From an entrepreneurial point of view, Europe’s start-up environment is maturing. Since start-up teams can be dispersed, and venture capital is invested remotely, entrepreneurial ecosystems are becoming increasingly international and interconnected in nature. As a result of this new environment, it is more crucial than ever for Europe to embrace and promote entrepreneurship.

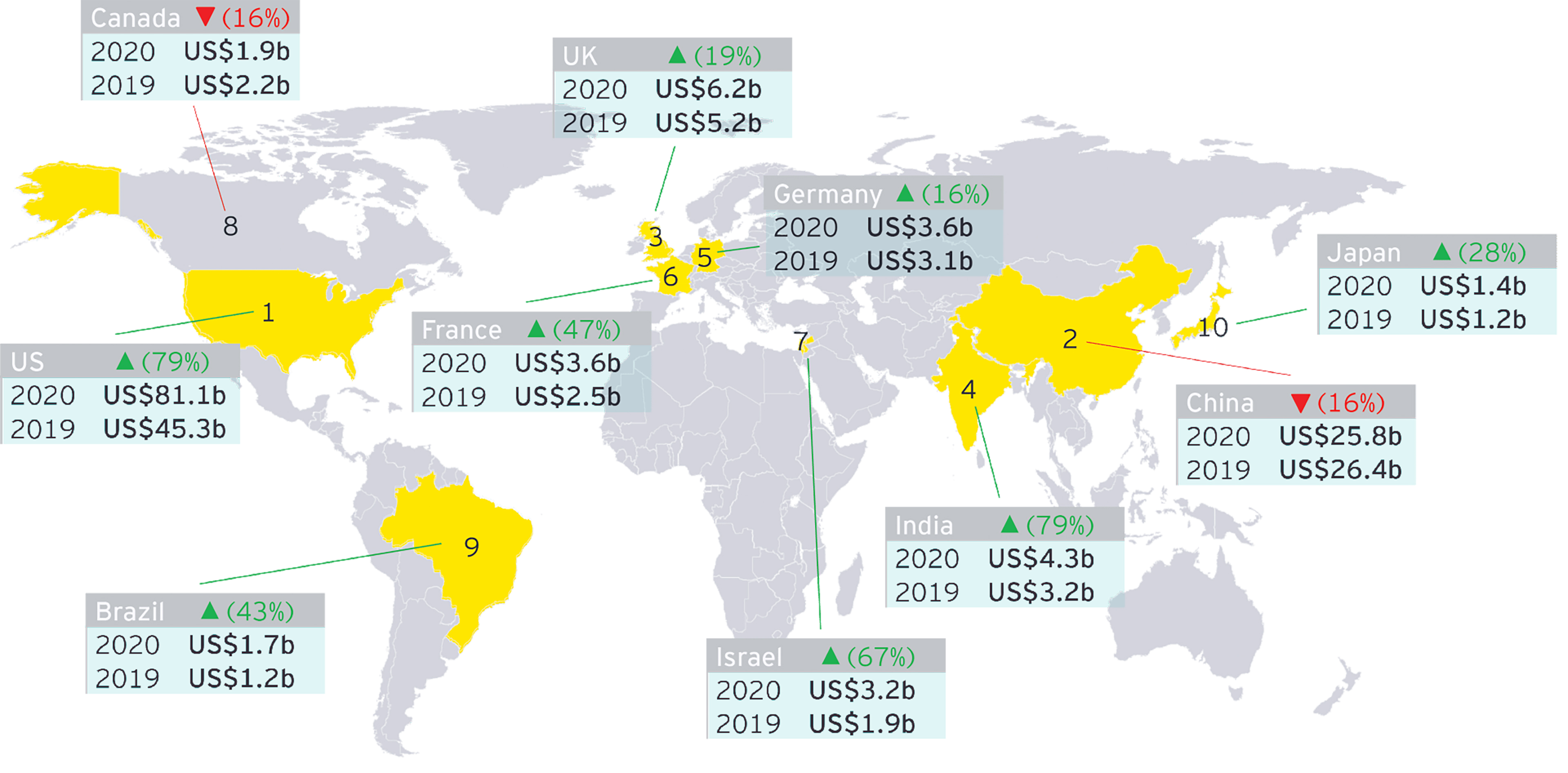

Innovation ecosystems and start-up hubs represent the combination of the actions of VC investors, companies, universities, and research centers, attracting entrepreneurs, investors, and talents. These European hubs are challenging classic tech hubs such as Silicon Valley and are attracting more and more investors. EU-Start-ups identified a list of the top start-up hubs based on data by Crunchbase and Dealroom, and lists London, Berlin and Paris as the top three destinations; in addition, the cities with the most growth in terms of number of unicorns since 2015 are Paris, Munich, Manchester, Stockholm, Amsterdam, Madrid and Berlin. From a global perspective, the top five global start-up ecosystems are Silicon Valley which maintains its #1 position, followed by New York, London, Bejing and Boston.

The impact on employment is significant: start-ups (most of which are backed by venture capital) represent about 1% of all European jobs today. Considering that venture capital has been around much longer in the United States, venture capital-backed companies account for 10% of all jobs in United States.

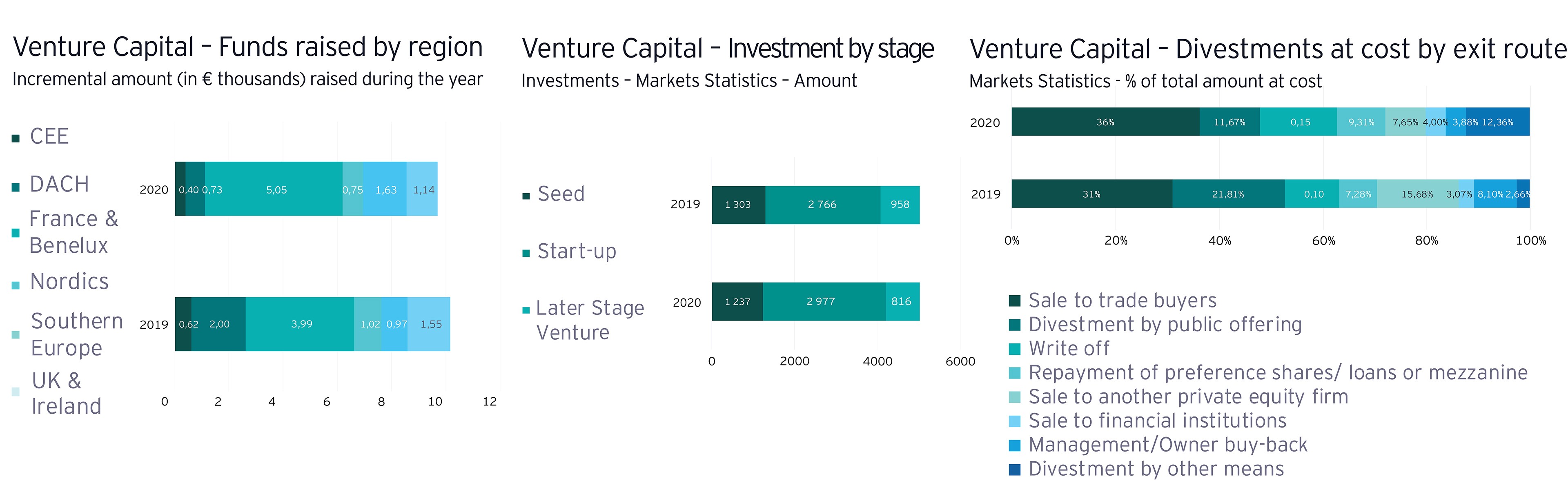

European VC is expected to continue its upward trend thanks to low interest rates, a significant amount of dry powder on the market, the two key sectors of technology and healthcare that have managed to grow significantly during the pandemic and also the emergence of unicorns and European hubs for innovation and start-ups.

Supporting start-ups

Although the Venture Capital industry had significant inflows of funds from investors over the past months and found new growth opportunities, various countries supported the start-ups with dedicated government support measures throughout the pandemic.

Since the global financial crisis, various government financing programs have made it easier for start-ups to get equity funding. For instance, the European Investment Fund and its sub-initiatives, such as the European Angels Fund, offer co-investment and technical advisory services. This has resulted in growing public support for VC firms, primarily through public funds co-investing with private actors and has already in the past supported VC funds in the fundraising phase.

In Europe, fiscal assistance has risen in a variety of ways. With the help of EU budget guarantees, the European Investment Fund was able to convince banks to lend liquidity, potentially providing at least €8 billion in investment to at least 100 000 start-ups and SMEs.

Certain nations have committed to co-investing equity in diverse forms. It is the case of the German government’s initiative to offer equity in the form of venture capital funding, which is planned to enable the continuation of financing rounds for new creative businesses in order to secure employment and innovation for the country. This scheme includes two things: a public venture capital umbrella fund, where investors will receive additional short-term public funds as co-investment for start-up financing rounds “corona matching facility”, and secondly simplified venture capital and equity substitutes for young start-ups and small SMEs that do not have VC firms among their shareholders.

In France the government has decided to launch a comprehensive plan which will benefit start-ups, providing them guarantees, accelerated tax credits, financing, and liquidity measures. Among them, the government together with the public investment bank Bpifrance have decided to dedicate 80 million euros to assist start-ups which were in the process of raising new funds or were ready to start a new fund-raising round; this package is available as a co-financing mechanism with private investors, bringing the total investment in the ecosystem to €160 million. Start-ups shall also be entitled to borrow as much as two years of payroll for employees based in France or 25% of annual revenues.

In the UK, the corona pandemic package for innovative businesses includes a £500 million investment named “Future Fund” for high-growth companies impacted by the crisis, made up of funding from the government and the private sector, as well as £750 million grants and loans fund for SMEs focusing on research and development.

Luxembourg, an attractive ecosystem for start-ups

Luxembourg is the home of approximately 500 start-ups; over the past years between 5-10 start-ups attracted a funding of more than €2 million annually from investors. The country invited start-ups to submit projects relating to the development of innovative, technological products and made available an amount of up to €150,000 per project. The program was widely accepted and received numerous applications from start-ups. Outside the context of the pandemic, the country supports the eco-system among others with the €150m Luxembourg Future Fund (LLF) that aims to stimulate the diversification and sustainable development of the national economy by attracting VC fund managers and early to later stage innovative businesses. Also, in 2020, an amount of 13.4 million euros was granted for financial aid for research and development projects (R&D) to 44 start-ups.

Overall, the efforts in the pandemic demonstrate a strong interest of many countries to support local start-ups, which is seen as a motor for growth and employment in the future. At the same time, the number of successful entrepreneurs increases who have a similar interest to invest in the eco-system and create a strong prosperity in the future.

The future of VC is brighter than it has ever been

Despite a slight reduction in VC fundraising activity in Europe during the pandemic in 2020, the overall trend is very positive as investment activity increased and numerous unicorns have been created. With Q3 2021 already underway, the future of VC is brighter than it has ever been. Globally, the pandemic has brought to light the significance of VC’s two key investment sectors, which are healthcare and technology; furthermore, the pipeline of new deals appears to be very solid. VC is an asset class that is widely accessible by institutional investors and enjoys high growth, but additionally countries understand the importance of start-ups for the future and have dedicated support measures to help them through the pandemic.

This article was published in AGEFI Luxembourg.