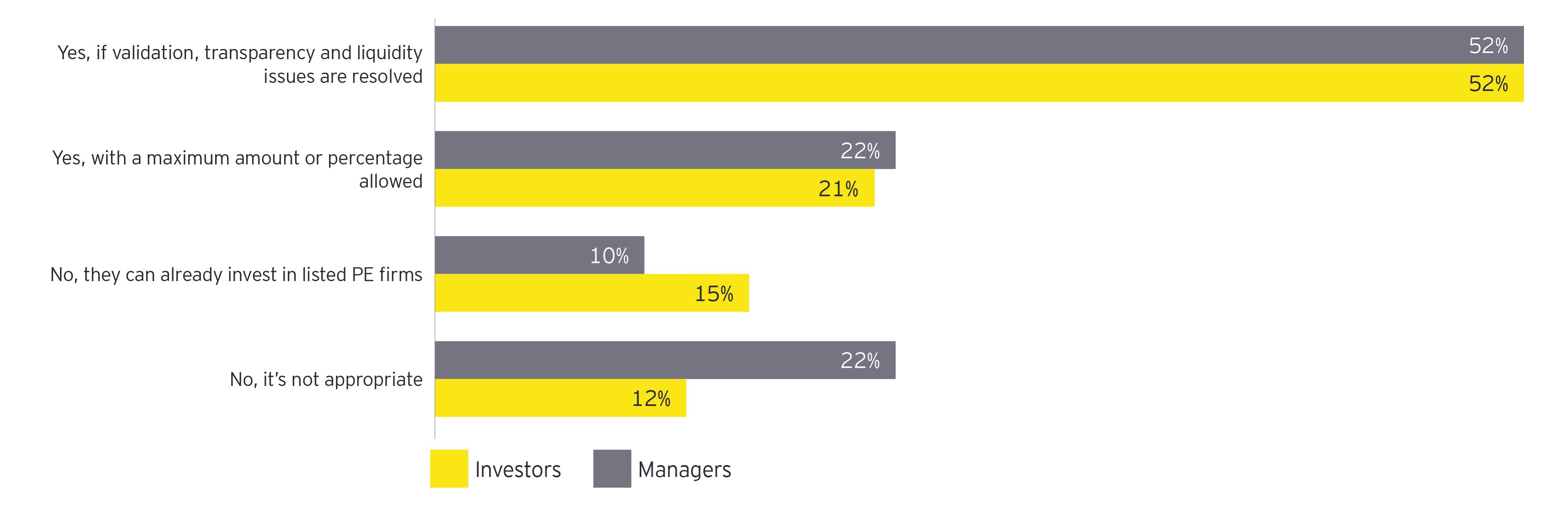

Source: 2021 SEI survey of 400+ fund managers and investors and EY

The reasons behind this growing appetite can be explained by the same drivers that have driven professional investors a few decades ago: the resilience of the asset class, the diversification of their overall asset allocation or the historical outperformance of the strategy in a context of volatility of the public markets. For retail investors, the trend is further reinforced by the recent rise of the real estate markets, the growing wealth of certain segments of the retail investors and the willingness to invest side-by-side with professional investors sometimes described as the ‘smart investors’. Lastly, the new generation of investors are also keen to see the impact of their investments in the real economy which Private Equity strategies addresses in concrete terms.

Policymakers and regulators are addressing the opening of private markets

As a result of the rising demand from retail investors, authorities are increasingly pushing to open private equity products to retail investors to stimulate capital growth and meet industry demand. In North America, the Securities and Exchange Commission (SEC) is consulting on this matter. Amendments to widen the scope of the 'accredited investor' definition were implemented in 2020. An important number of fund managers have already launched specialized retail programs with billions of dollars under management.

In Europe, the European Long-Term Investment Fund (ELTIF) was introduced in 2015. It was designed to gather the institutional and retail investor community and allows them to invest in long-term assets, including infrastructure and debt instruments. Other benefits are the initial minimum investment which starts as low as €10,000 as well as the benefit of the EU passport for a pan-European retail distribution.

While addressing the constraints for retail distribution, this first version of the ELTIF nevertheless had a modest success with only 57 products2 launched across four jurisdictions, namely Italy, France, Spain and Luxembourg. The reason of this mixed outcome can be explained by the lack of flexibility in terms of investment rules, including the eligibility of the underlying assets, the diversification requirements, the concentration limits as well as the possibility to leverage the product which made the product hardly investable for retail investors. It is for example not possible to offer a fund of funds strategy, although this strategy is very relevant for retail investors who seek for diversification with a limited wealth.

Late November 2021, the European Commission unveiled its proposal to amend the first version of ELTIF (ELTIF 2) which will greatly improve the flexibility of the vehicle in terms of eligible assets, portfolio composition, distribution and authorization. The draft regulation also introduces optional liquidity windows that Fund managers can create for investors.

The revamped regulation has been unanimously welcomed by the asset management community and is seen as the missing piece of regulation that bridges the gap between the AIFM regulation (distribution of AIF to professional investors) and the UCITS regulation (distribution of non-AIF to retail investors). In a nutshell, it opens the door to retail distribution of Private Equity strategies.

Private equity Fintech platforms accelerate the transformation

In parallel to the change in regulation, recent years have seen the rise of new technology-driven players that are overcoming the main bottlenecks for investing in private equity. Their technology allows to access private markets via digital platforms, significantly broadening the investors population and increasing the transparency of the asset class.

A first category of Fintech’s offers high net worth investors, qualifying as professional investors, the possibility to invest on their own thanks to master-feeder structures on digital platforms, reducing the "transaction and search costs" associated with finding a suitable investment and increasing the overall level of transparency of the industry.

Others deliver a "plug-and-play" technological solution to traditional wealth management institutions willing to expand their offering of private equity funds to their clients. Their solution manages end-to-end operations and allows to address the appetite of their clients while limiting the change of their own operating model and reducing their time to market on this segment.

Lastly, as more and more retail investors are entering the market, other platforms are striving to address a major hurdle for retail investors: the issue of illiquidity. They offer a secondary market that allows to buy and sell private funds.

These innovations are comparable to the “neo-banks” in the universe of traditional retail banking and are a breakthrough in the industry where intermediation has been the norm for decades.

Listed private equity and the rise of open-ended private equity funds

While a close-ended limited partnership has been the norm to access private equity in the past, a recent trend is the creation by a selection stock exchanges of specific compartments to list closed-ended funds. In Europe, Euronext and the Luxembourg Stock Exchange offer access for professional investors to such regulated market, dedicated to closed-end funds.

Globally there are over 200 private equity vehicles that trade on recognized financial exchanges3. Tomorrow, the combination of this offering and the revamping of the ELTIF regulation may be an incredible accelerator to this segment as it brings liquidity to the product, lowers the entrance barrier and increase transparency and governance to investors.

Another growing trend is the emergence of “evergreen” open-ended private equity funds launched by Tier 1 private equity firms. These products do not have a specific term, implying that there is no deadline for liquidating the fund: open-ended funds raise, invest, harvest, and distribute capital perpetually.

Similar to listed products, the model addresses the challenges of liquidity for investors on one hand while the asset managers can adopt a long-term horizon when investing on the other hand, sometimes accompanying companies over several decades.

Such products nevertheless also have their limits. The first one is the “asset-liability management” at the level of the fund to allow redemptions to happen on a timely basis when requested by investors. This necessarily requires implementing revolving facility and/or to keep some level of cash on the balance sheet of the fund at the expense of the investors. The second risk relates to the determination of the redemption price considering that significant judgment is applied when valuing the assets as a result of the absence of market data. Such risk may lead to inequal treatments between investors, a risk which does not exist in the closed-ended world.

Wealth Management is ready to redirect capital

In this dynamic context, wealth management institutions and boutiques have a key role to play as they are owning the relationship with investors. Many of them have already strengthened their teams by acquiring portfolio and risk management talents from the industry, adapting their operating model, or partnering with fintech platforms and consultants to build appropriate solutions.

Evolving regulation, proven demand, and ongoing innovations both at products and distributor’s level: all ingredients for the perfect take-off of the retail distribution of private market strategies.

[1] 2021 SEI survey of 400+ fund managers and investors and EY

[2] European Securities and Markets Authority (ESMA) data, 2021

[3] Edison –

Listed private capital report

This article was originally published on Agefi.