According to Pitchbook, fundraising in the European PE sector nearly set a new record, with around €120 billion raised across 117 funds. Interestingly, this robust fundraising was largely driven by megafunds, as the top five funds accounted for over half of the total capital raised, highlighting a trend towards larger, more established fund managers attracting the majority of investor interest. Investors are becoming more selective, often preferring to allocate their capital to established firms with proven track records “flight-to-quality”. This trend leads to a concentration of funds in the hands of a few large players, leaving smaller firms struggling to raise sufficient capital.

Regulatory pressures and compliance costs

The Private Equity sector is facing heightened regulatory scrutiny, leading to increased compliance costs. Smaller firms often find it challenging to bear these costs, which include the expenses of adhering to evolving regulatory standards and employing necessary legal and compliance staff. This pressure further incentivizes smaller firms to merge with larger entities to share the burden of compliance and regulatory requirements.

Succession planning

Succession planning is another pivotal factor contributing to the wave of consolidation. As the founders of specialized boutique firms approach retirement, they initiate succession plans, making them attractive prospects for larger Private Equity acquirers.

What’s next?

Anticipated consolidation opportunities are on the horizon for the next 5 to 10 years, offering established fund managers transformative chances to solidify their positions. This trend is expected to persist, allowing existing players to enhance their positions as the industry matures. Similar to the banking sector’s transformation in the 1990s, the Private Equity industry is moving toward dominance by large, diversified firms, potentially sidelining smaller niche players.

However, this consolidation and emergence of mega-managers are not without potential downsides. The reduction in the number of players in the market could lead to less competition, higher fees, and reduced choice for investors. Furthermore, integrating different firms and cultures poses its own set of challenges, potentially impacting the long-term success of these consolidations.

As Private Equity enters an era of rampant consolidation, the repercussions will ripple across the financial landscape. With fewer but more powerful players, the dynamics of investment, risk, and reward are poised to undergo a profound transformation. This consolidation is not just a reshaping of an industry but a reflection of broader economic shifts and a harbinger of the financial world’s future direction.

1) General Atlantic adds sustainable infrastructure strategy, as Actis joins platform to create a $96 billion AUM diversified global investor – General Atlantic website (General Atlantic adds sustainable infrastructure strategy, as Actis joins platform to create a $96 billion AUM diversified global investor| General Atlantic)

2) BlackRock Agrees to Acquire Global Infrastructure Partners (“GIP”), Creating a World Leading Infrastructure Private Markets Investment Platform – BlackRock website (BlackRock Agrees to Acquire Global Infrastructure Partners (“GIP”))

3) With the acquisition of IK Partners, Wendel initiates its development strategy in third-party asset management – Wendel website (With the acquisition of IK Partners, Wendel initiates its development strategy in third-party asset management - WendelGroup)

4) Private equity M&A set to whittle sector down to 100 ‘next generation’ firms – Financial Times

5) TPG to Acquire Angelo Gordon – TPG website (TPG to Acquire Angelo Gordon | TPG Inc.)

6) EQT combines with BPEA to capture growth opportunities in Asia – EQT website (EQT combines with BPEA to capture growth opportunities in Asia (eqtgroup.com))

7) Top 50 measured by capital raised in private equity, real estate, infrastructure, and private debt funds over the past decade – Source: Financial Times “Private equity is in for rampant consolidation” / Bain & Company

8) Top 50 measured by capital raised in private equity, real estate, infrastructure, and private debt funds over the past decade – Source: Financial Times “Private equity is in for rampant consolidation” / Bain & Company

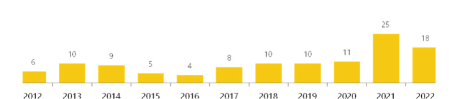

9) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

10) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

11) Is Strategic M&A Finally Catching On in Private Capital? – Bain & Company

12) TPG to Acquire Angelo Gordon – TPG website (TPG to Acquire Angelo Gordon | TPG Inc.)

13) EQT combines with BPEA to capture growth opportunities in Asia – EQT website (EQT combines with BPEA to capture growth opportunities in Asia (eqtgroup.com))

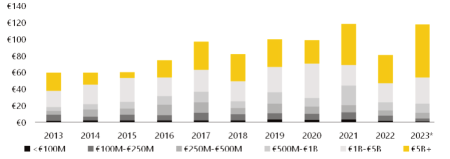

14) Pitchbook – 2023 Annual European PE Breakdown

15) Pitchbook – 2023 Annual European PE Breakdown