Chapter 1

Challenging corporate reporting to achieve value-driven reporting

Reporting plays a central role in rebuilding trust by providing clear insight into organizations’ financial and nonfinancial performance

Companies and capital markets depend on trusted and relevant corporate reporting. It underpins companies’ reputations and builds market confidence in the actions of company leaders.

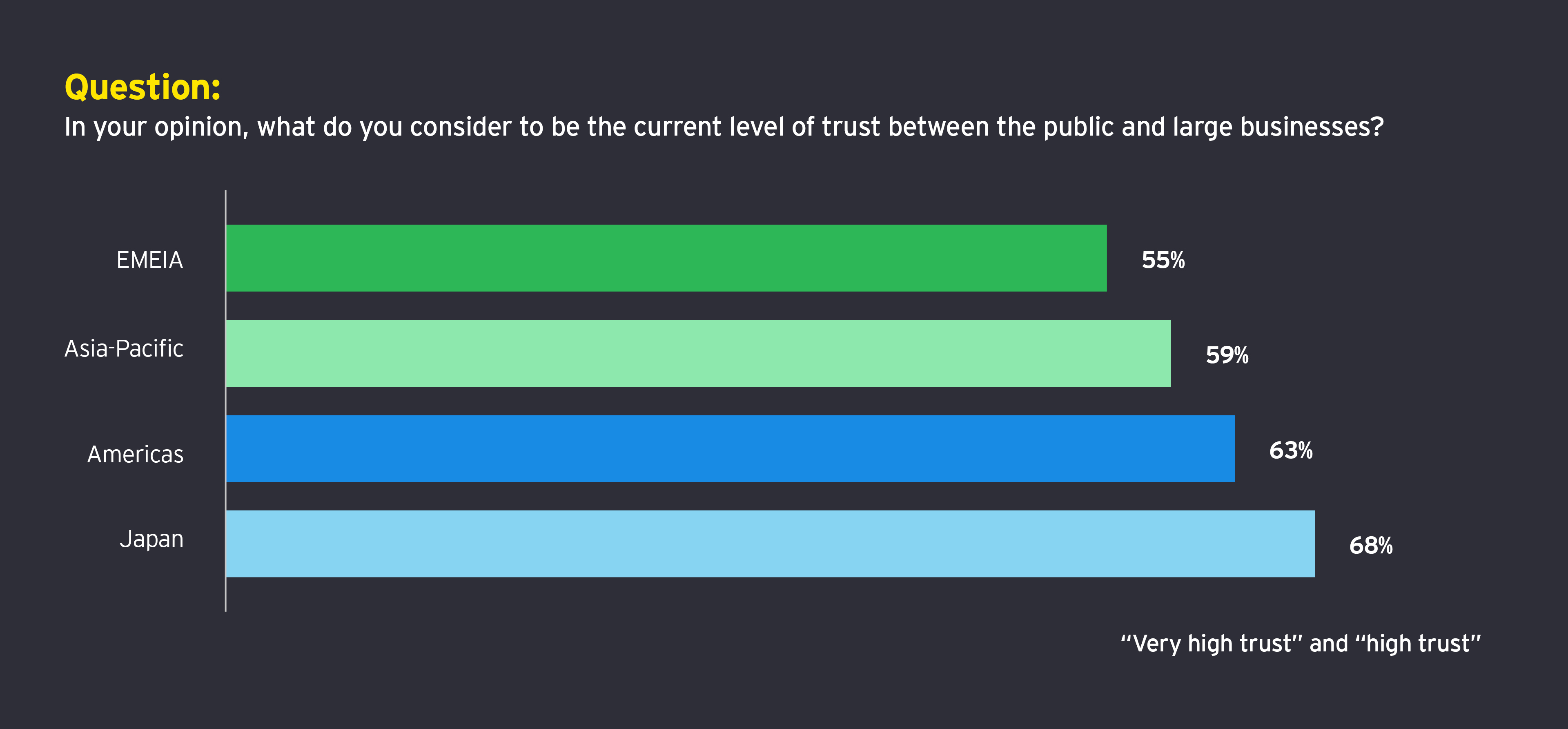

Now, however, the effectiveness of corporate reporting is threatened on two fronts. The first is the widening trust gap between business and society. This EY research found that only 58% of finance leaders are prepared to say that businesses are highly trusted. It might be expected that corporate finance leaders would be relatively positive about trust in business, but a lukewarm response is a common pattern across many regions. For example only 55% of respondents in EMEIA are prepared to say that businesses enjoy either “very high trust” (12%) or “high trust” (43%).

Finance leaders are far from bullish about public trust in businesses

58%of respondents are prepared to say that businesses enjoy either “very high trust” or “high trust”

The public’s weak trust levels in business are reinforced by the disconnect between the reporting agenda of corporates and the public’s agenda. Often, reporting fails to capture nonfinancial information as a driver of organizational performance. Therefore, organizations should account for and explain performance much more clearly and coherently.

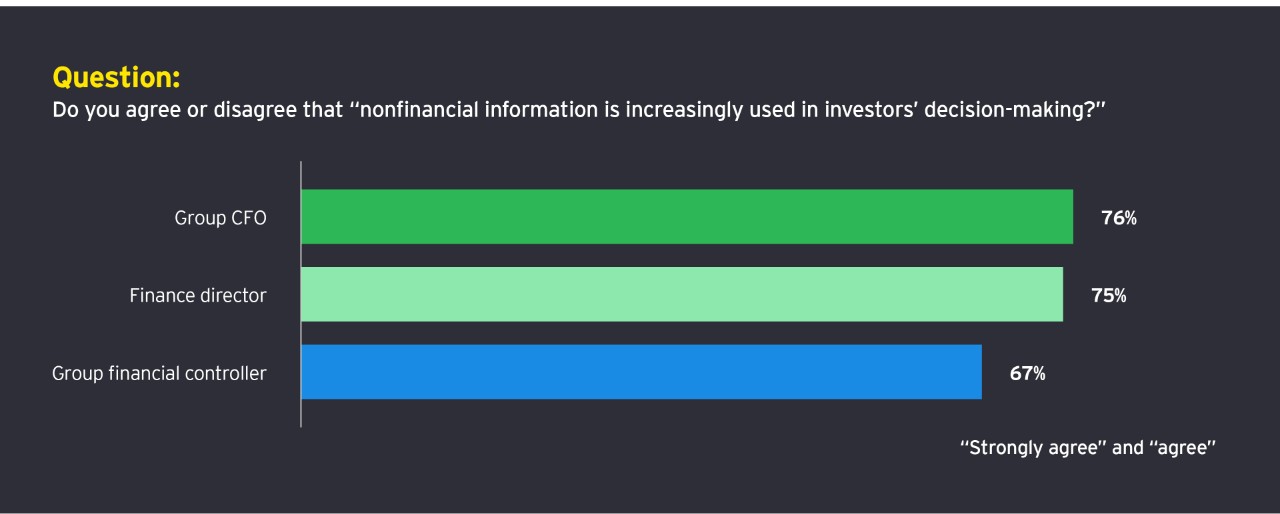

The research shows that finance leaders now expect reporting on a bigger picture. Just under three-quarters (72%) of finance leaders say that nonfinancial information is increasingly used in investors’ decision-making, and over three-quarters of group CFOs emphasize its importance.

To rebuild trust and offer stakeholders insight into an organization’s plans to create long-term value, finance teams should focus on two priorities:

Account for and explain organizational performance much more clearly and coherently

Companies have made significant progress in their reporting of financial and nonfinancial information. They now report against key performance indicators (KPIs) – economic; strategic; and environmental, social and governance (ESG). According to this EY research, the most common KPIs include “treatment of employees” and “customer loyalty” or “net promoter score.”

Organizations are also communicating nonfinancial information in a variety of ways. These are (in order according to this research):

- Company-defined report that integrates financial and nonfinancial information

- Integrated report that follows the International Integrated Reporting Council’s (IIRC’s) International Integrated Reporting Framework

- Specific section within the annual report

- Standalone corporate social responsibility report

- Standalone sustainability report

However, despite this significant progress, more should be done to challenge reporting. There is a tendency to report the wrong things – measuring what is easy rather than what stakeholders want to know. This is particularly true of intangible or nonfinancial assets. Close to three-quarters of finance leaders – 73% - say “our performance on nonfinancial KPIs has a significant impact on intangible assets.” This is a sentiment shared across the finance function with 75% of group CFOs and 70% of group financial controllers agreeing.

The long-term value approach demands new frameworks that communicate the value of strategic assets, provide information that multiple stakeholders demand, and show how organizations are creating value over the long term. The Embankment Project for Inclusive Capitalism is a step toward this kind of framework.

Manage nonfinancial information with the same rigor and assurance as managing financial information

The increasing focus on nonfinancial information means that stakeholders will challenge reporting more.

Management and boards should be convinced that the information is useful and relevant; regulators will want to know that it is accurate and compliant. If all reporting information – whether it is financial or nonfinancial – is not investment-grade, trust will suffer.

Independent assurance of information, either mandated or voluntary, can play a critical role. EY research finds that companies that have their nonfinancial information independently verified are more likely to be confident that their corporate reporting is trusted. Overall, 62% of respondents say that corporate reporting enjoys high levels of investor trust, but this increases to 83% among those who have their nonfinancial information audited.

Chapter 2

Making the most of artificial intelligence and smart technology

Many teams are overwhelmed by the volume of data available. They should utilize technology but not at the expense of standards and trust

Organizations and their finance teams have more data than ever before thanks to increases in computer processing power, ever-growing connectivity, and the cloud and its massive storage capacity.

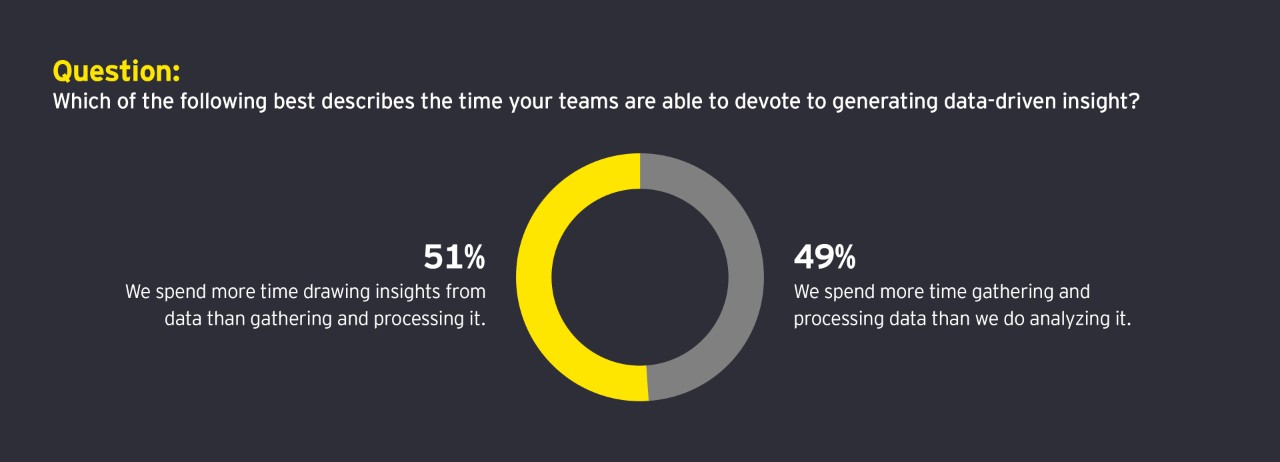

However, many finance and reporting teams are simply overwhelmed by the volume and variety of that data. In this EY research, about half of the finance leaders (49%) say they “spend more time gathering and processing data than they do analyzing it.”

Many finance and reporting teams are overwhelmed by the volume and variety of data

49%say they spend more time gathering and processing data than they do in analyzing it

To turn data into truly value-driven reporting, finance teams should focus on two priorities:

Exploiting rapid technological advances in automation, artificial intelligence and blockchain

Automation: giving finance teams freedom to focus on insight generation

The most agile finance and reporting teams are using automation to drive new levels of operational agility:

- They are advanced in using robotic process automation (RPA) to drive new levels of efficiency. And they are using rules-based robotics technologies to automate high-volume transactional finance processes.

- They are already exploring the next frontier in automation – intelligent process automation, which combines RPA with AI such as machine learning. These technologies learn over time as they are exposed to more data, allowing finance teams to target high-value finance responsibilities. As these tools improve, they will move on to reading, managing and analyzing complex contracts and data. Other intelligent technologies that could work here include speech recognition, natural language processing, biometrics and chatbots.

Artificial intelligence: harnessing insight from data

Finance leaders can use AI to look for underlying patterns in data as well as machine learning to predict scenarios and improve outcomes.

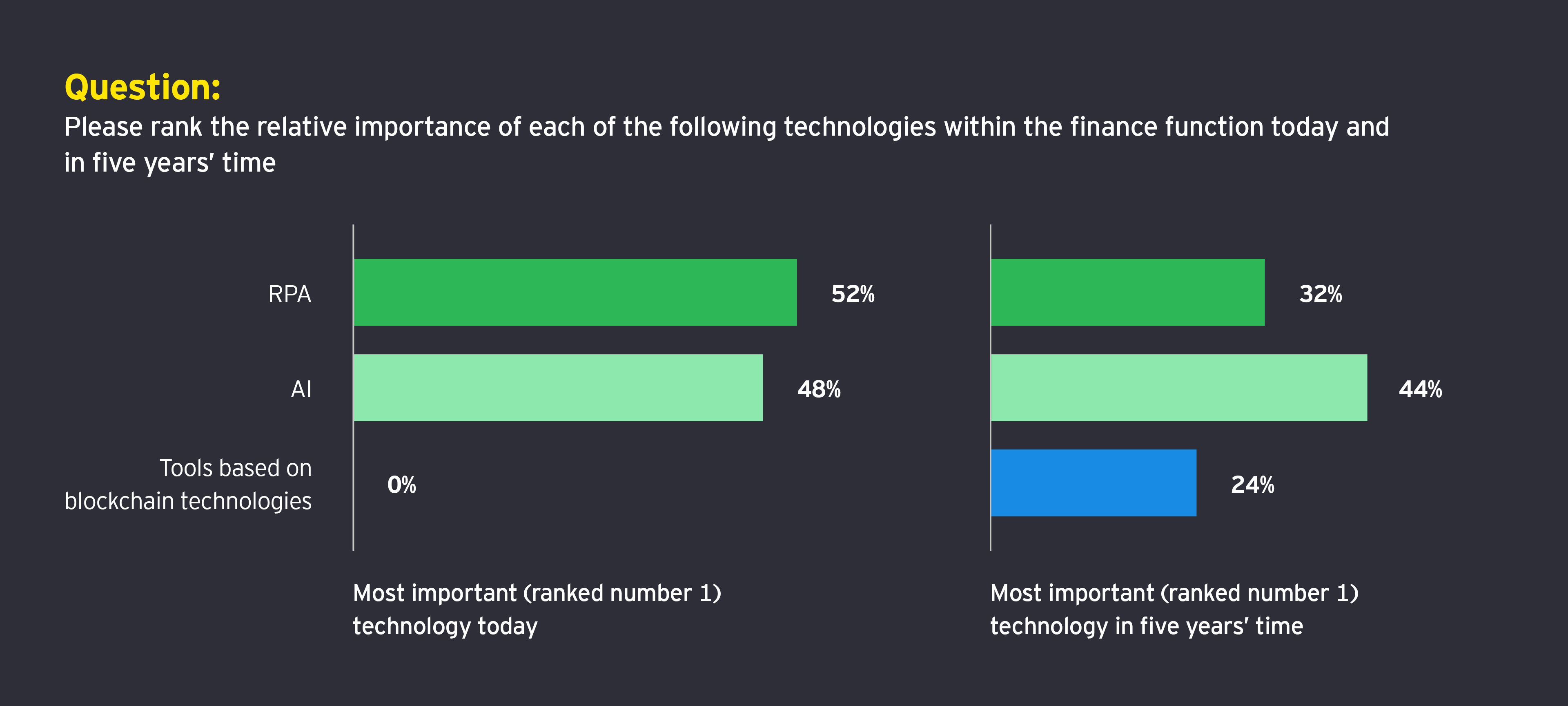

Close to three-quarters of finance leaders in this research (72%) say that AI will have a significant impact on the way finance drives data-driven insight, and that AI will be the critical technology for the finance function in the future. Finance leaders were asked to rank the importance of three technologies – RPA, AI and blockchain-based tools. Although RPA came out on top for now, AI leads the list in five years’ time.

However, finance leaders do not just have to think about how they use AI in their finance functions. They should also think about how stakeholders, such as investors, are using it to highlight corporate reporting. This is because AI allows investors to analyze corporate financial information in ways that were previously unthinkable.

Related

Artificial intelligence: harnessing insight from data

72%say that AI will have a significant impact on the way finance drives data-driven insight, and that AI will be the critical technology in the future

Blockchain: disrupting the future of reporting as we know it?

Blockchain records transactions using a distributed ledger, which gives every network participant a secure audit trail of all transactions ever made – in near real-time. Some commentators, therefore, expect the technology to become the industry standard for reporting and accounting, replacing existing back-end IT and traditional reporting practices. If blockchain is used to automatically consolidate accounting records automatically, then reporting teams can spend less time on cross-checking and aggregation, and more time on analyzing data that can be trusted.

This research shows that a number of finance leaders agree on the technology’s potential. Our research shows that close to one-quarter (24%) say that blockchain will be finance’s most important technology in five years’ time. Of course, a number of challenges will need to be overcome. For example, key stakeholders – from regulators to boards – would need to agree on and implement the required regulatory environment.

Build trust in your data analytics

Finance leaders are focusing on turning data into reporting insight, but they have to negotiate a difficult balancing act; driving innovation in how they use data without compromising standards and undermining trust.

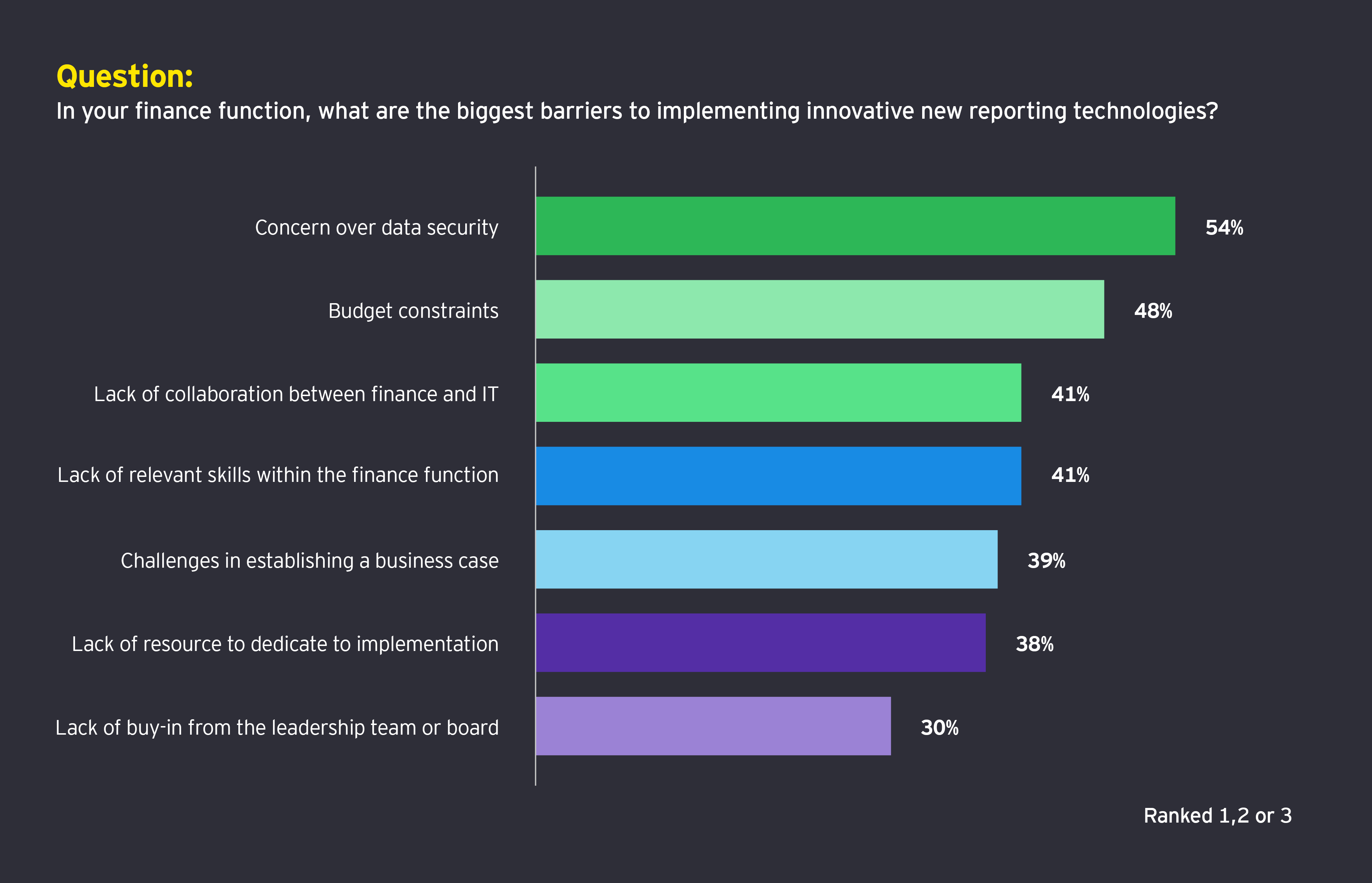

This research shows that concerns about data risk are at the top of finance leaders’ minds. And concerns about data security are one of the most critical barriers to implementing new reporting technologies.

However, concerns about digital and data risks should not hold organizations back. To get to true value-driven reporting finance teams should be able to embrace their data with confidence. This will require changes not only to technology and processes, but also to mindset, skills and governance.

Top 5 challenges facing finance leaders today are:

- Heightening data protection and privacy risk

- Meeting the pace of technology change

- Increasing scrutiny and regulatory change

- Increasing demand for real-time, forward-looking information

- Meeting changing societal norms

Chapter 3

Transforming the finance team and overcoming cultural barriers

Finance functions require a different talent profile that may require leaders to overcome cultural barriers and entrenched processes

Value-driven reporting does not just demand that finance teams adopt new technology – they also require a different talent profile and skill sets.

The finance function will benefit from team members with a range of new capabilities beyond traditional finance and accounting skills, including strategic awareness of new technologies, such as AI, and knowledge in disciplines such as data science and advanced statistics.

Those who can help the team understand and measure the interdependencies between nonfinancial and financial information will prove valuable. That skill requires a grasp the nuances of nonfinancial information management and understand the interdependencies among the organization’s different types of capital.

Finance leaders know the function’s talent profile needs rebooting. A significant majority (79%) of the CFO respondents to this research say that there is an urgent need for finance to recruit new skills.

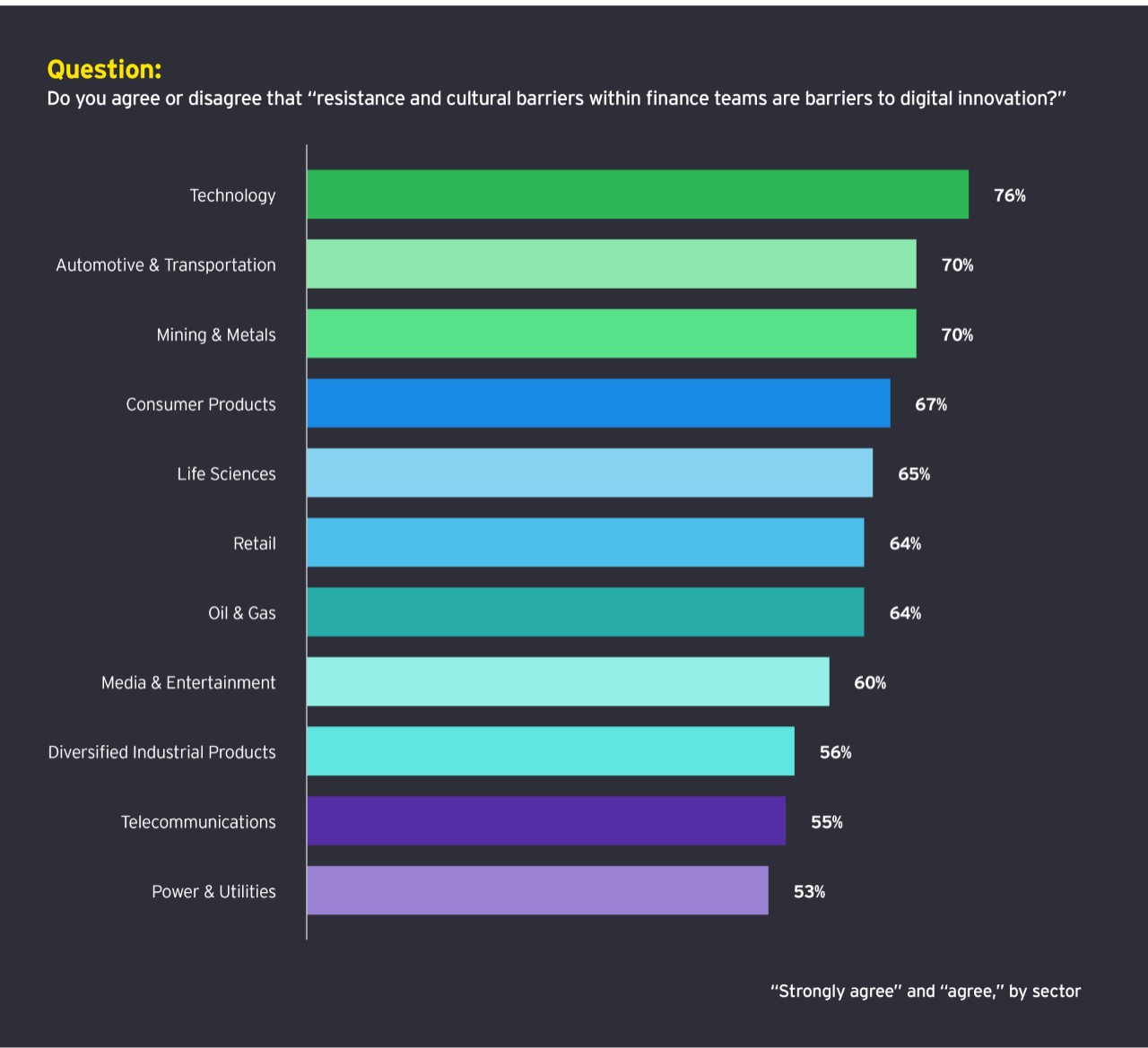

However, driving a change in approach can be very difficult, with an entrenched culture and resistance to change acting as a brake on progress. In this research, 63% of finance leaders say that “resistance and cultural barriers within finance teams are barriers to digital innovation.” In technology companies – which have to constantly drive innovation to survive in an industry where the technology agenda is constantly changing – senior finance leaders are particularly concerned about their teams’ ability to embrace digital ways of working with the speed that the organization as a whole demands.

To overcome resistance and accelerate the changes that should happen in the finance workforce, organizations should focus on two priorities.

Get creative about people and profiles

Finance is starting to require people with new skills. The next generation should understand not just accounting and their industries, but also AI, blockchain and machine learning – as well as how these technologies work together.

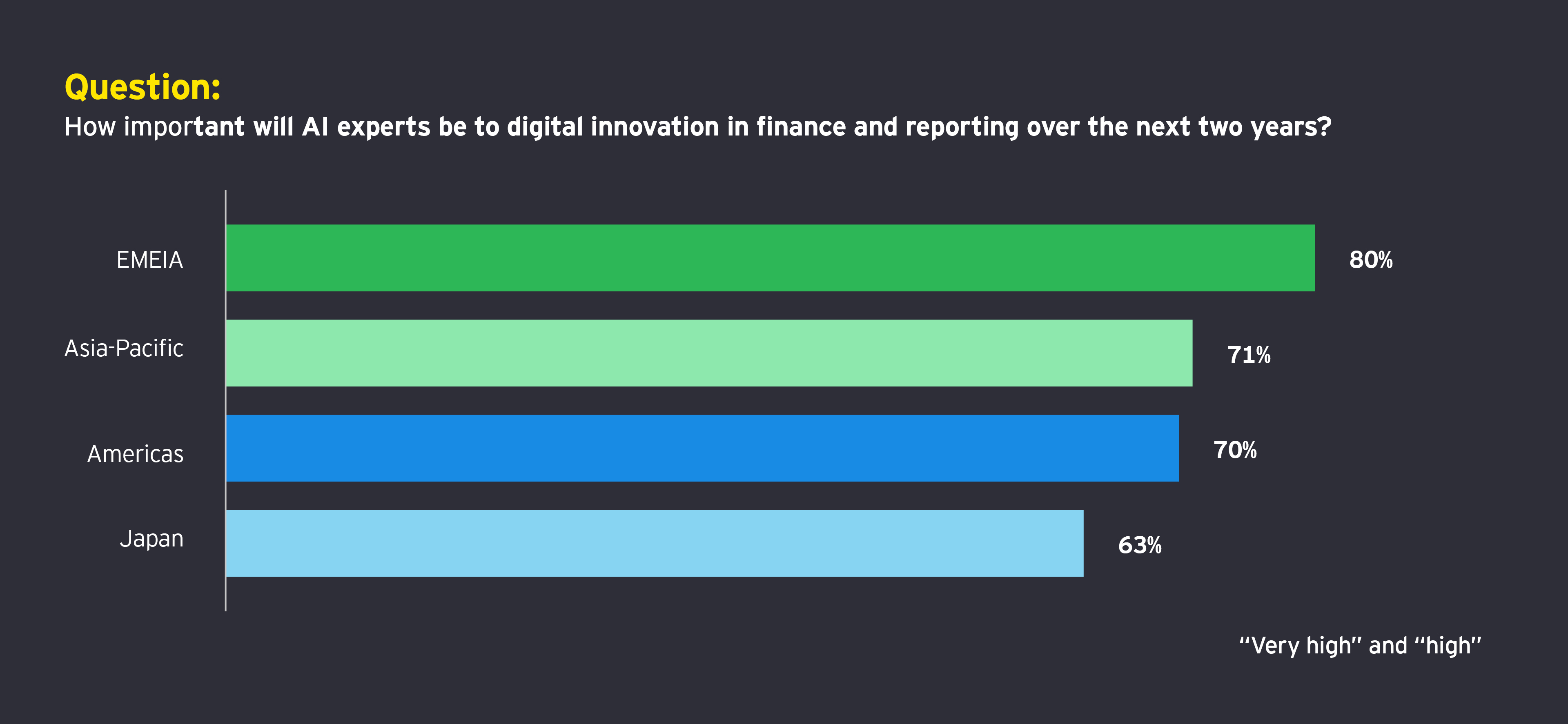

In this research, 72% of all finance leader respondents say that AI experts will be critical to driving innovation in finance and reporting over the next two years and this is a priority across all areas.

Finance leaders should define the skills and capabilities they will require on the basis of their companies’ strategy as well as the need to maintain or increase transparency and build long-term value.

Leading finance functions are auditing the existing capabilities of their teams to understand what gaps they face. This should include both hard skills required to exploit new technologies and data as well as soft interpersonal and strategic skills.

A premium on artificial intelligence expertise

72%of all finance leader respondents say that AI experts will be critical to driving innovation in finance and reporting over the next two years

Approach hiring, talent development and resourcing more innovatively

Many organizations understand that they require new skills and profiles, but they often fail to look for talent in different places, and do not use new tactics for developing their people. Too often, they are stuck in traditional practices: they use the same methods that have been in place for years, and were used to recruit and develop themselves.

Finance should do more to challenge these entrenched approaches and views of what constitute finance capabilities. The automotive industry, for instance, has responded boldly to the challenge of digital disruption and connected cars.

Finance leaders in this research recognize that they should be creative about how they source and develop people: 76% say that finance should widen its recruitment net to find people with nontraditional backgrounds.

Chapter 4

The way forward

By exploiting the rich data available, the finance function can provide insights into the business and support long-term value to stakeholders

Trust can take a lifetime to build and seconds to lose. While rebuilding it depends on many factors, reporting can play a vital role.

Reporting teams should be able to exploit the rich, multidimensional data they now have access to. Using digital technology and analytics skills, you may provide the reporting insights that give stakeholders visibility into the business and support long-term value.

For reporting to play this role, finance leaders should consider three critical actions:

Understand how your approach to reporting and transparency measures up against your peers

You should compare your approach to reporting against peers and leaders in this field. This can help stimulate your thinking about creating a structured framework for reporting long-term value to key stakeholders. You also should consider how they approach nonfinancial assurance so that external stakeholders and boards trust that information. You should also consider how to manage risk and seize opportunities to improve supporting processes and systems.

Create a compelling but pragmatic vision for how finance could utilize new technology advances

Over the coming years, intelligent systems are likely to play an increasing role in more reporting processes and tasks, transforming the ability of finance teams to drive insight from their data. To realize the potential of intelligent systems, you should act now to identify the reporting issues these technologies may solve and to set out how they could transform your approach. This can give finance both a compelling vision and a practical road map for change. This may also help you overcome organizational resistance and engage with key stakeholders such as supervisory boards and audit committees.

Manage the difficult tension between mitigating data as a risk and exploiting it as an opportunity

There is an important balance to strike between “data as a risk” and “data as an opportunity.” You should drive data innovation while avoiding lapses in data security and threats to your customers’ privacy. This means creating the right internal culture for data, with everyone following a clear data strategy underpinned by a code of conduct and data governance framework. And rather than seeing regulatory frameworks for data protection and privacy just as compliance exercises, you should consider reframing them as an opportunity to take a positive approach to data.

Summary

Organizations have an urgent need to develop reporting transparency in a way that builds trust and helps explain how they are creating long-term value by exploiting the data at their disposal and turning it into a strategic asset.

In order to help rebuild trust, organizations should utilize new technology to organize and analyze data and adopt new competencies beyond traditional accounting skills to deliver value-driven reporting.