EIR Engine

The EIR Engine is an IT solution developed by EY for calculating EIR and catch-up adjustments, as well as recalculating EIR. It can also provide Credit Adjusted EIR (CA-EIR) for assets Purchased or Originated as Credit Impaired (POCI) in line with specific IFRS 9 requirements for POCI assets.

What EY can do for you

The key feature of the EIR Engine is the flexible adoption of bank-specific triggers indicating whether EIR should be re-calculated or if a catch-up adjustment should be booked, and the definition of hierarchy for cases where multiple triggers emerge at the same time.

EIR Engine key functionalities:

- EIR calculation and re-calculation

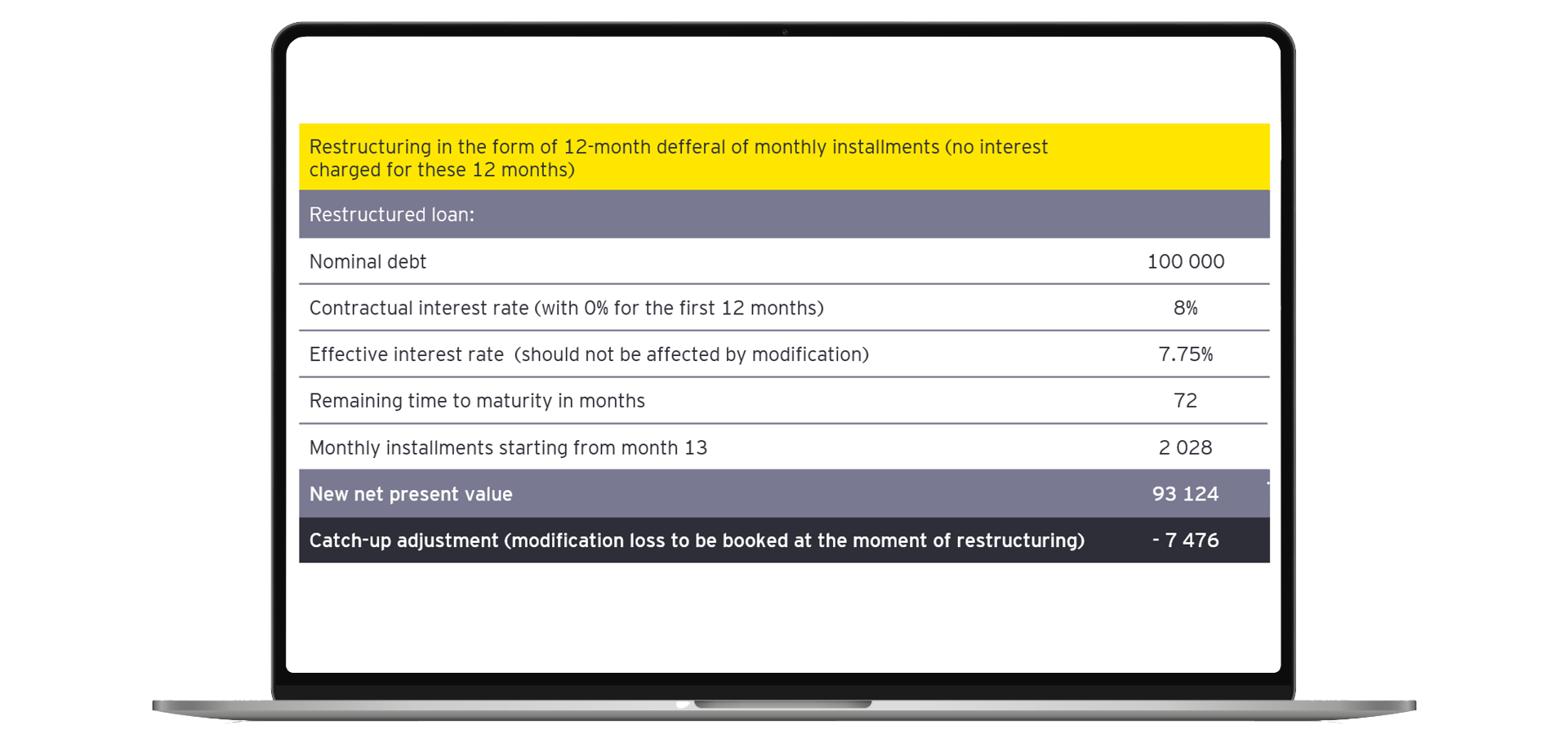

- Modification gains/losses calculation

- Trigger event identification based on a customizable set of criteria

- Prioritization of trigger events enabling a layered approach to EIR re-calculation

- Fees, Commissions and other EIR related balances amortizations

The EIR Engine can also be easily integrated into the LIC Solution® as both tools are based on MS SQL and thus use similar technologies and data flow. The resulting values calculated by the EIR Engine are stored in a database, which can be further used as one of the inputs for the LIC Solution® and other systems.

Learn more about LIC Solution®

Below we illustrate the responses to changes in the financial instrument characteristics based on possible triggering events:

The team

Contact us

Like what you’ve seen? Get in touch to learn more.