EY refers to the global organization, and may refer to one or more, of the member firms of Ernst & Young Global Limited, each of which is a separate legal entity. Ernst & Young Global Limited, a UK company limited by guarantee, does not provide services to clients.

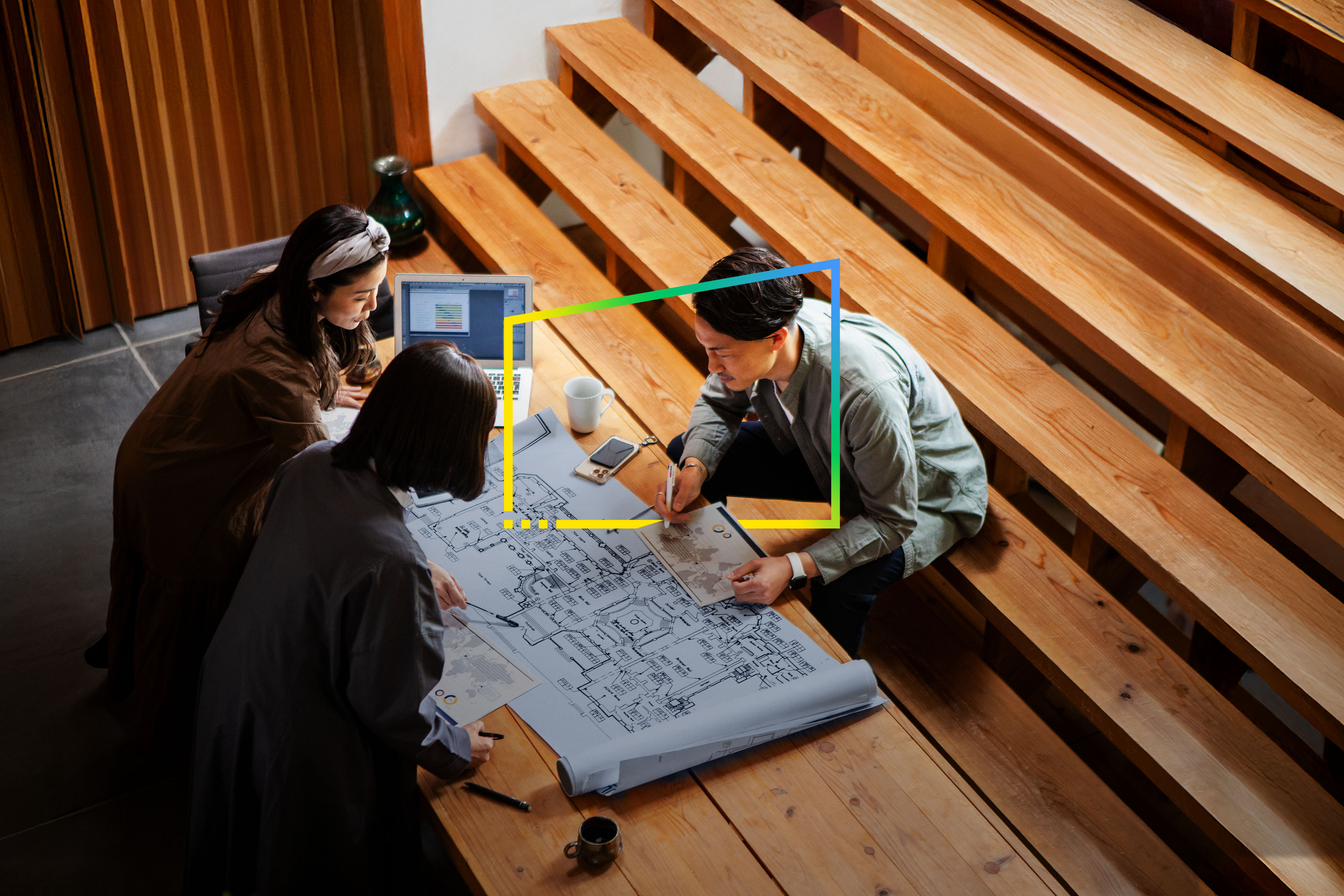

IPO

Providing IPO support to companies looking to build on growth opportunities. Find out how.

Our latest thinking

How can you navigate your IPO planning with confidence?

The EY Global IPO Trends covers news and insights on the global IPO market for Q3 2025 and an outlook for Q4 2025. Learn more.

How CEOs juggle transformation priorities – the art of taking back control

EY-Parthenon CEO Survey September 2025 reveals how leaders build confidence, resilience, and growth strategies amid disruption and transformation.

How GenAI is reshaping private equity investment strategy

A balanced approach to investment strategy is needed to defend against GenAI disruption while also driving portfolio performance. Learn more.

Private Equity Pulse: key takeaways from Q3 2025

Private equity exits reach a three-year high as firms seize opportunities to turn strategic value creation into realized returns.

How EY can Help

-

With decades of experience helping companies go public, our IPO readiness assessment team can help you get ready for the big day — and beyond. Learn how.

Read more -

Our IPO destination services team can help you choose the best place to list your company — be it your home market, nearby or overseas. Learn more.

Read more -

Our 7 Drivers of Growth framework can help your business successfully execute your growth strategy over the long term. Find out how.

Read more -

We guide you through potential capital-raising strategies and the organizational changes required to execute and sustain a successful IPO.

Read more -

Our venture capital consulting services can help your business find potential backers and can help venture funds develop portfolios companies. Learn more.

Read more