The world’s largest investor, BlackRock, recently announced it would place sustainability at the center of its investment approach and actively exit investments that indicate a high sustainability risk, such as coal-sourced energy.6 This is important to understand, because the move clearly highlights a common driver of investors seeking sustainable investments: systemic risk. A large portion of the world’s invested capital is traded by large institutional investors, who should balance the factors affecting an individual firm’s performance with the broader factors impacting their entire portfolio, such as climate change and transparency.7

Amid the current COVID-19 pandemic, BlackRock and other major investors are now seeking to double their sustainable exchange-traded funds (ETF) offerings and take note of ESG risks in their portfolios and processes.8 This sentiment may be shared by others in the financial community. Though the short-term focus may be on managing through the present crisis, remaining investors and firms may emerge with a new perspective about risk management with the long-term in mind.

Consumer

Consumers’ demand for sustainable products is increasing. They are willing to rethink their buying habits to incorporate environmental and social product benefits into their buying decisions. This means that markets may change and open new opportunities for consumer value extraction.

Research shows:

- Revenue from sustainable products is growing at about six times the rate of other products.9

- 50% of consumers are willing to pay a higher price for products that have a positive social and environmental impact on the supply chain.10

- In the US, an expected $150 billion is to be spent on sustainable products by 2021.11

- By 2025, consumers will consistently prefer products or services that are less damaging to the environment, human health and society.12

This trend is especially driven by younger generations who are more connected to the idea that their futures may be significantly influenced by the impacts of climate change.

What was previously a choice of convenience, if all other variables align, now seems to increasingly become a priority in purchasing decisions. This trend applies immediately to consumer products companies and may ripple through markets, affecting business-to-business companies as demand for sustainable products permeates the entire value chain.13

Industry peers

Sustainability commitments from large companies have reached a critical mass and now are placing peer pressure on any chief executive officers (CEOs) yet to announce their commitment. The sustainability imperative seems driven by a realization of the global business community: a firm’s purpose beyond profit and its codependency on other firms, organizations and individuals in the ecosystems in which it operates represent significant forces in maintaining long-term profitability.14

More businesses are adopting sustainability as a core corporate strategy because of the financial potential of sustainable opportunities and because employees now seek “purposeful” work. In turn, these businesses are exerting significant pressure over other businesses to follow their lead:

- 140 large global companies are seeking a standardized framework to report nonfinancial ESG factors.15

- Over half of US businesses have increased their commitments to renewable energy.16

- More than 9,500 companies, including 28 companies with combined market cap of US$1.3 trillion, have committed to step up to new levels of climate ambition.17

This wave of announcements is cause enough for executives to reflect on the long-term purpose and impact of their own businesses. It also legitimizes the logic and value proposition behind the movement.

Governments

So far, corporate interest in sustainable management is being driven primarily by the upside it offers to investors, consumers and corporations themselves. However, government penalties for not complying with climate regulations already hurt companies across industries. Given what is at stake if further actions are not taken, governments may increasingly bring aspects of sustainable management into hard-coded law.18

Pressure is mounting from governments around the world to hold companies accountable for sustainably operating. The German Bundestag, for example, is examining legislation that would force companies to investigate every sequence of their supply chain and likely would penalize them for unsustainability.19

The bottom line is this: the longer the free market does not demonstrate evidence-based control over its externalities that have negative impacts on society and the environment, the more severely regulatory bodies may try to impose restrictions on business operations. In this movement, it seems that the number of stakeholders, the amount of capital, and most importantly, the social and environmental risks at play may be too significant for governments not to step in.

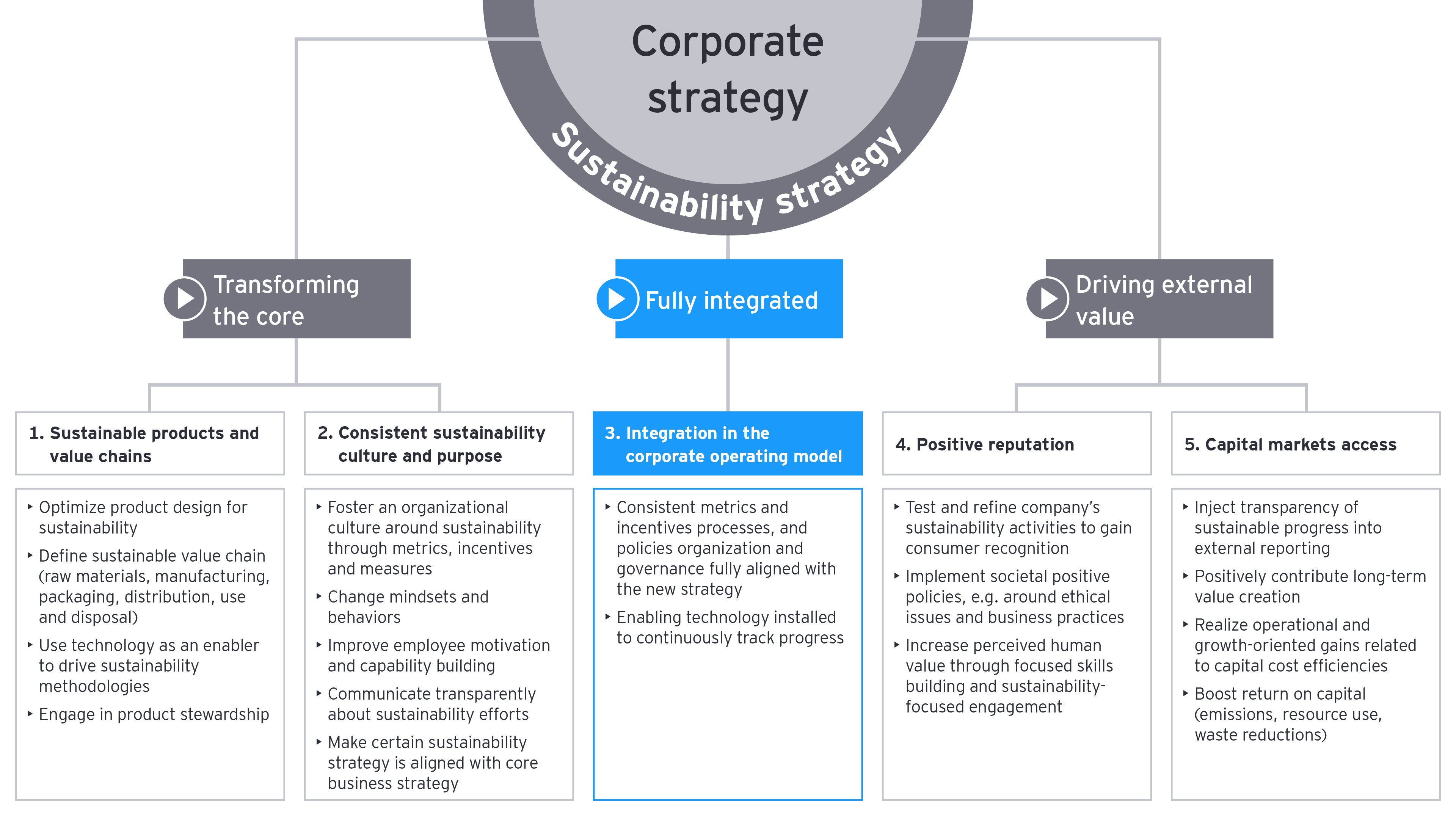

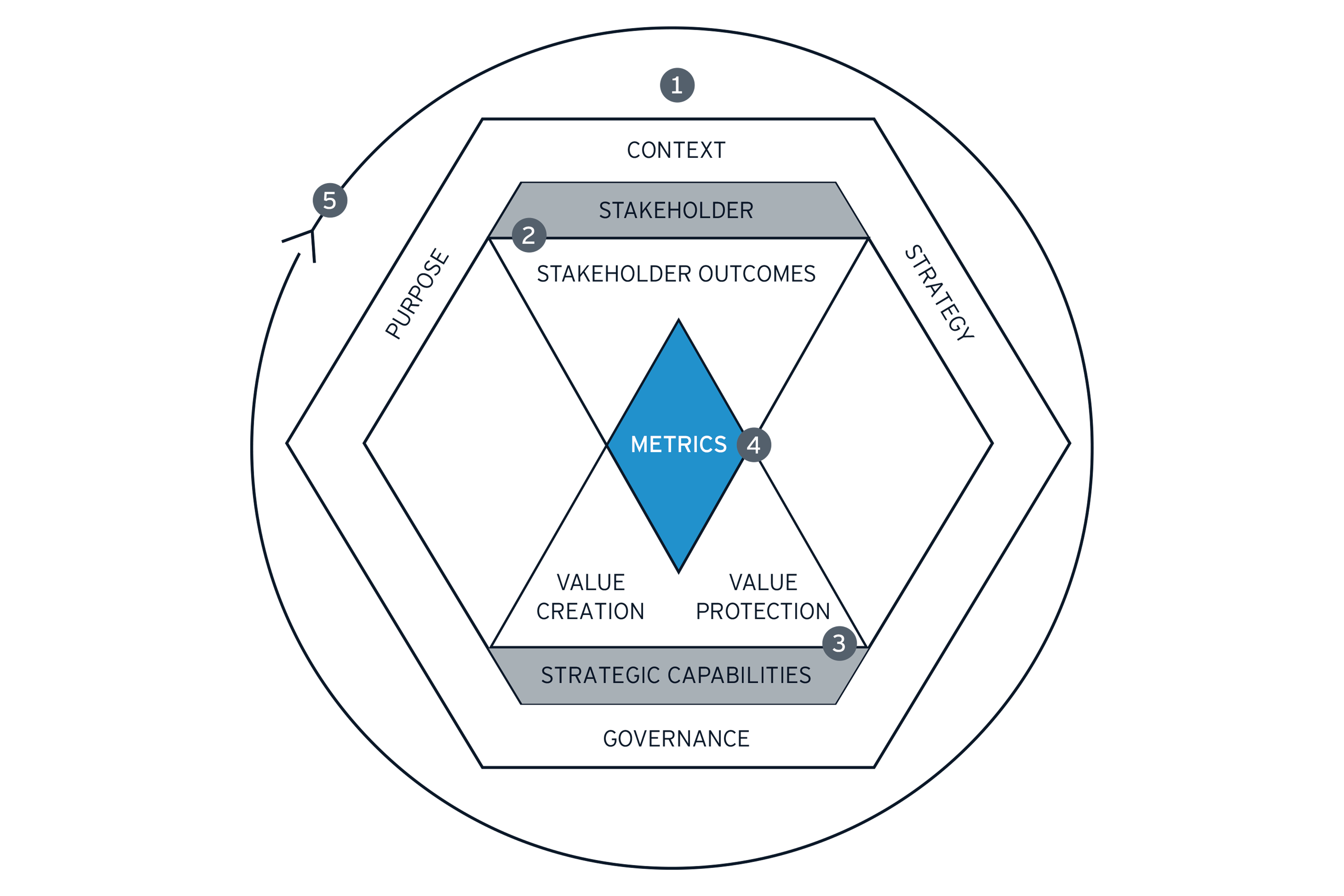

How to build a successful corporate sustainability strategy using the five pillars

The sustainability imperative is here, and executives may consider taking one of two paths.

The first is where companies take a high-risk, superficial approach to capitalize on the sustainability movement through marketing activities while maintaining existing operations.

The second path is to become truly sustainable — transforming from the inside out to integrate sustainability into the core of the business. This corporate strategy may be more difficult, but one that we believe will separate thriving organizations from those that may not last over the long-term. Our perspective is intended for organizations taking the second road.