The Long Goodbye is a consistent, steady change reflecting well-established patterns of consumer and commercial behavior. We don’t know how the final result, but The Long Goodbye is a possibility.

EVs are increasingly cost- and performance-competitive, but consumers don’t always choose what might be considered the best or cheapest alternative.

As we said in Fueling the Future, the speed and extent of the energy transition, the role of oil and gas and the return on oil and gas assets hinge on five variables:

- The concentration of economic growth

- The role of coal and nuclear power

- Efficiency improvements in the internal combustion engine

- The rate at which consumers accept EVs

- The speed at which distributed solar replaces natural gas

Let’s consider what those things look like under The Long Goodbye scenario.

The impact of economic growth

Oil and gas demand are far more sensitive to economic growth in developing countries than in developed countries, and our scenarios draw that distinction. We observe that economic growth in developing countries works against decarbonization. In the recent past certainly, India and China have been more coal-dependent and less natural gas-dependent. Countries and regions that are richer and where energy needs are satiated are more agreeable to higher-cost alternatives and less-proven technologies.

From this perspective, The Long Goodbye is a baseline scenario. Economic growth in developed and less-developed countries is currently consistent with World Bank projections.

The role of coal and nuclear

In The Long Goodbye scenario, we assume coal-fired generation decreases by an average of 1% per year globally, which is reasonably consistent with recent history.

In the last five years, global coal consumption has gone down by 0.5% per year, largely due to reductions in the cost and price of natural gas and the emergence of cheaper renewables. However, the story is very uneven geographically. Coal consumption has gone down by 5% per year in Europe and North America, increased by 5% per year in India and has been steady in China. Nonetheless, The Long Goodbye is pessimistic from the perspective of climate change, as the Paris Agreement goals call for a sustained 5% reduction in coal consumption until it’s phased out completely.

As for nuclear power, The Long Goodbye assumes 2% growth per year. The recent history shows lower growth than that, but a march toward decarbonization at any speed will require nuclear power to hold its own in terms of market share.

Internal combustion engine fuel efficiency

The long-run trend of internal combustion engine vehicles is better fuel efficiency.

The Long Goodbye scenario assumes 1% annual improvement in internal combustion engine fuel efficiency. Slower than it could be but continuing to steadily improve. Notwithstanding the environmental benefits of more-efficient cars, we expect the policy environment will be focused on vehicle electrification. Efficiency improvement requires investment, and it’s likely that capital will migrate toward developing new technologies rather than improving incumbent ones.

Consumer acceptance of EVs

EVs are increasingly cost- and performance-competitive, but consumers don’t always choose what might be considered the best or cheapest alternative.

Paris-compliant scenarios assume rapid vehicle electrification. Governments around the world have announced outright bans on internal combustion engines, and Paris Agreement goals require essentially 100% market share by 2035. In The Long Goodbye scenario, it takes longer to overcome consumer resistance to a fundamentally different driving and fueling experience. That’s not to say that it’s better or worse, just different — and different takes time. EVs claim a market share a little lower than 40%, a number that’s historically consistent with the adoption of other alternative technologies, such as color TV. It’s also consistent with most auto industry projections of EV penetration.

The transition to renewable power

In our models, we measure the speed of transition to renewables in terms of the marginal share of renewables and gas in the generation mix. In other words, what percentage do renewables and natural gas take after factoring demand growth, coal attrition and increases or decreases in nuclear generation. To meet the goals of the Paris Agreement, the renewable share should be bigger than 100%. Essentially, gas generation needs to be shut down and replaced by renewables. It’s roughly 50/50 now. In The long goodbye, we assume a roughly 80% share for renewables by 2035. That’s much more than we have now, but consistent with cost projections and some views of the amount of dispatchable power necessary to keep the power system stable.

The impact on oil and gas demand

There are many estimates of when oil demand will peak and how natural gas demand will grow. In scenarios that are consistent with the Paris Agreement, oil demand should peak within the next 5 years, and natural gas should grow very slowly for the next 25 years before peaking in the first half of this century and declining to roughly the level where it is now.

The Long Goodbye scenario envisions a somewhat more gradual transition. Oil demand peaks in 2040 at roughly 135 million barrels per day and ends the middle of this century at this same level of barrels. Natural gas demand grows steadily and increases by more than 285 billion cubic feet (BCF) to 655 BCF per day, compared with current demand of 370 BCF per day.

What does this mean for returns?

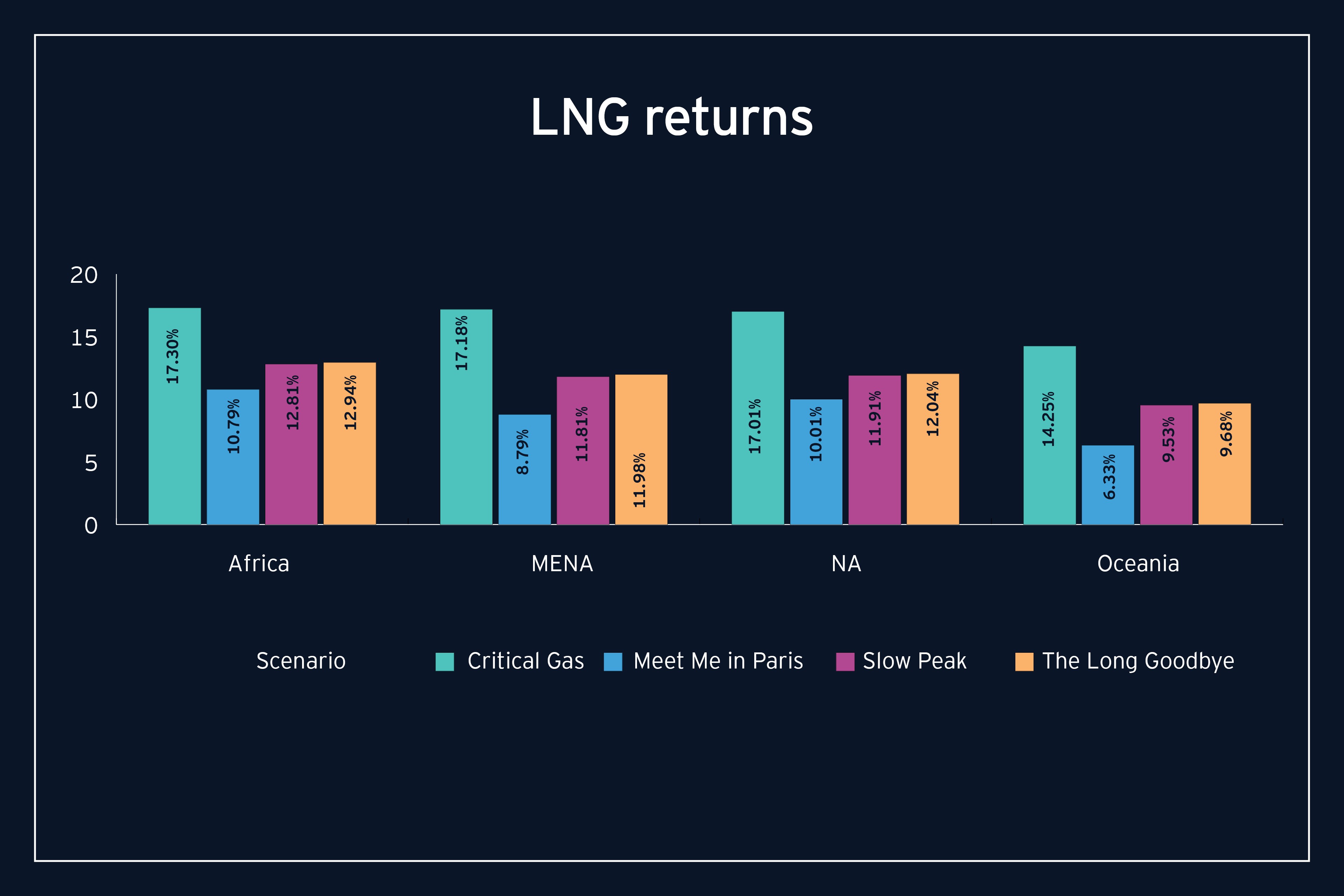

One of the major findings of Fueling the Future is that asset returns are remarkably resilient with respect to all four energy transition scenarios. In The Long Goodbye scenario, returns across regions and asset classes are well within what investors should expect to receive on non-oil and gas assets with similar risk profiles.

The road to decarbonized energy is likely to be a long one. The current energy mix is serving consumers in OECD countries well and is profitable for the industry. The Long Goodbye scenario is a story of consistent, steady change that reflects well-established patterns of consumer and commercial behavior. We don’t know how it will turn out, but The Long Goodbye is certainly a possibility.

Summary

Once alternative energy becomes competitive with fossil fuels on a large scale in terms of cost and performance, the timing of the energy transition will be a matter of consumer preference. That is the theme of The long goodbye. In this scenario, consumers call the tune. Once consumer preferences shift significantly, the energy transition happens.