4. Keys to popularizing Open RAN and V-RAN

As they have until now, industry trade groups and telecom carriers continue taking various steps to popularize the implementation of Open RAN and V-RAN. But what exactly do they need to be aware of when taking the applications of RAN to the next level? We have summarized those key issues below.

Points shared across Open RAN and V-RAN

① Promoting initiatives for the enhancement of alliances and commercial implementation

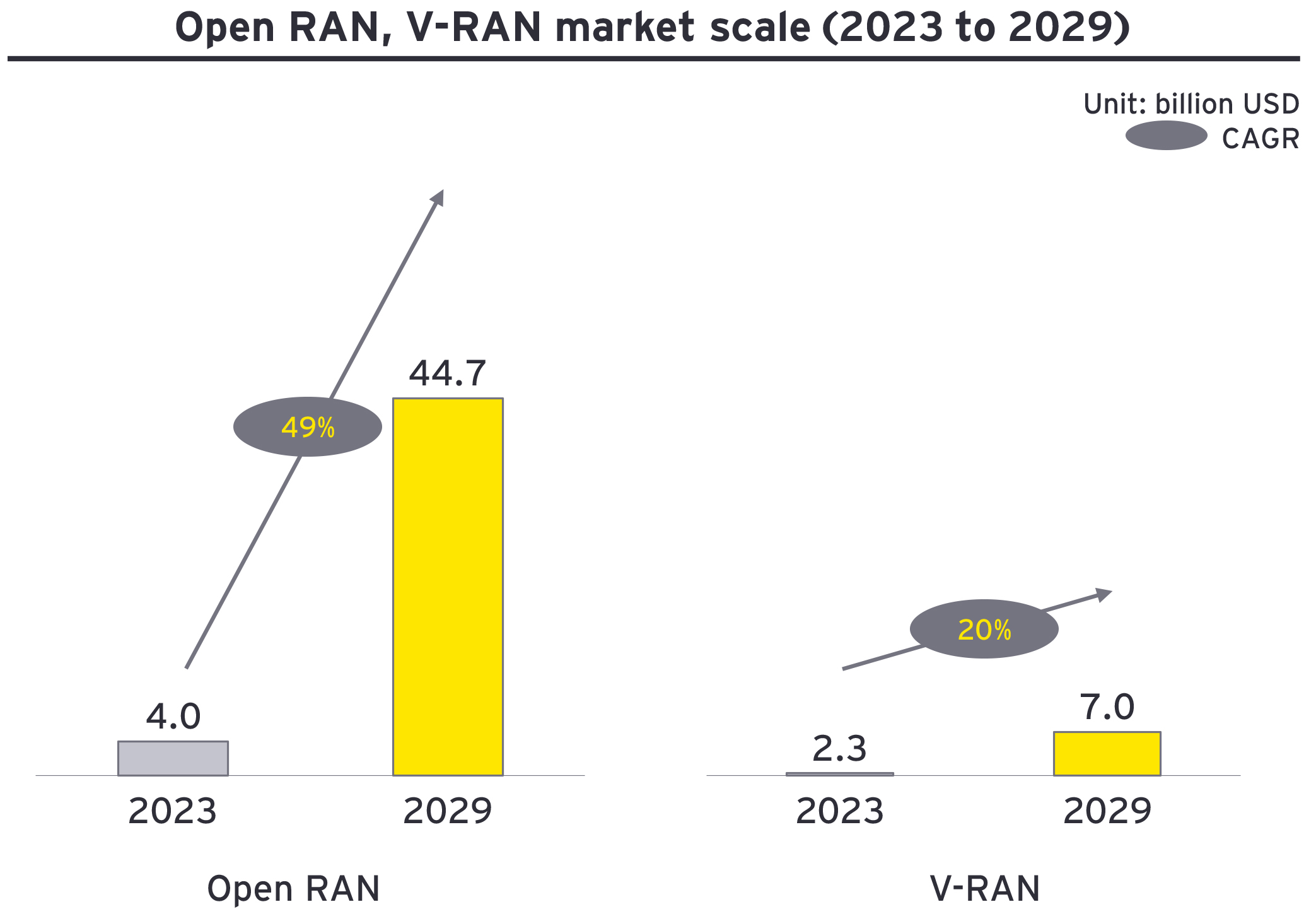

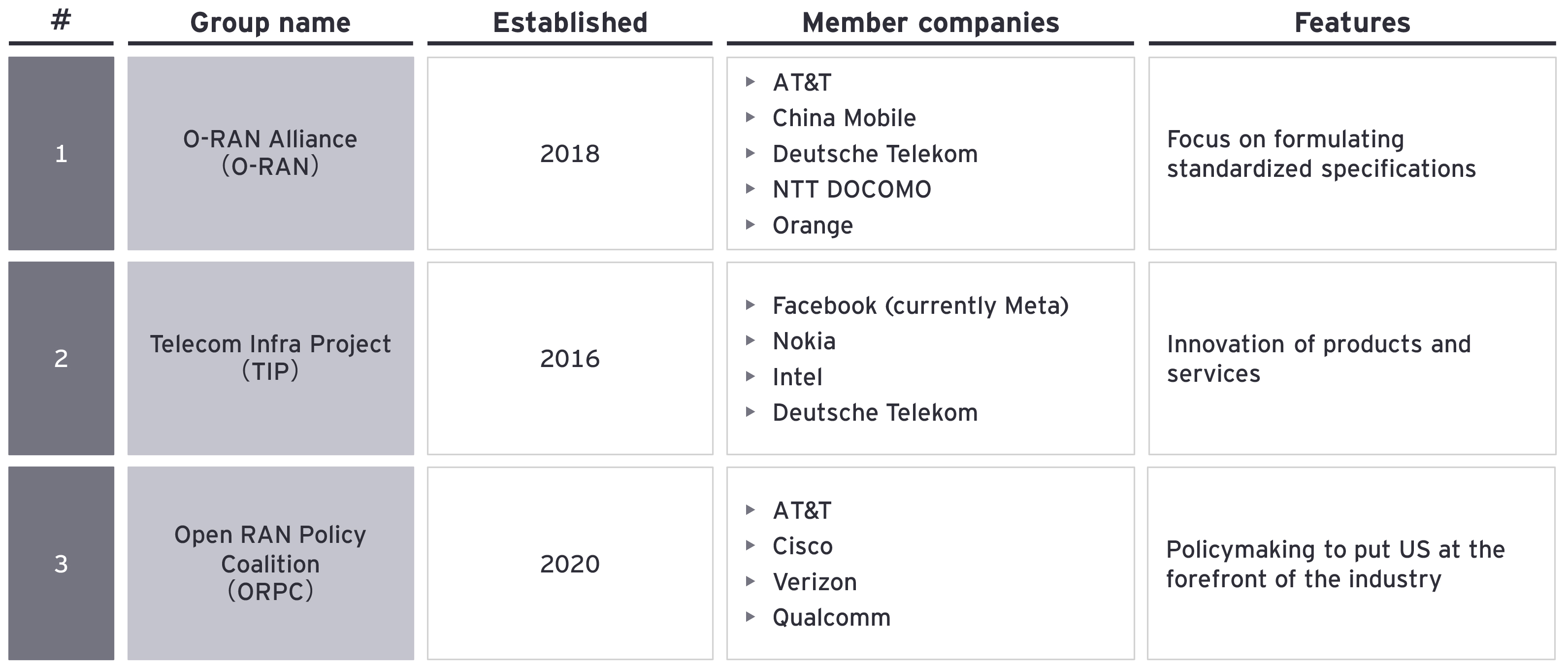

Open RAN and V-RAN are recent technologies, meaning the key to their widespread adoption is taking advantage of these initial stages of implementation to involve as many business operators as possible in forming businesses alliances, as well as continuing to actively engage in efforts needed for successful commercialization, such as specification formulation and the development of product services. Beyond such efforts, leading Open RAN and V-RAN to their growth stage requires such initiatives to not lose momentum. The introduction of Open RAN and V-RAN must be effective and the market should be able to clearly identify what differentiates them from traditional RAN technology.

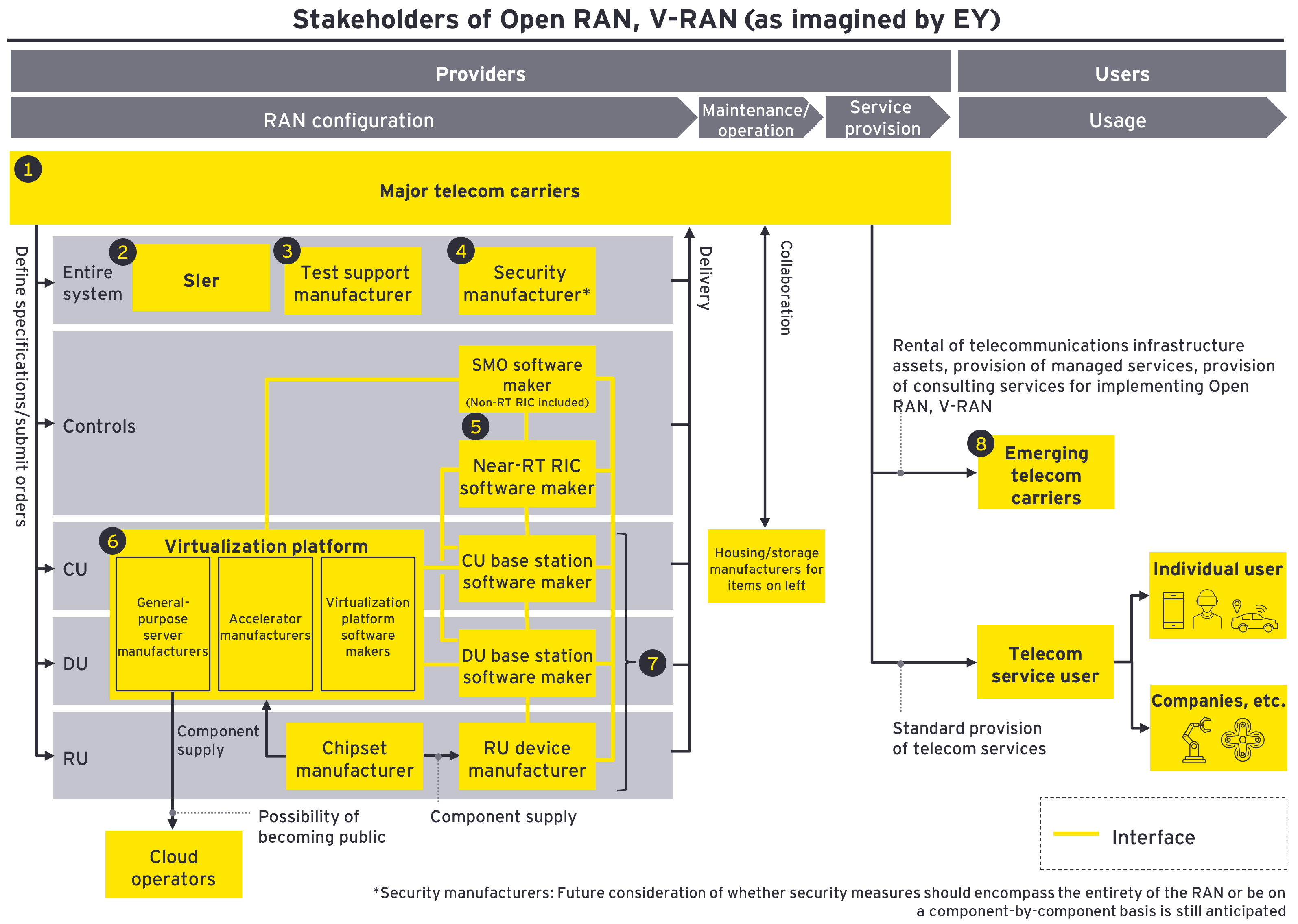

② Knowledge/technical proficiency to ensure communication quality

With Open RAN, the combination of equipment from different vendors requires the careful verification of interconnectivity between the equipment and an accelerated improvement cycle. V-RAN also requires the verification of interconnectivity between general-purpose servers/accelerators/virtualization platform software/base station software. If a telecom carrier is technically proficient, it can perform verification on its own and guarantee communication quality. However, not all telecom carriers are capable of this. Even if systems integrators (“SI”) can verify interconnectivity and test support manufacturers can conduct quality tests, the telecom carrier is the party ultimately responsible for guaranteeing the communication quality, and as such is required to have the knowledge and technical proficiency to accept and test incoming products and services.

③ Verification of cost benefits, including for integration

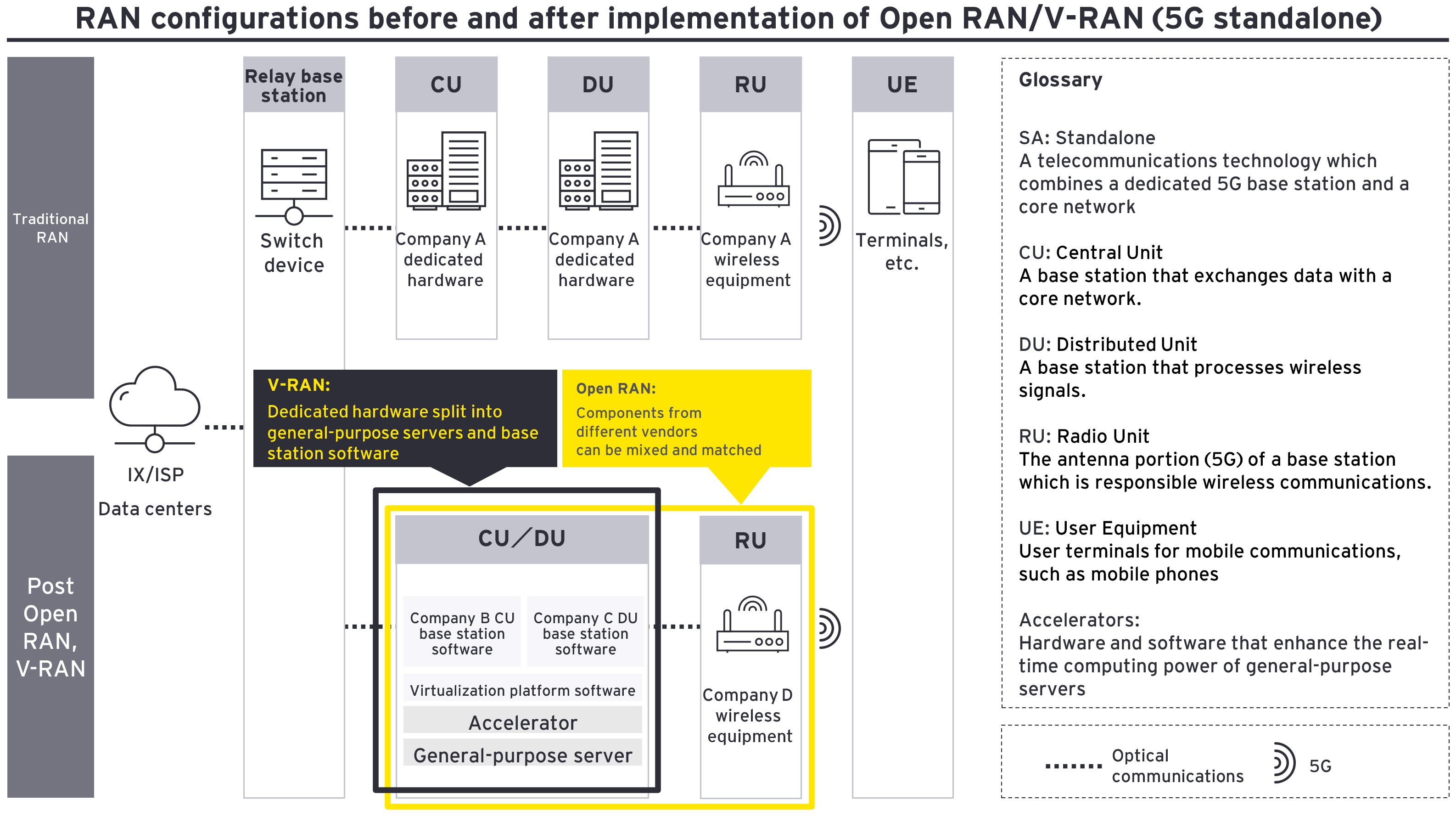

While Open RAN and V-RAN are expected to reduce capital expenditure and operating costs, if equipment from various vendors is adopted for CU/DU/RU, or if base station software is run on general-purpose servers with built-in accelerators, costs will still be incurred for the system integration needed to operate the RAN appropriately. Accordingly, telecom carriers must verify whether cost advantages actually exist compared to the conventional TCO12 which also takes integration into account.

Open RAN

④ Cyber security specific to Open RAN

Compared to traditional RAN, Open RAN has more interfaces (connections) between CU/DU/RU and new components. As a result, there are cybersecurity concerns about Open RAN that did not exist for conventional RAN. It will be necessary to meticulously identify potential security risks and prepare the appropriate security requirements and solutions. More specific considerations will be required in the future, such as whether security countermeasures should be taken for the components of each individual vendor, or whether telecom carriers will take comprehensive measures for the entire RAN on their own.

⑤ Standardization of RAN maintenance and operational procedures

With traditional RAN, specific vendors delivered the CU/DU/RU as a single package, which meant the types of manuals available for maintenance and operations were limited, even across the entire base station. On the other hand, with the adoption of a multi-vendor environment for Open RAN, the entire base station will have multiple manuals from various vendors, causing concern that maintenance and operation will become even more complicated than with traditional RAN. Standardization and the establishment of specification and procedures for maintenance and operation are necessary so that any vendor can potentially be used.

V-RAN

⑥ Improving integration of general-purpose servers and base station software

The combination and connectivity of CU/DU/RU devices are major discussion points for Open RAN. On the other hand, V-RAN requires building and implementing an architecture for hardware and software within the DU equipment in order to process wireless signals. As such, a greater impact on communication quality is expected when compared to Open RAN. For virtualization to become mainstream in the future, it will be essential to improve integration so that it enables base station software to function on general-purpose servers equipped with accelerators, as well as to implement technology that stabilizes communication quality.

⑦ Early defect detection and advance preparation of BCP

Traditional CU/DU were procured from a single vendor, meaning any system interruptions due to defects could be swiftly resolved by vendors familiar with the dedicated hardware they delivered. On the other hand, V-RAN will likely use different vendors for each component, creating concern around the difficulty of identifying where a defect or failure has occurred within the general-purpose servers/accelerators/virtualization platform software/base station software. Accordingly, swift resolution of such instances can only be achieved by designing mechanisms and systems that enable the early detection of defective areas. In addition, it is important to make advance preparations for a business continuity plan (“BCP”), such as preparing manuals that detail response procedures and recovery methods for each specific issue that may arise.