Chapter 1

The global opportunity

Why financial inclusion is a growth opportunity for banks.

EY research into financial inclusion demonstrates sizable economic benefits for emerging economies and strong upside for banks. As technological advances dramatically reduce the cost of serving these unbanked and underbanked segments, banks can help propel rapid expansion and development of high-potential economies, while profitably growing their own customer and revenue base.

Specifically, our research shows that financial inclusion can:

- Boost GDP by up to 14% in large developing economies such as India and up to 30% in frontier markets such as Kenya

- Increase banking revenues by US$200 billion (equivalent to 20% of emerging market banks’ 2016 revenue) in 60 countries

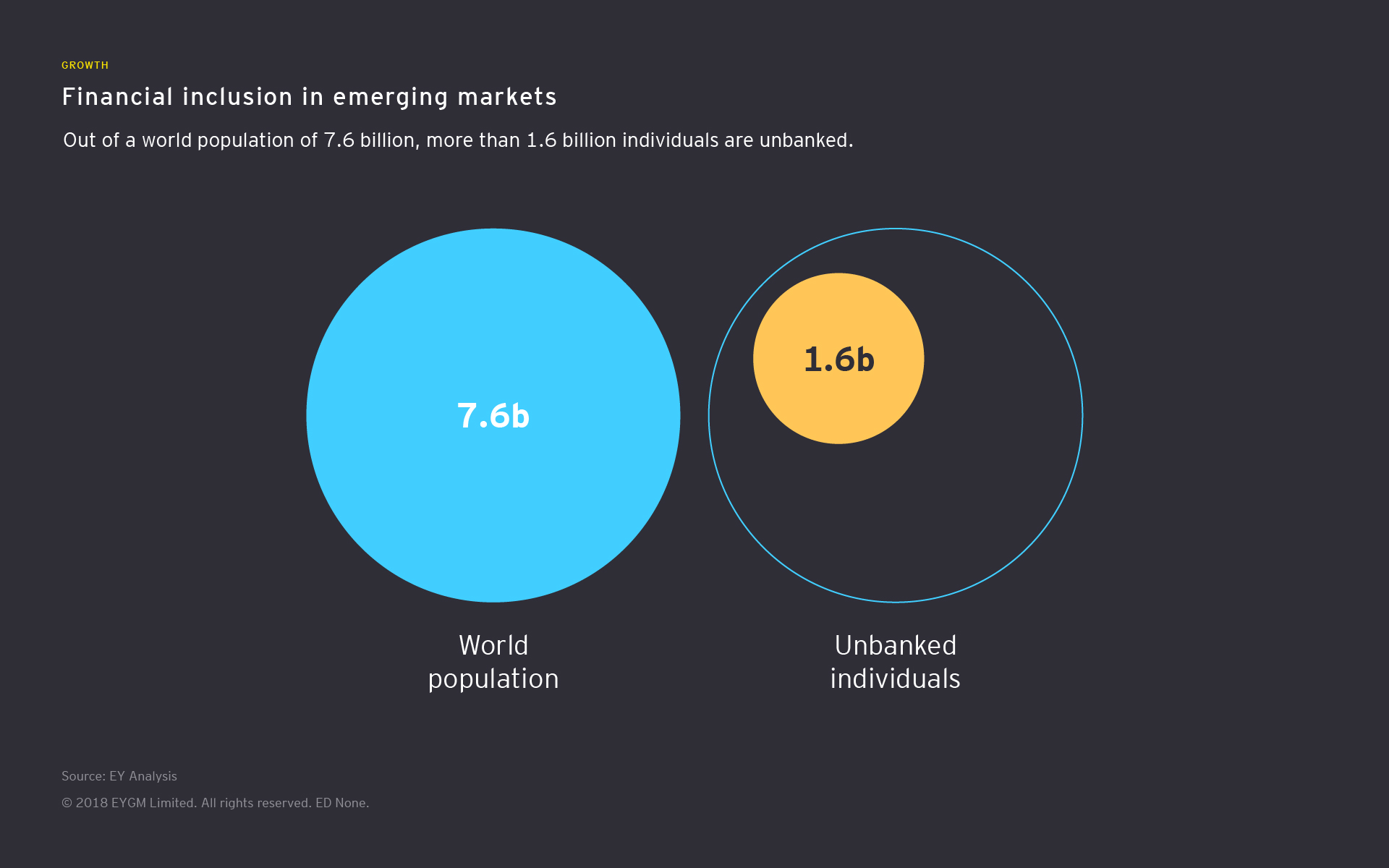

The scope of the opportunity correlates to the massive number of people and businesses that remain excluded from traditional banking systems: more than 1.6 billion individuals worldwide, out of a total population of 7.6 billion. Approximately 75% of these individuals are clustered in just 25 countries.

Similarly, more than half of the MSMEs in emerging markets (equating to more than 200 million businesses) are currently without access to banking services. A large concentration of such business can be found in just five markets: China, Brazil, India, Columbia and Thailand.

MICRO, SMALL AND MEDIUM ENTERPRISES WITHOUT ACCESS TO BANKING SERVICES

200+ millionSource: MSME: Finance expanding opportunities and creating jobs, World Bank

Why aren’t banks serving these customers today? Common reasons include:

- Inadequate education

- No valid identification

- Geographic challenges

- Financial products too expensive

- No credit history

While these barriers can be significant, technology now provides the means to overcome many of them. And many emerging markets have made great progress in establishing infrastructure that banks can build on.

Chapter 2

Where should banks start the journey?

How to assess the inclusive growth opportunity in emerging markets.

With opportunities all over the world, prioritizing those that can deliver the highest social impact and/or financial returns is a sensible first step. The markets where financial inclusion offers the greatest benefits will be those that embrace technology-led innovation and have a clear and supportive policy framework for financial stability. Banks should look for the following markers when prioritizing their investments in financial inclusion.

11 markers for assessing the inclusive growth opportunity in emerging markets

1. High levels of mobile adoption and e-payments: more mobile adoption, coupled with government action to digitalize payments, could be a catalyst for low-income communities to adopt financial services. In Kenya, m-Pesa has transformed access to financial services by providing an entry-level e-payment platform for the majority of the population, while the Bolsa Família program in Brazil delivers financial assistance to one-third of the population via digital payments into a card or bank account.

2. National digital identity (ID) systems: banks could leverage biometric ID programs to verify customers at ATMs or service counters as they seek to widen access to financial services. India’s Aadhaar system, for example, provides real-time verification of identities using a fingerprint scan, iris scan or digital face print to enable the direct transfer of government subsidies and unemployment benefits.

3. Credit data infrastructure: some countries have formed MSME credit registries for the collation of reliable and transparent data that potential lenders can use to facilitate loan applications. Banks seeking to boost lending to underserved segments could use MSME credit registries to address information asymmetry and reduce their overall cost to serve.

4. Open access to digital data: open application programing interfaces (APIs) allow financial institutions to collaborate with FinTechs, governments and external partners on innovative mobile applications and digital payment solutions. This collaboration – particularly in areas such as security, authentication and e-signatures – can lower the cost of customer acquisition and foster financial inclusion.

5. Currency digitization: digital currencies would lower transaction costs and drive financial inclusion, but also would require tight regulation, including linkage to fiat money (state issued paper money or coins not related to a physical commodity like gold or silver), and an innovative response from banks that wish to remain relevant.

6. Strong customer safeguards: because low-income consumers are particularly susceptible to aggressive and predatory sales and collection practices, stringent consumer protection laws with strong transparency and disclosure, financial integrity and effective recourse mechanisms for grievances are necessary. Simpler legal documents would also foster financial inclusion.

7. Responsible financial literacy programs: basic education on financial offerings can help individuals and MSMEs understand the value of having access to the financial system. Banks should consider supporting state programs, such as the Central Bank’s move to establish a dedicated advocacy unit to promote financial awareness in the Philippines, as a means to build relationships and strengthen loyalty.

8. Bankruptcy regimes: countries that regulate the wind-down of failed companies and ventures, support creditor rights and help to resolve claims in an orderly and unbiased manner facilitate financial inclusion.

9. Regulatory incentives for banks: recognizing that onerous regulations can be a barrier to financial inclusion, some governments have moved to ease selected rules. Examples include the Reserve Bank of India’s simplification of onboarding requirements for no-frills accounts, and measures in Brazil, Peru, Colombia and Mexico that reduce know-your-customer (KYC) documentation for small balance accounts.

10. Diverse financial ecosystems: increased provision of financial services by nongovernmental organizations (NGOs), e-commerce firms, FinTechs, retailers and telecommunication providers has a direct impact on expanding financial inclusion. Consequently, a vibrant start-up community with access to diverse sources of capital is an important enabler. Digital finance can dramatically increase sales revenues and access to capital for small merchants, while large financial platforms make investments more accessible for lower-income communities.

11. Interoperable financial systems: interoperability allows for a collaborative financial system, enabling users on multiple digital networks to transact across platforms. For example, Peru’s Government, its financial sector and four main telecommunications providers launched Modelo Peru in 2016 to establish an interoperable mobile payment platform for customers to transact across mobile networks and financial providers.

Chapter 3

Banks‘ action plan for financial inclusion

The three steps which are critical for success.

In markets with the right infrastructure and policies, banks will need to adapt their operations to achieve profitable financial inclusion. We believe the following three actions are critical to success.

1. Customize offerings to raise relevance and broaden the reach of account adoption

While regulators in certain markets have required banks to offer basic accounts, simplify onerous documentation or allow correspondent banking (e.g. by post or phone), such measures do not always deliver desired results. Banks must structure highly relevant and possibly simplified financial solutions that meet specific customer needs at an affordable cost. They can do this by developing deeper customer understanding and offering a compelling value proposition. With the right mix of innovative products and services, institutions can earn the loyalty of new customers and drive cross- and up-sell opportunities.

2. Innovate channels to reach more customers at lower cost

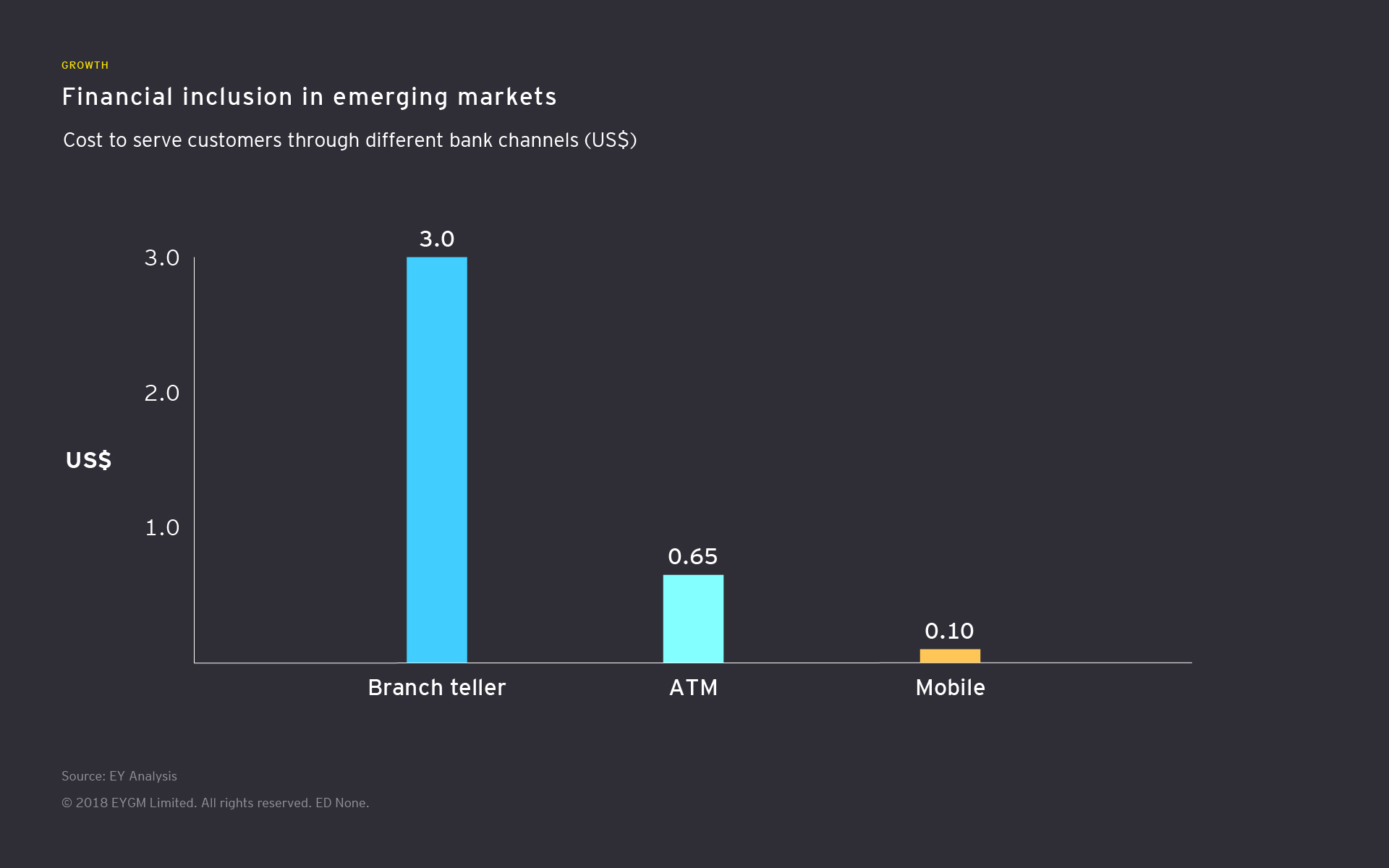

Digital channels have been instrumental in helping providers overcome challenges related to infrastructure and geography in many developing countries (see chart below). While digital channels may have the lowest operational costs, effective financial inclusion will likely require a ”bricks and clicks” distribution model that includes physical branches to build trust and confidence, perhaps supplemented by correspondent agents (such as post offices and supermarkets). Such a model can still operate efficiently if automation is employed effectively with no-frills mini-branches, kiosks and correspondent agents offering standard products.

3. Creatively mitigate risk to address absence of credit histories

Many financially excluded individuals and MSMEs lack the financial track record that banks traditionally rely on to support lending decisions. Nor do they necessarily have access to proven identity, address and security, which cuts off their access to bank credit. Creative credit profiling and credit scoring analytics could help bridge this lending gap. Some nonbanks use digital footprints related to e-commerce, social media, biometrics, and their customers’ feedback on product and service credibility as data sources to evaluate business viability and creditworthiness.

Chapter 4

Financial inclusion innovations from around the globe

How technology is shaping financial innovations.

In Kenya, Umati Capital has created an app called Umati Application, which offers Supply Chain Financing (SCF), a product that gives small businesses credit to pay up to 80% of their suppliers’ invoices in days. This is resulting in fewer past-due statements, more loyal suppliers and smoother income flows.

In Indonesia, Bank Rakyat’s floating branches bring financial services to inhabitants of the country’s remote islands. Subsequently, in 2016, the bank also launched its own satellite to provide reliable connectivity to support these floating banks and other self-service banking stations in villages.

In Mexico, Konfio is an online lending platform that measures the creditworthiness of MSMEs through a proprietary algorithm that uses more than 5,000 biographical, social and financial data points to create a single credit measure. Since launching its first product in 2014, Konfio has originated more than 50,000 business loans.

In Africa, Mastercard has developed a mobile platform called 2KUZE (Swahili for “let’s grow together”), which aims to bring the benefits and security of mobile commerce to farmers. Discover more about Mastercard's journey to fostering financial inclusion through digital payments in this video:

The time for greater inclusion is now

There has never been a better time to seek revenue growth through financial inclusion. Banks that seize this opportunity today — and are able to customize offerings strategically, take advantage of innovative channels and mitigate risk creatively — will be well positioned to capture market share and play a transformative role in the growth of emerging market for years to come.

Resumen

Banks that seek revenue through financial inclusion can not only gain a competitive advantage, but also help drive inclusive growth.