The OPay and PalmPay fundings occurred within the same week and dwarfed most previous investment in African FinTech. The main driver for the influx in investment is the decision by Nigeria’s central bank to open up the market to non-bank providers. The opportunity on the offer is gigantic – 95% of transactions in Nigeria are currently cash-based and 60% of adults are without bank accounts.5 Across SSA, the potential is similarly huge. According to the International Monetary Fund, only 43% of adults in the region had either a bank or mobile money account in 2017. With the mobile money market set to surge, understanding the value chain, business models and stages of market development can help potential investors make the most of the opportunity.

Understanding a complex value chain can help identify investment potential

The traditional mobile money value chain has five parts, which can be covered by banks, mobile network operators (MNOs) or third parties, such as FinTechs:

- Deposit holder: Mobile money customers exchange cash for mobile money credits. The deposit holder holds this cash, in a tightly regulated part of the value chain usually handled by banks.

- Electronic money issuer: The electronic money issuer issues customers mobile money credits in exchange for cash. These businesses must guarantee they will always have enough liquid funds to pay out customers that might decide to redeem their credits for cash. Usually a license is required for this heavily regulated part of the value chain.

- Agent network operator: This player recruits, trains and manages the agents who handle customers’ transactions. These agents are often small retailers or postal outlets best positioned to target unbanked and often rurally-based customers.

- Payment service provider: These companies provide the technical and commercial infrastructure used by merchants and agents to process transactions. They are only required in a B2C context, not in the typical P2P transactions.

- Telecom network provider: The telecom network provides the communications infrastructure which hosts the technical and commercial infrastructure.

These functions can be covered by different providers, as we see in the prevalence of several mobile money operating models.

- Bank-led: The bank covers all functions except for those of the telecom channel. This model, as employed by Nigeria’s EcoBank, is similar to that of mobile banking, with mobile money markets relying on existing bank branches and affiliated agents.

- Mobile network operator-led: Nigeria’s reforms have opened the doors to many new mobile money services, including those run by MNOs which rely on local agents, such as stores or post offices, to spread their services.6 The success of MNO-led schemes lies in having a large network of agents in rural areas which are often home to large unbanked populations.

An example of this model is Kenya’s Safaricom, which covers every part of the chain except holding deposits, which is done by the Kenyan central bank.

- FinTech-led: In this model, demonstrated by Uganda’s Micropay, the Mobile Money Operator (MMO) does not hold deposits or provide the telecom channel – but, it does everything else. These MMOs act as a platform where partners offer various value-added services, such as financial products, airtime, data or voice packages. This model is becoming more prevalent and we’re seeing providers that begin with other business models transition to platforms once they have a strong customer base.

Mobile money markets are at varying stages of development

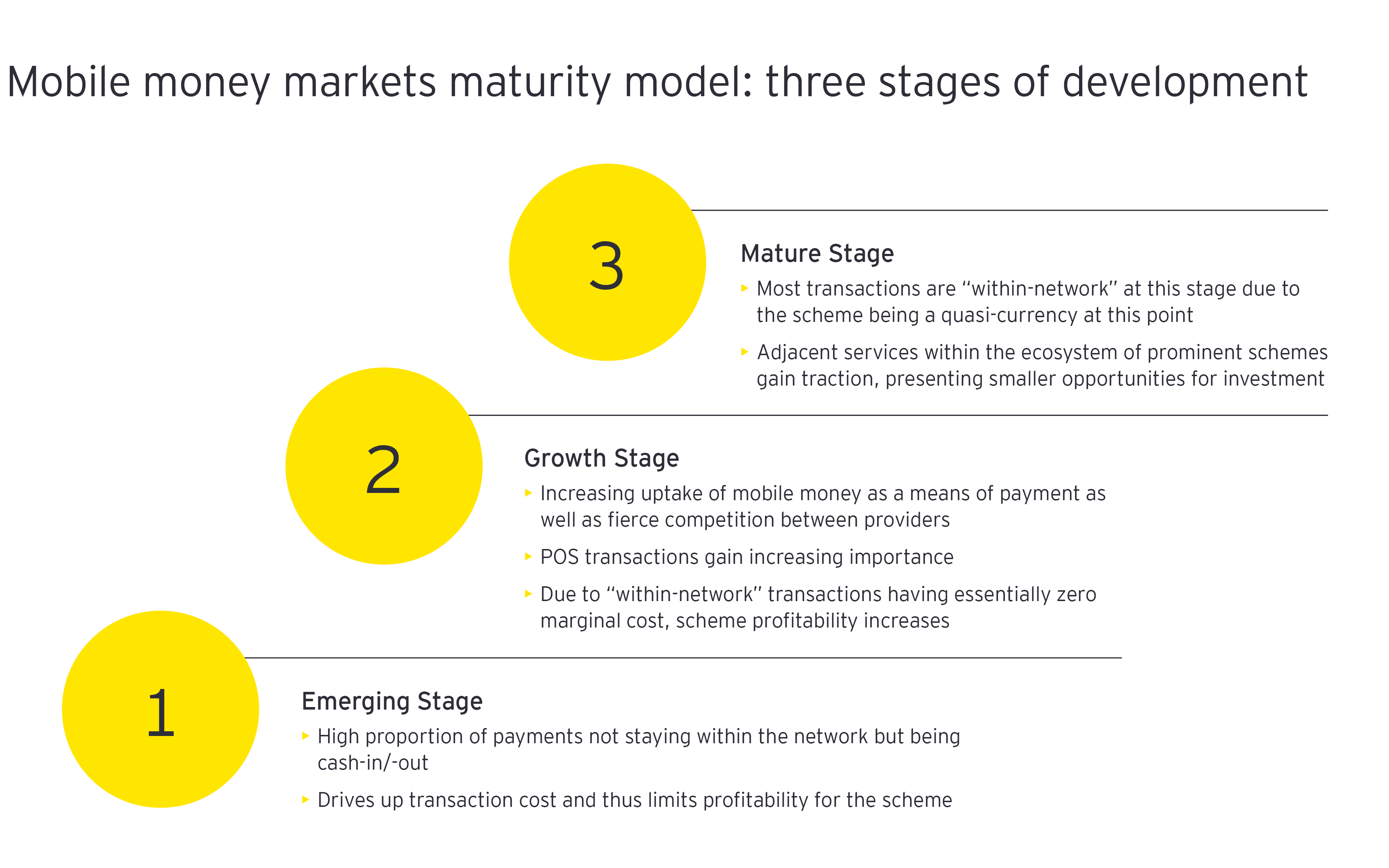

These business models are constantly evolving in what is a dynamic environment. Three stages of development across the SSA MMO market can help potential investors determine an appropriate entry strategy:

Emerging

In regions where mobile money is still in the early stages – for example, in Cote d’Ivoire and Senegal – the market tends to be characterized by a high proportion of cash in or cash out payments that always involve an agent, driving up the cost per transaction for providers and limiting a scheme’s profitability.

Investors that move into these markets will need deep local knowledge to understand how to drive customer adoption, be prepared to take risks and have deep pockets to support losses during the first phase. Players with this combination of characteristics may include local banks, telcos and well-funded startups. Others may be challenged and should reconsider investment in this environment, or at least seek local expertise before making a move.

Growth

Markets in the growth stage, such as Mozambique, experience fast consumer adoption and increasing competition between providers. At this point, the share of transactions within a scheme typically grows, increasing its profitability as transactions in the same network have essentially zero marginal cost.

Investing in schemes at this stage, and within large addressable markets, can yield large returns, but choosing the right scheme can be challenging. Investors will need to have a strong knowledge of market characteristics as well as an appetite for risk.

Mature

Kenya is the best example of a mature mobile money market. Here, penetration is above 100% due to many customers holding multiple SIM cards. M-Pesa controls more than 80% of the Kenyan market, showcasing the “winner takes all” dynamics of mobile money. High adoption of the scheme sees it morph into a quasi-currency, and most transactions are “within-network.” Adjacent services within the ecosystem of prominent schemes gain traction, presenting smaller opportunities for investment. Start-ups can use existing infrastructure – for example, remittance providers can offer mobile money payouts or interoperability across schemes, e.g. smoothly transferring money from Orange to M-Pesa.

Investment into schemes at this point is not always possible but, if so, is usually a more conservative play, with modern risk and return prospects.