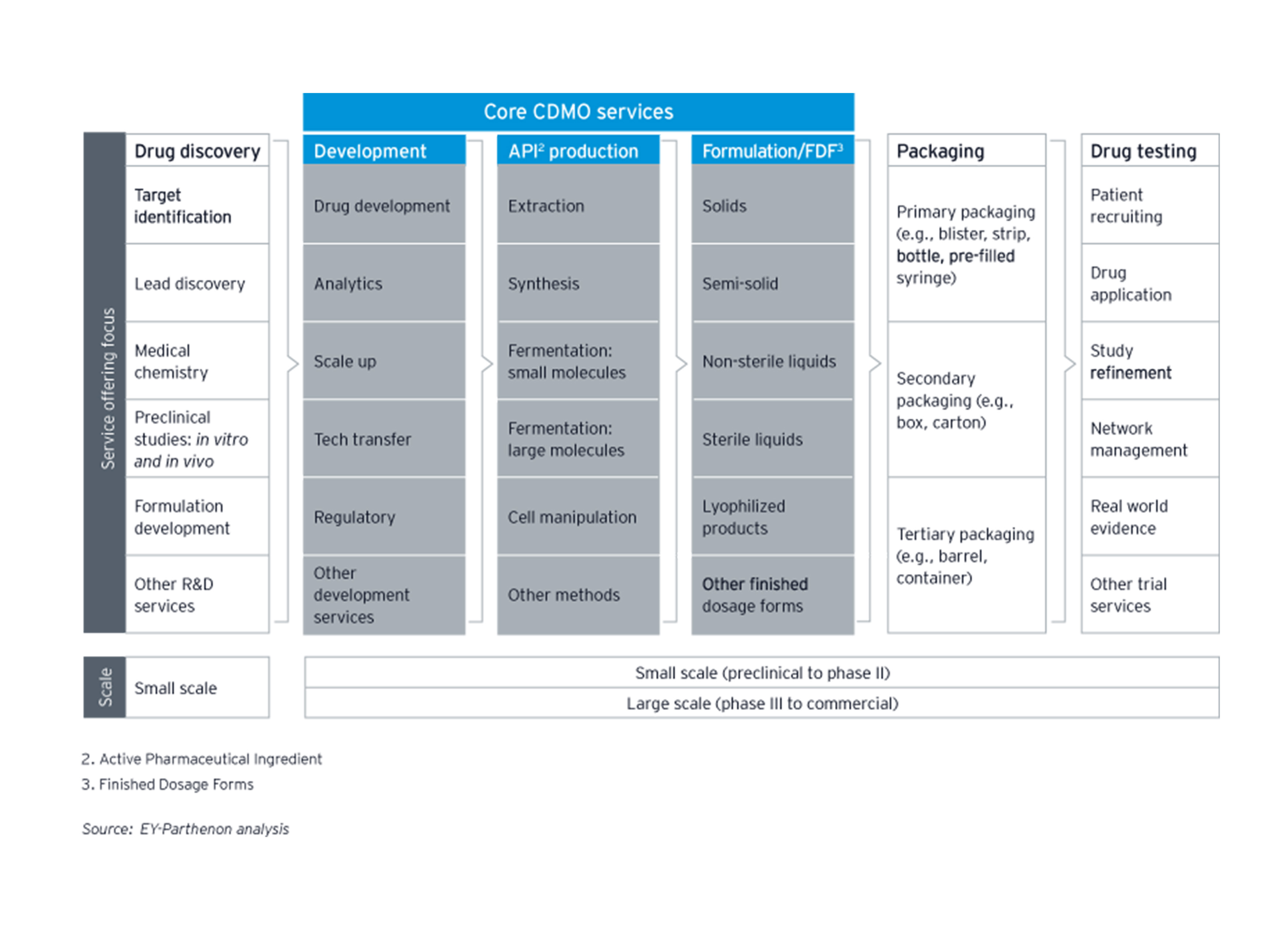

As flexible third-party service providers, CDMOs support pharmaceutical companies at all stages of the process of making medicines: by providing services in the research and development stages, by offering support in manufacturing, and by providing formulating and finishing processes. CDMOs have been on the rise in the last decade, with an increasingly dynamic mergers and acquisition (M&A) landscape driven by consolidation.

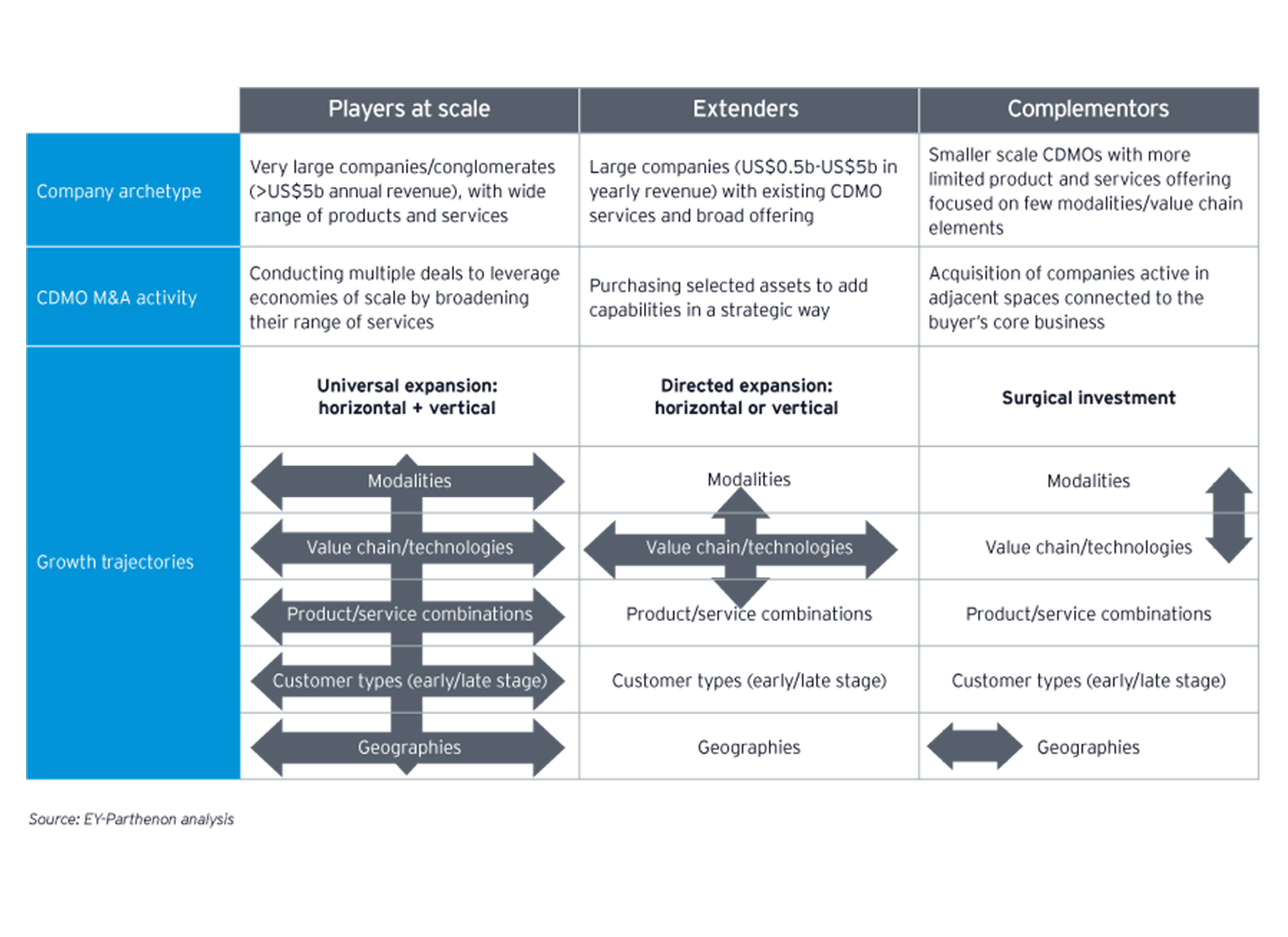

As indicated by EY research, in the period from 2017 to 2021, 244 publicly announced M&A transactions involved CDMOs. EY teams analyzed these transactions, and also reviewed 92 publicly announced internal investments of 15 selected global CDMOs, to create an integrated perspective on the CDMOs M&A landscape. In line with our previous analysis focusing on the period from 2012 to 2016I, this latest assessment reveals ongoing consolidation in the market. However, new developments are likely to continually change the position of CDMOs.

CDMOs are shifting their business model in response to a changing environment

Historically, CDMOs operated on a business model which predominantly focused on serving as external service providers for manufacturing mature pharmaceuticals. This model included the addition of capacity by the acquisition of manufacturing facilities from pharmaceutical companies. However, CDMOs have increasingly become leaders of innovation and are covering more areas of the pharmaceutical business, not only manufacturing; adding additional revenue streams. Through acquisitions, CDMOs can rapidly expand their capabilities and, thus, are able to deliver technically advanced services at scale.

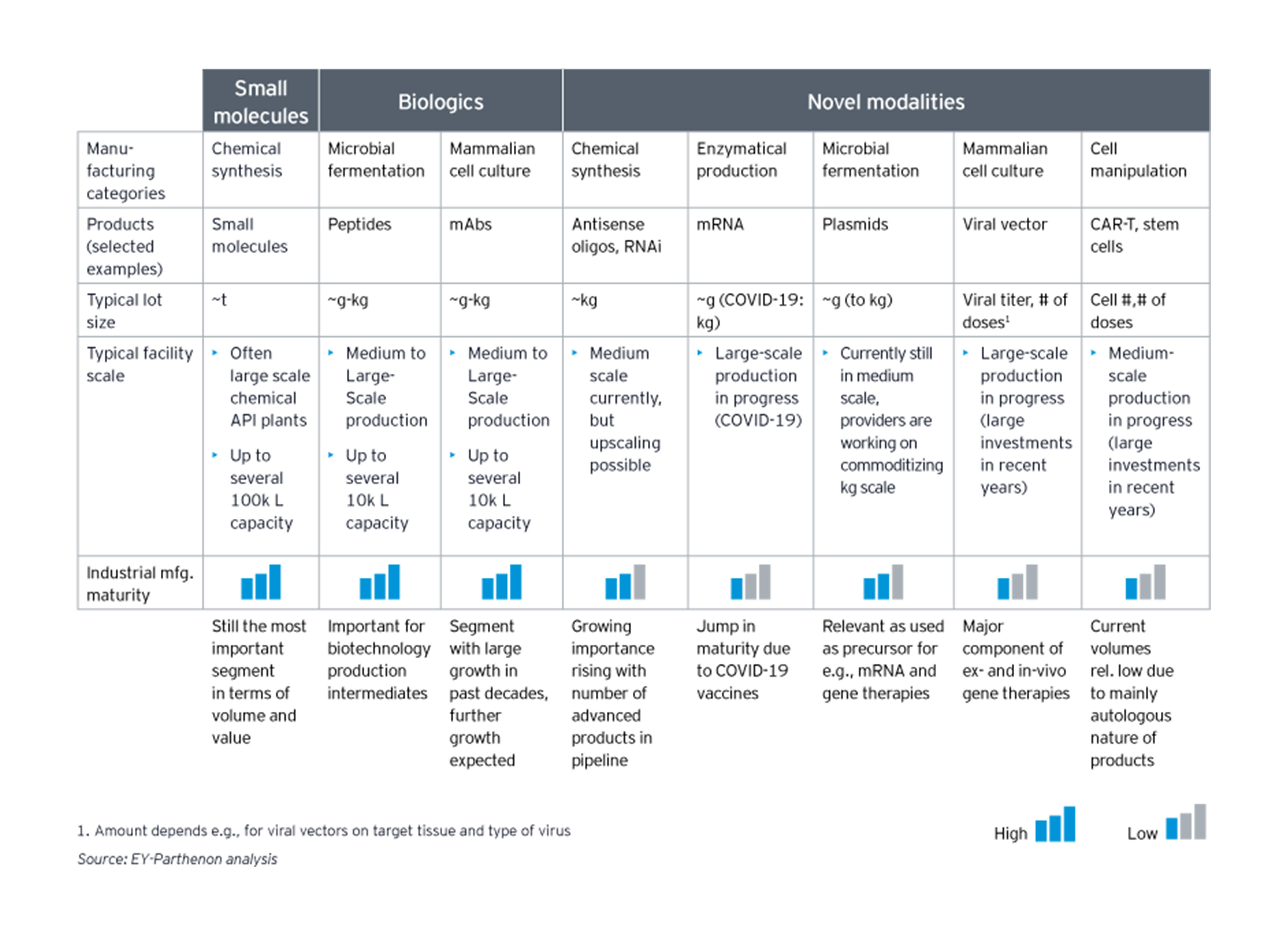

This change of focus has been accompanied by a change in the M&A landscape in the market. For example, the rise of novel modalities (such as cell therapies, gene therapies or mRNA therapies) and innovative vaccines in the last decade has required a significant investment in new additional manufacturing capabilities for viral vectors, cell manipulation, as well as nucleic acids and lipid-based formulations. Well-positioned CDMOs have been able to flexibly alter their production lines to meet the increasing demand of smaller, more diverse projects. New partnerships have arisen that further enable CDMO players to fuel the rapid growth of capacities and capabilities, helping the industry to succeed in ramping up in areas such as vaccine production.