Intentions to divest have hit all-time highs as January 2018 saw US$323b in deals worldwide, this was an 18-year high, driven by the increasing burden facing companies as digital innovation pressures them to confront disruption and transform business models, according to the EY Global Corporate Divestment Study 2018.

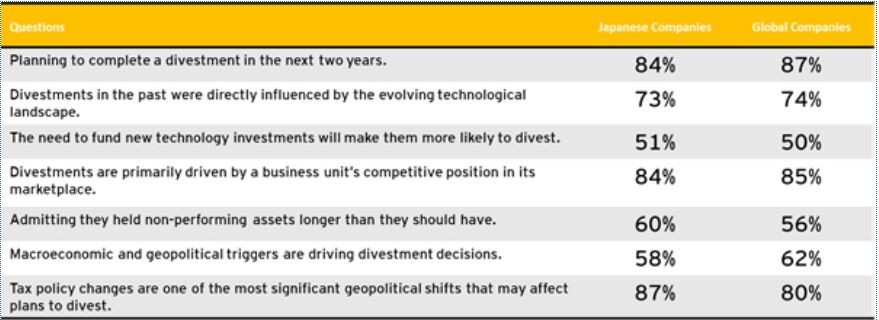

The number of respondents planning to complete a divestment in the next two years more than doubled from last year (42% to 84%), illustrating that this growth strategy has climbed the list of corporations' priorities. Almost three-quarters of Japanese companies (73%) said their divestments were directly influenced by the evolving technological landscape, up from 55% in 2017. Almost half Japanese companies (51%) say the need to fund new technology investments will make them more likely to divest, using the proceeds to improve operating efficiency and address changing customer needs in their core businesses.

Paul Hammes, EY Global Divestiture Advisory Services (DAS) Leader, says:

"More than ever, corporate executives are looking in the mirror to understand what's holding their organizations back from being more competitive. Urgency has arisen among these executives who see technology altering the competitive plane and recognizing their organization needs to adapt quickly. With access to new analytic technology that optimizes value and lowers risk, executives feel more comfortable than ever to act on a divestment."

Divestments are primarily driven by a business unit's competitive position in its marketplace, as cited by 84% of Japanese companies in the latest findings, up from 42% in 2017. Businesses are motivated to shed non-performing assets that they believe may have sat too long in their portfolios with 60 % of Japanese companies of executives admitting they held these assets longer than they should have. Nearly three-quarters Japanese companies (73%) are prompted by opportunistic, unsolicited bids, up dramatically from 20% in 2014, according to the survey. The survey also found that those that conduct portfolio reviews annually are twice as likely to exceed performance expectations for divesting "at the right time." Companies that continue to create value in their businesses prior to sale are 27% more likely to beat their sale price expectations.

Hammes says: "Unprepared sellers can find themselves at a critical disadvantage when weighing opportunistic offers - but they can protect against this undesirable dynamic. Companies that can show sustained improvements prior to buyer diligence, and those that leverage cutting-edge analytics in pre-sale preparation, are doing what's necessary to land in a power position during negotiation. This proactive mindset can be the 'make-or-break' difference in achieving the sale price you want - and nobody feels good about leaving money on the table."

Fifty-eight Japanese companies stated that macroeconomic and geopolitical triggers are driving their divestment decisions. Additionally tax reforms offer a new opportunity to revamp corporate strategies, with 87% highlighting tax policy changes as one of the most significant geopolitical shifts that may affect plans to divest.

Hammes says: "Certain changes to corporate tax profiles as a result of new policy will spark incentives for making divestments. The recently passed reduction in US corporate rates may offer domestic corporate sellers the opportunity to increase after-tax cash proceeds. Executives should evaluate the complex dynamics of new tax policies taking hold around the globe as part of their strategic divestment planning, rather than during or following the transaction."

Shinichi Ogo, EY Japan DAS Leader says that the corporate governance reform led by Prime Minister Shinzo Abe has been a major driver of divestment activity in Japan. Large traditional Japanese companies are under pressure to appoint external directors to in their board of directors meetings. This change has brought increased pressure on internal directors to identify non-core and low-profitability businesses. This trend is expected to persist, as Japanese trading houses, with similar business characteristics of traditional companies already under reform, expected to follow suit.

Fig.1) Comparison with Japanese and Global result of 'Global Corporate Divestment Study 2018'.

Japanese companies: Companies which headquartered in Japan of all respondents.