As insurers navigate a period of immense change in response to ESG and the need to serve a broader set of stakeholders, we believe the four following metrics reflect some of the most immediate risks associated with climate change and the broader environmental agenda:

- Total shareholder return (TSR)

- Brand value

- Economic net worth (ENW)

- Return on capital

We believe these four metrics will represent the most accurate and holistic barometers of exposure to climate-related risks and perceptual issues that threaten insurers’ value during the next three to 18 months. To reiterate, we believe similar metrics are necessary to model the social and governance dimensions of value creation.

Why do we believe that these are the most sensible metrics to gauge stakeholder views of the industry’s approach to ESG in the near term? Primarily because they are:

- Pragmatic and practicable

- Universally accepted

- Already tracked and reported by some insurers

- Often signed off in standard audit procedures

They are also easily decomposed into sub-metrics to enable root-and-branch analyses, support mapping to non-financial metrics and provide line-of-site to different stakeholder groups. Plus, they accommodate multiple time horizons and diverse stakeholder interests, as well as near-term measures of both value destruction and protection.

Because financial metrics will remain the dominant way of communicating to stakeholders, they will be more easily adoptable. The development of more sophisticated “hybrid” metrics to accurately and credibly correlate ESG to financial performance requires more time. Such metrics will be of limited relevance to insurers, which will be net users of data to make investment and underwriting decisions once standards have been established. This is an iterative process involving many industries.

Total shareholder return

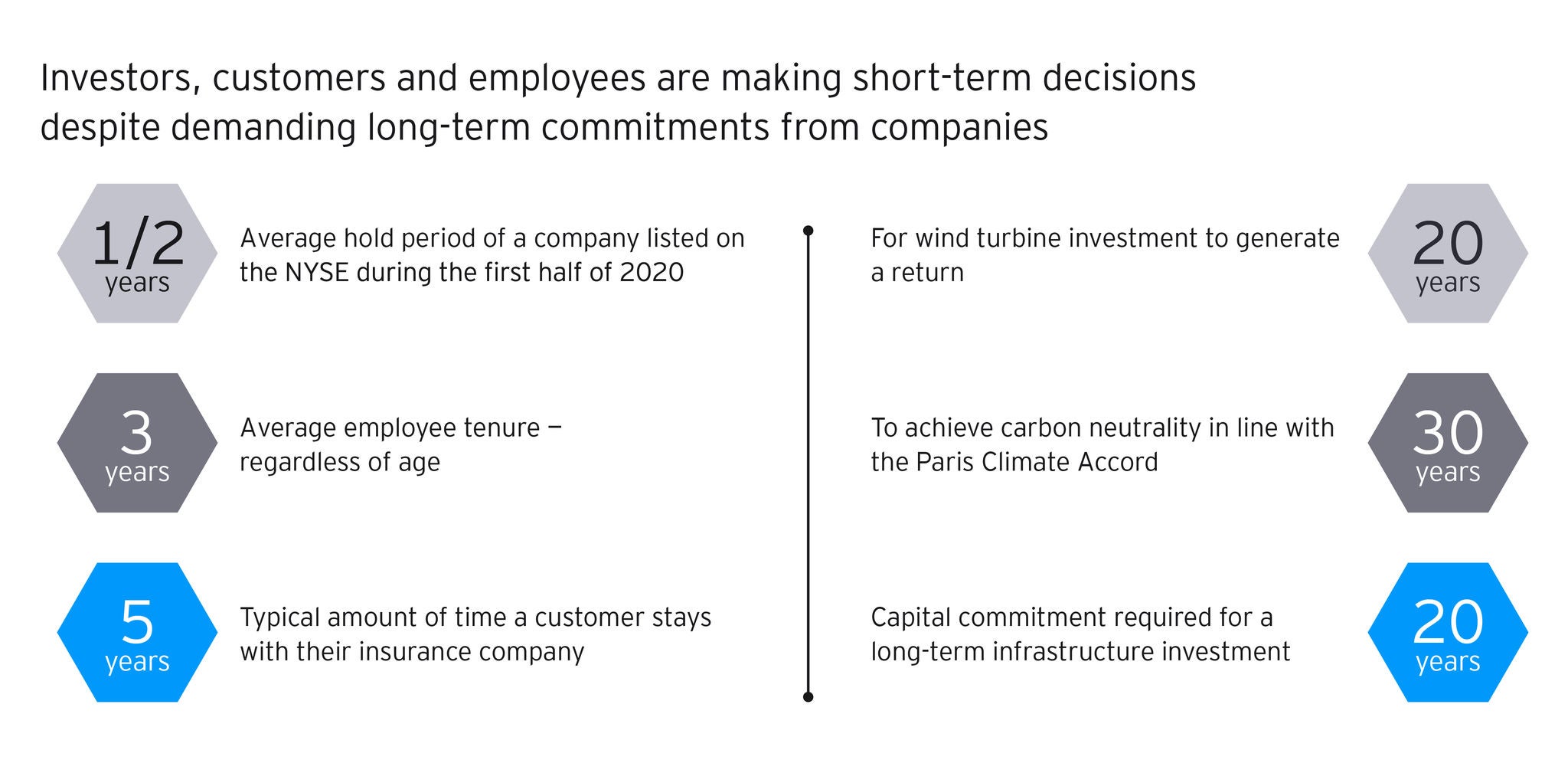

This metric incorporates all time horizons – from minutes (e.g., trading volumes, price fluctuations) to years and decades (e.g., the entire duration of an insurer’s listing on an exchange). It’s also comprehensive in incorporating the long-term growth prospects of a company, its resilience and reputation, commitment to innovation, ability to address consumer, societal, and environmental issues and meet governmental regulatory requirements.

One of the most pressing issues for the C-suite currently is the ESG rating that a company is being given by equity analysts. There are significant concerns associated with the inconsistencies in how these ratings are conferred. These concerns are justified due to the potential impact of these ratings on share price and investor appetite (e.g., institutional investors may decline to invest due to new ESG investment policies). Many senior insurance leaders fear that bad or even mediocre ESG ratings will make them look bad relative to their peers and lead to stock price depreciation.

ESG ratings are a critical path for ESG index inclusion (e.g., DJSI, MSCI). Over the past 12 months, flows into “green” funds and ETFs have increased fivefold in the UK and other markets. Inclusion in these types of funds typically leads to higher stock prices. Missing out could result in underperformance relative to peers.

As more investors introduce ESG criteria into portfolio management, demand and supply will drive up share prices of the firms that meet the criteria. So, it is highly likely over the short and medium terms that share price performance will become a good measure of how well individual insurers present their ESG credentials and tell their ESG stories.

Over the long term, it is our conviction that firms that make choices to enhance long-term value will also deliver superior returns to investors. Whilst TSR is a good overall indicator, the challenges of decomposing it into sub-metrics are well known. The following three metrics offer some correlation to TSR and are more readily decomposed into underlying drivers.

Brand value

Intangible but measurable, brand value may be the ultimate long-term-value metric, with direct positive correlation to shareholder value. Franchise value functions similarly to brand value. Strong brands are built strategically, with a view to building positive brand equity in the form of positive associations and perceptions (e.g., trust and confidence) among investors, customers and employees. These attributes translate into positive financial performance on both the top and bottom lines, and via pricing power.

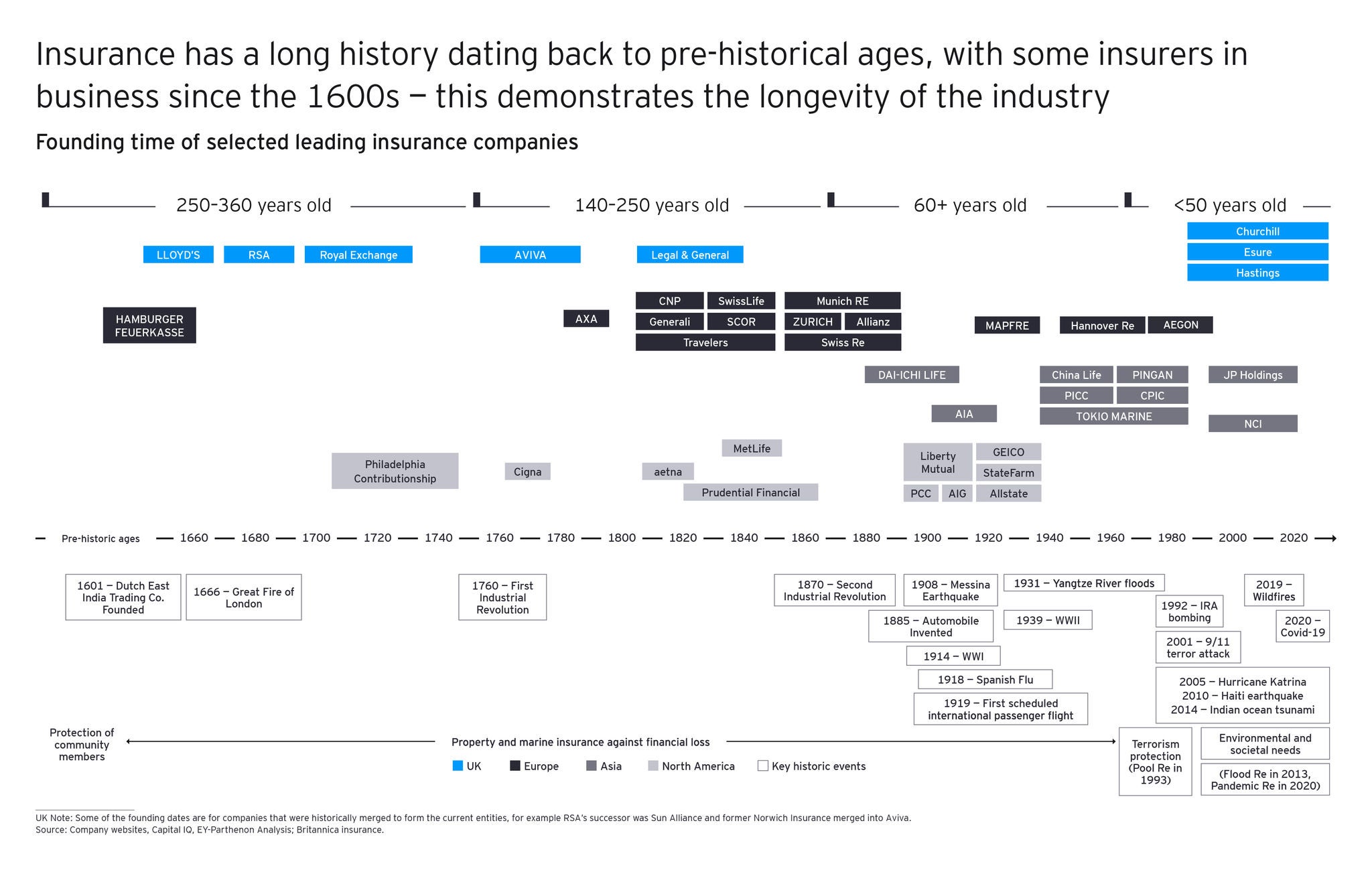

In the insurance sector, brands have typically emphasized perceptions of financial strength, stability and longevity. ESG principles, including transparency and accountability, that are geared toward a sustainable, long-term perspective can be excellent complements to traditional positioning.

Conversely, brands that don’t credibly demonstrate a commitment to a greener economy, diverse workforces, ethical business practices and a more equitable society may face backlash in public opinion and increased regulatory scrutiny. Decreases in favorability ratings and, ultimately, financial value would likely follow. In other words, damaged brands can make stock prices fall.

Brands are financially valuable to firms precisely because of their value to other stakeholders, including customers, employees, suppliers and partners. While these are often considered “soft” metrics, they are nevertheless measurable and will become more important to tracking value in the age of ESG.

Economic net worth – including embedded value metrics and equivalent regulatory and accounting measures

The time horizon of the insurance sector is, by default, long-term, due to the nature of the risks it covers in its policies. Because of the short-term focus of past accounting standards, insurers have for some time been disclosing various non-GAAP measures (including market consistent embedded value and Solvency II Own Funds) to show shareholders their economic net worth (ENW) and ability to create long-term value. With the introduction of IFRS 17 in 2023, investors will also be able to infer a GAAP measure of ENW.

ENW growth over time provides a good barometer on whether a firm is adding to its long-term value or depleting it. However, we are seeing important changes in the risk and return profile on both the asset and liability sides as a result of ESG considerations; therefore, we expect that the approach to evaluation will evolve even further.

On the asset side, particularly for life insurers, the intensifying focus on ESG is creating urgency to rebalance portfolios. There is growing evidence of customer expectations for socially-aware investment policies. In recently awarding a major buy-out deal, the trustees of a major UK pension fund took into account ESG policies and how they would best serve pension holders for the next 30 years and beyond. The pressure to comply with regulations and establish policies to secure a positive ESG rating and sustain brand equity and the stock price must also be taken into account. However, changes to the asset portfolio and investment policy will have value creation and value protection impacts that will be felt for the next 10-50 years.

First and foremost, there is the exposure to “brown” sector assets. Insurers must determine their timing and approach to achieve net-zero targets by 2050, and some may choose to move the time horizons forward. A decision must be made as to letting positions naturally run off vs. making conscious exits. To pick the right course, insurers will need to stress-test the future value of these assets. We would expect to see ENW impacted by revised forward-looking assumptions around the risk-adjusted value of brown assets, which would over time penalize the firms that are slowest to transition.

In addition, Mark Carney, former head of the Bank of England and UN Special Envoy on Climate Action and Finance, has prodded the industry by describing its crucial role in allocating investments to fund long-term projects in renewables. Insurers that embrace the role will need deep insights into and confidence about their projected yields and payback timelines. The long-term and illiquid nature of these investments makes them highly suitable for matching long-dated liabilities, a practice often rewarded by ENW frameworks. Firms that embrace the trend and build deep understanding of the risk profiles of these investments will be more effective in demonstrating their contribution to ENW growth.

On the liability side, particularly for property and casualty insurers, we see similar pressure to be more selective on the projects, companies and industries they choose to underwrite in order to meet their stated net-zero targets. In some cases these can be binary decisions; a number of firms have already stated publicly their withdrawal from insuring certain risk pools (e.g., thermal coal power stations).

However, in many cases these underwriting decisions will be less clear cut, and more flexible tools will be needed. As with the asset side, “brown” clients and industries will have a different insurance risk profile in the future than in the past; “green” clients and industries will offer new sources of underwriting profit for the firms that can most effectively build an understanding of those risk profiles.

For both assets and liabilities, firms should take stock of the way they measure their current values to reflect the fact that risk profiles and future expectations are changing in response to climate action. They can use this insight to communicate a robust assessment of their current ENW. They should also look to quickly embed new data, assumptions and valuation techniques related to green assets and liabilities into their ENW frameworks as increasingly useful differentiators relative to long-term value creation.

Return on capital (ROC)

The capital-intensive nature of the insurance business stems from the need for large reserves against the broad variety of underwritten risks covering a broad spectrum of time horizons (e.g., longevity, mortality, morbidity and climate-related risks). ROC effectively measures the ability to underwrite, price and manage risk effectively to generate positive returns.

Many insurers already have sophisticated risk modeling, often mandated by regulatory capital standards, and perform stress tests against key risk factors to ensure they remain adequately capitalized. Risk-based capital requirements are a good indicator of exposure to “tail risks” and the firms able to generate a positive ROC are often the ones best able to price for these risks in their underwriting.

There is growing momentum in the industry to include climate risks (including both physical and transition risks) in insurers’ internal capital models. There are also regulatory moves toward climate scenario testing. We expect to see significant evolution as data on climate impacts and exposures evolves, and also expect ROC to become an increasingly important indicator of an insurer’s success in managing its exposure.