Rebalance, recharge and communicate

Overall, 68% of life sciences CFOs say it’s time to rebalance the company portfolio to focus on their core business, with 47% saying there is an opportunity to recharge or reinvent through M&A.

Communicating a consistent message to key stakeholders about the long-term strategy and how capital allocation decisions support that strategy is essential to prepare stakeholders for the impact of any capital investments. For life sciences CFOs, suppliers were the most likely stakeholders to be addressed (named by 60% vs 52% across industries). Life sciences companies need to discuss demand and supply planning, procurement, distribution, and inventory plans with suppliers so that they can be aligned with how the company plans to meet its goals, especially as supply chains are revamped.

Employees are another key constituency but named less frequently by life sciences CFOs (58%) than by those across industries (69%). This could be an area of opportunity, as people and corporate culture are key elements of strong capital allocation strategy that instills personal accountability, involves partners or other influential leaders so new assets are integrated into the larger business, empowers project owners and develops an organization-wide definition of “winning.” This is even more essential as companies transform their business models, which can create uncertainty for employees.

Bringing qualitative KPIs to the decision-making table

As in all industries, life sciences CFOs are well aware of financial KPIs, such as growth rate, R&D spending, free cash flow and return on invested capital. But aside from supporting financial value, KPIs should also be used to reflect patient value (such as the impact of certain treatments), customer value (such as satisfaction and loyalty), people value (such as employee engagement and diversity and inclusion) and societal value (such as carbon footprint and ethics).

Some of these are reflected by KPIs considered by the majority of life sciences companies, including safety and regulatory requirements (76%) and workforce impact (61%). Environmental impact (37%) and social impact (21%) are less frequently cited in life sciences capital allocation decisions but may need to be factored in more as environmental, social and governance (ESG) criteria become higher priorities for regulators, lawmakers and investors. In fact, the majority of life sciences CFOs say impact on sustainability (65%) and impact on diversity or social goals (61%) have become more important factors in their capital allocation process over the past year. KPIs should also be reviewed regularly, and those that did not lead to long-term value investments may be discarded for new metrics that more closely align with the current strategy.

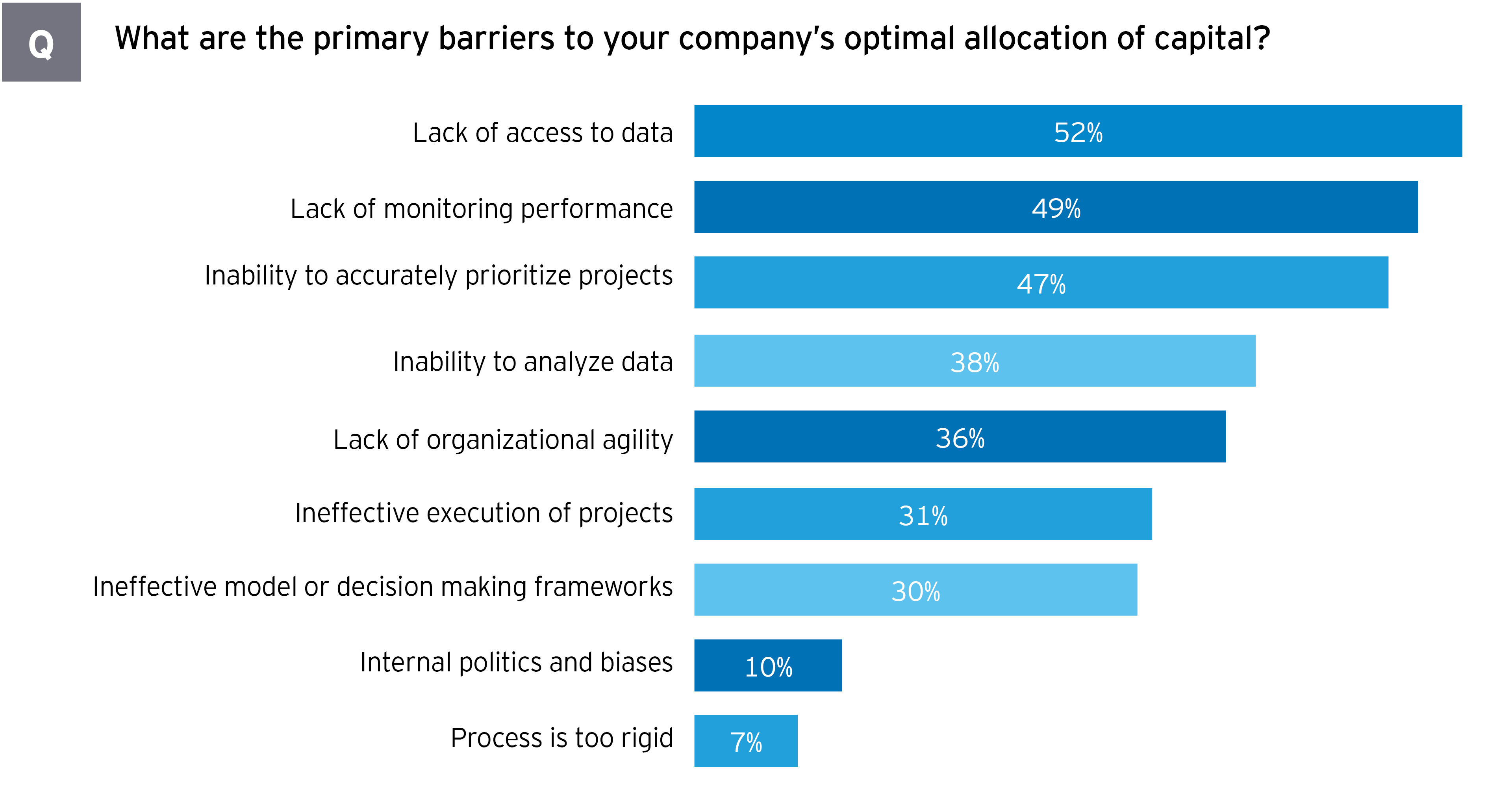

In order to weigh qualitative KPIs on equal footing with quantitative metrics, life sciences companies may consider employing a balanced scorecard approach that can weigh both qualitative and quantitative factors and provide for an objective analysis of investment opportunities. Analytical tools and technologies improve the effectiveness as your capital allocation process by allowing you to:

- Perform look-back analyses to assess the quantitative and qualitative assumptions versus actual performance

- Develop a central repository for relevant historical and current data

- Define and measure KPIs consistently

- Create robust analyses that include various scenarios

- Update and monitor performance using real-time data

- Provide key stakeholders consistent information in a useful format

A holistic approach to capital allocation

It’s clear that life sciences CFOs think they need to take a new approach to capital allocation. They need to look beyond the bottom line and take a holistic view of how capital allocation decisions bring long-term value to all stakeholders, not just shareholders.

A process that aligns with the company’s post-pandemic strategy, brings rigor that allows for consistent decisions across the organization and weighs qualitative KPIs on a scorecard with quantitative metrics can help the capital allocation process support long-term growth.

Paul D’Arezzo, Navneet Dagar, Shivam Jaitly and Anil Sharma of Ernst & Young LLP contributed to this article.