These foundations help provide consistent check-out experiences for retail customers. For example, a customer who buys goods online and receives rebate vouchers may use those to walk into a bricks-and-mortar store. This may sound simple, but these vouchers are qualified by analyzing the underlying payment data (online or store). These need to be harmonized to make certain that, at checkout, the eligibility and voucher amount can be verified. And if this customer then decides to return this purchase, either online or in-store, this reverse-payment transaction must be handled seamlessly as well.

The omnichannel payment provider faces the challenge of setting up internal processes independently from payment channels and methods. This is difficult since various payment schemes have different processes, rules and regulations for chargeback or retrieval processes, e.g., the number of chargebacks allowed for specific types of merchants (MCC). Omnichannel payment providers may want to invest in a workflow management system to reduce the manual effort and help back-office staff operate the processes more efficiently.

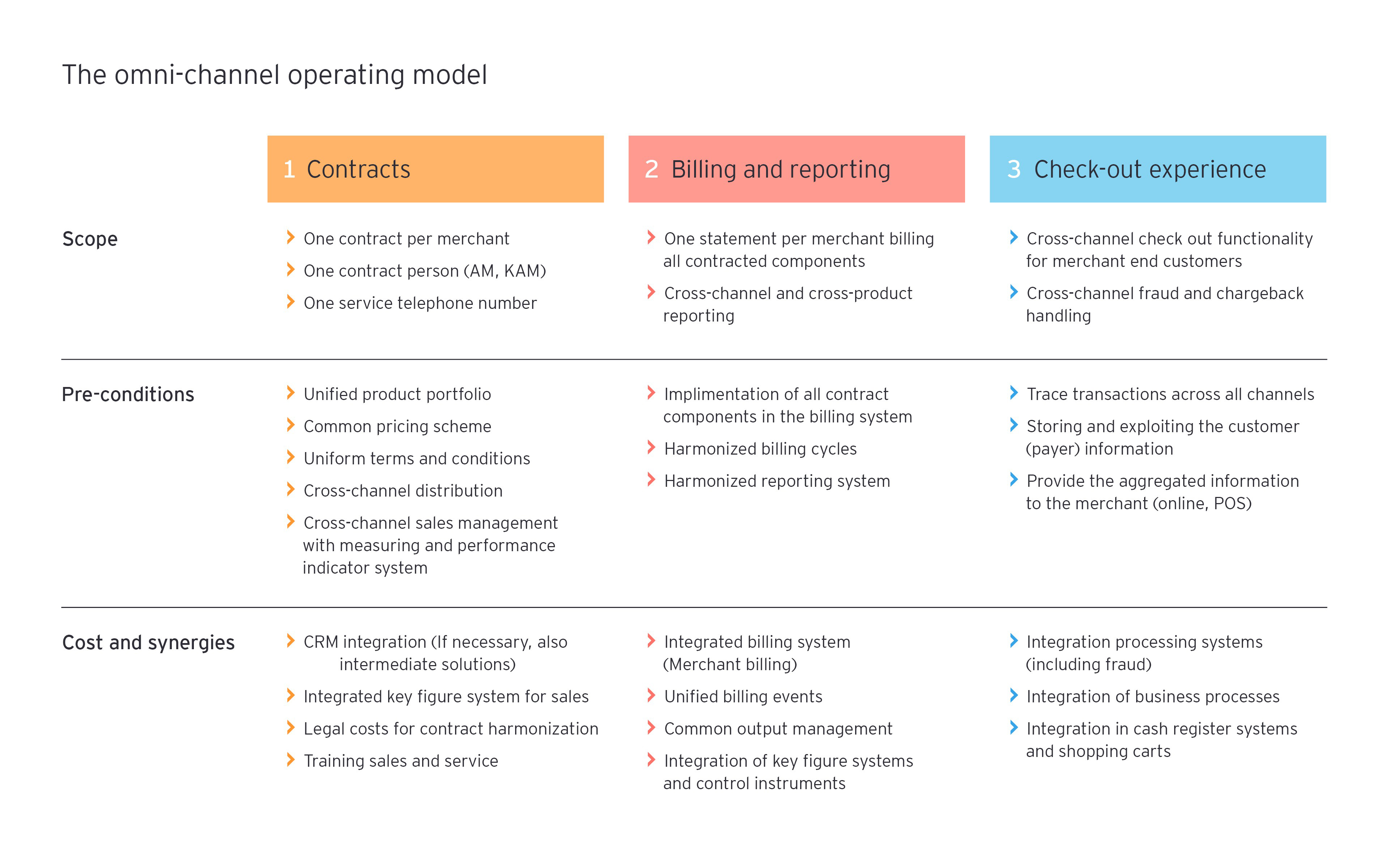

Becoming truly omnichannel will require payment provides to radically reinvent their operating models, integrate products, services, data models and data sources, remodel internal processes and educate their staff. This is a huge investment and, with shrinking margins and increasing competition from startups, even big international players may find this difficult to achieve (especially considering shareholder pressure). But becoming omnichannel is critical if payment providers are to remain competitive in a tight market.

Author contribution from Alexander Christoph.

Summary

Developing a sustainable and commercially successful omnichannel operating model requires payment providers to think beyond a sales-centric approach. It’s imperative to combine products and services, customer management systems and high performing payment platforms for a compelling omnichannel offering that meets the demands of today’s merchants.