Chapter 1

Is medtech investing enough in its own future?

Medtech revenues and valuations rose again in 2019, but the industry must secure its future growth.

In 2018-19, medtech’s collective revenues increased by 7% to US$407.2 billion, medtech’s third consecutive year of growth. Valuations are also robust: medtech’s cumulative public valuation rose 38% in the 18 months ending 30 June 2019, far outpacing the broader life sciences industry.

As technologies converge, medtech can be at the center of a revolution in health care. But is the industry investing in its own future? Here the numbers are less promising.

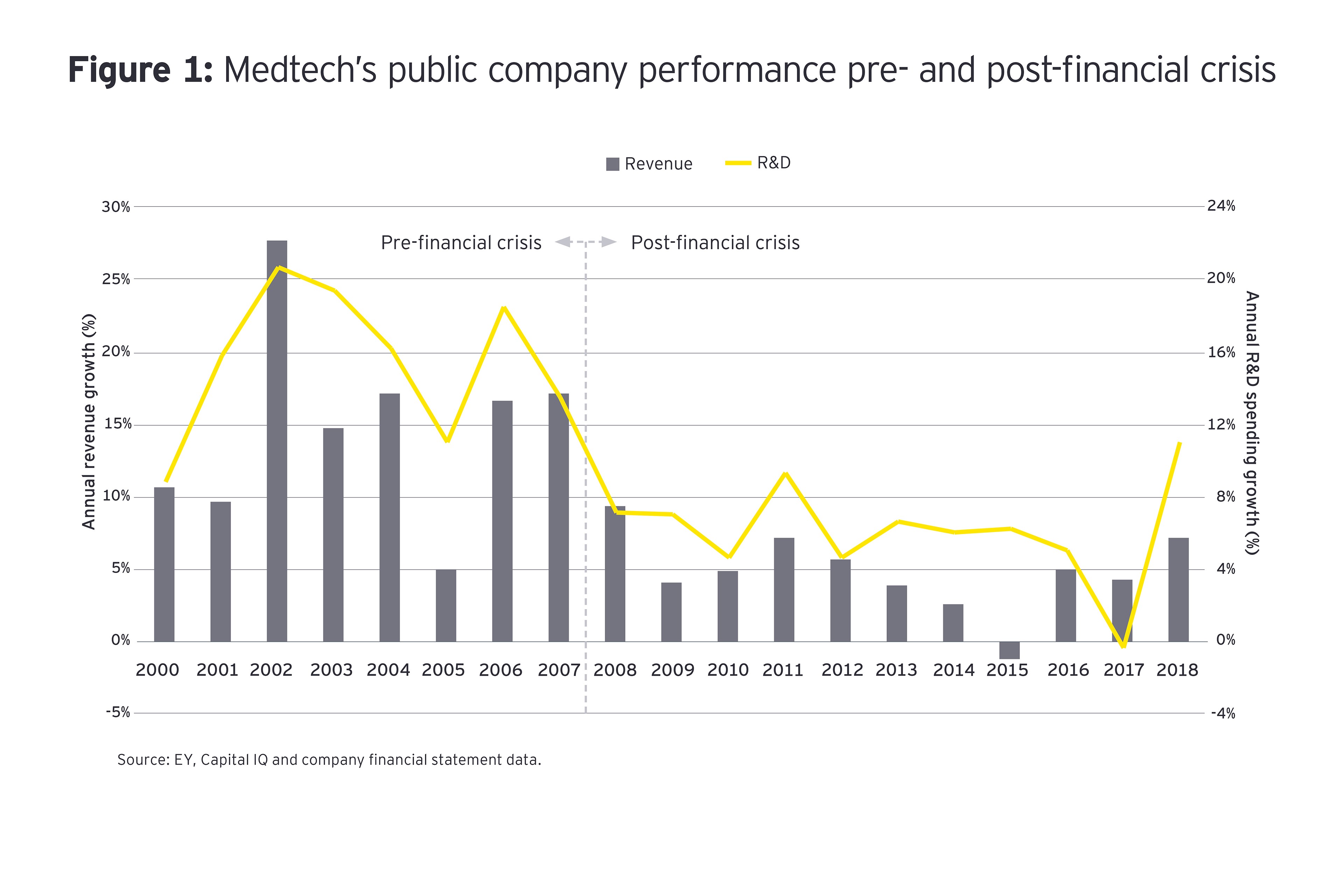

Though R&D spending increased 11% this year, a glance at the longer-term picture shows that growth in both R&D spending and company revenues has yet to regain the levels the industry recorded prior to the financial crash of 2007.

The industry overall is still allocating more of its capital to share buybacks and investor dividends than it is to R&D spending. The proportion of cash returned to shareholders rose in 2018, equalling the levels medtech invested in growth activities. With its future dependent on innovation, this strategy may please shareholders in the short term, but has long-term potential downside. The industry’s willingness to return cash to shareholders seems symptomatic of uncertainty about how to invest for growth.

In 2019, there are fewer billion-dollar opportunities in traditional medtech. Nevertheless, opportunities remain. Witness Abbott’s significant breakthrough with MitraClip, its mitral valve repair device that has spurred a surge in acquisitions and investments by competitors. Advances of this scale in traditional device areas are limited.

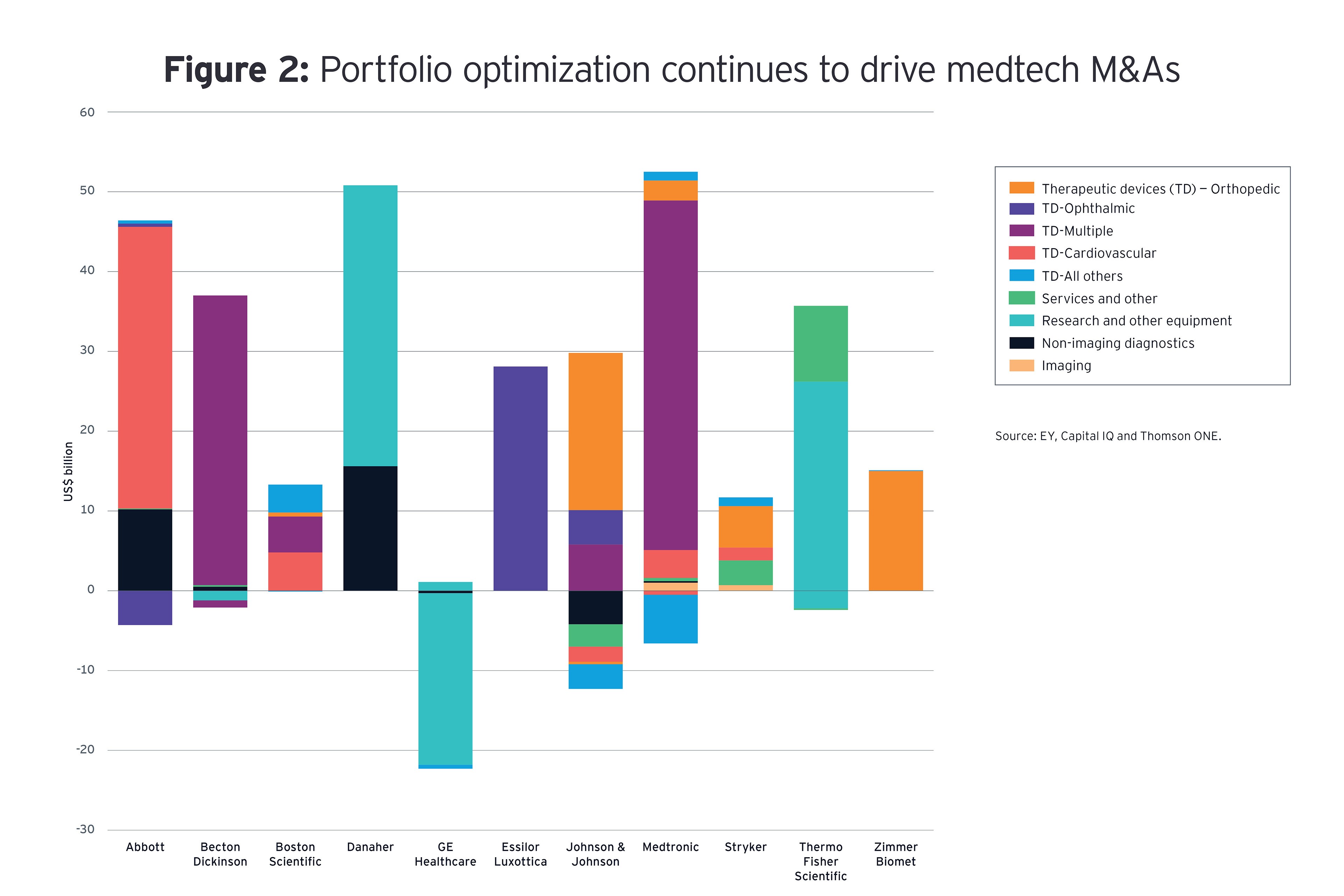

With clarity on the next big device innovation lacking, medtech companies are cautious about acquisitions, especially given the strong valuations for target companies. M&A spending increased in the 12 months ending 30 June 2019, but deals are getting smaller, with medtechs prioritizing tuck-ins and portfolio optimization, rather than bold or transformative deals.

As technologies converge, medtech can be at the center of a revolution in health care. But is the industry investing in its own future?

The caution toward unproven new technologies continues to hurt the startup companies that provide the traditional fuel for medtech innovation. In the current M&A climate, many must win reimbursement before they seek the traditional exit route of acquisition by a major medtech company. And though venture capital continues to flow into medtech, overall industry financing levels declined for the second year in 2018. This slight contraction in raised capital mirrors the drop in new approvals reaching the market this year via the FDA’s PMA and 510(k) approval pathways.

Meanwhile, the stakeholders that have been the industry’s primary customers across the ecosystem are struggling. With payers cutting reimbursement to providers, hospital networks are spending cautiously and resent the industry’s ongoing efforts to upsell rather than deliver value. In short, medtech’s stakeholders don’t see the industry as a true partner with whom they can collaborate. As for the ultimate end-users, medtech has yet to make the move toward regarding patient-consumers as its real customers. Efforts are still focused on provider systems.

Chapter 2

What are the key trends shaping medtech’s future?

As medtechs seek the right deals, diagnostics, digital tech and data could become key to delivering value.

Beyond the headline numbers for the industry in 2019, closer analysis reveals the emergence of four important trends that signpost the industry’s direction toward a more personalized, data-driven future.

1. Portfolio optimization

The cautious M&A climate is a negative for overall industry growth, but medtech’s strategic approach to optimizing company portfolios is a good first step to prepare for the future.

In an environment where capital is scarce and development timelines are long and expensive, companies need to use their capital wisely to win – and continue winning. Instead of a steady stream of acquisitions, companies want to invest more in deals with potential to deliver bigger rewards. While companies arguably need to be doing more to invest in the right new technologies and innovations, the portfolio optimization underway suggests medtechs are trying to identify must-win areas and invest with a longer-term strategic mindset.

2. Non-imaging diagnostics

Diagnostics are the pathways that offer medtechs direct access to the patient-consumer – and the field is booming. At 11% revenue growth, non-imaging diagnostics companies outpaced the broader industry. In contrast revenue growth for therapeutic devices grew only 6%. These strong revenue figures were reflected in the high interest VC start-ups showed in the space. Diagnostic start-ups such as Thrive Earlier Detection, Click Diagnostics and uBiome were among the biggest funding rounds of 2018.

Much of the attention remains on the lucrative genomics subsector of non-imaging diagnostics. In 2019, the advance of genomics toward mass-market availability continued, thanks to Illumina's announcement that it had reached an agreement to acquire Pacific Biosciences for US$1.2 billion in November 2018.

3. Digital health

A string of new approvals continue to validate the possibilities of digital health technologies. In October 2018, the FDA approved the first augmented reality (AR) system for surgical training, the OpenSight system built on collaboration between Novarad and Microsoft HoloLens. At the same time, the agency approved a steady stream of AI algorithms over the past year. AI is a significant driver of decentralized care.

Diabetes is still the therapeutic area that sets the pace for the digital health market. In the last year, we’ve seen the market success of Dexcom and Tandem’s interoperable system illustrating that it isn’t devices alone but interoperable, patient-centered networks of devices and data analytics that capture market share.

4. Progressive providers and payers

Other companies in the health care ecosystem seem to be rethinking the business model. Consider Mercy, which has pursued the idea of a bedless hospital based on remote monitoring, predictive analytics and integrated clinician teams. Other leading providers and payers are working to integrate data, too.

Building a viable long-term model for health care data may require companies to embrace an open data architecture that can incorporate core elements such as electronic health records without being constrained by legacy products. Payers, too, continue to try and reinvent the business model, with UnitedHealthcare and Aetna, for example, pursuing value-based approaches.

While these trends are all significant for the future of medtech’s business model, the challenge for companies is to identify what steps they can take now to prepare themselves for the emergence of a more data-driven, digital era in health care.

Chapter 3

How can medtech prepare for the future now?

Medtech will need secure connected devices, agile supply chains and the right business model.

As the health care ecosystem becomes more connected, the advances in diagnostics, genomics, AI and other emergent data technologies will reinforce each other, driving an exponential acceleration toward personalized care. Ultimately, this will transform medtech in ways that cannot yet be fully anticipated. We can, however, identify some of the key elements that need to be established for success.

A cybersecure ecosystem for data exchange

Across the US alone, health care data breaches have been recorded at a rate of about one per day in 2018-19. This level of vulnerability must be addressed before a connected ecosystem can be achieved. Medical devices need to become part of the solution.

Companies that want to win trust should not wait for the regulators to take the lead: they should move proactively to show that they’re taking steps to secure both their products and the data ecosystem around their products. The companies that are thinking beyond their own vulnerability to the bigger question of building safe networks to move data around the ecosystem will be best placed to become the trusted partners of the future.

Securing the supply chain

The deficiencies in data availability and trust between stakeholders limit the effectiveness of the medtech supply chain, making it a prime target for transformation. With connected devices enabling a bidirectional dataflow along the supply chain, companies will have the tools to create more agile logistics capabilities. This will mean using real-time data to understand not just where products are in the market but where they need to be next.

As care increasingly decouples from traditional channels and institutions, the data supply chain will become as critical as the product supply chain, and medtechs must secure those data streams for themselves and their stakeholders.

Securing the business model

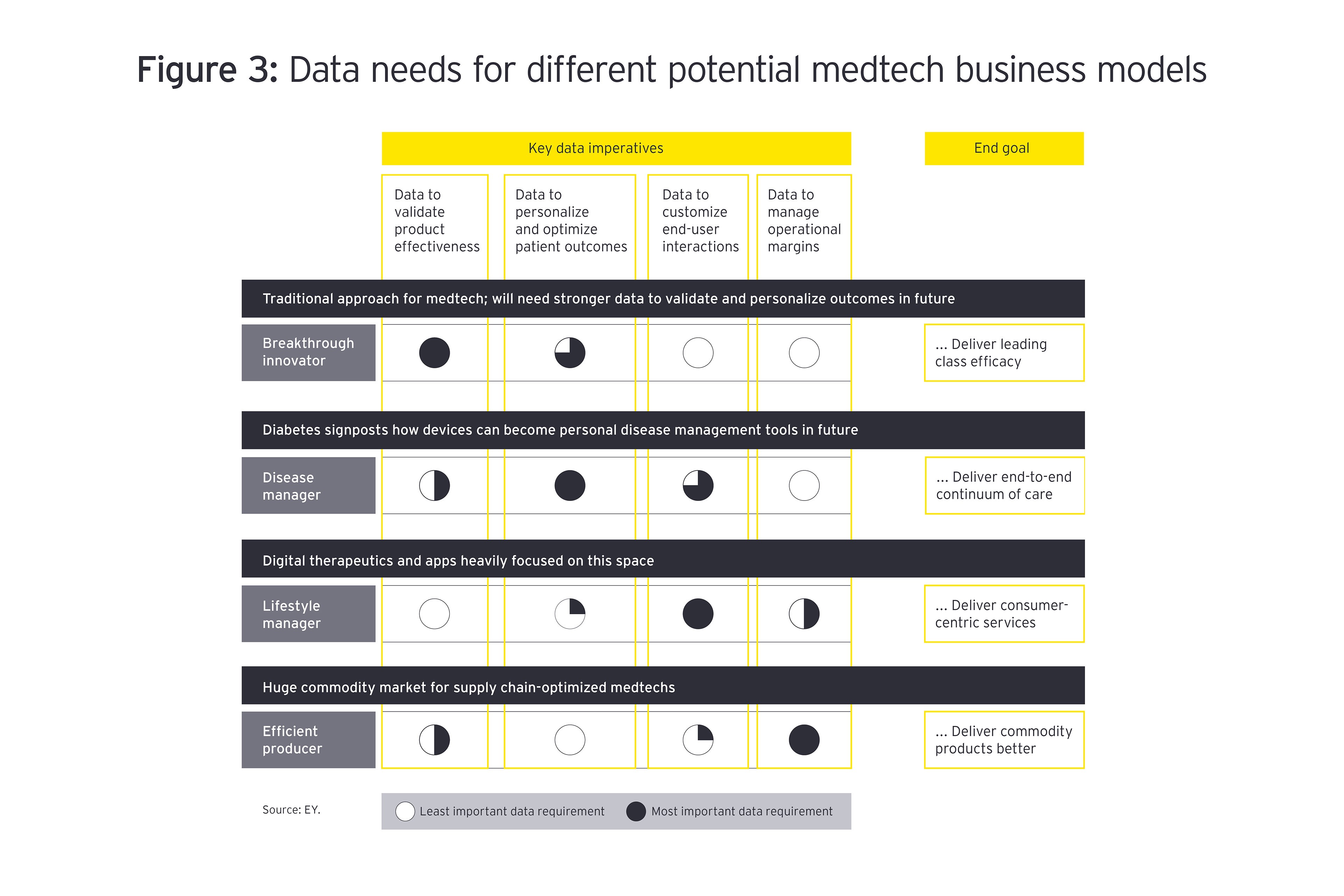

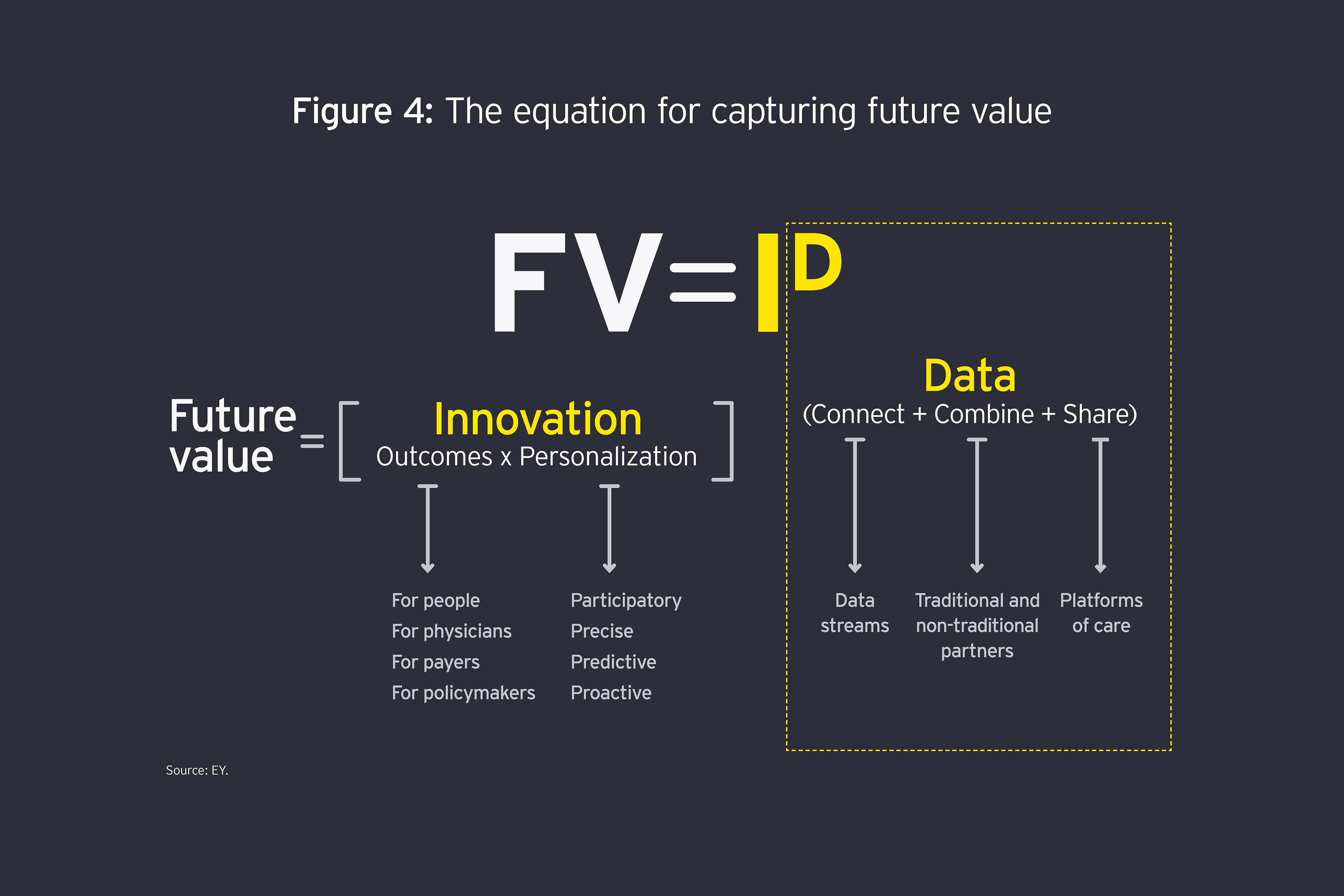

As health care evolves toward a more dynamic ecosystem built on data sharing, medtechs should identify the business model that represents the best vehicle for them to deliver future value. Our analysis characterizes four distinct business models associated with medtechs, each with highly specific data and analytics needs.

- Breakthrough innovators: Medtech has traditionally generated value by creating innovative devices that are tested in clinical trials. Future success depends not just on the cutting-edge hardware but on its ability to connect into a wider data ecosystem, to help deliver better health outcomes. Increasingly, it will be not just a question of creating innovative devices but of demonstrating how their use can drive better outcomes.

- Disease managers: As data capture opportunities increase via connected devices, devices may become highly personalized tools for individual patients to manage their disease – a trend already visible in the diabetes market. Future disease managers will need to look beyond therapeutic area siloes to deliver care holistically, maximizing the use of data to best manage all the patient’s chronic conditions and co-morbidities.

- Lifestyle managers: Consumer electronics devices are already evolving beyond fitness and nutrition applications to provide real-time, medical-grade feedback that can help patient-consumers manage their lifestyles more effectively. The ubiquity of sensors, wearables and smartphone software represents a huge opportunity for companies to develop this “softer” side of personalized medtech.

- Efficient producers: Companies that focus primarily on cutting margins via supply chain transformation can target the significant market in low-tech, commodity medtech products. To succeed in this market, medtechs will need to utilize sophisticated data analytics to run operations on as efficient a basis as possible.

Chapter 4

Is medtech ready to collaborate to build future value?

A data-driven, personalized future needs a dynamic ecosystem – with stakeholders working together.

In 2019, medtech is already creating connected devices. What it can’t create is a connected ecosystem to plug these devices into. That’s because building a working, linked-up ecosystem isn’t a task for the industry to undertake alone – it needs to be a collaborative effort between industry, regulators, providers, payers and patient-consumers together, and it will also involve technology companies from outside the sector playing an enlarged role. Put simply, if medtech can’t strengthen its connections with the other stakeholders, it can’t extract full value from its connected devices.

In the journey toward delivering better patient outcomes, improving access and lowering overall costs of care, collaborations in risk-based contracting, operational alignment and data transparency are foundational requirements.

Two major roadblocks prevent the industry from forging closer collaborative links with other stakeholders:

- First, the technical challenge: the lack of interoperability between the data-management systems used across health care means that data are locked in siloes. Without a shared digital infrastructure, there’s no mechanism to allow data to flow seamlessly between stakeholders.

- Second, there is no incentive for other stakeholders to work together on developing that digital infrastructure if they don’t feel that medtech companies are aligned with their values. There are few precedents for stakeholders collaborating at the scale needed.

Overcoming stakeholder skepticism about medtech’s ability to be a trusted partner will be an ongoing challenge. Steps that will help include medtech’s greater embrace of value-based payment as part of a closer collaboration. As John Liddicoat, EVP and President, Medtronic Americas Region, says, “In the journey toward delivering better patient outcomes, improving access and lowering overall costs of care, collaborations in risk-based contracting, operational alignment and data transparency are foundational requirements.”

Some medtech innovators are already planning for a highly connected, data-driven future. Susan Tousi, Illumina’s Senior Vice President of product development, notes the company’s goal is – “to connect our smart sequencers to the internet, to each other and to our partners' applications through a seamless data fabric,” with the intent to integrate “rich data streams, open up new analytical possibilities and usher in the era of digitized biology.”

At a broader scale, the technical and logistical demands of building a “digital backbone” that can be accepted and used by all stakeholders represent a longer-term challenge that may demand expertise with data systems that lie outside the industry’s current capabilities.

Nevertheless, medtechs can begin to address both of these issues at a local scale, by building devices that capture and share data securely, working closely to understand their real customers’ needs, and using data to better deliver value to those customers. The onus is on the industry to take the first steps toward constructing the connected ecosystem, and the potential rewards are significant for the companies that seize this opportunity.

Summary

As the Fourth Industrial Revolution transforms health care, patient-consumers will use new technologies to demand and receive personalized treatments any time, anywhere. To remain relevant, companies must begin to create the products that future patient-consumers and providers will demand while still meeting current needs.