mRNA becomes the rising star of nucleic acid therapy

After decades of research and the accumulation of theoretical knowledge, the COVID-19 pandemic has brought mRNA to the forefront as a new modality, and finally reached the tipping point in demonstrating its utility in infectious diseases.

Although complex, the technology is based on a relatively simple principle: mRNA vaccines, upon delivery, tell our cells to synthetize proteins, e.g., resembling those from the coronavirus (the SARS-Cov-2 spike proteins). This cellular generation of proteins then elicits an immune response in which the body produces virus-neutralizing antibodies even before infection with the real pathogen.

There is little question that the mRNA presents an attractive opportunity for creating a preventive vaccine. Relative to traditional approaches, mRNA therapeutics can offer a quick development-manufacturing-scaling-up cycle.

However, the mRNA delivery itself poses multiple challenges. Designing the right vehicle is crucial for proper tissue targeting, cellular uptake and ultimately the product’s pharmacokinetic and pharmacodynamic performance. Therefore, the mRNA component of a vaccine must be “packed” properly, typically into stable small lipid spheres, so-called lipid nanoparticles (LNPs).

Still, recent advances in LNP, decades of research, successful launches of other RNA therapies and, undoubtably, the COVID-19 urgency accelerated the recent developments of the mRNA platforms to the benefit of this modality.

This acceleration has had significant implications for the whole mRNA market. The requirements for light-speed research has connected global scientific hubs and increased the available knowledge in disease mechanisms and the development of potential mRNA-based therapies, which has led to fast-track mRNA drug authorizations. Meanwhile, fast scaling of the manufacturing process has fueled cooperation between biotechnology and pharmaceutical giants, as well as multiple contract development and manufacturing organizations (CDMOs) and technology providers. While uncommon handling requirements for mRNA therapies have created additional challenges in the supply chain, this has strengthened interactions among pharmaceutical companies, logistics service providers and governments.

Opportunities beyond COVID-19 vaccines for mRNA therapies

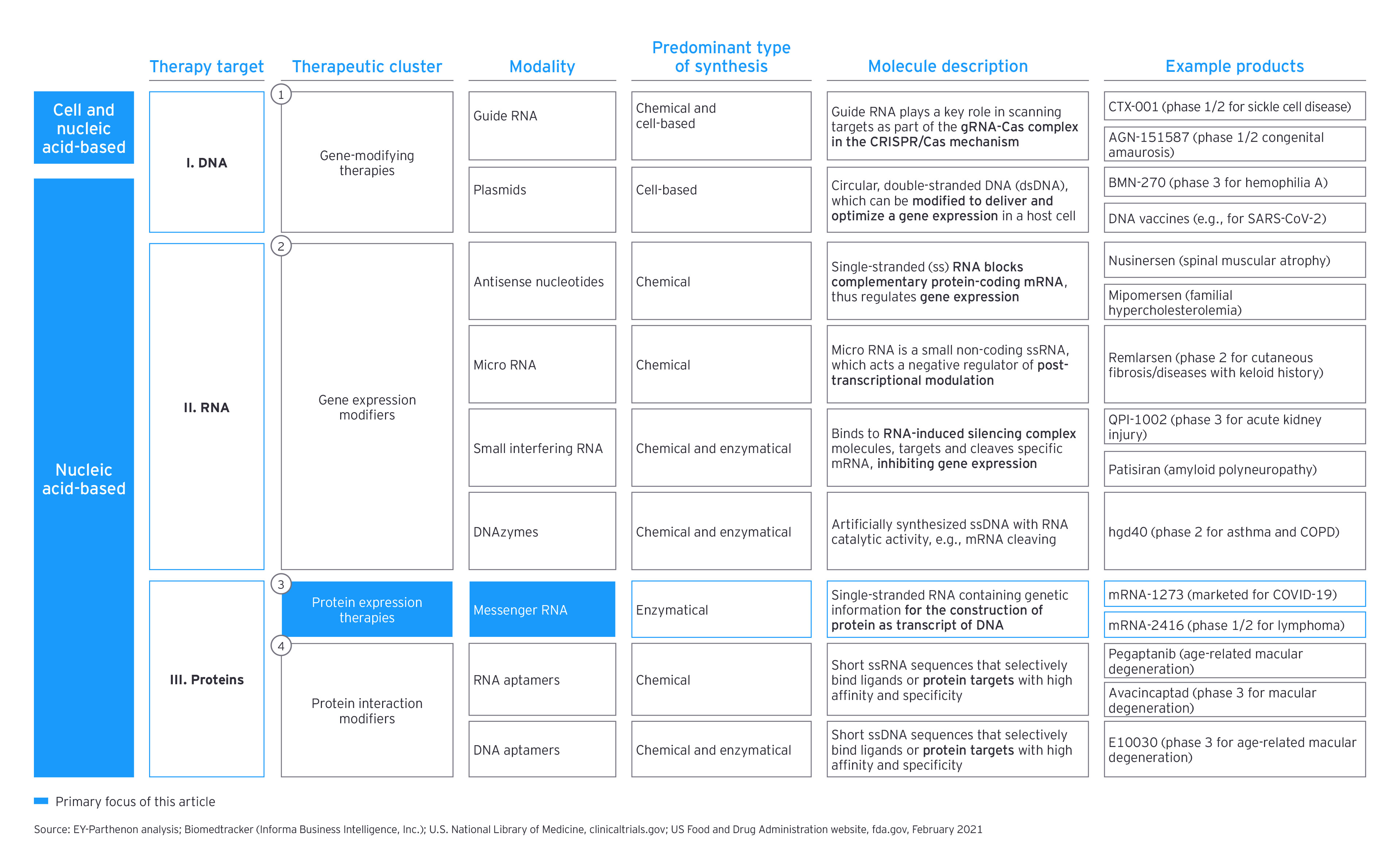

While mRNA technologies carry a broad theoretical and some empirical applicability in specific scenarios where an immune-related response is required, such as infectious disorders and cancer, they also could be designed to directly encode functional versions of missing or altered proteins, including immune-silent approaches.

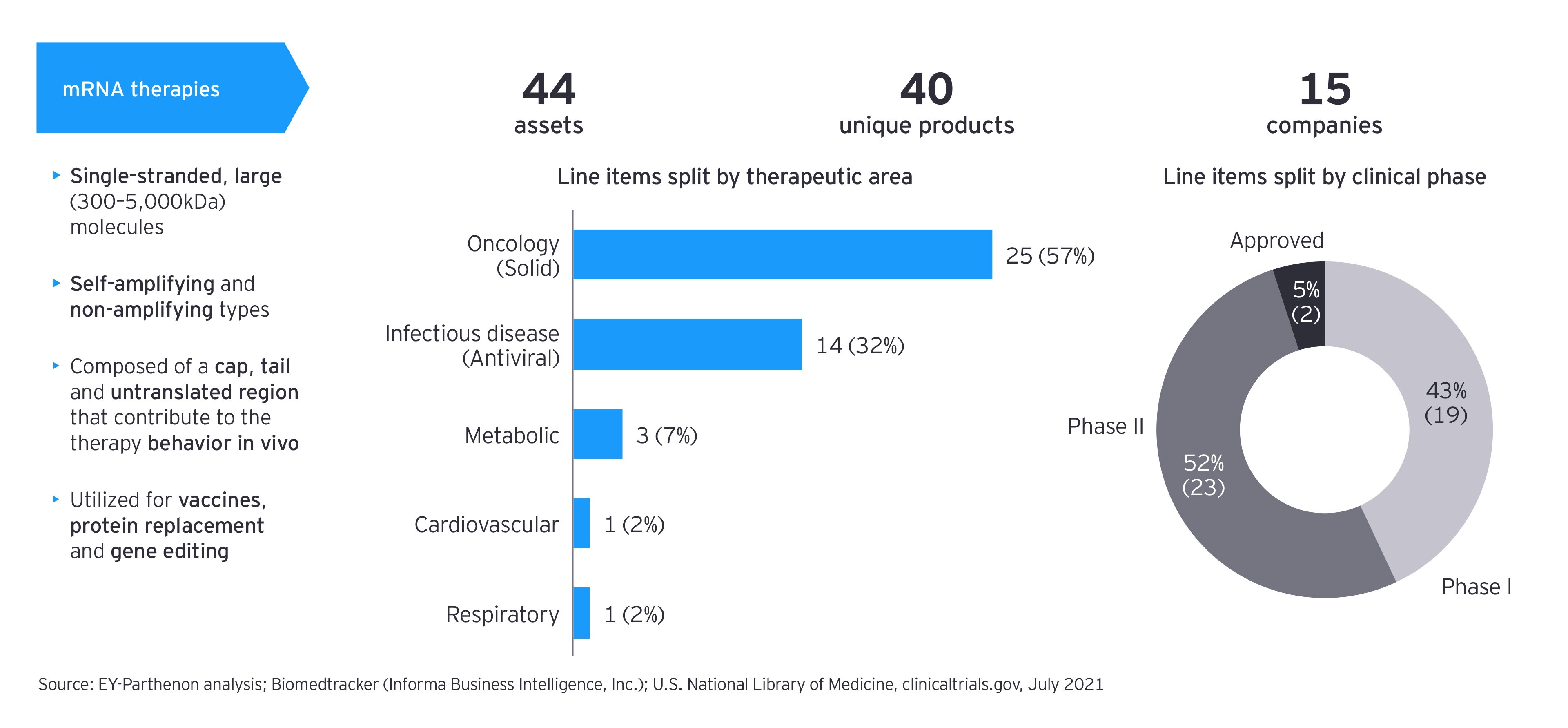

There is a promising subset of early clinical mRNA assets. In addition to oncology therapies for solid tumors, which represent 60% of the pipeline, there are other infectious disease-modifying drugs, such as antivirals, as well as metabolic, cardiovascular and respiratory therapies.

There are great breakthroughs… and there are challenges

Although there has been a huge buzz around mRNA therapies recently, only few companies have been able to move their ideas forward, converting science into clinical practice. For example, COVID-19 vaccination trials were accelerated to get patients immunized as quickly as possible.

At the same time, it remains to be seen whether lessons learned from the COVID-19 vaccination program may translate, either directly or indirectly, into other therapy areas. For example, although there has been success igniting an immune reaction, it remains unclear whether this success can be replicated for other mechanisms of action, such as direct expression of metabolic enzymes, the production of hormones, or any other proteins.

Also, given the molecular variability and genetic instability, most cancer therapies might have to embark on a personalized approach, limiting large-scale production opportunities. Long-term effects on patients related to packing mRNA therapies into lipid spheres need to be further investigated.

What does the future hold for mRNA?

Although the COVID-19 vaccine landscape remains fluid, mRNA platforms will likely continue to solidify as a therapeutic concept and capture a tangible share of the preventive vaccines market. Beyond the near-term COVID-19 opportunity, the mRNA market is expected to grow significantly, reaching almost $5b by 2025.1 Riding current mRNA successes, numerous mRNA startups, spread mainly across the US and Europe, have secured approximately $4.6b in investment flows.2

There are several great ideas for the application of mRNA therapies beyond the use in preventive medicine (though infectious diseases remain the second-largest group by numbers of trials based on our pipeline scan, with approximately 30%). As the potential for using mRNA in eliciting an immune response has been also seen as an interesting option in the treatment of cancer, the largest number of current research projects is focused on that therapy area — often in trials on personalized therapies. But mRNA is also emerging in other disease areas and with other mechanisms of action, including the production of hormones or cytokines in areas such as metabolic diseases, cardiovascular diseases, or respiratory illnesses.