full potential of their ambitions. EY Private teams offer distinct insights born from the long EY history of working with business owners and entrepreneurs. These teams support the full spectrum of private enterprises including private capital managers and investors and the portfolio businesses they fund, business owners, family businesses, family offices and entrepreneurs. Visit ey.com/private

About EY’s Initial Public Offering Services

Going public is a transformative milestone in an organization’s journey. As the industry-leading advisor in initial public offering (IPO) services, EY teams advise ambitious organizations around the world and helps equip them for IPO success. EY teams serve as trusted business advisors guiding companies from start to completion, strategically positioning businesses to achieve their goals over short windows of opportunity and preparing companies for their next chapter in the public eye. EY advisors served on companies that raised 58% of all IPO proceeds in 2020. ey.com/ipo

About the data

The data presented in the Global IPO trends: Q2 2021 report and press release is from Dealogic and EY. YTD 2021 (i.e., January-June) is based on completed IPOs from 1 January 2021 to 30 June 2021. Data as of COB 30 June UK time. All data contained in this document is sourced from Dealogic, CB Insights, Crunchbase and EY unless otherwise noted. Special purpose acquisition company (SPAC) IPOs are excluded in all data included in this report, except where indicated.