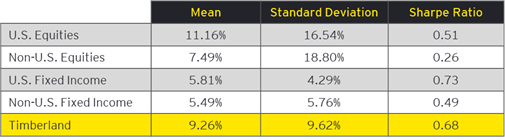

In comparison, US fixed income had an average return of 5.81%, non-US fixed income had an average return of 5.49%, US equities had an average return of 11.16%, and non-US equities had an average return of 7.5%. Despite US equities performing better, they also had a higher level of volatility compared to timber.

Investing in timber and forestry can also have positive environmental impacts. Sustainable forest management practices can help reduce the impact of deforestation, promote biodiversity and protect ecosystems. Furthermore, trees absorb carbon dioxide from the atmosphere, helping to reduce greenhouse gas emissions and mitigate climate change. Most timber and forestry investment funds are focused on sustainable forestry practices and responsible land management. The areas of value creation within forestry assets have been crystalizing over the past years; examples of which include the generation of carbon credits or the development of the land for windparks.

Another benefit of investing in timber and forestry is the potential for diversification. According to research by Nuveen in 2021, private investments in illiquid real assets such as timberland and farmland have demonstrated low or negative correlations with equities and fixed income, providing resilience and diversification from uncorrelated market exposure. One of the reasons for this lack of correlation is the portion of the investment return generated through biological growth, which is independent of market movements. Additionally, payments for ecosystem services such as carbon credits provide another source of uncorrelated returns that have the potential to improve the diversification benefits of timberland investments.

Navigating the risks of forestry funds: what investors need to know

While forestry funds offer the potential for long-term growth and diversification, they also carry significant risks that investors must consider before committing capital.

From an asset perspective, one of the primary risks is the potential for natural disasters, such as wildfires, droughts or storms, to damage or destroy forests. While insurance can provide some protection against these risks, it typically does not cover the full value of the lost timber. Concerns regarding deforestation, illegal logging and land rights disputes have raised questions about the sustainability of some forestry investments. Investors are urged to conduct thorough due diligence and engage with reputable fund managers that adhere to internationally recognized standards, such as the Forest Stewardship Council (FSC) and Programme for the Endorsement of Forest Certification (PEFC).

Another risk of investing in timber and forestry is the potential for changes in government regulations or policies to affect the industry. Similarly, changes in trade policies or tariffs could affect demand for wood products, potentially reducing return on investment. As with any investment, forestry funds carry their own set of risks, including currency risks and costs. The majority of the world's forest-rich countries are located overseas, including Russia, Brazil, Canada, the US and China. This means that investors in forestry funds must be prepared to deal with potential currency fluctuations and foreign transaction fees.

Regarding the funds themselves, one of the most significant disadvantages/risks is illiquidity. Timber investments are still quite an uncommon asset, therefore the market doesn't guarantee a rapid sale – and even pooling investments with others in forestry funds does not necessarily solve this problem. Typical lock-in periods for forestry funds can be 10 years or more, making them illiquid investments that require a long-term investment horizon. In addition to illiquidity, income from forestry investments can be unpredictable. Forestry provides income when the trees are harvested, but when the timber price falls, it is common to delay harvesting, resulting in a halt to that income. Growth can also take years, and investors need to be patient and willing to incur costs while waiting for their trees to grow.

Valuing forestry investments can be challenging, as the timber price is notoriously volatile and data on the industry can be opaque and infrequent. Forestry valuations are therefore complex and require careful consideration of a range of factors, such as soil quality, climate and the maturity of the trees.

The future of forestry funds

Sustainability as we know it today has been defined by forestry. It was first mentioned in the 17th century by Hans Carl von Carlowitz who managed the natural resources of forests in a long-term responsible way by only harvesting the amount of timber that the forest could regrow. Intergenerational management of forests is key in the long-term success of this asset class. After all, we will not be the ones harvesting what we plant today. For long-term investors, who are looking for stable long-term returns paired with low volatility and the benefit of an investment opportunity with a positive environmental impact, forestry is a great addition to any portfolio.

With the Sustainable Finance Disclosure Regulation's (SFDR) stricter implementation since the start of 2023, timing favors the forestry fund sector, providing an opportunity to demonstrate their dedication to responsible forestry practices and Co2 savings. By disclosing their environmental, social, and governance (ESG) characteristics and carbon footprint, forestry funds can distinguish themselves in a crowded investment landscape. As such, forestry fund managers should view the SFDR as a chance to demonstrate their commitment and attract new investors, as sustainability becomes a standard requirement.

The outlook for forestry funds remains optimistic – as the world grapples with the devastating effects of climate change, the need for sustainable and renewable resources will only increase. With their dual benefits of attractive financial returns and positive environmental impacts, forestry funds are well-positioned to become a crucial component of the global investment landscape in the coming years. In a changing market, forestry funds have the potential to move from a niche investment category to a mainstream one.