Trends in Saudi Arabia’s private education sector

Saudi Arabia’s privatization update

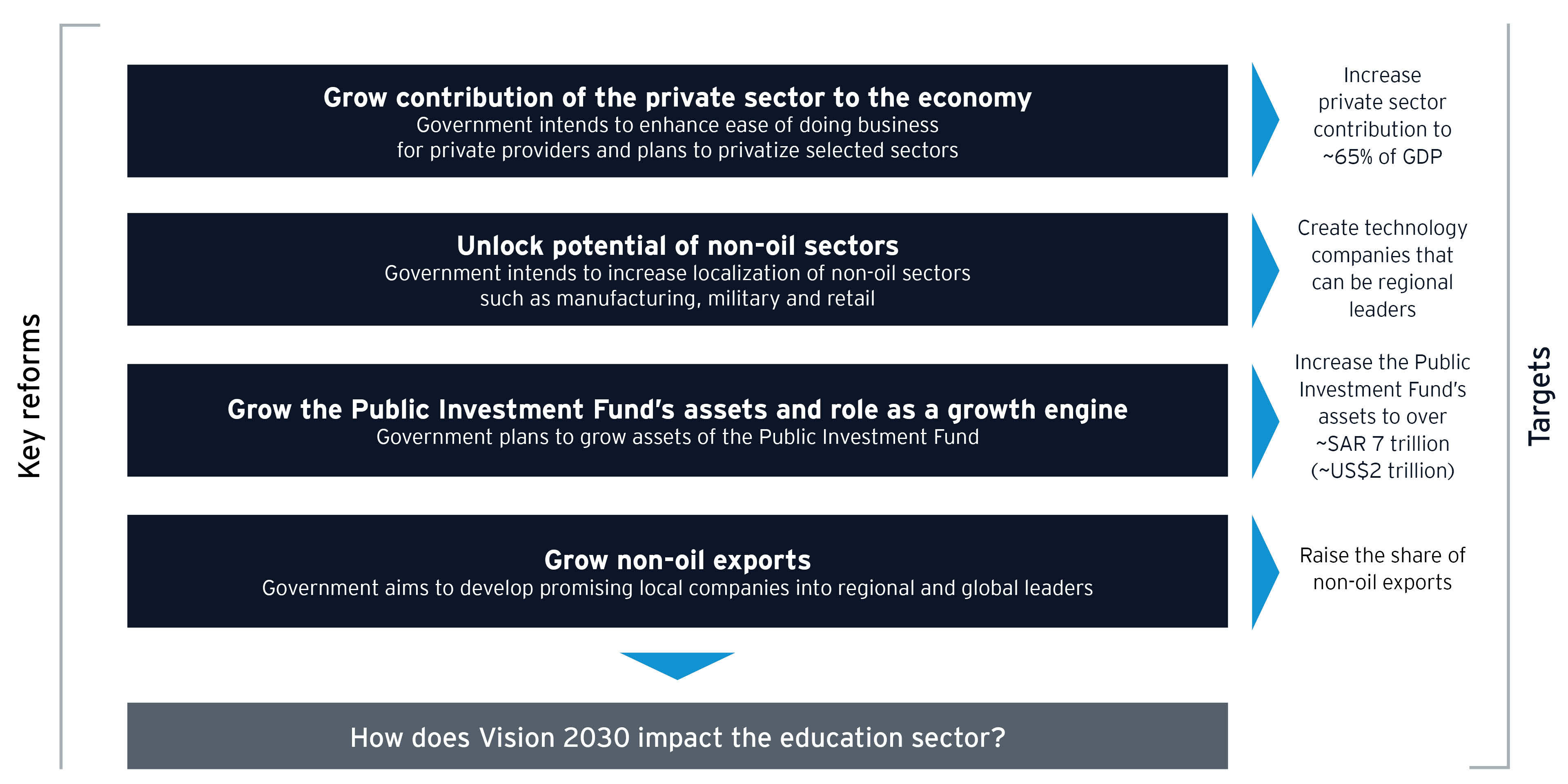

The Saudi government established the National Centre for Privatization (NCP) in 2016 to promote privatization initiatives across sectors. Education represents 1 of 10 target sectors. The aim of privatization in education is twofold: (i) reduce fiscal and operational dependence on the public sector and (ii) enhance learning outcomes. Core public-private partnerships in education include the construction and maintenance of new public schools by private partners and the transfer of operational and financial responsibility of some public schools to private companies.

So far, the NCP has announced initiatives primarily in the K-12 segment, but tenders to the private sector are expected in other segments, including early childhood education as well as higher and technical and vocational education.

Importance of local partners

Even as the market opens to allow 100% foreign ownership in education, local partnerships continue to be relevant. For example, navigating regulations and processes on establishment, operations and recruitment are easier through a local partnership. GEMS Education acquired Saudi Arabia’s largest private school operator, Ma’arif (officially called Ma’arif for Education and Training) in May 2019 through a joint venture with Hassana Investment. GEMS Education is a large chain, with ~100⁴ schools globally, of which 47 schools are in the MENA region⁵ and Hassana Investment is an investment arm of the Saudi Arabia government. Together, they plan to invest $800 million⁶ over the next decade to build and operate schools.

Enrollment growth in private schools

The private sector’s share in education (14%⁷ in 2018) has historically been the lowest in Saudi Arabia compared to its GCC peers. In recent years, however, the private sector has grown faster than the public sector at a CAGR of 3% between 2015 and 2018.

Saudi Arabia’s government is supporting efforts to increase the attractiveness of private K-12 schools for Saudi nationals. For example, Saudi students have the option to attend private schools offering international curricula. As a result, private schools that predominantly enrolled international students are now also attracting local students.

Popularity of international curriculum schools

Within Saudi Arabia, American curriculum schools (schools with curriculum based on US national standards, including Common Core, Next Generation Science Standards, National Core Arts Standards, C3 and AERO Common Core Plus), have been the most popular choice. In 2018, ~50%⁸ of international enrollment was concentrated in schools offering American curriculum.

Changes in tertiary education

Similar to K-12, tertiary education has also seen growth in private sector provision, but continues to be dominated by the public sector. Although Saudi Arabia has a high share of working age population (ages 25-54) with formal tertiary education qualification, a larger share of the labor force with advanced degrees in Saudi Arabia remains unemployed.

Lack of existing private universities

Based on EY-Parthenon analysis, the Saudi higher education market is estimated to enroll ~2.1 million students in the year 2022. Current supply is insufficient to meet this demand and will translate into an unmet demand of ~150k seats by 2022.

Rollback of government-funded scholarships

Recently announced cutbacks in overseas scholarships tie in with Saudi Arabia’s overall mandate to reduce public education spend. The scholarship is now restricted to students who are accepted to the world’s top 50 academic programs in their field, or the world’s top 100 universities.⁹