Chapter 1

Service delivery and operating model

Defined service delivery and operating models are critical foundations for the payroll function.

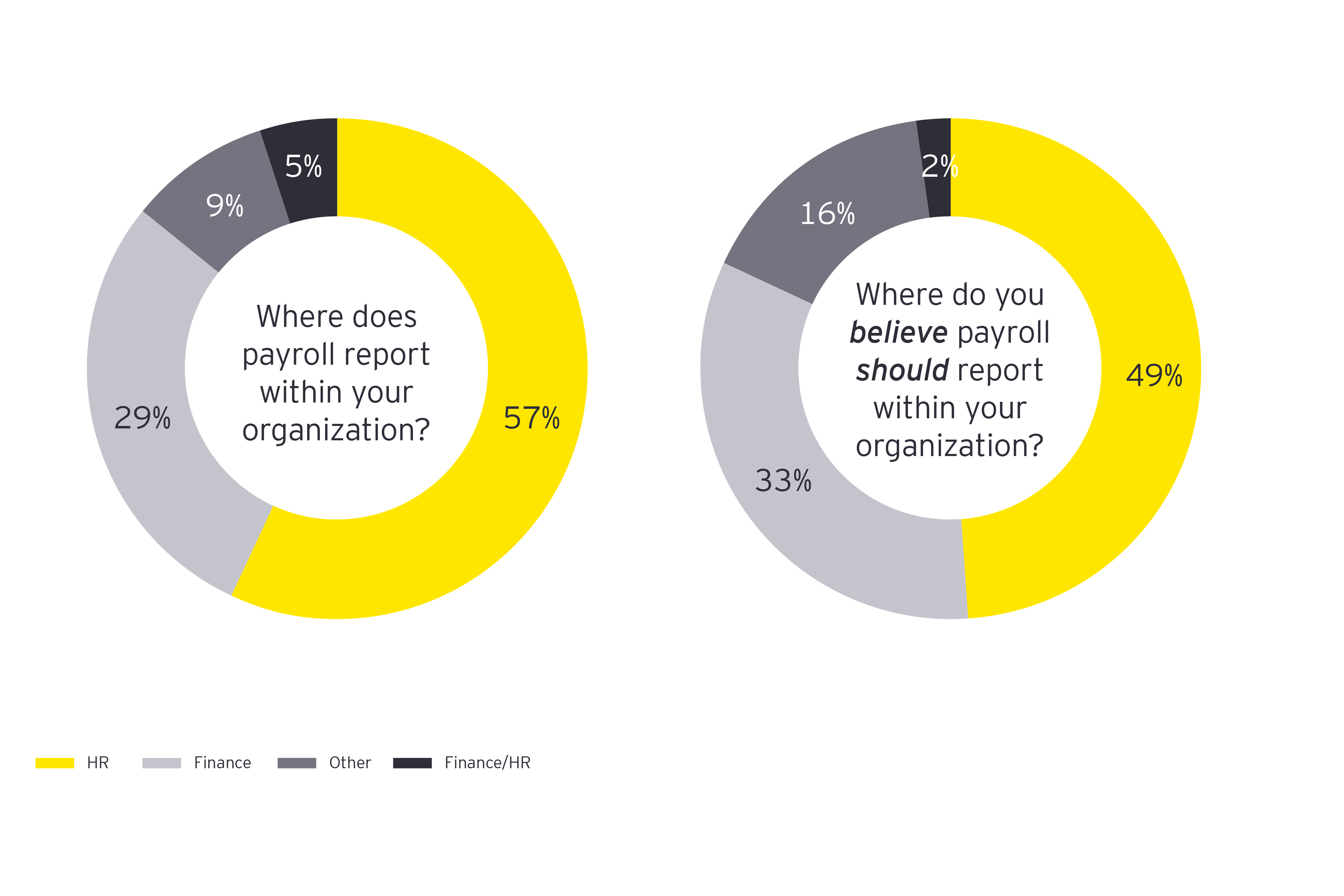

A critical success factor for an effective payroll strategy often begins with the determination of a service delivery model. Often, HR and payroll strategies are linked due to data integration, desire for a positive employee experience and overlapping processes. Among survey respondents, 57% indicated that payroll reports to HR (to be further discussed in the organizational structure section below). Survey respondents reported the number one priority for HR is to redesign the HR operating and service delivery model.

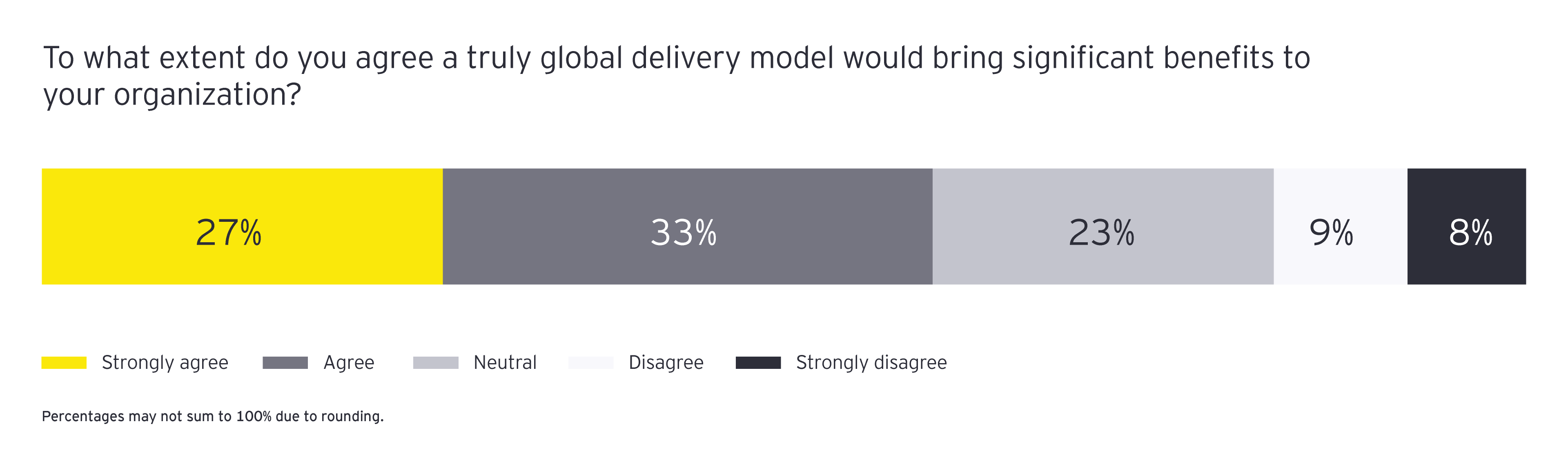

On a similar question, 60% of respondents indicated they agreed or strongly agreed that a truly global payroll delivery model would bring significant benefits to their organization. With both HR and payroll requiring effective delivery models, it is crucial for payroll and HR to be in lockstep so that design strategies complement and enable one another.

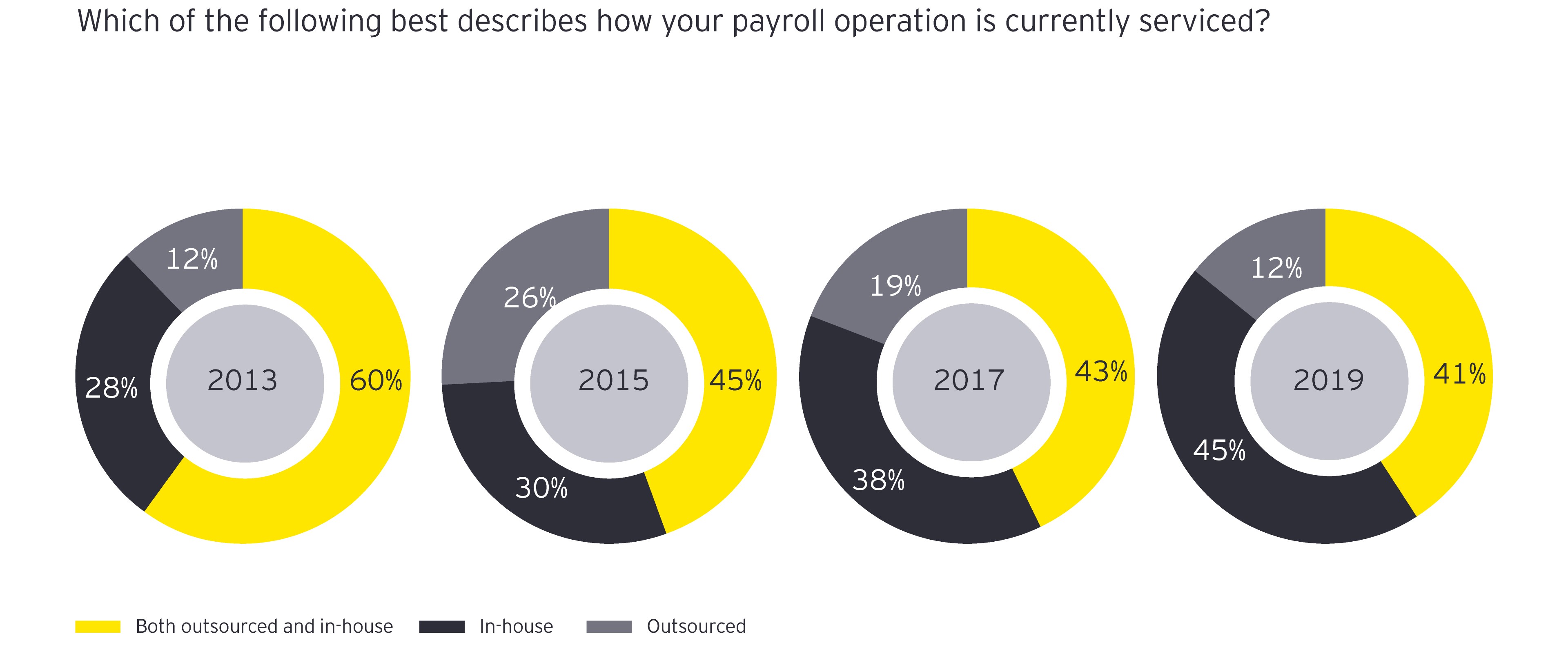

A service delivery model can be composed of many delivery vehicles that may include insourcing activities, outsourcing and managed services, co-sourcing or shared services. One consistent service delivery finding is the shift of payroll operations back in-house, with a 7% increase from 38% in 2017 to 45% in 2019. Looking all the way back to the original survey in 2013, the shift back in-house has increased from 28% to 45%, almost doubling the percentage of those who choose to service their payroll operations internally.

A deeper analysis reveals the shift is more relevant for organizations with a headcount smaller than 10,000; organizations with an employee population of more than 10,000 still favor the co-sourced model. Additionally, those with a formal payroll strategy slightly favor outsourced and co-sourced solutions as compared to those without.

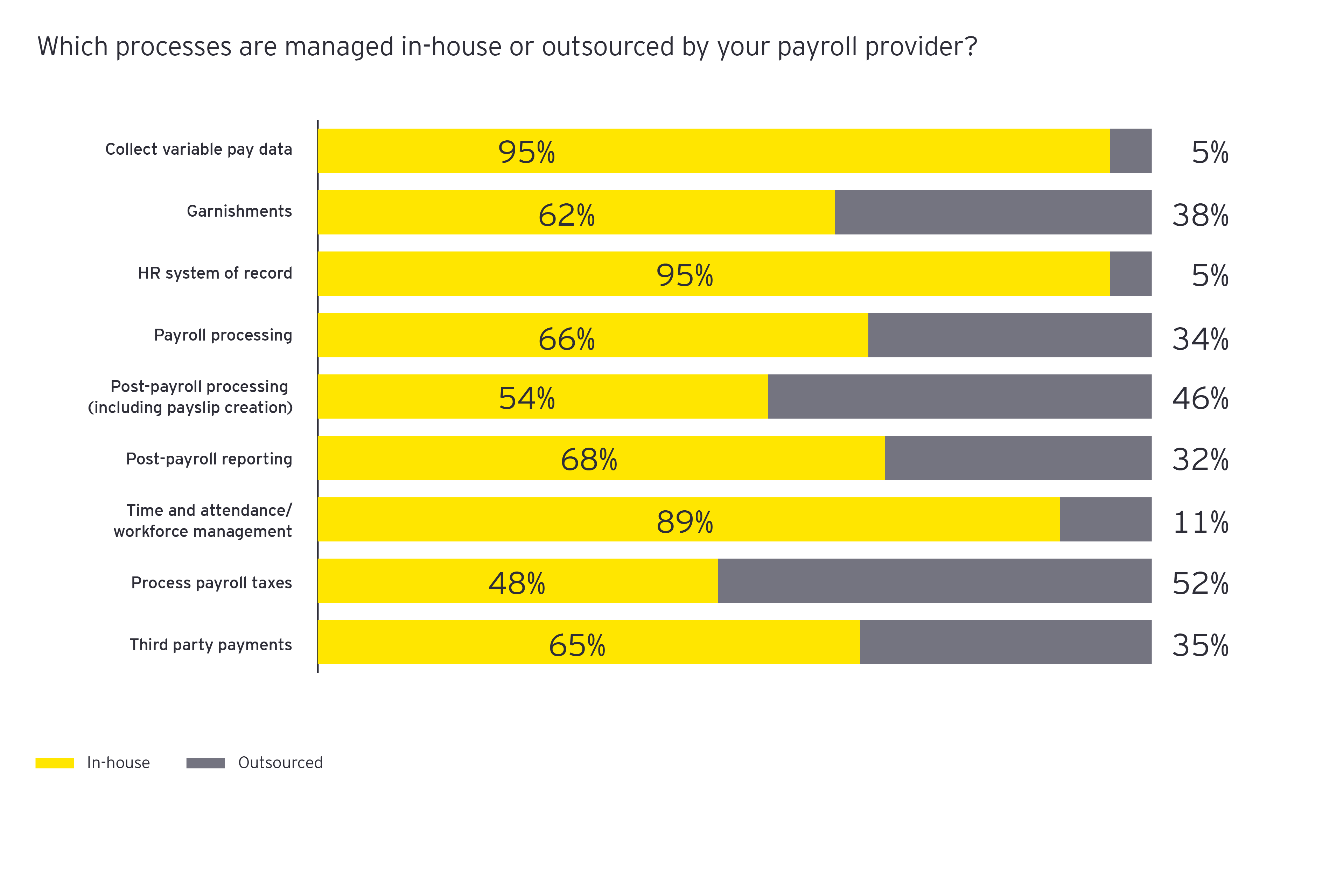

The period from 2017 to 2019 did not show significant change as to which payroll processes are outsourced versus insourced. Core data management tasks such as collecting variable pay, maintaining the HR system of record and time, and managing attendance/workforce management are the top processes for insourcing. Post-payroll processes, tax and garnishment processing remain on top of the outsourcing list. Two key changes indicate that organizations are shifting their approach in service delivery back in-house:

- Gross-to-net payroll processing

- Third-party payments to in-house operations

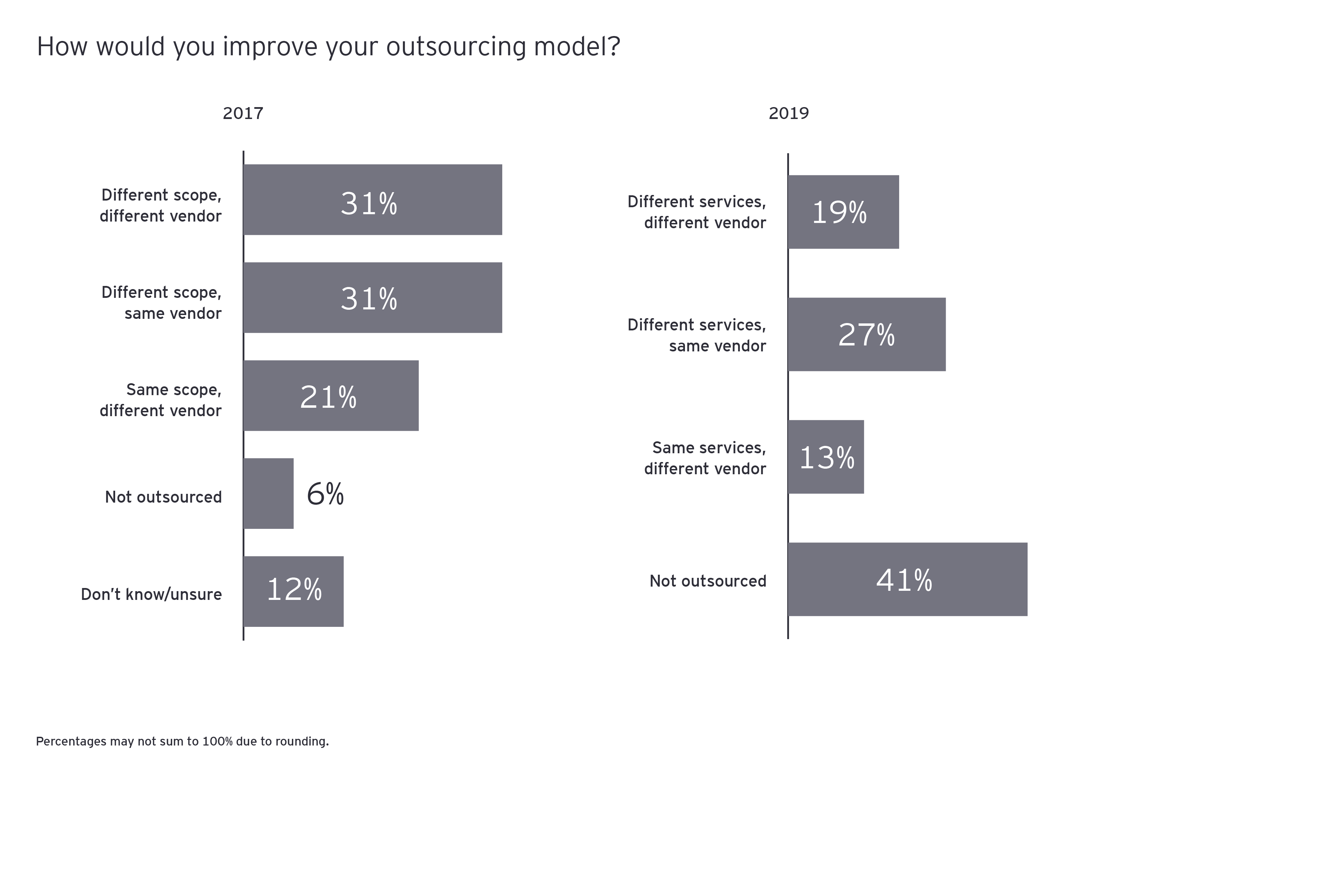

Regardless of service delivery archetype, 66% of respondents indicated they would not want to change from their current model in place, a 6% decrease since 2017 graph displayed in survey results preview. Overall, the number of respondents who agree with their choice in current service delivery model did not change significantly from 2017 to 2019.

Even though organizations may choose to keep their existing service delivery model in place, participants who outsource in 2019 indicated their top method to improve operations via outsourcing would be to select different services but remain with the same vendor (27%) as compared with 31% in 2017. In 2019, 19% also indicated they would choose to move forward with different services and a different vendor, a 12% drop since 2017. The two year span between iterations of the 2017 and 2019 survey indicated a slight change in participant choice to improve outsourcing through services rather than vendor realignment.

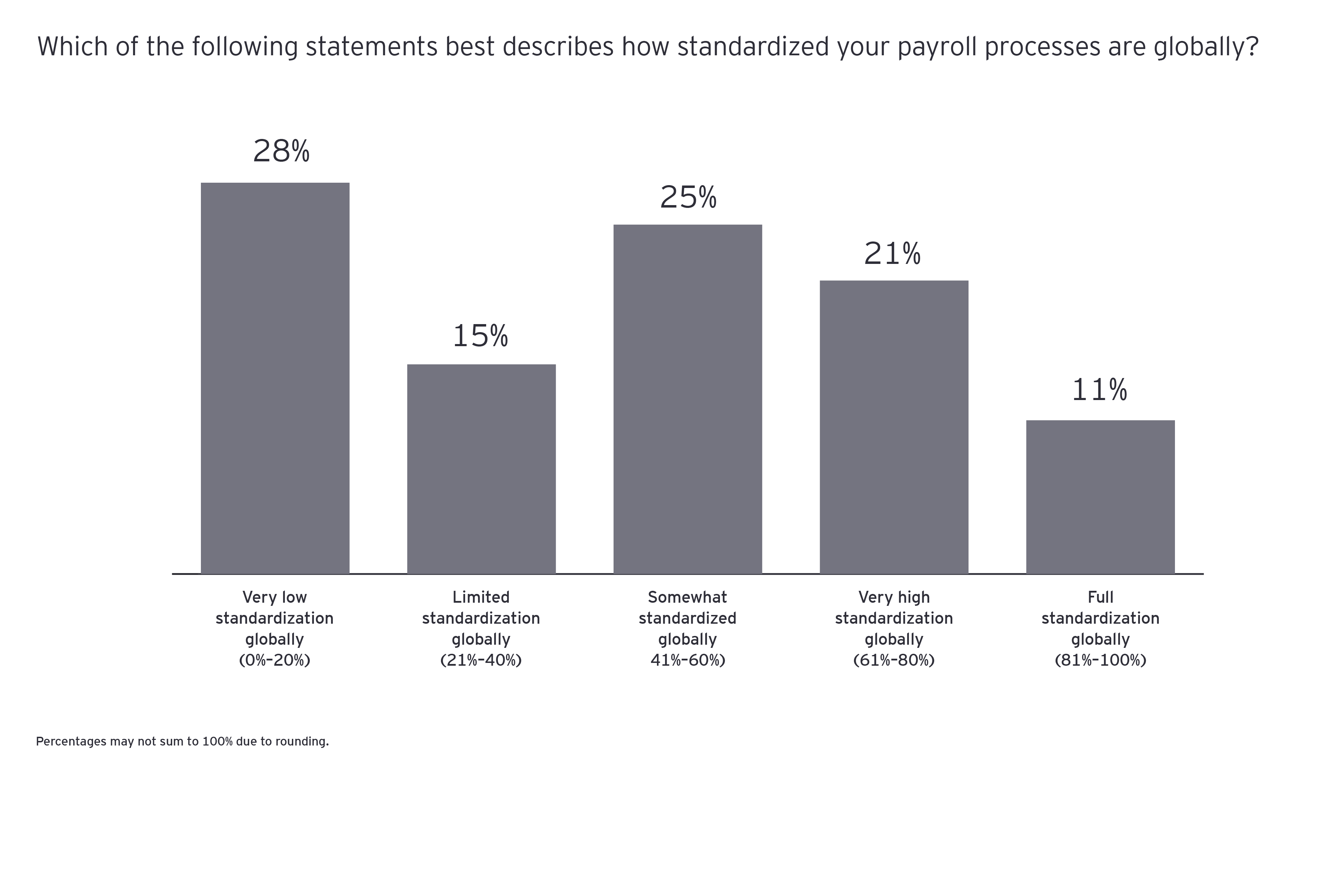

Another critical aspect in successful payroll delivery is the standardization of processes put in place to support the chosen operating model. Forty-three percent of respondents shared that their organization has very low or limited process standardization in payroll. The rate of standardization decreases for larger and more global organizations. The data does show an uptick in standardization of processes for companies with a formal payroll strategy as well as for those who outsource portions of their payroll operations.

Overall, this year’s responses indicating 32% of organizations have very high or full standardization is a positive driving force, which can significantly impact payroll operations for the better. Process standardization is an important aspect of the overall payroll strategy, one that can significantly enable the service delivery model to be more effective.

Chapter 2

Organizational structure

Payroll reporting alignment can impact how strategic initiatives are actioned.

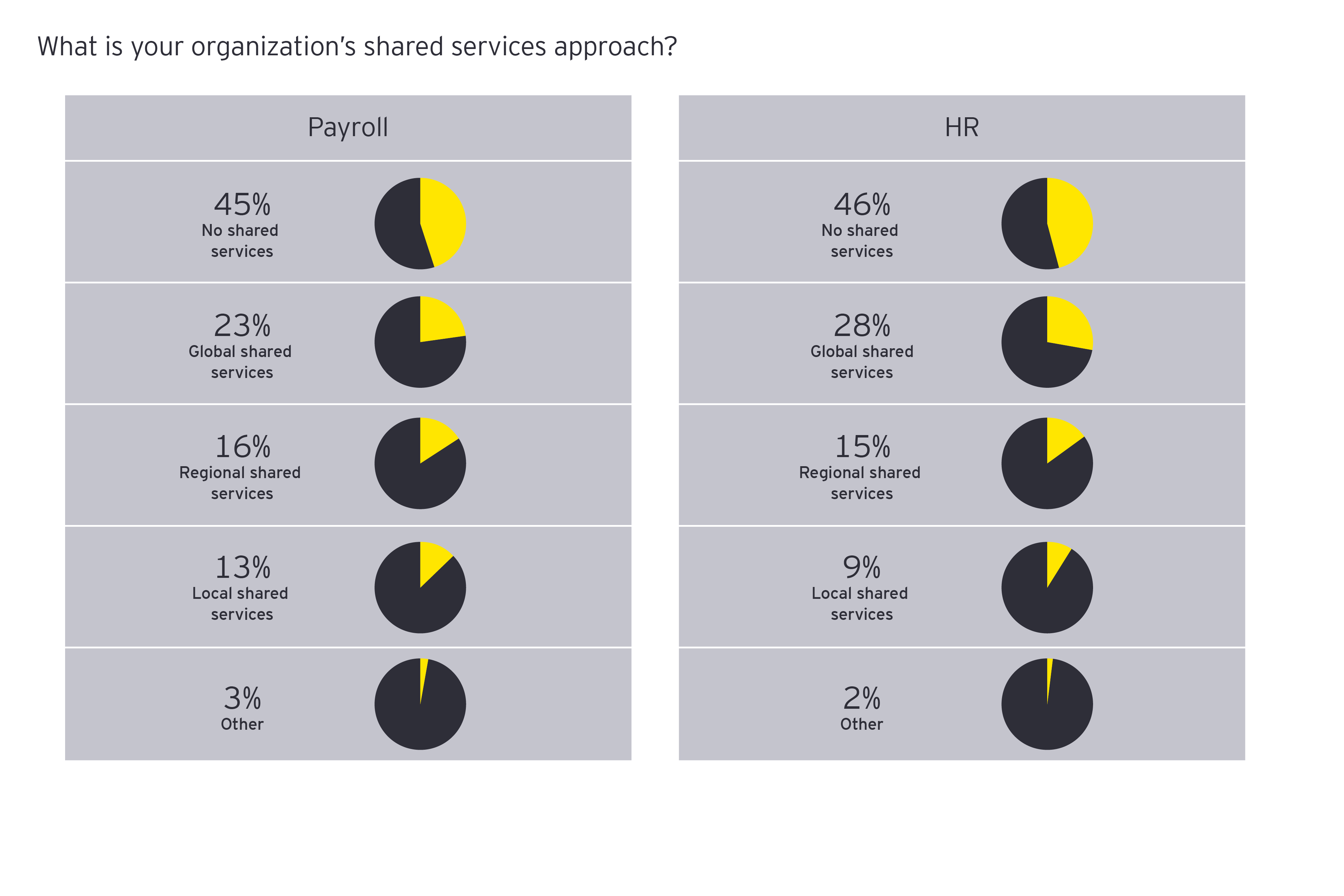

While the service delivery model is a crucial and foundational component of a payroll strategy, another key factor in structuring the payroll organization is the use of shared services.

The decision of how to structure payroll operations is largely dependent on the organization’s geographic footprint. When asked, survey participants indicated that the top areas for adding employee headcount were North America, Asia and Europe. As expansion continues, payroll must also shift or add resources to administer in new markets. Companies must determine the most effective and efficient use of resources, such as enlisting the support of external providers, hiring or transferring payroll resources and creating or further developing a shared services location.

Despite the close alignment of HR and payroll strategies, only 58% of companies with a payroll function reporting to HR have a formal strategy in place, as compared to 78% with payroll reporting to finance. Reporting alignment can have significant impact on the implementation of key payroll decisions. Often, payroll choices fall in line with the governing function to which payroll reports, swaying the strategic direction of operations significantly. Similarly, competing or related priorities may hinder or benefit the timing and pace in which payroll initiatives are implemented. Perhaps this explains one interesting 2019 survey result: while 57% of respondents report to HR, only 49% actually believe payroll should report to HR.

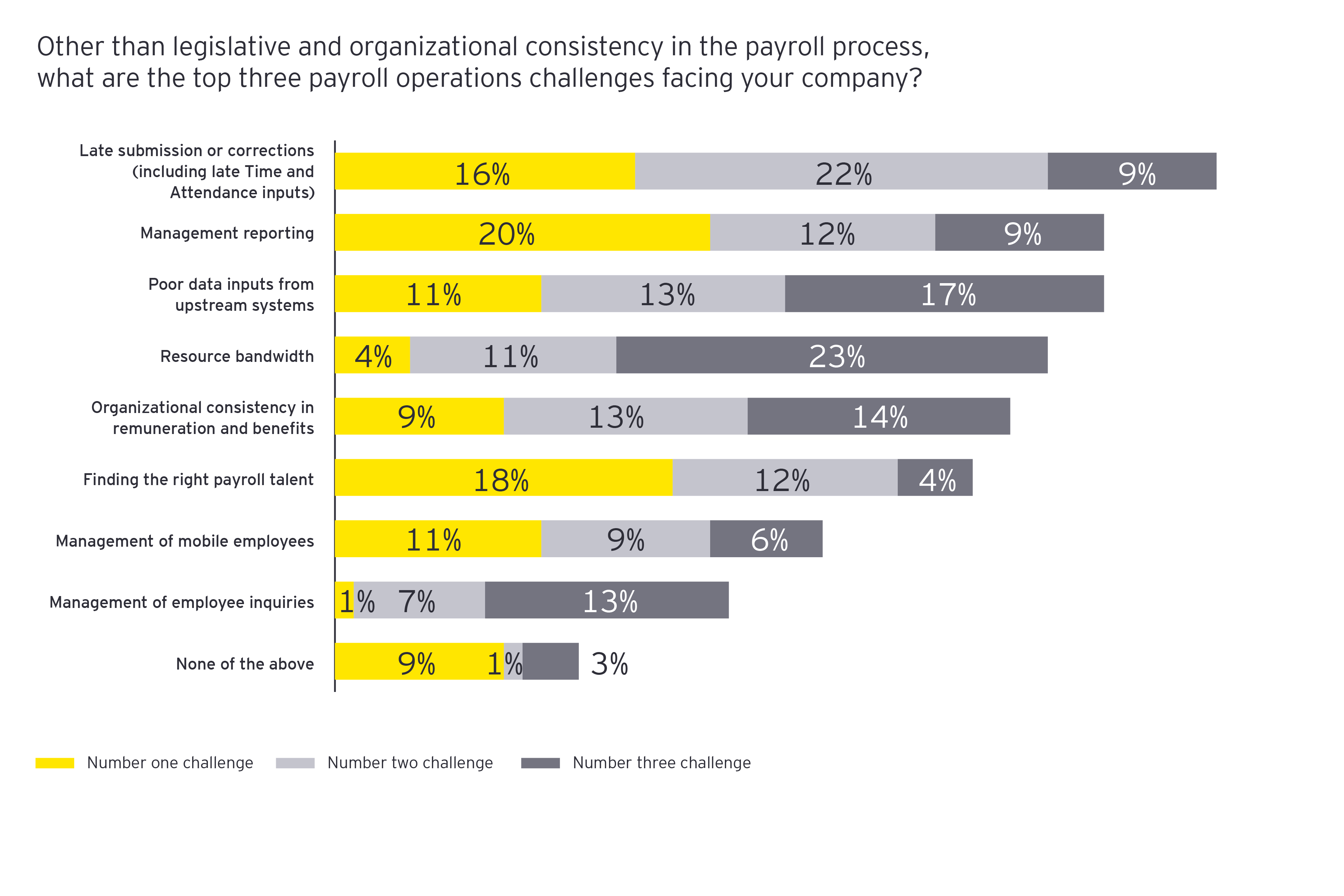

A final consideration for the organizational design in payroll involves the makeup of the payroll team. While not a top three challenge overall, finding the right payroll talent was selected by 18% of survey respondents as the number one challenge in payroll operations. Resources must be selected with many factors in mind: technology know-how, ability to adapt to changing business requirements, staying up to date on the latest legislation for the region supported and compatibility with other team members.

Many participants shared they would address the payroll talent need at the local level, if at all. However, given the increasingly global nature of companies in today’s landscape, reviewing payroll talent at the global level allows organizations to make effective decisions to service payroll operations with leading-class resources in the right roles.

All the while, consideration must be given to the structure of the overall team and resource bandwidth as payroll improvement projects are undertaken while delivery of regular payroll must be maintained. A potential solution for limited bandwidth or payroll knowledge often is to hire external support to deliver or assist on certain components of payroll delivery.

Chapter 3

Vendor governance

Vendor satisfaction remains stagnant, but strong governance methods improve vendor results.

Vendor governance is one of the most critical components of a global payroll strategy, impacting several aspects of service delivery for those who outsource or co-source their payroll operations. While payroll professionals must partner with providers to effectively process payroll, 32% of respondents in 2019 found that conducting business with payroll providers is difficult, a 13% increase since 2017.

Conducting business with payroll providers

32%Percentage of respondents who found it difficult to conduct business with payroll providers.

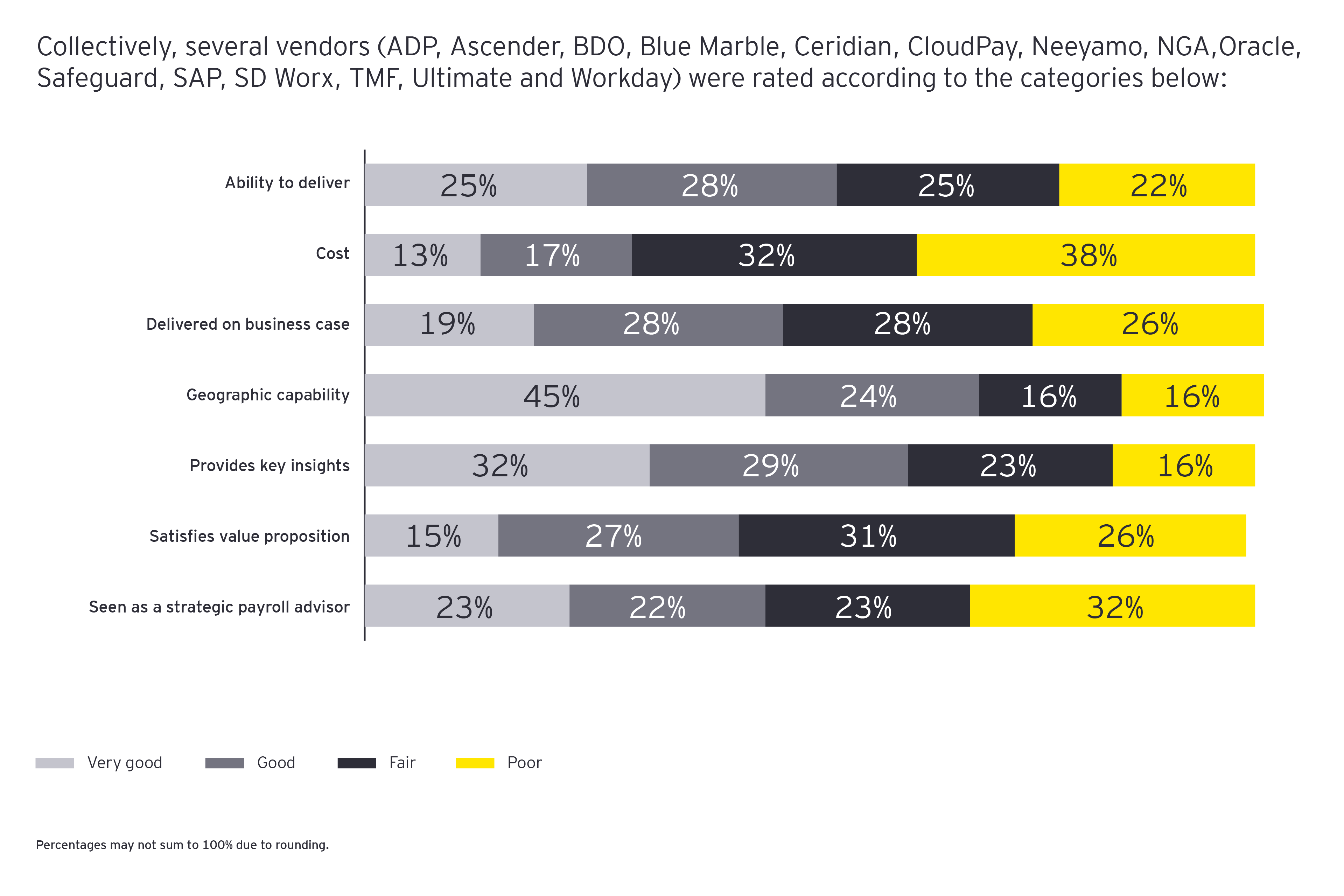

A new section was added to the 2019 survey, asking each participant to rank all known vendors in several categories. Providers collectively received the lowest ratings in the areas of: cost, ability to deliver on their business cases, ability to satisfy the value proposition, ability to deliver and be viewed as a strategic payroll advisor.

Collectively, results show providers rated fairly well on concepts related to day-to-day delivery (e.g., ability to deliver and geographic capability) compared with those demonstrating strategic value (e.g., business case, value proposition, strategic payroll advisor).

Collectively, several vendors (ADP, Ascender, BDO, Blue Marble, Ceridian, CloudPay, Neeyamo, NGA, Oracle, Safeguard, SAP, SD Worx, TMF, Ultimate and Workday) were rated according to the categories below:

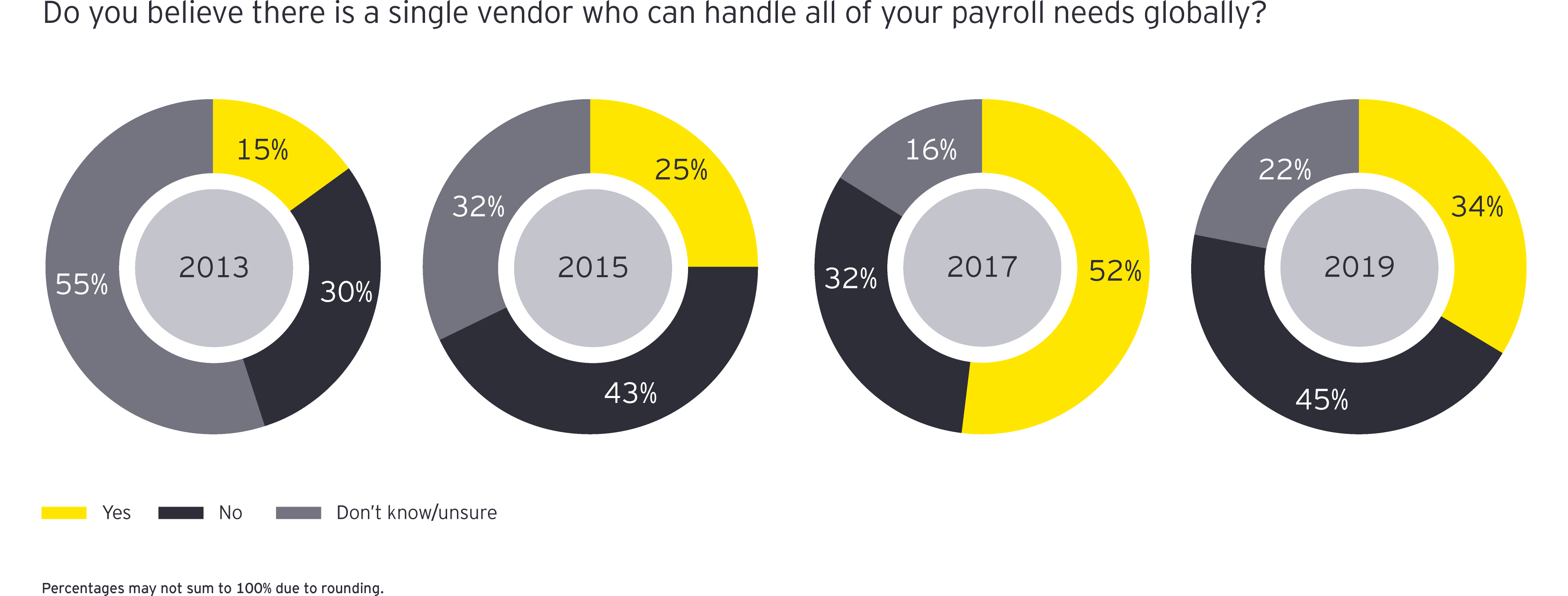

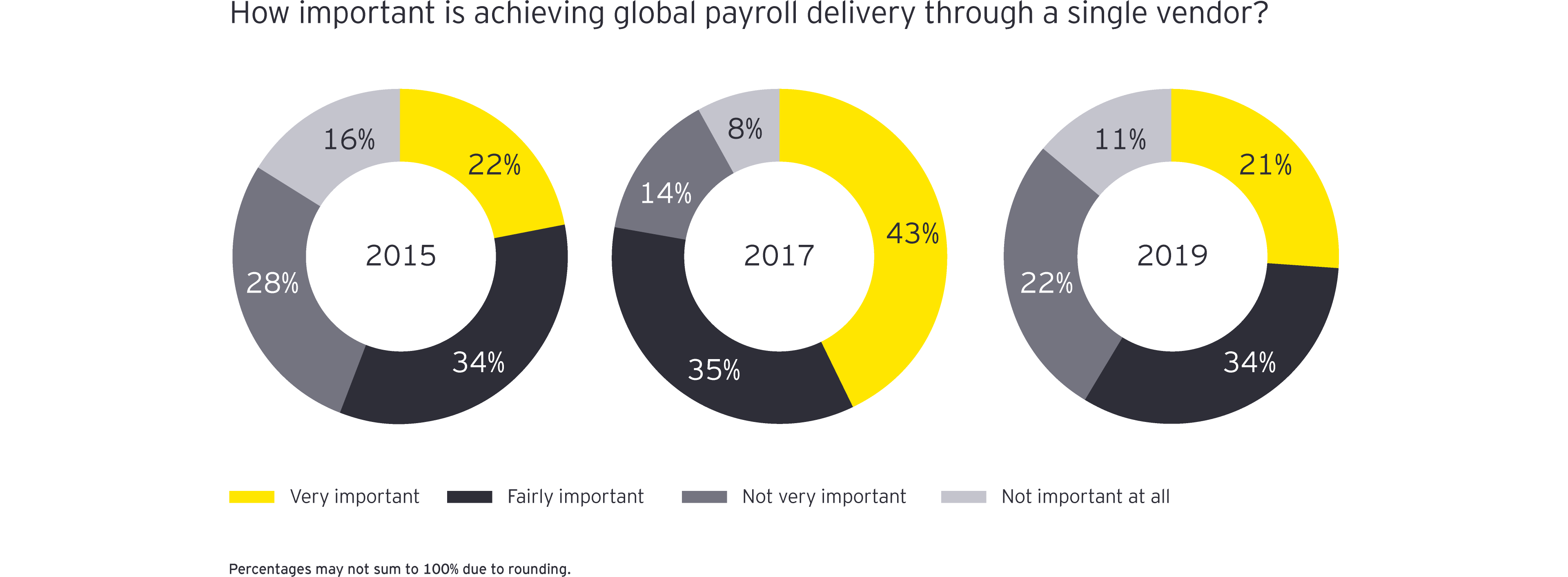

The search for a single vendor that can address payroll needs globally remains elusive. Forty-five percent of respondents said they do not believe there is a single vendor who can handle all their payroll needs globally, a 13% increase since 2017. However, there was also a 10% decrease (from 78% in 2017 to 68% in 2019) in respondents saying they thought it was fairly/very important to achieve global payroll delivery through a single vendor. The results remain consistent according to region and size, and regardless of whether the organization has a formal payroll strategy.

What is creating the disparity between company’s desire for a single payroll vendor and their inability to find such a provider? Based on the responses to the survey, it appears many payroll professionals still desire to consolidate operations to one vendor, but confidence about whether such a vendor even exists has eroded in recent years. The insights gained from companies across industries and market sizes indicate there are numerous factors for why leveraging a single vendor may not be possible: local legislations and language barriers, single vendor product capability across global geographies, existing contractual obligations due to strong vendor relations and potential cost savings. For these reasons, many organizations choose to utilize a multiple-vendor model to fulfill their global payroll needs.

Alternatively, the continued finding that some companies are moving payroll operations back in-house may provide another option for organizations to serve as their own perceived global payroll provider. However, operating internally as a global payroll provider does not come without risks. Training and developing payroll talent to track legislative changes and maintain compliance become potential challenges without enlisting the support of external vendors.

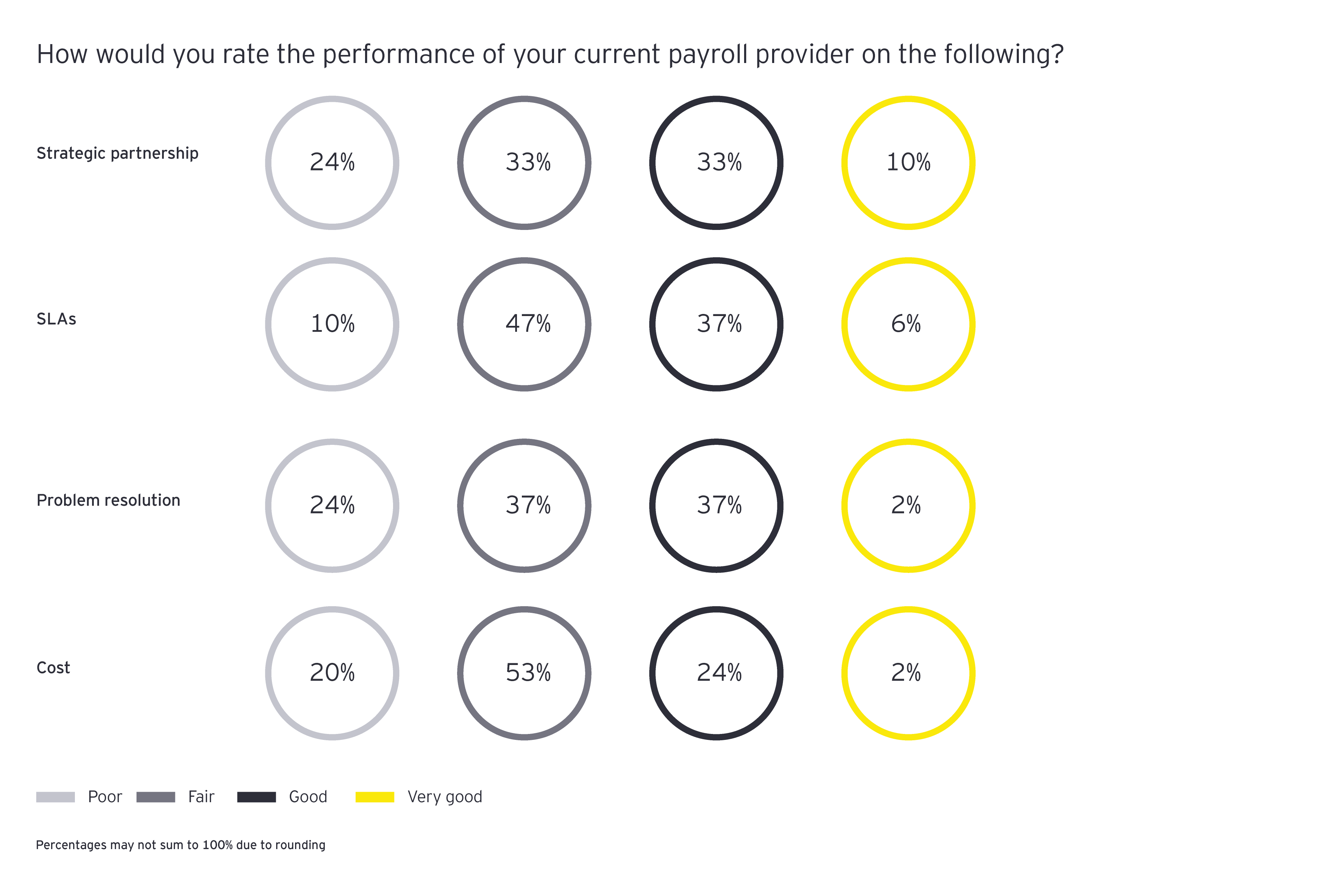

When asked about payroll provider performance, respondents indicated that areas of heavy dissatisfaction included strategic partnership, service-level agreements (SLAs), problem resolution and cost. At second glance, the rates of dissatisfaction are reduced with a formal payroll strategy.

Due to the significant perceived lack of single-provider capability shown within this report, organizations are pushed to implement a payroll strategy that focuses on components within their control. Improving the interaction with multiple vendors can include creating standard processes to be applied consistently across providers, establishing clear SLAs up front for each provider to follow, maintaining a strong governance team to interact with each vendor and gathering metrics to track performance over time. The criticality of leveraging the right mix of vendors based on an organization’s payroll strategy then becomes apparent to improve the vendor management relationship, lower cost and partner with providers to deliver on the proposed value proposition.

Whether service delivery is being addressed through a provider or internally, technology can help or hinder the success of payroll operations.

Chapter 4

Technology and data

Cloud-based solutions and AI gain momentum in the payroll space.

While implementation of new HR technologies and digital tools is not the top priority for organizations in 2019 (as compared with results from 2017), technology remains a major component of the overall payroll strategy.

Respondents were asked if their organization’s human capital management (HCM) platform in use was an on-premise or a cloud-based solution (a new question added in the 2019 survey), and not surprisingly the results show cloud-based HCM platforms have gained momentum in use among survey respondents, with 55% stating that they have a cloud-based HCM platform (with an even higher rate of response from those with a formal strategy in place).

Cloud-based platform adoption may be attributed to several factors: insourced payroll operations are more common, using cloud-based solutions due to the retiring of legacy on-premise platforms, lack of satisfaction with payroll provider value proposition and greater ability of providers to deliver out-of-box solutions that meet company needs without heavy customization.

Benefits offered by cloud-based products include shorter implementation life cycles and cost savings, but these products often require organizations to standardize their processes so that operations are enabled using these platforms. While cloud vendors have historically targeted smaller and mid-market companies, they have expanded capabilities to meet the needs of larger clients, which may mean the trend will continue.

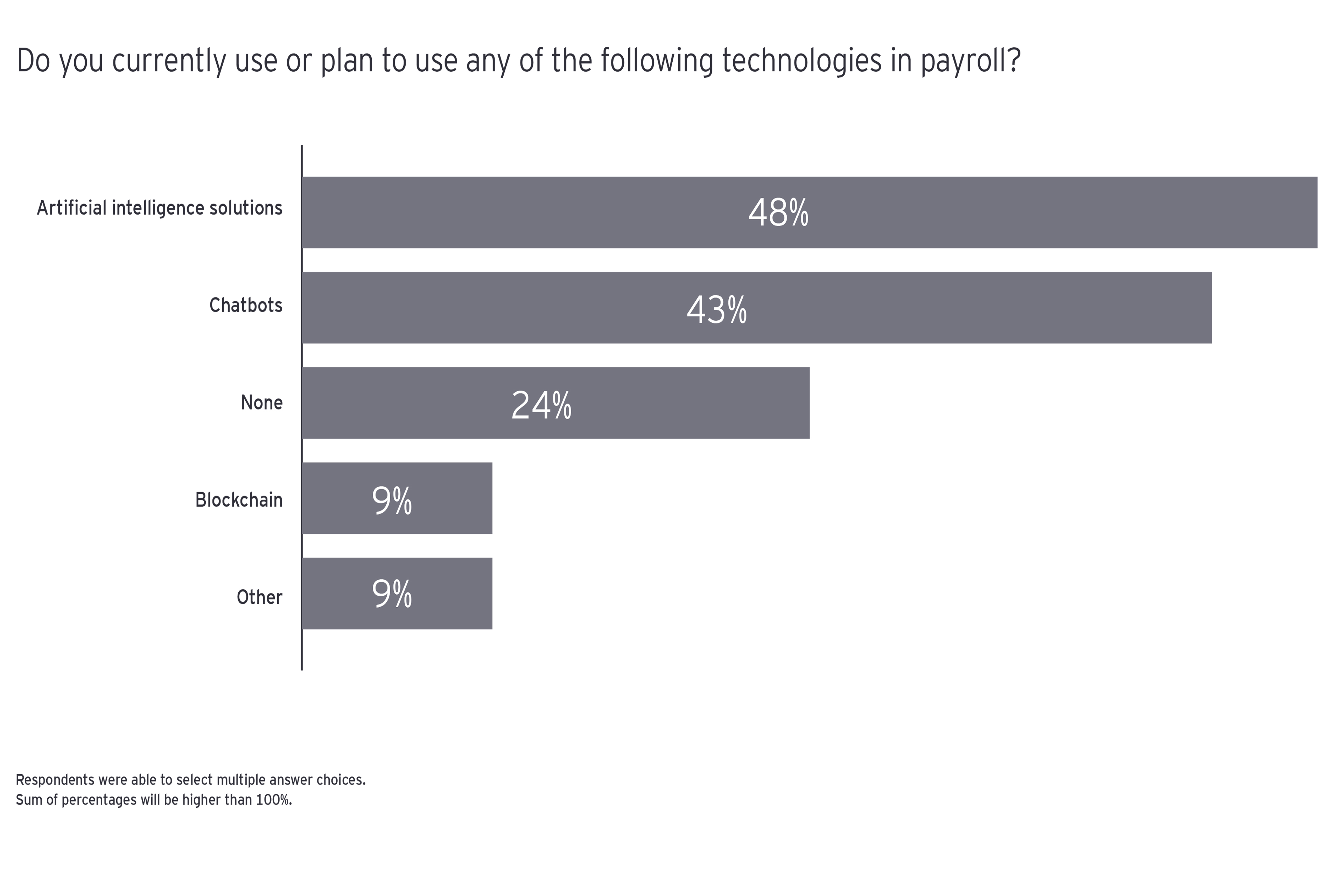

Payroll can be enabled not only through HR and payroll technology platforms, but also through other digital solutions. Automation remains a top payroll service delivery challenge as companies continue to invest heavily in emerging technologies, with a high percentage of surveyed organizations either using or planning to use intelligent automation and chatbots for payroll processing and interaction with employees.

Finally, as operations are streamlined via the payroll strategy components mentioned thus far (service delivery and operating model, vendor management and technology), increasingly companies are further investing in the employee experience.

Chapter 5

Employee experience

Payroll is taking an active role in driving a positive employee experience.

In 2019, a survey section was added regarding employee experience, as companies have previously shared their challenges with driving a positive employee interface with payroll. As payroll leaders continue to evolve their strategies both in foundational improvements and innovative solutions, organizations have also begun to view payroll as a more integral component of the overall employee value proposition.

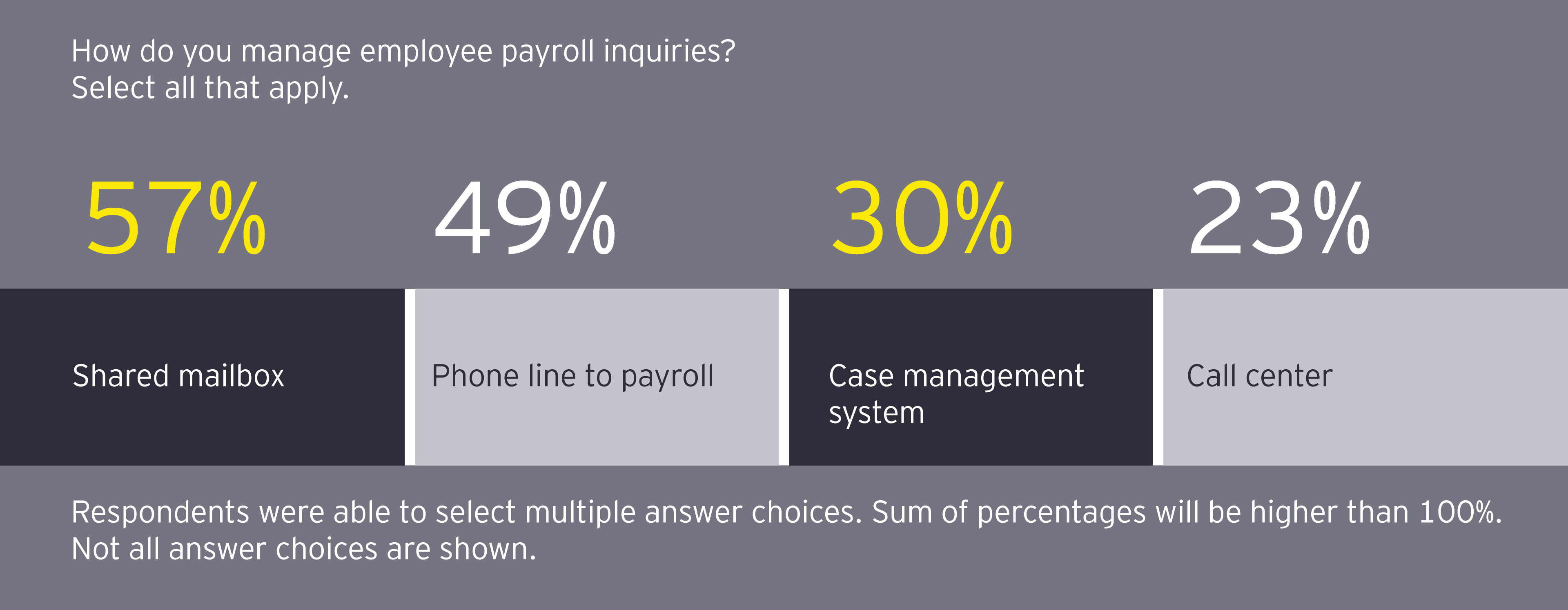

Many organizations are considering the implementation of an inquiry management system to enhance employee’s ability to log and track their questions to payroll and HR (among other functions). In 2019, respondents said shared mailbox is the most commonly used medium for inquiry management, followed by phone line to payroll and case management system. Implementation of a case management system can improve the efficiency and accuracy of responses to employee questions while improving the user interface with these functions.

Those with a payroll strategy in place are more likely to use preferred employee inquiry management methods such as case management system and call center as well as less likely to use shared mailbox and phone line to payroll.

Organizations with payroll strategy are considering the employee experience more and more by focusing on these tools, which directly impact the end user.

Another contributing factor that can impact the employee experience is the use of self-service functionality; when asked, survey respondents indicated self-service functionality was the number one selection criteria when choosing a new time and attendance and workforce management system and third highest HR priority overall. In addition to recent technology releases via enhanced mobile applications and improved off-the-shelf provider offerings, employees can own and interact with their HR and payroll data more than ever before. This improves both employee engagement with core internal functions as well as employee and manager ownership to enter data accurately and in a timely manner for effective downstream impacts.

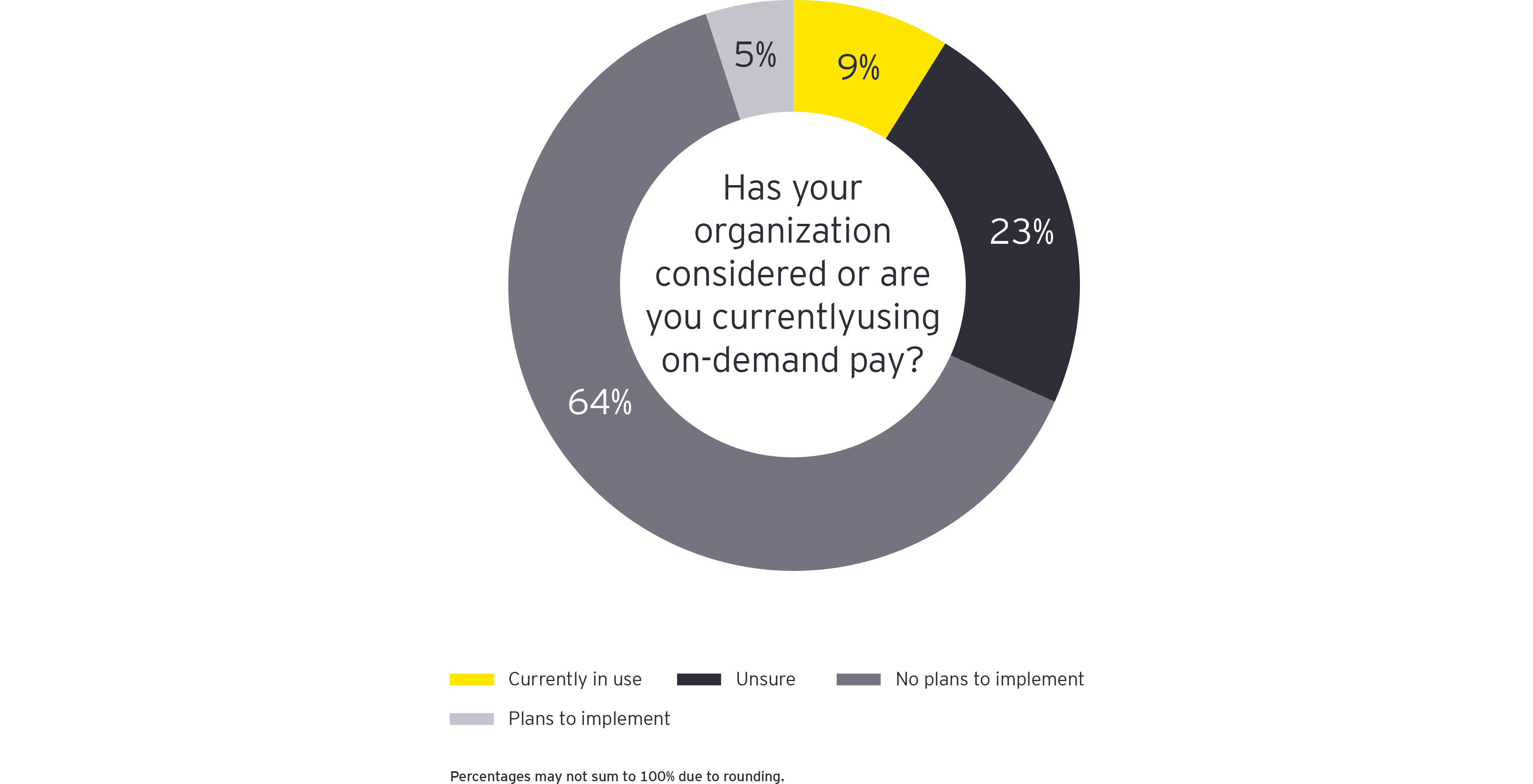

As employee engagement continues to be remedied through new ways of payroll service delivery, innovative practices are generating a lot of interest. Many organizations have begun to request more information regarding the rollout of on-demand pay, and as a result, there was a survey question on the topic in 2019. Only 9% of respondents indicated they are utilizing on-demand pay, which allows individuals to be paid for hours worked before the standard payday. As the payroll function continues to evolve, pay flexibility may serve as a talent attraction and retention mechanism. However, there are cost factors and important regulatory and tax considerations, which may explain the lack of adoption thus far.

Final thoughts

Overall, 65% of companies responding to the survey indicated they have a formal strategy in place. In light of the complex decisions that must be made with each aspect of payroll operations, it is increasingly clear that there is a need for formal payroll strategies to be put in place. Companies often struggle to plan HR and payroll transformation when their challenges include organizational changes, impending technology retirement, limited budget and time constraints. In many cases, companies must evaluate their service delivery models, update their processes and implement new technologies simultaneously. For this reason, EY professionals encourage clients to understand the goals of their future state payroll function, develop a strategy and plan, and act accordingly. Due to competing priorities, a strong program management team and implementation plan must be put in place to effectively deliver transformative changes.

Summary

Our survey found organizations with a formalized payroll strategy indicated more advanced payroll operations. Cloud-based solutions and AI are gaining momentum in the payroll space. Vendor satisfaction remains stagnant, but strong governance methods improve vendor results. Lastly, payroll is taking an active role in driving a positive employee experience.